Suriname_en.pdf

... year is affecting related fiscal revenue and expenditure. For the year as a whole, revenue is expected to stand at approximately 36% of GDP, while expenditure is expected to represent around 32% of GDP. Taxation revenues and royalty payments from the increased production of bauxite, gold, alumina an ...

... year is affecting related fiscal revenue and expenditure. For the year as a whole, revenue is expected to stand at approximately 36% of GDP, while expenditure is expected to represent around 32% of GDP. Taxation revenues and royalty payments from the increased production of bauxite, gold, alumina an ...

3A Semester 1 Examination 2011 Mt Lawley SHS

... the balance on goods and services plus the net income minus net transfers. direct foreign investment plus domestic investment. the balance on financial account plus balance on goods and services plus net income. government savings plus private sector savings minus domestic investment. ...

... the balance on goods and services plus the net income minus net transfers. direct foreign investment plus domestic investment. the balance on financial account plus balance on goods and services plus net income. government savings plus private sector savings minus domestic investment. ...

review guide for principles of macro economics

... 9. Understand how the above fit into an Open Global Economy, especially how they are related to: Imports and Exports and Net Exports ...

... 9. Understand how the above fit into an Open Global Economy, especially how they are related to: Imports and Exports and Net Exports ...

2009 Budget Deficit originally estimated to be $407 billion

... The Underpinnings for Major Inflation • U.S. is creating new money at a faster rate than economic growth to finance its budget deficits and trade deficit (Credit Crisis has made this problem much bigger). • Excess money availability is the one thing in common that all major inflations have througho ...

... The Underpinnings for Major Inflation • U.S. is creating new money at a faster rate than economic growth to finance its budget deficits and trade deficit (Credit Crisis has made this problem much bigger). • Excess money availability is the one thing in common that all major inflations have througho ...

The International Monetary Fund and East Asian Financial Crisis

... The quick capital liberalization that East Asian countries completed was unsuitable for their long-term economic growth. It allowed domestic banks and firms to borrow as much as they wanted abroad, where interest rates were lower than in their respective countries. The method of borrowing foreign fu ...

... The quick capital liberalization that East Asian countries completed was unsuitable for their long-term economic growth. It allowed domestic banks and firms to borrow as much as they wanted abroad, where interest rates were lower than in their respective countries. The method of borrowing foreign fu ...

Assessment Terms

... A system in which the value of a country’s currency is determined by market forces. Note: also called a floating exchange rate NZ has had this sort of system since 1985 The idea of reducing government intervention. It is based on the assumption that resources are better allocated if the free market ...

... A system in which the value of a country’s currency is determined by market forces. Note: also called a floating exchange rate NZ has had this sort of system since 1985 The idea of reducing government intervention. It is based on the assumption that resources are better allocated if the free market ...

Highlights of Colombia Economic analysis 2011

... The United States and the Europe Union grew about 1.5% in 2011. Asian economies showed greater energy, with rates above 6.5%, except in the case of Japan. The real estate market in the United States is still at a standstill. Fears regarding public debt sustainability continued to be felt at the Euro ...

... The United States and the Europe Union grew about 1.5% in 2011. Asian economies showed greater energy, with rates above 6.5%, except in the case of Japan. The real estate market in the United States is still at a standstill. Fears regarding public debt sustainability continued to be felt at the Euro ...

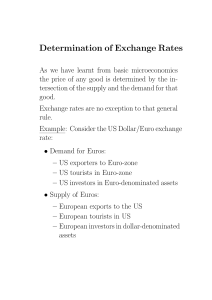

Determination of Exchange Rates

... money supply. Local prices gradually increase over time. Initially the increase in the money supply will drive interest rates down as investors buy more bonds with the excess cash on hand. As the interest rates are now lower capital begins to flow out of the country in search of higher returns. The ...

... money supply. Local prices gradually increase over time. Initially the increase in the money supply will drive interest rates down as investors buy more bonds with the excess cash on hand. As the interest rates are now lower capital begins to flow out of the country in search of higher returns. The ...

Summary Irish residential mortgage market

... chosen as the base year. For any subsequent year, the output is measured using the price level of the base year. This excludes any nominal change in output and enables a comparison of the actual goods and services produced. Interest, inflation, and exchange rates – If the interest rate charged by a ...

... chosen as the base year. For any subsequent year, the output is measured using the price level of the base year. This excludes any nominal change in output and enables a comparison of the actual goods and services produced. Interest, inflation, and exchange rates – If the interest rate charged by a ...

World Economic Situation and Prospects 2004

... • Finance growth (output, employment) with developmental financial system • Ensure inclusive financial system -- NEW • Monterrey policy coherence: Align IMF, WB with UN development agenda, IADGs • But who will lead comprehensive reform process? ...

... • Finance growth (output, employment) with developmental financial system • Ensure inclusive financial system -- NEW • Monterrey policy coherence: Align IMF, WB with UN development agenda, IADGs • But who will lead comprehensive reform process? ...

