Emmanuel Tumusiime-Mutebile: The Eurozone crisis and its impact

... more volatile. The current account balances of sub-Saharan African (SSA) economies have worsened markedly since the onset of the global crisis, from an average surplus of 0.7 percent of GDP during 2004–08 to a projected average deficit of 3.3 percent of GDP during 2012–13.1 The deterioration of the ...

... more volatile. The current account balances of sub-Saharan African (SSA) economies have worsened markedly since the onset of the global crisis, from an average surplus of 0.7 percent of GDP during 2004–08 to a projected average deficit of 3.3 percent of GDP during 2012–13.1 The deterioration of the ...

Principles of Economic Growth

... Equilibrium real exchange rate Equilibrium in the balance of payments BOP = X + Fx – Z – Fz =X–Z+F = current account + capital account ...

... Equilibrium real exchange rate Equilibrium in the balance of payments BOP = X + Fx – Z – Fz =X–Z+F = current account + capital account ...

Presentation - International Development Economics Associates

... But the stock market bubble burst in 2001 The US government responded with very expansionary fiscal and monetary policies—keeping interest rates low and fuelling, in effect, a larger ensuing financial crisis caused by the realestate bubble (exacerbated, indeed, by new complex forms of leveraging of ...

... But the stock market bubble burst in 2001 The US government responded with very expansionary fiscal and monetary policies—keeping interest rates low and fuelling, in effect, a larger ensuing financial crisis caused by the realestate bubble (exacerbated, indeed, by new complex forms of leveraging of ...

Direct Deposit Authorization Form

... I hereby authorize Benefit Strategies, LLC to deposit funds directly to my (please check one): ...

... I hereby authorize Benefit Strategies, LLC to deposit funds directly to my (please check one): ...

balance of payment

... merchandise exports (which has a 1.7 per cent share of world trade in goods), the potential exists to substantially enhance this. While some of the larger sectors, such as travel and tourism, IT and telecom and, to an extent, healthcare, have managed to grow, the potential in fields like media and e ...

... merchandise exports (which has a 1.7 per cent share of world trade in goods), the potential exists to substantially enhance this. While some of the larger sectors, such as travel and tourism, IT and telecom and, to an extent, healthcare, have managed to grow, the potential in fields like media and e ...

How long would it take to swim from the USA to Asia

... 18. A tariff puts a tax on ___ to make local items less expensive. EXPORTS LOCALS IMPORTS 19. When trade is ____, both parties benefit. VOLUNTARY FORCED REQUIRED 20. A tariff will cause prices to be ___ on foreign goods. LOWER CHEAPER HIGHER 21. An embargo is when two countries don’t… COMMUNICATE TR ...

... 18. A tariff puts a tax on ___ to make local items less expensive. EXPORTS LOCALS IMPORTS 19. When trade is ____, both parties benefit. VOLUNTARY FORCED REQUIRED 20. A tariff will cause prices to be ___ on foreign goods. LOWER CHEAPER HIGHER 21. An embargo is when two countries don’t… COMMUNICATE TR ...

External Sector Accounts, Analysis, and Forecasting

... Advantage of analytical presentation It ...

... Advantage of analytical presentation It ...

Dominican_Republic_en.pdf

... Source:Economic Commission for Latin America and the Caribbean (ECLAC), on the basis of official figures. a Preliminary figures. b Based on figures in local currency at constant 1991 prices. c Includes gas supply and business services. d Based on figures in local currency expressed in dollars at cur ...

... Source:Economic Commission for Latin America and the Caribbean (ECLAC), on the basis of official figures. a Preliminary figures. b Based on figures in local currency at constant 1991 prices. c Includes gas supply and business services. d Based on figures in local currency expressed in dollars at cur ...

CH17

... C) any gold that it owns and foreign and domestic assets. D) any silver that it owns and foreign and domestic assets. 2.The liabilities side of a central bank include A)deposits held by the private banks. B) currency in circulation. C) deposits held by the private banks and currency in circulation. ...

... C) any gold that it owns and foreign and domestic assets. D) any silver that it owns and foreign and domestic assets. 2.The liabilities side of a central bank include A)deposits held by the private banks. B) currency in circulation. C) deposits held by the private banks and currency in circulation. ...

L06_CurrentAccount

... • Lower Per-Capita income, Higher inflation, and Higher External Debt --- lower the country’s credit rating ...

... • Lower Per-Capita income, Higher inflation, and Higher External Debt --- lower the country’s credit rating ...

Circular Flow Model

... 2. Financial Institutions 3. Businesses 4. The Government 5. The Foreign Sector ...

... 2. Financial Institutions 3. Businesses 4. The Government 5. The Foreign Sector ...

Presentation for conference on Non-China Developing Asia?

... authorities in the region intervened in foreign exchange markets to purchase dollars, but this motive has likely diminished in importance as reserves have become very substantial). Once domestic demand revives, however, the authorities will likely be more comfortable with allowing exchange rates to ...

... authorities in the region intervened in foreign exchange markets to purchase dollars, but this motive has likely diminished in importance as reserves have become very substantial). Once domestic demand revives, however, the authorities will likely be more comfortable with allowing exchange rates to ...

