* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download MIDLANDS STATE UNIVERSITY FACULTY OF COMMERCE

Neuromarketing wikipedia , lookup

Target audience wikipedia , lookup

Ambush marketing wikipedia , lookup

Guerrilla marketing wikipedia , lookup

Viral marketing wikipedia , lookup

Digital marketing wikipedia , lookup

Youth marketing wikipedia , lookup

E-governance wikipedia , lookup

Marketing plan wikipedia , lookup

Integrated marketing communications wikipedia , lookup

Target market wikipedia , lookup

Marketing mix modeling wikipedia , lookup

Marketing channel wikipedia , lookup

Multicultural marketing wikipedia , lookup

Direct marketing wikipedia , lookup

Sensory branding wikipedia , lookup

Street marketing wikipedia , lookup

Advertising campaign wikipedia , lookup

Marketing strategy wikipedia , lookup

Green marketing wikipedia , lookup

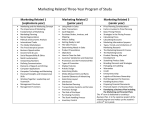

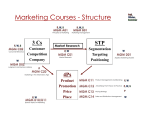

MIDLANDS STATE UNIVERSITY FACULTY OF COMMERCE DEPARTMENT OF MARKETING MANAGEMENT Course Outline: Marketing Of Financial Services (MMRK812) Lecturer: Mr N. Nkomazana, Msc. Phone: 0774 382 517 Email: [email protected] COURSE OBJECTIVES: This course builds on key principles learned in marketing of services and places them in the context of the financial services sector. The course seeks to study how consumers decide to purchase financial services and contrast this process with how non-financial services and goods are purchased. As traditional distinctions among types of financial institutions continue to blur, competitive edge in this marketplace will require strategic not just tactical marketing. Marketing of financial services give students an opportunity to examine the contribution that marketing can make to the success of an organization that operates in this industry. The focus is on learning how to solve marketing problems and applying marketing theories to “real life” situations. This will help students and practitioners to understand key issues and future trends that surround the financial services sector. Having completed this course, students should be able to manage consumer marketing activities for a wide array of financial products and to optimize tactical and strategic components of marketing plans for financial services organizations. ASSESSMENT: Coursework will constitute 30% of the final mark, with the final examination at the end of the semester contributing the remaining 70%. Coursework will be made up of one individual assignment and one group presentation. COURSE CONTENT The course contents are as follows: 1. The role of marketing in financial institutions 1 Main players in the financial services sector and their functions Trends in the Zimbabwean financial services sector Categories of financial products and services Challenges of marketing financial services Main characteristics of financial services © Nkomazana 2012 2. Customer decision process in financial services Rational consumer decision making Heuristic decision making Framework for understanding consumers’ financial decisions Decision patterns related to human cognitive circuitry Behavioural patterns related to emotions Behavioural patterns related to insufficient consumer knowledge Ethical implications of the consumer decision process 3. Pricing Challenges in pricing financial services Common approaches to pricing financial services Category specific pricing practices Strategic consideration in pricing 4. Advertising Unique aspects of advertising in financial services Framework for financial services advertising Advertising basics Success factors in financial services advertising Steps in advertising financial services regulation and financial services advertising 5. Distribution Strategic role of distribution in financial services marketing Distribution systems used in financial services marketing The agency system Determining distribution system characteristics Impact of technology in financial services distribution Financial services distribution strategy 6. New product introduction in financial services markets New product opportunities in the product attribute space How new products and services are created Methods of identifying new product needs Testing the market acceptance of new financial services The product life cycle 7. Segmenting financial services markets The segmentation process 2 © Nkomazana 2012 Cluster analysis Targeting customer segments Segmenting customers based on existing relationships 8. Customer satisfaction with financial services Benefits of customer satisfaction with financial services Determinants of customer satisfaction Measuring customer satisfaction Dimensions of customer satisfaction with financial services Improving customer satisfaction using Gap analysis Customer relationship management Methods of strengthening customer relationships 9. Strategic market planning in financial services The need for financial services marketing strategies Strategic challenges in financial services marketing The DIAMOND framework for financial services marketing Developing a Marketing plan TEXTBOOKS A number of alternative textbooks are considered suitable for the material covered in this course. The following are some of the recommended texts: Ayadi, D. (1994) Advertising and Promotion: the Marketing of Financial Services, 2nd Edition. Cetina, I. and Mihail, N. (2000) Price strategies in Banking Marketing. Journal of Banking Marketing, 3:21-28. Clapp, B. A. and Vaglio, N. (2008) Shifts happens: The new age of bank marketing – How changing lifestyles and customer experience are challenging bank marketers. CreateSpace Publishing: USA Estelami, H. (2007) Marketing Financial services, Dog Ear Publishing, Indianapolis: USA. Naggeman, J. (2009) The professional’s guide to financial services marketing: Bitesized insights for creating effective approaches. John Wiley & Sons, Inc. New Jersey: Canada INDIVIDUAL ASSIGNMENT QUESTION a) Identify a specific financial category that you find interesting. b) Develop the specifications of an innovative financial product that can be introduced into this market. 3 © Nkomazana 2012 c) Determine the optimal pricing and advertising strategy. d) Establish which methods are best suited for distributing the product to your target market. e) Establish the investment requirements and the return on investment for launching this financial service in the Zimbabwean market and provide a 3-year timetable of required marketing activities. Due date: 30 March 2012 GROUP PRESENTATIONS Group one: Using an organization of your choice within the financial services sector, critically review the marketing strategy adopted and prepare a report which assess the effectiveness of the following: a) The company’s approach to market segmentation. b) The strategies it uses to differentiate itself and its offerings from the competition. Group two: In addition to the traditional channels through insurance agents or brokers, people can now buy insurance through direct channels (e.g. Internet or telephone) or banks. What are the relative advantages and disadvantages of each channel of distribution for insurance? What are the consumers’ attitudes towards these channels? In view of the industry restructuring, what is the future of the insurance companies? Group three: There is a trend towards adopting self-service technologies in the financial services sector (e.g. internet, telephone, ATM, etc). What are the consumers’ attitudes towards these selfservice technologies? What will be the impact of these self-service technologies on the future of the financial industry? Group four: Examine the specific financial needs of small businesses. How do their needs differ from large corporations? How do the banks manage their relationships with the small businesses? What would you suggest to improve the small business-bank relationships? Group five: “Foreign banks are mostly ahead of the domestic banks in formulating marketing strategies” Discuss. Due date: These are to be presented on the last day of the block (20 January 2012). 4 © Nkomazana 2012