This PDF is a selection from a published volume from... Volume Title: NBER International Seminar on Macroeconomics 2008

... The first three papers concern the continued macroeconomic interdependence of major economies, which is attributable to international capital flows that do not necessarily help stabilize national economies. If we scan today’s global economy, “decoupling” is nowhere in sight. Surprising to internatio ...

... The first three papers concern the continued macroeconomic interdependence of major economies, which is attributable to international capital flows that do not necessarily help stabilize national economies. If we scan today’s global economy, “decoupling” is nowhere in sight. Surprising to internatio ...

exchange raate management in the face of global crisis

... External debt came down to less than 2 per cent of GDP in 2007 from about 50 per cent in 2004 while debt service to export ratio fell to 0.7 per cent. ...

... External debt came down to less than 2 per cent of GDP in 2007 from about 50 per cent in 2004 while debt service to export ratio fell to 0.7 per cent. ...

OCTOBER 2014

... Authority, the slowdown was supported by the “lower increments in the indices of food and alcoholic beverages, clothing and footwear, and restaurant and miscellaneous goods and services”. Year-to-date inflation averaged at 4.3%, well-within the 3-5% target of the government. Moreover, core inflation ...

... Authority, the slowdown was supported by the “lower increments in the indices of food and alcoholic beverages, clothing and footwear, and restaurant and miscellaneous goods and services”. Year-to-date inflation averaged at 4.3%, well-within the 3-5% target of the government. Moreover, core inflation ...

Real exchange rate - YSU

... Short Run Equilibrium for Aggregate Demand and Output • Equilibrium is achieved when the value of income from production (output) Y equals the value of aggregate demand D (expenditure approach on the national account of output). Y = D(EP*/P, Y – T, I, G) ...

... Short Run Equilibrium for Aggregate Demand and Output • Equilibrium is achieved when the value of income from production (output) Y equals the value of aggregate demand D (expenditure approach on the national account of output). Y = D(EP*/P, Y – T, I, G) ...

The value of the Iraqi currency and structural economic imbalances

... became a floating exchange rate orbit. Figure (1) shows the exchange rate of the Iraqi dinar against the U.S. dollar, the official at the Central Bank (Auction currency) and in the parallel market (the local exchange market) for the period from January 2011 to February 2013. Source: Central Bank of ...

... became a floating exchange rate orbit. Figure (1) shows the exchange rate of the Iraqi dinar against the U.S. dollar, the official at the Central Bank (Auction currency) and in the parallel market (the local exchange market) for the period from January 2011 to February 2013. Source: Central Bank of ...

Argentina_en.pdf

... decline in agricultural output and a contraction in demand, affecting exports, durable goods consumption and investment. The gross domestic investment rate was about 21.2% of GDP and this, while a lower figure than in 2008, translated into a substantial increase in real assets. Exports fell consider ...

... decline in agricultural output and a contraction in demand, affecting exports, durable goods consumption and investment. The gross domestic investment rate was about 21.2% of GDP and this, while a lower figure than in 2008, translated into a substantial increase in real assets. Exports fell consider ...

ECON5335 - International Economics

... Differences in labor productivity may explain why some countries export certain products. How relative supplies of capital, labor and land are used in the production of different goods may also explain why some countries export certain products. ...

... Differences in labor productivity may explain why some countries export certain products. How relative supplies of capital, labor and land are used in the production of different goods may also explain why some countries export certain products. ...

THE GEORGE WASHINGTON UNIVERSITY

... rate today AND the highest US unemployment rate during the Great ...

... rate today AND the highest US unemployment rate during the Great ...

Introduction

... Relationship • The openness of an nation’s economy is another potentially important factor that affects the responsiveness of a nation’s real output to changes in the price level. • It turns out, however, the openness can have conflicting effects on the output –inflation relationship. • Openness is ...

... Relationship • The openness of an nation’s economy is another potentially important factor that affects the responsiveness of a nation’s real output to changes in the price level. • It turns out, however, the openness can have conflicting effects on the output –inflation relationship. • Openness is ...

Costa_Rica_en.pdf

... compensation will continue to exert pressure on the fiscal balance, which, barring any significant improvement in fiscal revenues and assuming that spending stabilizes, will once again be a deficit of over 5% of GDP. High fuel and commodity prices will keep the current account deficit at about 4% of ...

... compensation will continue to exert pressure on the fiscal balance, which, barring any significant improvement in fiscal revenues and assuming that spending stabilizes, will once again be a deficit of over 5% of GDP. High fuel and commodity prices will keep the current account deficit at about 4% of ...

Forecasting outstanding debt securities in Europe

... Private transfers registered a negative annual growth rate of 29.6%; ...

... Private transfers registered a negative annual growth rate of 29.6%; ...

Why Study Money, Banking, and Financial Markets?

... • Monetary policy is the management of the money supply and interest rates – Conducted in the U.S. by the Federal Reserve System (Fed) ...

... • Monetary policy is the management of the money supply and interest rates – Conducted in the U.S. by the Federal Reserve System (Fed) ...