* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download TypeA - Department Of Economics

Survey

Document related concepts

Ragnar Nurkse's balanced growth theory wikipedia , lookup

Business cycle wikipedia , lookup

Pensions crisis wikipedia , lookup

Full employment wikipedia , lookup

Real bills doctrine wikipedia , lookup

Fear of floating wikipedia , lookup

Modern Monetary Theory wikipedia , lookup

Nominal rigidity wikipedia , lookup

Quantitative easing wikipedia , lookup

Monetary policy wikipedia , lookup

Great Recession in Russia wikipedia , lookup

Fiscal multiplier wikipedia , lookup

Exchange rate wikipedia , lookup

Early 1980s recession wikipedia , lookup

Phillips curve wikipedia , lookup

Transcript

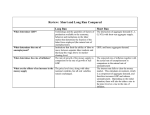

NAME: NO: SECTION: Boğaziçi University, Department of Economics Spring 2016 EC 102 PRINCIPLES of MACROECONOMICS FINAL 21.05.2016, Saturday 10:00 TYPE A • Turn off your cell phone and put it away. During the exam if you are seen with a cell phone, on or off, your exam will be taken away instantaneously. Put away all your lecture notes, books, etc. • Write your full name, student number and section on the top. • Please put all your answers in your answer key. • Do not forget to put your EXAM TYPE on your answer key. • There are 80 multiple choice questions and 12 pages in the exam. Make sure you have them all. • You have 120 minutes. GOOD LUCK!! 1. Suppose an increase in the price of rubber coincides with Figure 1. an advance in the technology of tire production. As a result of these two events, the demand for tires (a) decreases, and the supply of tires increases. (b) is unaffected, and the supply of tires decreases. (c) is unaffected, and the supply of tires increases. (d) None of the above is necessarily correct. ANSWER: d 2. What would happen to the equilibrium price and quantity of lattes if the cost to produce steamed milk, which is used to make lattes, increased, and scientists discovered that lattes cause heart attacks? 3. Refer to Figure 1 above. Suppose a price ceiling of $5 is (a) Both the equilibrium price and quantity would in- imposed on this market. As a result, crease. (a) the quantity of the good supplied decreases by 20 (b) Both the equilibrium price and quantity would de- units. crease. (b) the demand curve shifts to the left; quantity sold is (c) The equilibrium price would decrease, and the effect now 30 units and the price is $5. on equilibrium quantity would be ambiguous. (c) buyers total expenditure on the good decreases by (d) The equilibrium quantity would decrease, and the $80. effect on equilibrium price would be ambiguous. (d) the price of the good continues to serve as the ra- ANSWER: d tioning mechanism. 1 ANSWER: a ANSWER: b 7. Suppose an economy produces only cheese and fish. In 4. Refer to Figure 1. Suppose a price floor of $8 is imposed 2010, 20 units of cheese are sold at $5 each and 8 units on this market. As a result, of fish are sold at $50 each. In 2009, the base year, the (a) buyers’ total expenditure on the good decreases by price of cheese was $10 per unit and the price of fish was $20. $75 per unit. For 2010, (b) the supply curve shifts to the left; quantity sold is (a) nominal GDP is $500, real GDP is $800, and the now 30 units and the price is $8. GDP deflator is 62.5. (c) the quantity of the good demanded decreases by 10 (b) nominal GDP is $500, real GDP is $800, and the units. GDP deflator is 160. (d) the price of the good continues to serve as the ra- (c) nominal GDP is $800, real GDP is $500, and the tioning mechanism. GDP deflator is 62.5. (d) nominal GDP is $800, real GDP is $500, and the ANSWER: c GDP deflator is 160. 5. In 2014, a farmer grows and sells $3 million worth of corn ANSWER: a to Big Flakes Cereal Company. Big Flakes Cereal Company produces $8 million worth of cereal in 2014, with 8. During a presidential campaign, the incumbent argues sales to households during the year of $7 million. The un- that he should be reelected because nominal GDP grew sold $1 million worth of cereal remains in Big Flake Cereal by 12 percent during his 4-year term in office. You know Companys inventory at the end of 2014. The transactions that population grew by 4 percent over the period and just described contribute how much to GDP for 2014? that the GDP deflator increased by 6 percent during the past 4 years. You should conclude that real GDP per (a) $3 million person (b) $7 million (a) grew by more than 12 percent. (c) $8 million (b) grew, but by less than 12 percent. (d) $11 million (c) was unchanged. ANSWER: c (d) decreased. 