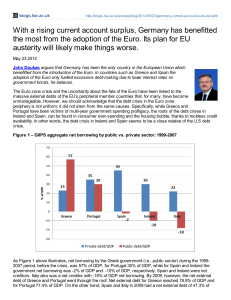

With a rising current account surplus, Germany has benefitted the

... GDP and 42.9% of GDP, respectively, similar to that of 48.5% of GDP for Germany. What is interesting here to note is that the public sector net external debt of countries like Spain and Italy, skyrocketed in a very short span of time (2007-2009). Similarly, the Irish public sector external debt dur ...

... GDP and 42.9% of GDP, respectively, similar to that of 48.5% of GDP for Germany. What is interesting here to note is that the public sector net external debt of countries like Spain and Italy, skyrocketed in a very short span of time (2007-2009). Similarly, the Irish public sector external debt dur ...

Contributions - Polestar Benefits

... above noted transaction date. In the case of the payment being rejected for Non Sufficient Funds (NSF) I understand that Polestar Benefits, Inc. may at its discretion attempt to process the charge again within 30 days, and I agree to an additional $25 charge for each attempt returned NSF, which will ...

... above noted transaction date. In the case of the payment being rejected for Non Sufficient Funds (NSF) I understand that Polestar Benefits, Inc. may at its discretion attempt to process the charge again within 30 days, and I agree to an additional $25 charge for each attempt returned NSF, which will ...

FRBSF E L

... Fiscal and current account balances are commonly used measures to assess respectively a country’s internal and external balances. The fiscal balance is the difference between government revenues and expenditures. A negative fiscal balance, i.e., a fiscal deficit, is a measure of internal imbalance b ...

... Fiscal and current account balances are commonly used measures to assess respectively a country’s internal and external balances. The fiscal balance is the difference between government revenues and expenditures. A negative fiscal balance, i.e., a fiscal deficit, is a measure of internal imbalance b ...

Chile_en.pdf

... g Economically active population as a percentage of the working-age population; nationwide total. h Percentage of the economically active population; nationwide total. i Percentage of the working population; nationwide total. j Non-adjustable 90-360 day operations. k Does not include publicly g ...

... g Economically active population as a percentage of the working-age population; nationwide total. h Percentage of the economically active population; nationwide total. i Percentage of the working population; nationwide total. j Non-adjustable 90-360 day operations. k Does not include publicly g ...

SIMON FRASER UNIVERSITY Department of Economics Econ 345 Prof. Kasa

... it is quite important and relevant for what’s going on now in Europe. You can read the Gopinath et.al paper for yourself, but the basic idea is as follows - Greece has two constraints. One, it obviously has a fixed exchange rate with the rest of Europe due to its common currency. Hence, a convention ...

... it is quite important and relevant for what’s going on now in Europe. You can read the Gopinath et.al paper for yourself, but the basic idea is as follows - Greece has two constraints. One, it obviously has a fixed exchange rate with the rest of Europe due to its common currency. Hence, a convention ...

Colombia_en.pdf

... bank. Falling goods and services prices reflected the absence of domestic demand pressures and a sufficient food supply. Cuts in certain tax rates adopted as part of the tax reform, especially fuel duty, as well as the discount on waste-collection rates and the decision not to increase the cost of u ...

... bank. Falling goods and services prices reflected the absence of domestic demand pressures and a sufficient food supply. Cuts in certain tax rates adopted as part of the tax reform, especially fuel duty, as well as the discount on waste-collection rates and the decision not to increase the cost of u ...

Using Economic Indicators for Fiscal Policy Decision Making

... • Ratio of inventories to sales made • Ratio of consumer credit outstanding to personal income • Average prime rate charged by banks ...

... • Ratio of inventories to sales made • Ratio of consumer credit outstanding to personal income • Average prime rate charged by banks ...

1 - UCSB Economics

... purposes: stock and bond trades denominated entirely in euros, all transactions between banks, bank customers can write checks in euros. Euro notes were introduced in January, 2002, with time limits on using/converting the old national notes. This is an extreme version of fixed exchange rates, as it ...

... purposes: stock and bond trades denominated entirely in euros, all transactions between banks, bank customers can write checks in euros. Euro notes were introduced in January, 2002, with time limits on using/converting the old national notes. This is an extreme version of fixed exchange rates, as it ...

Session 5.3

... 1. External shocks – though the evidence is contradictory – it may have been worse in EA 2. Overborrowing in LA – important but contradictory evidence – significant borrowing occurred in EA too – the key is in the way in which it was managed a. Examples: Korea and Thailand had larger current account ...

... 1. External shocks – though the evidence is contradictory – it may have been worse in EA 2. Overborrowing in LA – important but contradictory evidence – significant borrowing occurred in EA too – the key is in the way in which it was managed a. Examples: Korea and Thailand had larger current account ...

IM_04 - BUS 313 - University of Hawaii

... S + T + Im C is spent on consumption S + T + Im is money not spent (goods not purchased), but the money goes to financial institutions, the government and to foreigners ...

... S + T + Im C is spent on consumption S + T + Im is money not spent (goods not purchased), but the money goes to financial institutions, the government and to foreigners ...

Global Outsourcing Trends

... Reciprocal returns • OK if cash earned by countries providing outsourcing services returns to the US via purchase of US goods • One of the reasons for FTAs ...

... Reciprocal returns • OK if cash earned by countries providing outsourcing services returns to the US via purchase of US goods • One of the reasons for FTAs ...