* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Brokerage Accounts, Transferring Stocks, and Handling Bonds

Systemic risk wikipedia , lookup

Corporate venture capital wikipedia , lookup

Leveraged buyout wikipedia , lookup

Private money investing wikipedia , lookup

Investor-state dispute settlement wikipedia , lookup

Dodd–Frank Wall Street Reform and Consumer Protection Act wikipedia , lookup

Short (finance) wikipedia , lookup

Early history of private equity wikipedia , lookup

Securities fraud wikipedia , lookup

Financial crisis wikipedia , lookup

International investment agreement wikipedia , lookup

Socially responsible investing wikipedia , lookup

Systemically important financial institution wikipedia , lookup

Stock trader wikipedia , lookup

Environmental, social and corporate governance wikipedia , lookup

Investment banking wikipedia , lookup

Investment management wikipedia , lookup

History of investment banking in the United States wikipedia , lookup

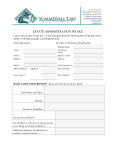

Tenth Annual Probate Administration November 13, 2014 Chapter 6 11:00-11:15am Brokerage Accounts, Transferring Stocks Sarah L. Moen, Moen Law Offices, P.S. There is no PowerPoint for this Presentation Electronic format only: 1. Brokerage Accounts; Transferring Stocks and Bonds Brokerage Accounts; Transferring Stocks and Bonds Sarah L. Moen MOEN LAW OFFICES, P.S. It is not uncommon for a decedent to hold an interest in brokerage accounts, stock certificates, or government bonds at death. If these investments are a part of the probate estate, the PR has a duty to marshal these investments and either liquidate or distribute them prior to closing the Estate. A. How Is the Investment Titled? The PR needs to determine whether the investment is subject to probate. The PR should ascertain whether the investment is held solely by the decedent, subject to a joint tenancy, or subject to a payable-on-death (“POD”) designation. If the investment is held solely by the decedent or as a joint tenant without survivorship rights, the PR has a duty to marshal the investment. If the investment is held as a joint tenant with right of survivorship or subject to a POD designation, then the investment is a nonprobate asset and is not a part of the probate estate. Although the PR does not have a duty to marshal non-probate investments, the PR should still be aware of the value of the investment for any federal and state estate tax apportionment under RCW 83.110A. Practice Tip: The best evidence of how an investment is held is to request a copy of the signature card/application form and any amendments thereto from the financial institution. Do not rely upon the names and addresses identified on the monthly statements or upon representations made by family and friends. B. Marshaling the Investment. The investment will need to be re-titled into the name of the PR on behalf of the Estate. This must be done regardless of whether the PR intends to distribute or liquidate the investment, because the Estate is considered to be a separate taxable entity Page 1 of 7 for federal tax reporting purposes. Any tax reporting attributable to the investment after death should be reported by the Estate. To do this, the PR will need to apply to the Internal Revenue Service for a tax identification number (“TIN” or “EIN”) for the Estate. 1. Brokerage Account. After the PR has verified that the investment is a probate asset, the PR should contact the brokerage firm to advise of the death, his appointment as PR, and to request the necessary forms to establish a new Estate account. These forms are often available for download on the brokerage firm’s website. Some brokerage firms have additional requirements such as a copy of the Order appointing the PR (sometimes certified), a copy of the death certificate (sometimes certified), a copy of the Will, or other internal forms provided by the firm. The PR may then submit the completed application to the brokerage firm along with a copy of his Letters Testamentary or of Administration and a letter instructing the broker to transfer the investment from the decedent’s account to the new Estate account and to close the decedent’s account. Practice Tip: It is preferable to establish the Estate account at the brokerage firm where the decedent held his account. It keeps the paperwork and the number of brokerage persons involved in the transfer to a minimum. There is also less of a chance of delay or error with transfers “in house.” The same is true if a PR is distributing the investments to the heirs. It is much more convenient if the heirs establish accounts at the same brokerage firm to complete the transfer. 2. Stock Issued in Certificate Form. Sometimes, a decedent will hold stock in certificate form or in his own name (as opposed to a “street name” held in the name of a brokerage Page 2 of 7 on behalf of a customer). The Author has found that holding stock in certificate form is more prevalent with the older generation. The Author has also found that the older generation is more inclined to purchase stock in certificate form for their grandchildren to be held jointly with the grandparent or with the grandparent as a custodian. To marshal this type of investment, the PR will need to either submit the original certificate for re-titling into the PR’s name on behalf of the Estate or, if the certificate has been lost, to issue a replacement certificate. This step, although tedious, is required even if the PR intends to liquidate the investment immediately. The PR should contact a stock transfer agent to begin the process. Some of the bigger stock transfer agents include Computershare, BNY Mellon Shareowner Service, American Stock Transfer & Trust Company, and Wells Fargo Shareowner Services. The forms necessary to make the transfer from the decedent to the PR are usually available on the company’s website. a. Medallion Signature Guarantee Program. Stock transfer agents will require that the documents being submitted (the original stock certificate and/or the stock transfer form) bear a Medallion Signature Guarantee from a financial institution such as a bank, credit union, or brokerage firm that participates in the Medallion Signature Guarantee Program. A Medallion Signature Guarantee is a guarantee by the financial institution that the PR’s signature is genuine, that the PR has the legal capacity to sign, that the PR is the appropriate person