6. When an Egyptian firm purchases a cement mixer from ANSWER: b Slovakia, 9. In an imaginary economy, consumers buy only sandwiches (a) Egyptian investment does not change, Egyptian net exports decrease, Egyptian GDP decreases, Slo- and magazines. The fixed basket consists of 20 sand- vakian net exports increase, and Slovakian GDP in- and a magazine cost $2. In 2007, a sandwich cost $5. creases. The base year is 2006. If the consumer price index in wiches and 30 magazines. In 2006, a sandwich cost $4 2007 was 125, then how much did a magazine cost in (b) Egyptian investment increases, Egyptian net ex- 2007? ports decrease, Egyptian GDP is unaffected, Slovakian net exports increase, and Slovakian GDP in- (a) $0.83 creases. (b) $2.25 (c) Egyptian investment decreases, Egyptian net ex- (c) $2.50 ports increase, Egyptian GDP is unaffected, Slo- (d) $3.00 vakian net exports decrease, and Slovakian GDP de- ANSWER: c creases. (d) Egyptian investment increases, Egyptian net ex- 10. Suppose the price of one liter of milk rises from 1.00 TL ports do not change, Egyptian GDP increases, Slo- to 1.20 TL and the price of a T-shirt rises from 8.00 TL vakian net exports do not change, and Slovakian to 9.60 TL. If the CPI rises from 150 to 195, then people GDP is unaffected. likely will buy 2 13. In 2009, the imaginary nation of Mainland had a pop- (a) more milk and more T-shirts. ulation of 7,000 and real GDP of 210,000. In 2010 the (b) more milk and fewer T-shirts. population was 7,300 and real GDP of 223,380. Over the (c) less milk and more T-shirts. year in question, real GDP per person in Mainland grew (d) less milk and fewer T-shirts. by (a) 2 percent, which is high compared to average U.S. ANSWER: a growth over the last one-hundred years. 11. Which of the following statements is true? (b) 2 percent, which is about the same as average U.S. growth over the last one-hundred years. (a) Even if we know the values of the consumer price (c) 4 percent, which is high compared to average U.S. index for the years 2009 and 2010, we cannot cal- growth over the last one-hundred years. culate the inflation rate for 2010 if we do not know (d) 4 percent, which is about the same as average U.S. which year is the base year. growth over the last one-hundred years. (b) If we know the base year is 1990, and if we know ANSWER: b the value of the consumer price index for the year 2010, then we have all the information we need to 14. Suppose that real GDP grew more in Country A than in calculate the inflation rate for 2010. Country B last year. (c) If we know the base year is 2000, and if we know (a) Country A must have a higher standard of living the value of the consumer price index for the year than country B. 1995, then we have all the information we need to (b) Country A’s productivity must have grown faster calculate the inflation rate for 1995. than country B’s. (d) If we know the base year is 2000, and if we know (c) Both of the above are correct. the value of the consumer price index for the year (d) None of the above are correct. 1995, then we have all the information we need to ANSWER: d calculate the percentage change in the cost of living between 1995 and 2000. 15. If an inexpensive alternative to oil were found, the price of oil adjusted for inflation ANSWER: d (a) would decline as the alternative would reduce the 12. Which of the following statements about real and nominal demand for oil. interest rates is correct? (b) would decline as the alternative would reduce the supply of oil. (a) When the nominal interest rate is rising, the real (c) would increase as the alternative would increase the interest rate is necessarily rising; when the nominal demand for oil. interest rate is falling, the real interest rate is necessarily falling. (d) would increase as the alternative would increase the supply of oil. (b) If the nominal interest rate is 4 percent and the inflation rate is 3 percent, then the real interest rate ANSWER: a is 7 percent. 16. Suppose there are constant returns to scale. Now suppose (c) An increase in the real interest rate is necessarily that over time a country doubles its workers, its natu- accompanied by either an increase in the nominal interest rate, an increase in the inflation rate, or ral resources, its physical capital, and its human capital, but its technology is unchanged. Which of the following both. would double? (d) When the inflation rate is positive, the nominal in- (a) both output and productivity terest rate is necessarily greater than the real interest rate. (b) output, but not productivity (c) productivity, but not output (d) neither productivity nor output ANSWER: d 3 (c) buy less new equipment and buildings. ANSWER: b This re- sponse helps explain why the supply of loanable 17. The country of Growpaw does not trade with any other funds is upward sloping. country. Its GDP is $20 billion. Its government purchases (d) buy less new equipment and buildings. $3 billion worth of goods and services each year, collects This re- $4 billion in taxes, and provides $2 billion in transfer sponse helps explain why the demand for loanable payments to households. Private saving in Growpaw is funds is downward sloping. $4 billion. What is investment in Growpaw? ANSWER: b (a) $5 billion 21. Josh is a full-time college student who is not working or (b) $4 billion looking for a job. Josh is counted as (c) $3 billion (a) unemployed and in the labor force. (d) $11 billion (b) unemployed but not in the labor force. ANSWER: c (c) in the labor force but not unemployed. 