1. The National Income Identity.

... private plus public components. Since T was 837.95 in that year, disposable household income Y − T = 5112.8. Thus, S private = Y − T − C = 1016.9, S public = T − G = −276.95. ...

... private plus public components. Since T was 837.95 in that year, disposable household income Y − T = 5112.8. Thus, S private = Y − T − C = 1016.9, S public = T − G = −276.95. ...

Fiscal Policy Challenges and Global Equilibrium

... expansion – creating money not to buy shares and other assets, but to buy goods and services. • Not possible within a monetary union, except by central agreement. • If a country left the Euro, it could do it. Its exchange rate would depreciate. ...

... expansion – creating money not to buy shares and other assets, but to buy goods and services. • Not possible within a monetary union, except by central agreement. • If a country left the Euro, it could do it. Its exchange rate would depreciate. ...

COUNTRY DATA POINTS POWERPOINT

... THE WORLD BANK MEASUREMENT ON GOVERNMENT EFFECTNESS ON SIX DIFFERENCE CRITERIA ON A SCALE 0F -2.5 TO +2.5 ...

... THE WORLD BANK MEASUREMENT ON GOVERNMENT EFFECTNESS ON SIX DIFFERENCE CRITERIA ON A SCALE 0F -2.5 TO +2.5 ...

Exchange Rate Determination

... A nation’s economic performance is best viewed in BOP data. It is a statistical statement that systematically summarizes, for a specified time period, the economic transactions of an economy with the rest of the world. Economic transactions include exports, imports, income flows, capital flows, gift ...

... A nation’s economic performance is best viewed in BOP data. It is a statistical statement that systematically summarizes, for a specified time period, the economic transactions of an economy with the rest of the world. Economic transactions include exports, imports, income flows, capital flows, gift ...

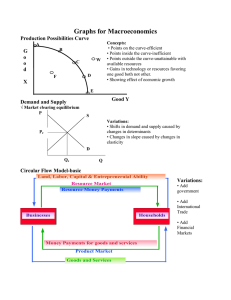

Graphs for Macroeconomics Production Possibilities Curve G o

... • As new demand and supply factors impact this market, changes in interest rate causes changes in investment and interest rate-driven consumption, which affects AD, ASsr, ASlr PL and Real GDP. • When government financing deficit spending, the impact of borrowing increases the demand curve and raises ...

... • As new demand and supply factors impact this market, changes in interest rate causes changes in investment and interest rate-driven consumption, which affects AD, ASsr, ASlr PL and Real GDP. • When government financing deficit spending, the impact of borrowing increases the demand curve and raises ...

Paraguay_en.pdf

... year’s strong economic figures and attributable to the very small contribution of the sector driving it — agriculture— to overall tax receipts. An even smaller increase, 3.4%, was recorded in overall income over this period, whereas total central government spending rose by 9.7%, driven by a 13.3% i ...

... year’s strong economic figures and attributable to the very small contribution of the sector driving it — agriculture— to overall tax receipts. An even smaller increase, 3.4%, was recorded in overall income over this period, whereas total central government spending rose by 9.7%, driven by a 13.3% i ...

Effects of the Financial Crisis on The US-China

... into greater competitiveness in international markets. Here the United States is clearly not in a position to take the high road, now just having introduced massive state subsidies into its own financial system and auto industry. The larger point is that the debate about China’s currency is far too ...

... into greater competitiveness in international markets. Here the United States is clearly not in a position to take the high road, now just having introduced massive state subsidies into its own financial system and auto industry. The larger point is that the debate about China’s currency is far too ...

Download

... past several years. IMF research suggests that the United States generally leads other advanced economies in the business cycle, and that the performance of the U.S. economy has a very significant impact on growth in developing countries. Monetary policy has been vigilant, and has played a valuable ...

... past several years. IMF research suggests that the United States generally leads other advanced economies in the business cycle, and that the performance of the U.S. economy has a very significant impact on growth in developing countries. Monetary policy has been vigilant, and has played a valuable ...

