* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Chapter 4: Demand

Survey

Document related concepts

Transcript

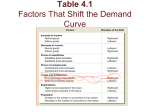

Chapter 4: Demand Section 1: What is Demand Demand – the desire, ability, and willingness to buy a product – can compete with others who have similar demands. Microeconomics – is the area of economics that deals with behavior and decision making by small units, such as individuals and firms. A) An Introduction to Demand a. A knowledge of demand is essential to understand how a market economy works. How we as consumers answer what we will buy. b. Demand Schedules are listing that shows the various quantities demanded of a particular product at all prices that might prevail in the market at a given time. Schedules show that two areas of Price and Quantity Demanded. c. There are Individual and Market Demand Schedules. Each show the same information; however, one is for individuals and the other reflects the entire market. d. Law of Demand – states that as price goes up - quantity demanded goes down. As price goes down – quantity demanded goes up. It is an inverse relationship. e. Demand Curves are sloping down and to the right. The Market Demand Curve shows the demand for everyone based upon the information from the Demand Schedule. B) Demand and Marginal Utility a. Utility describes the amount of usefulness or satisfaction that someone gets from the use of a product. b. Marginal Utility – the extra satisfaction a person gets from acquiring or using one more unit of product. i. One soda – two-three-four-five-etc. Section 2: Factors Affecting Demand A) Change in the Quantity Demanded a. A movement along the demand curve that shows a change in the quantity of the product purchased in response to a change in price. b. The Income Effect – when prices drop, consumers have more money to buy. Allowing more product to be bought or if price increases – less to buy. c. The Substitution Effect – is the change in demand because of the change in the relative price of the product. B) Change in Demand a. A change in demand is when people are now willing to buy different amounts of the product at the same price. b. This will result in an entirely new curve. c. The Demand Curve can change for several reasons: i. Consumer Income – as income goes up you can buy more. This will cause the curve to shift to the right. As income goes down the curve will shift to the left. ii. Consumer Tastes – if consumers want more of an item, they would buy more of it at each and every price. The curve will shift to the right. Also new products can effect consumer tastes. iii. Substitutes – they can be used in place of other products (butter and margarine) iv. Complements – products that are used with others (peanut butter and jelly, CD players and batteries). v. Change in Expectations – the way people think about eh future. vi. Number of Consumers – an increase in the number of consumers can cause the market demand curve to shift. Section 3: Elasticity of Demand Elasticity – a measure of responsiveness that tells us how a dependent variable such as quantity responds to a change in an independent variable such as price. A) Demand Elasticity – the extent to which a change in price causes a change in the quantity demanded. a. Elastic when a given change in price causes a relatively larger change in quantity demanded. b. Inelastic when a given change in price causes a relatively smaller change in the quantity demanded. c. Unit Elastic Demand when a given change in price causes a proportional change in quantity demanded. B) Determinants of Demand Elasticity a. Can the Purchase be Delayed? b. Are Adequate Substitutes Available? c. Does the Purchase Use a Large Portion of Income? d. If the Answers are more “yes” than Elastic. If Answers are more “no” then Inelastic. Chapter 5: Supply Voluntary decisions made by producers Supply is defined as the amount of a product that would be offered for sale at all possible prices that could prevail in the market Law of Supply, the principles that suppliers will normally offer more for sale at high prices and less at lower prices. Section 1: What is Supply? A) An Introduction to Supply All suppliers of economic products must decide how much to offer for sale at various prices a. The Supply Schedule – is a listing of the various quantities of a particular product supplied at all possible prices in the market Price ($) 30 25 20 15 10 5 Quantity Supplied 8 7 6 4 2 0 b. The Individual Supply Curve – a graph showing the various quantities supplied at each and every price that might prevail in the market. 1. All normal supply curves slope from the lower left hand corner of the graph to the upper right hand corner. c. The Market Supply Curve – the supply curve that shows the quantities offered at various prices by all firms that offer the product for sale in a given market. B) Change in Quantity Supplied Quantity supplied – is the amount that producers bring to market at any given price. Change in Quantity supplied – is the change in amount offered for sale in response to a change in price. C) Change in Supply Change in Supply – a situation where suppliers offer different amounts of products for sale at all possible prices in the market Changes in supply whether increase or decrease can occur for several reasons a. Cost of Inputs – a change in the cost of inputs can cause a change in supply. b. Productivity – when management motivates its workers, or if workers decide to work more efficiently, productivity should increase. c. Technology – New technology tends to shift the supply curve to the right. d. Taxes and Subsidies – Firms view taxes as costs. 1. If taxes go up - this causes the supply curve to shift to the left. 2. If taxes go down - then supply increases and the curve shifts to the right. 