18. Other things the same, an increase in the interest rate (d) neither in the labor force nor unemployed. (a) would shift the demand for loanable funds to the ANSWER: d right. 22. Suppose that the adult population is 6 million, the num- (b) would shift the demand for loanable funds to the ber of employed is 3.8 million, and the labor-force partic- left. ipation rate is 70%. What is the unemployment rate? (c) would increase the quantity of loanable funds demanded. (a) 6.7% (d) would decrease the quantity of loanable funds de- (b) 9.5% manded. (c) 10.5% ANSWER: d (d) 28% 19. An increase in the budget deficit would cause a ANSWER: b (a) shortage of loanable funds at the original interest 23. Which of the following is an explanation for the existence rate, which would lead to falling interest rates. of frictional unemployment? (b) surplus of loanable funds at the original interest rate, (a) efficiency wages which would lead to rising interest rates. (b) minimum-wage laws (c) shortage of loanable funds at the original interest rate, which would lead to rising interest rates. (c) unions (d) surplus of loanable funds at the original interest rate, (d) job search which would lead to falling interest rates. ANSWER: d ANSWER: c 24. Efficiency wages create a 20. As real interest rates fall, firms desire to (a) shortage of labor and so reduce unemployment. (a) buy more new equipment and buildings. This response helps explain why the supply of loanable (b) shortage of labor and so raise unemployment. funds is upward sloping. (c) surplus of labor and so reduce unemployment. (b) buy more new equipment and buildings. This re- (d) surplus of labor and so raise unemployment. sponse helps explain why the demand for loanable funds is downward sloping. ANSWER: d 4 25. The manager of the bank where you work tells you that (d) decrease, but leaves the money supply unchanged. the bank has $400 million in deposits and $340 million ANSWER: b dollars in loans. The Central Bank then raises the reserve requirement from 5 percent to 10 percent. Assum- 29. Suppose the money market, drawn with the value of ing everything else stays the same, how much is the bank money on the vertical axis, is in equilibrium. If the money holding in excess reserves after the increase in the reserve supply increases, then at the old value of money there is requirement? an (a) excess demand for money that will result in an in- (a) $0 crease in spending. (b) $20 million (b) excess demand for money that will result in a de- (c) $40 million crease in spending. (d) $60 million (c) excess supply of money that will result in an increase in spending. ANSWER: b (d) excess supply of money that will result in a decrease 26. The money supply increases when the Central Bank in spending. (a) lowers the discount rate. The increase will be larger ANSWER: c the smaller the reserve ratio is. 30. When the money market is drawn with the value of money (b) lowers the discount rate. The increase will be larger on the vertical axis, if money supply and money demand the larger the reserve ratio is. both shift to the right (c) raises the discount rate. The increase will be larger (a) the price level must have risen the smaller the reserve ratio is. (b) the price level must have fallen. (d) raises the discount rate. The increase will be larger (c) the price level rises if money supply shifts farther the larger the reserve ratio is. than money demand. ANSWER: a (d) the price level falls if money supply shifts farther 27. If the reserve ratio is 5 percent, banks do not hold excess than money demand. reserves, and people do not hold currency, then when the ANSWER: c Central Bank purchases $20 million worth of government 31. There is evidence that the rate at which money changed bonds, bank reserves hands rose during the German hyperinflation. (a) increase by $20 million and the money supply even- This means that tually increases by $400 million. (a) velocity rose. If monetary neutrality holds the rise (b) decrease by $20 million and the money supply even- in velocity increased the ratio M/P. tually decreases by $400 million. (b) velocity rose. If monetary neutrality holds the rise (c) increase by $20 million and the money supply even- in velocity decreased the ratio M/P. tually increases by $100 million. (c) velocity fell. If monetary neutrality holds the fall in (d) decrease by $20 million and the money supply even- velocity increased the ratio M/P. tually decreases by $100 million. (d) velocity fell. If monetary neutrality holds the fall in ANSWER: a velocity decreased the ratio M/P. 28. During wars the public tends to hold relatively more cur- ANSWER: b rency and relatively fewer deposits. This decision makes 32. You put money into an account and earn a real inter- reserves est rate of 4 percent. Inflation is 2 percent, and your (a) and the money supply increase. marginal tax rate is 25 percent. What is your after-tax (b) and the money supply decrease. real rate of interest? (c) increase, but leaves the money supply unchanged. (a) 1.5 percent. 