to endorse the security, and that the guaranteeing financial institution will accept liability for any forgery. This minimizes the liability to the stock transfer agent, but greatly increases the risk to the financial institution issuing the guarantee. Page 3 of 7 In order for a financial institution to participate in the Medallion Signature Guarantee Program, they must obtain a surety bond. The surety limits determines the value of securities that the financial institution may guarantee. The Signature Medallion Guarantee stamp issued to a financial institution will have a different alpha prefix corresponding to the surety limits. Presently, those alpha prefixes and limits are as follows: Alpha Prefix Surety Limit A $1,000,000 B $750,000 C $500,000 D $250,000 E $100,000 F (issued to Credit Unions) $100,000/transaction X $2,000,000 Y $5,000,000 Z $10,000,000 Because the potential for liability is high, each financial institution has its own rules and requirements for issuing the guarantee. Some common requirements include that the decedent have held an account with the institution, that the PR holds a current account with the institution, that the PR provide the most current statement for the investment, that the PR provide certified or exemplified copies of court documents, or that the PR pay a fee for the service. Page 4 of 7 Practice Tip: Call the financial institution ahead of time to verify that they participate in the Medallion Signature Guarantee Program and, if so, to schedule an appointment. Most financial institutions have a limited amount of employees who are able to issue the guaranty. The Author has had increasing difficulty with obtaining a Medallion Signature Guarantee as a number of banks in the downtown Seattle area are no longer participating in the program or have delegated these services exclusively to their brokerage affiliates. 3. U.S. Savings Bonds. U.S. Savings Bonds are more likely to be held as JTWROS or be subject to a POD designation and thus, are non-probate assets. However, in the event that the bond is subject to probate, the PR may either redeem the bond and distribute the proceeds to the Estate or reissue the bond in the name of a third person (heir). Documents that need to be submitted to the U.S. Treasury include the original bond, if available, Form PD F 5446 (available on the U.S. Treasury’s website), a certified copy of the death certificate, and a certified copy of the Letters Testamentary or of Administration issued within the last 12 months. If the PR is requesting that the bonds be reissued in the name of a third person, then that person much complete Form PD F 4000 for submission with the other documents. Like stock certificate transfers, the PR will need to obtain a Medallion Signature Guarantee on the documents. If the PR has the original bond, the PR should wait to endorse the back of the bond until he is in the presence of the person issuing the Medallion Signature Guarantee. Page 5 of 7 C. Understanding the Risks: Should the PR Distribute or Liquidate the Assets? The PR is exposed to greater personal liability when the Estate holds investments. The risks include losses sustained during market fluctuations or, if the PR decides to liquidate, in the form of attacks on the timing of or the costs of the sale. Examples of potential attacks include the amount of brokerage fees, PR fees, and/or legal fees incurred in the transaction, the amount of capital gain taxes or income taxes generated, the amount of loss sustained by the investment, etc. Practice Tip: The PR should retain professionals such as a broker and an accountant to provide advice in making a determination as to whether to distribute or liquidate an investment. The PR should also consider consulting with the heirs of the Estate on their wishes as to whether they prefer to receive their inheritance in kind or in cash. When in doubt, the PR should seek a Court Order to authorize or confirm his actions. 1. FDIC Coverage. Holding cash deposits is usually safer than holding brokerage investments. The disadvantage is that cash deposits have very low returns. At the present time, the return on a $250,000 short-term CD is approximately 0.10%. However, some professional fiduciaries prefer cash deposits because the deposit is likely insured by the Federal Deposit Insurance Corporation (“FDIC”). The FDIC is an independent agency created by The Banking Act of 1933 and funded by premiums paid by member financial institutions. It provides deposit insurance to a customer up to $250,000 per FDIC-defined ownership category. For large cash holdings, a PR may maximize FDIC coverage by depositing the funds with a financial institution participating in the Certificate of Deposit Account Registry Page 6 of 7 Service (CDARS) or with a brokerage firm offering brokerage CDs. These programs are similar in that the PR deposits all funds with a single financial institution. That institution then purchases CDs from various banks nationwide. Because each CD is purchased from different financial institutions for less than $250,000, each investment receives full FDIC coverage. The advantages of the CDARS program is that it allows the PR to delegate the administration of multiple banks and CDs to the depositing institution and provides for a single monthly bank statement from the depositing institution that identifies all of the CDs held in the various banks. The disadvantages include the administrative fees charged by the depositing institution and the current low rates being earned by short-term CDs. For example, the current APY for a six-month CD is approximately 0.15%. 2. SIPC Coverage. Holding investments in a brokerage account may yield a higher return and, as such, is attractive to heirs who may want to maximize their inheritance during the probate administration. This poses a risk to the PR, especially if the investment is volatile. Unlike a cash deposit, the FDIC does not insure investments. However, the investment may be insured by the Securities Investor Protection Corporation (“SIPC”). The SIPC is a non-profit corporation mandated under the Securities Investment Protection Act of 1970 and funded by member brokerage institutions. The SIPC insures customers in the event that a brokerage fails financially. It does not insure customers against market losses. Hence, SIPC coverage may not be comforting as the PR remains exposed to liability for market losses. Page 7 of 7