Recent Financial Crises

... (i) Current Account Deficits. The current account deficit would be contained by the control of aggregate demand through tight fiscal policies (fiscal deficit consistent with non-monetary financing) and tight monetary policies (control of money supply and credit) as well as by the current devaluation ...

... (i) Current Account Deficits. The current account deficit would be contained by the control of aggregate demand through tight fiscal policies (fiscal deficit consistent with non-monetary financing) and tight monetary policies (control of money supply and credit) as well as by the current devaluation ...

... of GDP in 2014. In particular, after growing by 11.6% in 2014, value added tax revenues dropped by 2.6% in 2015, hit by the slowdown in activity and lower price levels. This decline was not offset by the 15.0% increase in income tax receipts brought about by the administrative improvements associate ...

Chinese Currency Movements in Late

... • Having a freely traded currency makes it easier for the yuan to become more prominent in trade and payments internationally • A freely convertible currency also makes the yuan a more attractive reserve currency for Central Banks ...

... • Having a freely traded currency makes it easier for the yuan to become more prominent in trade and payments internationally • A freely convertible currency also makes the yuan a more attractive reserve currency for Central Banks ...

E 2

... deficit is a situation in which net exports (NX) are negative. Imports > Exports A trade surplus is a situation in which net exports (NX) are positive. Exports > Imports Balanced trade refers to when net exports are zero – exports and imports are exactly equal. ...

... deficit is a situation in which net exports (NX) are negative. Imports > Exports A trade surplus is a situation in which net exports (NX) are positive. Exports > Imports Balanced trade refers to when net exports are zero – exports and imports are exactly equal. ...

The Renminbi’s Prospects as a Global Reserve Currency

... financial market development, to improve the cost/benefit tradeoff; and (2) financial market development—that is, strengthening the banking system and developing deep and liquid government and corporate bond markets, as well as foreign exchange spot and derivative markets. China’s ability to meet th ...

... financial market development, to improve the cost/benefit tradeoff; and (2) financial market development—that is, strengthening the banking system and developing deep and liquid government and corporate bond markets, as well as foreign exchange spot and derivative markets. China’s ability to meet th ...

Chile_en.pdf

... 2008. Despite the outbreak of the global financial crisis in September and the prospects of a world recession, the rate was maintained until December as the core 12-month inflation index suggested that price rises would continue to steepen. It was not until December, after two months of negative mon ...

... 2008. Despite the outbreak of the global financial crisis in September and the prospects of a world recession, the rate was maintained until December as the core 12-month inflation index suggested that price rises would continue to steepen. It was not until December, after two months of negative mon ...

PDF Download

... these states could take on much more debt, without the interest rates reflecting the risks. In order to enforce government budget discipline in Europe, the capital markets must receive credible signals that in the case of one country’s over-indebtedness, the creditors bear liability before help from ...

... these states could take on much more debt, without the interest rates reflecting the risks. In order to enforce government budget discipline in Europe, the capital markets must receive credible signals that in the case of one country’s over-indebtedness, the creditors bear liability before help from ...

Sample Final Exam

... surge. The economy has ample spare capacity; inflation is, if anything, currently too low. As yet the weaker dollar has not pushed up import prices. Foreign exporters tend to fix their prices in dollars, and fierce competition has encouraged them to hold these down. Instead, they have trimmed their ...

... surge. The economy has ample spare capacity; inflation is, if anything, currently too low. As yet the weaker dollar has not pushed up import prices. Foreign exporters tend to fix their prices in dollars, and fierce competition has encouraged them to hold these down. Instead, they have trimmed their ...

The US Trade Deficit: Are We Trading Away Our Future

... financial markets are beginning to recover throughout the world, the real economies of many developing countries and Japan remain mired in recessions. For example, reliable private sector reports show that unemployment in Sao Paulo, Brazil currently exceeds 20%. The growth in the trade deficit over ...