5 (b) 2.5 percent. (c) price level rises and its currency depreciates relative to other currencies in the world. (c) 5.0 percent. (d) price level falls and its currency depreciates relative (d) 4.5 percent. to other currencies in the world. ANSWER: b ANSWER: b 33. Other things the same, if a country has a trade deficit 37. In the open-economy macroeconomic model, the demand and saving rises, for Turkish Liras shifts right if at any given exchange rate (a) net capital outflow rises, so the trade deficit increases. (a) foreign residents want to buy more Turkish goods (b) net capital outflow rises, so the trade deficit de- (b) Turkish residents want to buy fewer foreign goods and services. and services. creases. (c) Both A and B are correct. (c) net capital outflow falls, so the trade deficit in- (d) None of the above is correct. creases. (d) net capital outflow falls, so the trade deficit de- ANSWER: c creases. 38. In the open-economy macroeconomic model, if a country’s supply of loanable funds shifts right, then ANSWER: b 34. During some year a country had exports of $50 billion, (a) net capital outflow rises, so the exchange rate rises. imports of $70 billion, and domestic investment of $100 (b) net capital outflow rises, so the exchange rate falls. billion. What was its saving during the year? (c) net capital outflow falls, so the exchange rate rises. (d) net capital outflow falls, so the exchange rate falls. (a) $80 billion ANSWER: b (b) $100 billion 39. In 2002, the United States imposed restrictions on the (c) $120 billion importation of steel into the United States. The open- (d) $150 billion economy macroeconomic model shows that such a policy ANSWER: a would (a) lower the real exchange rate and increase net ex- 35. In Ireland, a pint of beer costs 3 euros. In Australia, a ports. pint of beer costs 4 Australian dollars. If the exchange rate is 0.8 euros per Australian dollar, what is the real (b) lower the real exchange rate and have no effect on exchange rate? net exports. (c) raise the real exchange rate and decrease net ex- (a) 4/2.4 pints of Irish beer per pint of Australian beer ports. (b) 3/3.2 pint of Irish beer per pint of Australian beer (d) raise the real exchange rate and have no effect on (c) 3.2/3 pints of Irish beer per pint of Australian beer net exports. (d) 2.4/4 pints of Irish beer per pint of Australian beer ANSWER: d ANSWER: c 40. When Mexico suffered from capital flight in 1994, U.S. demand for loanable funds 36. If purchasing-power parity holds, when a country’s cen- (a) and U.S. net capital outflow rose. tral bank decreases the money supply, its (b) and U.S. net capital outflow fell. (a) price level rises and its currency appreciates relative (c) fell and U.S. net capital outflow rose. to other currencies in the world. (d) rose and U.S. net capital outflow fell. (b) price level falls and its currency appreciates relative to other currencies in the world. ANSWER: b 6 (d) increase domestic bond purchases, so the domestic 41. According to the classical model, an increase in the money currency depreciates. supply causes (a) output to increase in the long run. ANSWER: c (b) the unemployment rate to fall in the long run. 46. Other things the same, an increase in the price level (c) prices to rise in the long run. causes the interest rate to (d) interest rates to fall in the long run. (a) increase, the domestic currency to depreciate, and net exports to increase. ANSWER: c (b) increase, the domestic currency to appreciate, and 42. Which of the following rises when the Turkish price level net exports to decrease. falls? (c) decrease, the domestic currency to depreciate, and (a) interest rates net exports to increase. (b) the value of TL in the market for foreign-currency (d) decrease, the domestic currency to appreciate, and exchange net exports to decrease. (c) real wealth ANSWER: b (d) All of the above are correct. 47. Which of the following both shift aggregate demand left? ANSWER: c (a) a decrease in taxes and at a given price level con- 43. The aggregate quantity of goods and services demanded sumers feel more wealthy changes as the price level rises because (b) a decrease in taxes and at a given price level con(a) real wealth falls, interest rates rise, and the dollar sumers feel less wealthy appreciates. (c) an increase in taxes and at a given price level con- (b) real wealth falls, interest rates rise, and the dollar sumers feel more wealthy depreciates. (d) an increase in taxes and at a given price level con- (c) real wealth rises, interest rates fall, and the dollar sumers feel less wealthy appreciates. ANSWER: d (d) real wealth rises, interest rates fall, and the dollar depreciates. 