3. A subsidy is a government payment to an individual, business, or other group to encourage or protect a certain type of economic activity. e. Expectations – future price of a product can also affect the supply curve. f. Government Regulations – new regulations or repeal of regulations can change costs and affect supply. g. Number of Sellers – a change in the number of suppliers causes the market supply curve to shift to the right or left. D) Elasticity of Supply Supply elasticity is a measure of the way in which quantity supplied responds to a change in price. a. Three Elasticities 1. Elastic – the change in price causes a relatively large change in quantity supplied 2. Inelastic – the change in price causes a relatively smaller change in quantity supplied 3. Unit elastic – the change in price causes a proportional change in the quantity supplied Section 2: The Theory of Production The theory of production deals with the relationship between the factors of production and the output of goods and services. Short run Long run A) Law of Variable Productions a. The Law of Variable Proportions states that in the short run output will change as one input is varied while the others are held constant. b. The Law of Variable Proportions deals with the relationship between the input of productive resources and the output of final products. B) The Production Function Raw materials – unprocessed natural products used in production. a. Total Product – total output produced by the firm b. Total Product Rises – more workers added and total product rises c. Total Product Slows – even with more workers and product rises, but at a slower rate. d. Marginal Product – the extra output or change in total product caused by the addition of one more unit of variable input. C) Three Stages of Production a. Increasing returns b. Diminishing returns – outputs increases at a diminishing rate as more units of a variable input are added c. Negative returns Section 3: Cost, Revenue, and Profit Maximization A) Measures of Cost a. Fixed cost – the cost that a business incurs even if the plant is idle and output zero. They remain the same. Salaries, interest, rent, taxes. b. Variable cost – costs that changes when the business rate of operation or output changes. Labor, raw materials. c. Total cost – the sum of the fixed and variable cost. d. Marginal cost – the extra cost incurred when a business produces one additional unit of production. B) Applying Cost Principles Self-Serve Internet sales -- e-commerce C) Measures of Revenue a. Total revenue is the number of units sold multiplied by the average price per unit b. Marginal revenue – the extra revenue associated with the production and sale of one additional unit of output. D) Marginal Analysis a. A type of cost-benefit decision making that compares the extra benefits to the extra costs of an action. b. Break Even Point – is the total output or total product the business needs to sell in order to cover its costs c. A business wants to do more than break even ---- PROFIT Chapter 6: Prices and Decision Making Price – the monetary value of a product as established by supply and demand – is a signal that helps us make our economic decisions. Prices communicate information and provide incentives to buyers and sellers. High prices are signals for producers to produce more and for buyers to buy less. Low prices are signals for producers to produce less and for buyers to buy more. A) Advantages of Prices Prices serve as a link between producers and consumers They help decide the three basic WHAT, HOW, and FOR WHOM questions. Without prices, the economy would not run as smoothly. a. Prices in a competitive market economy are neutral because they favor neither the producer nor the consumer. Prices are the result of competition between buyers and sellers. b. Prices in a market economy are flexible. Buyers and sellers react to the new level of prices and adjust their consumption and production accordingly. The ability of the price system to absorb unexpected “shocks” is one of the strengths of a market economy. c. Prices have no cost of administration. Competitive markets tend to find their own prices without outside help or interference. d. Prices are something that we have known about all our lives. B) Allocations Without Prices Prices are important because they help us make the everyday economic decisions that allocate scare resources and the products made from them. Rationing – a system under which an agency such as the government decides everyone’s “fair” share. Ration coupon – a ticket or a receipt that entitles the holder to obtain a certain amount of a product. a. The Problem of Fairness – the first problem with rationing is that almost everyone feels his or her share is too small. b. High Administrative Cost – second problem is the cost. Someone has to pay for the printing, etc. c. Diminishing Incentive – rationing has a negative impact on people’s incentive to work and produce. C) Price as a System Economists overwhelmingly favor the price system Rebate – a partial refund of the original price of the product Prices do more than convey information to buyers and sellers in a market – they also help buyers and sellers allocate resources between markets. Section 2: The Price System at Work Everyone who participates has a hand in determining price A) The Price Adjustment Process a. An Economic Model i. Using Supply and Demand is one of the most popular tools used by economists. ii. An Economic Model is a set of assumptions that can be a table, graph, or algebraically that helps analyze behavior and predict outcome. iii. The information in the schedule and curve reflects the Law of Demand and the Law of Supply. iv. When they are combined we have a complete model of the market, which will allow us to analyze how the interaction of buyers and sellers results in a price that is agreeable to all. b. Market Equilibrium – a situation in which prices are relatively stable, and the quantity of goods or services supplied is equal to the quantity demanded. c. Surplus – is a situation in which the quantity supplied is greater than the quantity demanded at a given price. This surplus shows up as unsold products on suppliers’ shelves. Price tends to go down as a result of the surplus. d. Shortage – is a situation in which the quantity demanded is great than the quantity supplied at the price given. Both the price and the quantity supplied will go up in the next trading period. e. Equilibrium Price – is the price that “clears the market” by leaving neither a surplus nor a shortage at the end of the trading period. B) Explaining and Predicting Price A change in price is normally the result of a change in supply, a change in demand, or changes in both. Elasticity of demand is also important when predicting price. a. Change in Demand – can affect the price of a good or service. C) The Competitive Price Theory Is important because it serves as a model by which to measure the performance of others, less competitive market structure. In the final analysis, the market economy is one that “runs itself” Section 3: Social Goals vs. Market Efficiency The goals most compatible with a market economy are freedom, efficiency, full employment, price stability, and economic growth. A) Distorting Market Outcomes a. Price Ceiling – a maximum legal price that can be charged for a product. This affects the allocation of resources but not the way intended in an open market. b. Price Floor – the lowest price under which a product cannot fall. A minimum wage is a type of price floor. B) Agricultural Price Supports C) When Markets Talk Markets are impersonal mechanisms that bring buyers and sellers together.