rezco stable fund application form – a class units

... RCI will endeavour to provide the investor with as much information as possible regarding its products and services, but such information does not constitute investment advice. ...

... RCI will endeavour to provide the investor with as much information as possible regarding its products and services, but such information does not constitute investment advice. ...

Rethinking Financial Deepening: Stability and Growth

... First and foremost, using a new, broad, measure of financial development, this study underscores that many benefits in terms of growth and stability can still be reaped from further financial development in most EMs. Financial development is defined as a combination of depth (size and liquidity of m ...

... First and foremost, using a new, broad, measure of financial development, this study underscores that many benefits in terms of growth and stability can still be reaped from further financial development in most EMs. Financial development is defined as a combination of depth (size and liquidity of m ...

Vanguard`s framework for constructing globally diversified portfolios

... subject to interest rate, credit, and inflation risk. Prices of mid and small-cap stocks often fluctuate more than those of large-company stocks. Funds that concentrate on a relatively narrow market sector face the risk of higher share-price volatility. Foreign investing involves additional risks in ...

... subject to interest rate, credit, and inflation risk. Prices of mid and small-cap stocks often fluctuate more than those of large-company stocks. Funds that concentrate on a relatively narrow market sector face the risk of higher share-price volatility. Foreign investing involves additional risks in ...

Fair Value Accounting: Information or Confusion for Financial Markets?

... of the evidence relies on valuation models that show an association between FVA-based assets and a firm’s stock price, which does not reveal much about the underlying process by which FVAderived information disseminates and is used by financial markets’ participants to set market prices. In that reg ...

... of the evidence relies on valuation models that show an association between FVA-based assets and a firm’s stock price, which does not reveal much about the underlying process by which FVAderived information disseminates and is used by financial markets’ participants to set market prices. In that reg ...

National wealth, natural capital and sustainable development in

... operators, under virtually an open-access regime, a practice that was halted after 1990. Namibia was unable to exert control over its 200-mile Exclusive Economic Zone (EEZ), which contained the most lucrative fisheries, because no country would recognise South Africa’s jurisdiction over the area. On ...

... operators, under virtually an open-access regime, a practice that was halted after 1990. Namibia was unable to exert control over its 200-mile Exclusive Economic Zone (EEZ), which contained the most lucrative fisheries, because no country would recognise South Africa’s jurisdiction over the area. On ...

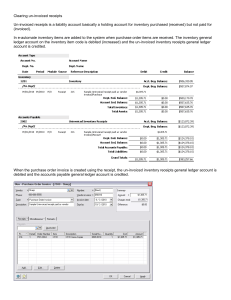

Understanding un-invoiced receipts

... If the invoice is recorded using a vendor invoice instead of a vendor purchase order invoice then the accounts payable account may appear correct but the charges used on the vendor invoice create double costs and the purchase order receipt does not get cleared out. Unfortunately, this may not be rec ...

... If the invoice is recorded using a vendor invoice instead of a vendor purchase order invoice then the accounts payable account may appear correct but the charges used on the vendor invoice create double costs and the purchase order receipt does not get cleared out. Unfortunately, this may not be rec ...

Analysis and comparison of methods of risk

... value of return on government bonds from the past or to focus on its direct estimate to the future? We can generally say that absolutely risk-free assets do not exist. In the US, treasury bills – US T. Bills are considered the least risky. Though, valuation based on their rate of return is used when ...

... value of return on government bonds from the past or to focus on its direct estimate to the future? We can generally say that absolutely risk-free assets do not exist. In the US, treasury bills – US T. Bills are considered the least risky. Though, valuation based on their rate of return is used when ...

How to Read a Value Line Fund Advisor Report

... some may find it useful to see funds ranked within narrow categories, such a system makes it impossible to meaningfully compare funds across these categories. For example, if small-company funds are ranked in isolation, there is no way to compare the rank of a fund in this group to that of a large-c ...

... some may find it useful to see funds ranked within narrow categories, such a system makes it impossible to meaningfully compare funds across these categories. For example, if small-company funds are ranked in isolation, there is no way to compare the rank of a fund in this group to that of a large-c ...