48. When the money supply decreases ANSWER: a (a) interest rates fall and so aggregate demand shifts right. 44. As the price level rises, the exchange rate (b) interest rates fall and so aggregate demand shifts (a) falls, so exports rise and imports fall. left. (b) falls, so exports fall and imports rise. (c) interest rates rise and so aggregate demand shifts (c) rises, so exports rise and imports fall. right. (d) rises, so exports fall and imports rise. (d) interest rates rise and so aggregate demand shifts left. ANSWER: d ANSWER: d 45. Other things the same, if the price level rises, people 49. Which of the following is correct? (a) increase foreign bond purchases, so the domestic currency appreciates. (a) An increase in the money supply causes the interest rate to decrease so that aggregate demand shifts (b) increase foreign bond purchases, so the domestic cur- left. rency depreciates. (c) increase domestic bond purchases, so the domestic (b) An increase in stock prices reduces consumption currency appreciates. spending so that aggregate demand shifts left. 7 (a) right, and an increase in the actual price level shifts (c) An increase in the price level causes the exchange short-run aggregate supply to the right. rate to rise so that aggregate demand shifts left. (b) right, and an increase in the actual price level does (d) A recession in other countries reduces Turkish net exports so that Turkish aggregate demand shifts left. not shift short-run aggregate supply. (c) left, and an increase in the actual price level shifts ANSWER: d short-run aggregate supply to the left. 50. Other things the same, continued technological progress (d) left, and an increase in the actual price level does not shift short-run aggregate supply. and continued increases in the money supply would unambiguously lead to ANSWER: d (a) rising prices only. 54. Suppose the economy is in long-run equilibrium. If there (b) rising real GDP only. (c) rising prices and rising real GDP. is an increase in government purchases at the same time there is a large increase in the price of oil, then in the (d) neither rising prices nor rising real GDP. short-run (a) real GDP will rise and the price level might rise, fall, ANSWER: b or stay the same. 51. If there are sticky wages, and the price level is greater (b) real GDP will fall and the price level might rise, fall, than what was expected, then or stay the same. (a) the quantity of aggregate goods and services supplied falls, which is shown by a shift of the short-run (c) the price level will rise, and real GDP might rise, fall, or stay the same. aggregate supply curve to the left. (d) the price level will fall, and real GDP might rise, (b) the quantity of aggregate goods and services sup- fall, or stay the same. plied falls, as shown by a movement to the left along ANSWER: c the short-run aggregate supply curve. Figure 2. (c) the quantity of aggregate goods and services supplied rises, as shown by a shift of the short-run aggregate supply curve to the right. (d) the quantity of aggregate goods and services supplied rises, as shown by a movement to the right along the short-run aggregate supply curve. ANSWER: d 52. People had been expecting the price level to be 120 but it turns out to be 122. In response Robinson Tire Company increases the number of workers it employs. What could explain this? (a) both sticky price theory and sticky wage theory 55. Refer to Figure 2 above. Which of the long-run aggregate- (b) sticky price theory but not sticky wage theory supply curves is consistent with a short-run economic ex- (c) sticky wage theory but not sticky price theory pansion? (d) neither sticky wage theory nor sticky price theory (a) LRAS1 ANSWER: a (b) LRAS2 (c) LRAS3 53. An increase in the expected price level shifts short-run aggregate supply to the (d) Both LRAS1 and LRAS3 8 ANSWER: a (c) withdraw money from interest-bearing accounts, and the interest rate will fall. Figure 3. (d) withdraw money from interest-bearing accounts, and the interest rate will rise. ANSWER: a 59. If the Central Bank decided to raise interest rates, it could (a) buy bonds to lower the money supply. (b) buy bonds to raise the money supply. (c) sell bonds to lower the money supply. (d) sell bonds to raise the money supply. ANSWER: c 60. If the Central Bank conducts open-market sales, which of 56. Refer to Figure 3 above. Suppose the economy starts at the following quantities increase(s)? Y. If there is a fall in aggregate demand, then the economy moves to (a) interest rates, prices, and