* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Study Guide Chapter 12 - MS BOLLY

Survey

Document related concepts

Transcript

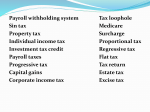

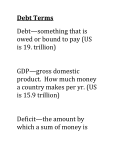

Study Guide Role of G in the Economy Economics Ms Bolly 1. Role of G in the economy: Intro notes: reasons why the governments is no longer Laissez Faire. Be able to offer examples for any of the listed reasons from history and/or current events. Externality: Define and offer examples. What is the “peace dividend”? What is the government safety net? Offer examples. 2. Government Debt: What is the difference between the DEBT and DEFICIT? What is the amount of the current US Deficit? Debt? Review to whom does the government owe its debt? Who is the largest holder of US government debt? What is a safe % for deficit spending relative to our GDP? When should we really be worried about the government deficit spending? What role do foreigners play in our economy? What is a trade surplus v trade deficit? Why does China own so much of our debt? What are realistic ways to reduce the deficit/debt? 3. Social Security: Review the 3 articles on social security and retirement: What is the difference between social security, pension and 401K? Why have pensions been declining? What are the advantages and disadvantages of a 401K? How does Social Security work? What is the % tax, who pays it, when can you collect social security… What is the relationship between the Social Security surplus and the government’s budget debt? What are some ways of fixing Social Security? What role do the baby boomers play in the social security issue? 4. Government budget: From where does the federal government collect taxes? What are the patterns for individual income tax and corporate tax over the years as a percent of the federal government’s budget? What is the difference between discretionary and mandatory spending when it comes to constructing the federal government budget? What is the difference between an Excise tax, Tariff and an Estate tax? When is an excise tax a sin tax? What is the order of spending categories in the federal government’s budget? What are Transfer payments, examples? What is an Exhaustive expenditure, examples? 5.Types of taxes: Be able to define, calculate and recognize examples of each: Progressive taxation Proportional taxation Regressive taxation 6. Principles of Taxation: Be able do define, identify and apply. Ability to pay Benefits received 7. $10 Trillion and Counting video guide: What is the “starve the beast” theory? What are reasons for the Clinton surplus turning into deficit spending under George W Bush? What president(s) raised taxes? What president(s) did not? What is the main issue/program that affects tackling deficit/debt for the US Federal Government?