Armenia Development Strategy for 2014-2025

... Table 1. ADS macroeconomic framework: projection of main indicators ...................................................... 27 Table 2. Development of economy by sector: projections of main indicators ............................................... 29 Table 3. Exports actual structure, by main produc ...

... Table 1. ADS macroeconomic framework: projection of main indicators ...................................................... 27 Table 2. Development of economy by sector: projections of main indicators ............................................... 29 Table 3. Exports actual structure, by main produc ...

Banking Industry Country Risk Assessment

... 6. A BICRA analysis for a country covers rated and unrated financial institutions that take deposits, extend credit, or engage in both activities in a particular country. The analysis incorporates the entire financial system of a country by considering the relationship of the banking industry to the ...

... 6. A BICRA analysis for a country covers rated and unrated financial institutions that take deposits, extend credit, or engage in both activities in a particular country. The analysis incorporates the entire financial system of a country by considering the relationship of the banking industry to the ...

mutual fund strategy

... Classification of funds by types of underlying investmentsMutual funds are normally classified by their principal investments, as described in the prospectus and investment objective. The four main categories of funds are money market funds, bond or fixed income funds, stock or equity funds, and hyb ...

... Classification of funds by types of underlying investmentsMutual funds are normally classified by their principal investments, as described in the prospectus and investment objective. The four main categories of funds are money market funds, bond or fixed income funds, stock or equity funds, and hyb ...

Consensus Revenue Agreement Final Report January 11, 2010 Economic and Revenue Forecasts

... found for currently delinquent homeowners in the program. Currently the program has worked out “permanent” terms for only a very small subset of homeowners who have entered the program. If the program’s performance does not improve markedly in the near future, many of the homes currently in the prog ...

... found for currently delinquent homeowners in the program. Currently the program has worked out “permanent” terms for only a very small subset of homeowners who have entered the program. If the program’s performance does not improve markedly in the near future, many of the homes currently in the prog ...

EMValWells

... holdings. You do risk carrying into your valuation any mistakes that the market may be making in valuation. The relative value solution: When there are too many cross holdings to value separately or when there is insufficient information provided on cross holdings, you can convert the book values of ...

... holdings. You do risk carrying into your valuation any mistakes that the market may be making in valuation. The relative value solution: When there are too many cross holdings to value separately or when there is insufficient information provided on cross holdings, you can convert the book values of ...

Serbian Association of Economists Journal of Business

... stabilizers: a. In monetary sphere the main automatic stabilizer is FX rate which should be stable and predictable (Currency board), b. In fiscal sphere there are various automatic stabilizers (transfers for unemployed, social transfers, tax benefits for investments etc.), c. Other automatic stab ...

... stabilizers: a. In monetary sphere the main automatic stabilizer is FX rate which should be stable and predictable (Currency board), b. In fiscal sphere there are various automatic stabilizers (transfers for unemployed, social transfers, tax benefits for investments etc.), c. Other automatic stab ...

Heterogeneity and Portfolio Choice: Theory and

... or beliefs. Second, public policy questions, such as whether investing social security contributions in the stock market would be welfare improving, or whether current tax laws favoring investments in owncompany stock should be changed, are also informed by a clearer understanding of the reasons for ...

... or beliefs. Second, public policy questions, such as whether investing social security contributions in the stock market would be welfare improving, or whether current tax laws favoring investments in owncompany stock should be changed, are also informed by a clearer understanding of the reasons for ...

Macroeconomic Stability and Financial Regulation: Key Issues for

... Affiliates, based primarily in European universities. The Centre coordinates the research activities of its Fellows and Affiliates and communicates the results to the public and private sectors. CEPR is an entrepreneur, developing research initiatives with the producers, consumers and sponsors of re ...

... Affiliates, based primarily in European universities. The Centre coordinates the research activities of its Fellows and Affiliates and communicates the results to the public and private sectors. CEPR is an entrepreneur, developing research initiatives with the producers, consumers and sponsors of re ...

CPY Document Title

... Letter from Neidhardt to Trosten, dated April 29, 2002, providing summary of various alternatives for restructuring a new investment by BAWAG in RGL, and mentioning a $750 million obligation or debt balance from RGHI to RGL ...

