* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Presentation by Mr. Christopher Towe, Deputy Director, Monetary

Survey

Document related concepts

Moral hazard wikipedia , lookup

Financial economics wikipedia , lookup

Syndicated loan wikipedia , lookup

Federal takeover of Fannie Mae and Freddie Mac wikipedia , lookup

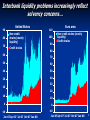

Securitization wikipedia , lookup

Public finance wikipedia , lookup

United States housing bubble wikipedia , lookup

Credit rationing wikipedia , lookup

Shadow banking system wikipedia , lookup

Global saving glut wikipedia , lookup

Systemic risk wikipedia , lookup

International monetary systems wikipedia , lookup

Interest rate ceiling wikipedia , lookup

Global financial system wikipedia , lookup

Financialization wikipedia , lookup

Transcript

Economic and Social Council of the Bretton Woods Institutions Christopher Towe Monetary and Capital Markets Department April 14, 2008 1 Outline… Risks of a further deterioration Key policy requirements The multilateral response 2 Outline… Risks of a further deterioration Key policy requirements The multilateral response 3 The global conjuncture and threats to systemic stability remain worrisome… Markets have stabilized somewhat in recent weeks… But only in response to a massive policy response: Extraordinary liquidity provision by central banks Cuts in official interest rates Fiscal stimulus Reform proposals And private market participants have also had to bolster capital… But interbank markets still impaired and there is a significant “tail risk” of self-sustained debt spiral 4 Our Global Financial Stability Map shows where the risks are most worrisome Emerging market risks Risks Credit risks October 2007 GFSR April 2008 GFSR Macroeconomic risks Market and liquidity risks Closer to center signifies less risk or tighter conditions Monetary and financial Risk appetite Conditions 5 IMF estimates of potential losses illustrate it’s not just a “sub-prime” problem… Estimates of Potential Write-downs to Holders of U.S.-Issued Securitized and Unsecuritized Debt Non-prime residential real estate 56% Leveraged loans Corporate credit 4% 8% 2% 4% 25% Consumer credit $945 billion Prime residential real estate Commercial real estate 6 The U.S. remains a key concern, with default rates rising now in “prime” markets Subprime 30 2006 25 Prime 2.5 2005 2000 2000 2.0 20 1.5 2004 2005 15 2006 2007 1.0 2007 2003 10 2004 0.5 5 2003 0.0 0 0 10 20 30 40 50 60 0 10 20 30 40 50 60 7 Non-U.S. real estate markets are also vulnerable to a downturn Residential Housing Price Trends 300 United Kingdom Spain Euro area France Ireland United States 250 200 150 100 2007Q1 2006Q1 2005Q1 2004Q1 2003Q1 2002Q1 2001Q1 2000Q1 1999Q1 1998Q1 1997Q1 1996Q1 1995Q1 50 8 Interbank liquidity problems increasingly reflect solvency concerns… 90 80 70 United States Non-credit strains (mostly liquidity) Credit strains 60 110 100 90 Non-credit strains (mostly liquidity) Credit strains 80 70 50 60 40 50 30 40 20 Euro area 30 20 10 0 -10 Jan-07 Apr-07 Jul-07 Oct-07 Jan-08 10 0 -10 Jan-07 Apr-07 Jul-07 Oct-07 Jan-08 9 Bank losses are spreading beyond the U.S…. Expected Nonprime-Related Bank Losses (In billions of U.S. dollars as of March 2008) 160 140 Conduits / SIVs 120 ABS CDOs 100 ABS Nonprime loans 80 60 40 20 0 Europe United States Asia Note: Losses aggregated over a two year period. ABS = asset-backed securities; CDOs = collateralized debt obligations; SIVs = structured investment vehicles. 10 The U.S. corporate sector is vulnerable to rising credit strains… Macroeconomic Indicators and Default Rates -3.5 -2.5 -1.5 14 Recessions Slower growth; tighter lending standards Lending standards 1/ 12 Default rate (rhs) 2/ 10 -0.5 8 0.5 6 1.5 4 2.5 2 3.5 0 1983 1988 1993 1998 1/ Net survey balances; standardized over 1990-present. 2/ Issuer-weighted. 2003 2008 11 Emerging market economies are feeling the pressure of the global financial crisis Emerging Market Private Sector Bond Issuance Emerging Market Corporate Spreads (billions of U.S. dollars) (in basis points) 35 450 Asia EMEA Latam 30 400 25 350 20 300 15 250 10 200 5 150 0 100 Jan-06 Q106 Q306 Q107 Q307 Q108 Asia EMEA Latam Jul-06 Jan-07 Jul-07 Jan-08 12 In summary, we still see significant threats to systemic stability from: A spreading of the U.S. sub-prime crisis in several dimensions To other real estate markets, both in the U.S. and abroad Beyond the banking sector, including to investment banks and monoline insurers Beyond the industrial world and into the emerging markets and developing countries To the macro-economies of both mature and developing countries 13 Outline… Risks of a further deterioration Key policy requirements The multilateral response 14 In the short term, the focus must remain on avoiding a self-sustained credit crunch Support for interbank markets Enhance bank disclosure Encourage bank recapitalization Early action by supervisors to deal stressed institutions Develop contingency plans for dealing with potentially large stocks of impaired assets 15 But steps over the medium term are also needed avoid future such episodes… The causes of the crisis were multi-faceted, so too must be the policy response Strengthen credit discipline: Tighten regulation and oversight over mortgage originators to improve underwriting standards Stricter application of consolidated supervision: Basel II reduces the incentives to move off-balance sheet, but vigilance will still be required Fair value accounting: Care is needed to minimize the procyclicality of this system Improve liquidity risk management: Supervisors need to more actively stress test Crisis management Enhance central bank liquidity frameworks Improve interagency coordination and information sharing Clarify enforcement responsibility 16 Outline… Risks of a further deterioration Key policy requirements The multilateral response 17 These messages have been given strong endorsement during the weekend… By the Fund’s International Monetary and Financial Committee The G7, too, called for: A 100-day plan Enhanced disclosure Review of (fair-value) accounting standards New liquidity risk and credit rating guidelines And by end 2008: Tighter capital requirements for structured credit products Enhanced transparency guidelines More fundamental changes in the use of credit ratings And cross-border supervisory cooperation is set to be strengthened in Europe and beyond 18 And for the Fund…? We will be responding on the multilateral front: Our Global Financial Stability Report (GFSR) provides a critical vehicle for disseminating our analysis and pressing our policy advice to a wide audience We will work closely with the Financial Stability Forum to help forge the consensus on specific policy responses We will be actively engaged with the key standard setters (e.g., Basel Committee) and key private industry groups And on the bilateral side: The lessons above will inform our FSAP and Article IV assessments, and our dialogue with national policymakers 19 Economic and Social Council of the Bretton Woods Institutions Christopher Towe Monetary and Capital Markets Department April 14, 2008 20