investment spending (b) interest rates and prices, but not investment spend- (a) V in the long run. ing (b) W in the long run. (c) interest rates and investment, but not prices (c) X in the long run. (d) interest rates, but not investment or prices (d) Z in the long run. ANSWER: d ANSWER: d 61. In a certain economy, when income is $400, consumer spending is $325. The value of the multiplier for this 57. According to the liquidity preference theory, an increase economy is 3.33. It follows that, when income is $450, in the overall price level of 10 percent consumer spending is (a) increases the equilibrium interest rate, which in turn (a) $360. For this economy, an initial increase of $50 in decreases the quantity of goods and services de- consumer spending translates into a $266.67 increase manded. in aggregate demand. (b) decreases the equilibrium interest rate, which in (b) $360. For this economy, an initial increase of $50 in turn increases the quantity of goods and services de- consumer spending translates into a $166.50 increase in aggregate demand. manded. (c) increases the quantity of money supplied by 10 per- (c) $341.67. For this economy, an initial increase of $50 cent, leaving the interest rate and the quantity of in consumer spending translates into a $266.67 in- goods and services demanded unchanged. crease in aggregate demand. (d) decreases the quantity of money demanded by 10 (d) $341.67. For this economy, an initial increase of $50 percent, leaving the interest rate and the quantity in consumer spending translates into a $166.25 in- of goods and services demanded unchanged. crease in aggregate demand. ANSWER: a ANSWER: b 58. If there is excess money supply, people will 62. Which of the following correctly explains the crowdingout effect? (a) deposit more into interest-bearing accounts, and the interest rate will fall. (a) An increase in government expenditures decreases the interest rate and so increases investment spend- (b) deposit more into interest-bearing accounts, and the ing. interest rate will rise. 9 (b) An increase in government expenditures increases 66. If a $1000 increase in income leads to an $800 increase in the interest rate and so reduces investment spend- consumption expenditures, then the marginal propensity ing. to consume is (c) A decrease in government expenditures increases the interest rate and so increases investment spending. (a) 0.2 and the multiplier is 1.25. (b) 0.8 and the multiplier is 5. (d) A decrease in government expenditures decreases (c) 0.2 and the multiplier is 1.25. the interest rate and so reduces investment spend- (d) 0.8 and the multiplier is 8. ing. ANSWER: b ANSWER: b 67. If businesses and consumers become pessimistic, the Cen63. Assume there is a multiplier effect and some crowding out effect. An increase in government expenditures changes tral Bank can attempt to reduce the impact on the price level and real GDP by aggregate demand more, (a) increasing the money supply, which raises interest (a) the smaller the MPC and the stronger the influence of income on money demand. rates. (b) increasing the money supply, which lowers interest (b) the smaller the MPC and the weaker the influence of income on money demand. rates. (c) decreasing the money supply, which raises interest (c) the larger the MPC and the stronger the influence rates. (d) decreasing the money supply, which lowers interest of income on money demand. rates. (d) the larger the MPC and the weaker the influence of income on money demand. ANSWER: b 68. A reduction in Turkish net exports would shift Turkish aggregate demand ANSWER: d 64. Assume the MPC is 0.65. Assuming only the multiplier effect matters, a decrease in government purchases of $20 billion will shift the aggregate demand curve to the (a) rightward. In an attempt to stabilize the economy, the government could increase expenditures. (b) rightward. In an attempt to stabilize the economy, (a) left by about $30.77 billion. the government could decrease expenditures. (b) left by about $57.1 billion. (c) leftward. In an attempt to stabilize the economy, the government could increase expenditures. (c) right by about $57.1 billion. (d) leftward. In an attempt to stabilize the economy, (d) right by about $30.77 billion. the government could decrease expenditures. ANSWER: b ANSWER: c 65. Imagine that the government increases its spending by $75 billion. Which of the following by itself would tend to make the change in aggregate demand different from $75 billion? 