... financial markets are beginning to recover throughout the world, the real economies of many developing countries and Japan remain mired in recessions. For example, reliable private sector reports show that unemployment in Sao Paulo, Brazil currently exceeds 20%. The growth in the trade deficit over ...

the September Review

... billion this year. This extraordinary swing of almost $400 billion in the Eurozone’s current-account balance did not result from a “competitive devaluation”; the euro has remained strong. So the real reason for the eurozone’s large external surplus today is that internal demand has been so weak that ...

... billion this year. This extraordinary swing of almost $400 billion in the Eurozone’s current-account balance did not result from a “competitive devaluation”; the euro has remained strong. So the real reason for the eurozone’s large external surplus today is that internal demand has been so weak that ...

Korea

... Voluntary rescheduling of short term debt- $24 billion of short term private debt turned into claims of one to three year maturity. ...

... Voluntary rescheduling of short term debt- $24 billion of short term private debt turned into claims of one to three year maturity. ...

ECON403 sample questions for chapters 17 and 19

... pesos per pound and the price of Brazilian coffee is 4 Brazilian reals per pound, then the exchange rate between the Colombian peso and the Brazilian real is: A) 40 pesos per real. B) 100 pesos per real. C) 25 pesos per real. D) 0.4 pesos per real. ...

... pesos per pound and the price of Brazilian coffee is 4 Brazilian reals per pound, then the exchange rate between the Colombian peso and the Brazilian real is: A) 40 pesos per real. B) 100 pesos per real. C) 25 pesos per real. D) 0.4 pesos per real. ...

SYLLABUS IM SYLLABUS (2017) ECONOMICS IM08

... The study of macroeconomics examines the economy as a whole. It deals with aggregate demand and supply together with output, employment and prices at national level. The circular flow of income is a model meant to explain how money flows between firms and households. However, not all incomes get pas ...

... The study of macroeconomics examines the economy as a whole. It deals with aggregate demand and supply together with output, employment and prices at national level. The circular flow of income is a model meant to explain how money flows between firms and households. However, not all incomes get pas ...

Talking Points Presentation - Federal Reserve Bank of St. Louis

... spending and/or increases in taxes, in theory are thought to decrease overall demand for goods and services. These actions move the budget position toward a surplus. Contractionary policies are rarely used. 4. If the government runs a deficit, it borrows to cover the deficit spending. This borrowing ...

... spending and/or increases in taxes, in theory are thought to decrease overall demand for goods and services. These actions move the budget position toward a surplus. Contractionary policies are rarely used. 4. If the government runs a deficit, it borrows to cover the deficit spending. This borrowing ...

Impact and Response of Asian Economic Crisis and Global

... 3. Credit-fuelled Booming Other factors can be contributed to the Asian financial crisis are as follows (Sheehan, 2009). 1. Ineffective quality of fund management system 2. Ineffective capital inflows stabilisation 3. Foreign banks entry restriction 4. Higher cost of financial services and NPL ...

... 3. Credit-fuelled Booming Other factors can be contributed to the Asian financial crisis are as follows (Sheehan, 2009). 1. Ineffective quality of fund management system 2. Ineffective capital inflows stabilisation 3. Foreign banks entry restriction 4. Higher cost of financial services and NPL ...

El_Salvador_en.pdf

... a Preliminary estimates. b Twelve-month variation to October 2009. c Twelve-month variation to September 2009. d A negative rate indicates an appreciation of the currency in real terms. e Year-on-year average variation, January to October. f Average from January to October, annualized. g Incl ...

... a Preliminary estimates. b Twelve-month variation to October 2009. c Twelve-month variation to September 2009. d A negative rate indicates an appreciation of the currency in real terms. e Year-on-year average variation, January to October. f Average from January to October, annualized. g Incl ...

SYLLABUS IM SYLLABUS (2016) ECONOMICS IM08

... The study of macroeconomics examines the economy as a whole. It deals with aggregate demand and supply together with output, employment and prices at national level. The circular flow of income is a model meant to explain how money flows between firms and households. However, not all incomes get pas ...

... The study of macroeconomics examines the economy as a whole. It deals with aggregate demand and supply together with output, employment and prices at national level. The circular flow of income is a model meant to explain how money flows between firms and households. However, not all incomes get pas ...