... Letter from Neidhardt to Trosten, dated April 29, 2002, providing summary of various alternatives for restructuring a new investment by BAWAG in RGL, and mentioning a $750 million obligation or debt balance from RGHI to RGL ...

inflation-protected bonds: a look at the new i bond series

... The U.S. Treasury now offers I bonds, a new series of savings bonds. While close cousins of series EE bonds, I bonds provide direct protection against the risks of inflation. I bonds were first offered in September 1998. So far, individual investors and the media have paid little heed to them. Yet, ...

... The U.S. Treasury now offers I bonds, a new series of savings bonds. While close cousins of series EE bonds, I bonds provide direct protection against the risks of inflation. I bonds were first offered in September 1998. So far, individual investors and the media have paid little heed to them. Yet, ...

Better banks for Eastern Europe

... (1) As the banks are almost exclusively state-owned, the bank managers have little incentive to act as prudent advocates of capital, be it their own capital or that of their depositors. Furthermore, the market for managers is underdeveloped. Many bank managers have little reason to care about their ...

... (1) As the banks are almost exclusively state-owned, the bank managers have little incentive to act as prudent advocates of capital, be it their own capital or that of their depositors. Furthermore, the market for managers is underdeveloped. Many bank managers have little reason to care about their ...

Decision Avoidance and Deposit Interest Rate Setting

... individuals are unhappy with the performance of investment funds they have displayed reluctance to change (Fry et al 2007). When assessing mutual funds, Kempf and Ruenzi (2006) report individuals which are subject to status quo bias select sub-optimal alternatives, as these were chosen before. The t ...

... individuals are unhappy with the performance of investment funds they have displayed reluctance to change (Fry et al 2007). When assessing mutual funds, Kempf and Ruenzi (2006) report individuals which are subject to status quo bias select sub-optimal alternatives, as these were chosen before. The t ...

Meeting of the Full Council

... Background and Advice The UK Municipal Bonds Agency (MBA) was established by the Local Government Association (LGA) and 56 local authorities, including Lancashire County Council, for the purpose of enabling local authorities to borrow on better rates of interest than would otherwise be available to ...

... Background and Advice The UK Municipal Bonds Agency (MBA) was established by the Local Government Association (LGA) and 56 local authorities, including Lancashire County Council, for the purpose of enabling local authorities to borrow on better rates of interest than would otherwise be available to ...

Proactive Financial Reporting Enforcement and Firm Value

... In this paper, we exploit a setting with unanticipated, within-country changes in enforcement intensity to provide evidence on whether, and under what conditions, additional proactive financial reporting enforcement (FRE) increases equity values. We examine the proactive focus sector review program ...

... In this paper, we exploit a setting with unanticipated, within-country changes in enforcement intensity to provide evidence on whether, and under what conditions, additional proactive financial reporting enforcement (FRE) increases equity values. We examine the proactive focus sector review program ...

2013 Low-Income Countries Global Risks and Vulnerabilities

... ensuing impact on the funding costs and budgetary positions of a sub-group of frontier market LICs. This would have a significant fiscal impact only if sustained over a number of years, but a more immediate, if potentially shorter-lived, impact on domestic interest rates and/or the exchange rate. ...

... ensuing impact on the funding costs and budgetary positions of a sub-group of frontier market LICs. This would have a significant fiscal impact only if sustained over a number of years, but a more immediate, if potentially shorter-lived, impact on domestic interest rates and/or the exchange rate. ...

Ch - Special projects

... What we often see in practice is the payment of dividends at a stable dollar level (not based on a stable payout ratio, which is the percentage of net income paid out as dividends), rising over time as the firm becomes more profitable. Reasons may include: ...

... What we often see in practice is the payment of dividends at a stable dollar level (not based on a stable payout ratio, which is the percentage of net income paid out as dividends), rising over time as the firm becomes more profitable. Reasons may include: ...

Corporate Leverage and Currency Crises - S-WoPEc

... pegged to the foreign one. The government can make investments feasible by not defending the currency and thus letting it ‡oat. The resulting equilibrium currency depreciation increases the pro…tability of new investments when revenues from the new investments are in a foreign currency and costs den ...

... pegged to the foreign one. The government can make investments feasible by not defending the currency and thus letting it ‡oat. The resulting equilibrium currency depreciation increases the pro…tability of new investments when revenues from the new investments are in a foreign currency and costs den ...