69. The primary argument against active monetary and fiscal policy is that (a) attempts to stabilize the economy do not constitute (a) both the multiplier effect and the crowding-out ef- a proper role for government in a democratic society. (b) these policies affect the economy with a long lag. fect (b) the multiplier effect, but not the crowding-out effect (c) the crowding-out effect, but not the multiplier effect (d) neither the crowding out effect nor the multiplier (c) these policies affect the economy too quickly and with too much impact. (d) history demonstrates that interest rates respond unpredictably to active policies, leading to unpre- effect dictable effects on income. ANSWER: a ANSWER: b 10 70. In his famous article published in an economics journal 72. Refer to Figure 4 above. Assume the figure depicts pos- in 1958, A.W. Phillips sible outcomes for the year 2018. In 2018, the economy is at point A on the left-hand graph, which corresponds to (a) used data for the United States to show a negative relationship between the rate of change of the U.S. point A on the right-hand graph. The price level in the year 2017 was consumer price index and the U.S. unemployment (a) 144. rate. (b) used data for the United States to show a negative (b) 150. relationship between the rate of change of wages in (c) 152. the U.S. and the U.S. unemployment rate. (d) 156. (c) used data for the United Kingdom to show a negative relationship between the rate of change of the ANSWER: b U.K. consumer price index and the U.K. unemployment rate. 73. Refer to Figure 4 above. Assume the figure charts possible outcomes for the year 2018. In 2018, the economy (d) used data for the United Kingdom to show a nega- is at point B on the left-hand graph, which corresponds tive relationship between the rate of change of wages to point B on the right-hand graph. Also, point A on in the U.K. and the U.K. unemployment rate. the left-hand graph corresponds to A on the right-hand graph. The price level in the year 2018 is ANSWER: d (a) 155.56. 71. If policymakers expand aggregate demand, then in the (b) 159.00. long run (c) 163.50. (a) prices will be higher and unemployment will be (d) 170.04. lower. ANSWER: c (b) prices will be higher and unemployment will be un74. A policy that raised the natural rate of unemployment changed. would shift (c) prices and unemployment will be unchanged. (a) both the short-run and the long-run Phillips curves (d) None of the above is correct. to the right. ANSWER: b (b) the short-run Phillips curve right but leave the longrun Phillips curve unchanged. Figure 4. (c) the long-run Phillips curve right but leave the shortrun Phillips curve unchanged. (d) neither the long-run Phillips curve nor the short-run Phillips curve right. ANSWER: a 75. If people anticipate higher inflation, but inflation remains the same then In Figure 4 above, the left-hand graph shows a shortrun aggregate-supply (SRAS) curve and two aggregate- (a) the short-run Phillips curve would shift right and unemployment would rise. (b) the short-run Phillips curve would shift right and demand (AD) curves, with the price level on the vertical unemployment would fall. axis, and Y represents output. On the right-hand di- (c) the short-run Phillips curve would shift left and un- agram, U represents the unemployment rate, with the employment would rise. inflation rate on the vertical axis. 11 (d) the short-run Phillips curve would shift left and un- (d) the short-run Phillips curve but not the long run Phillips curve to shift left. employment would fall. ANSWER: a ANSWER: d 76. If a central bank increases the money supply in response to an adverse supply shock, then which of the following 79. If a central bank reduced inflation by 2 percentage points quantities moves closer to its pre-shock value as a result? years and the unemployment rate rise from 3 percent to and that made output fall by 1 percentage points for 2 5 percent for 2 years, the sacrifice ratio is (a) both the price level and output (b) the price level but not output (a) 1/2. (c) output but not the price level (b) 1. (d) neither output nor the price level (c) 2. (d) 4. ANSWER: c ANSWER: b 77. A favorable supply shock will cause inflation to 80. Suppose a central bank takes actions that will lead to a (a) rise and shift the short-run Phillips curve right. higher inflation rate. The public, however, is slow to ad- (b) rise and shift the short-run Phillips curve left. just its expectation of inflation. Then, in the short run, (c) fall and shift the short-run Phillips curve right. unemployment (d) fall and shift the short-run Phillips curve left. (a) rises. As inflation expectations adjust, the short-run ANSWER: d Phillips curve shifts right. (b) rises. As inflation expectations adjust, the short-run 78. Disinflation would eventually cause Phillips curve shifts left. (a) the short-run and the long run Phillips curve to shift (c) falls. As inflation expectations adjust, the short-run right. (b) the short-run and the long run Phillips curve to shift Phillips curve shifts right. (d) falls. As inflation expectations adjust, the short-run left. (c) the short-run Phillips curve but not the long run Phillips curve shifts left. ANSWER: c Phillips curve to shift right. 12