* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download LECTURE 5. The Business Cycle

Nouriel Roubini wikipedia , lookup

Economic democracy wikipedia , lookup

Non-monetary economy wikipedia , lookup

Production for use wikipedia , lookup

Ragnar Nurkse's balanced growth theory wikipedia , lookup

Fiscal multiplier wikipedia , lookup

Post–World War II economic expansion wikipedia , lookup

Great Recession in Russia wikipedia , lookup

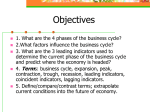

ABSE 102 The Business Cycle 1. Definition and phases The Business cycle is defined as periodical fluctuations of aggregate demand around the level of the potential GDP. The aggregate demand is measured by the level of real GDP and presents the economic activity in the country. The Business cycles trace out a wavelike pattern with a length between 3.5 and 8 years. The business cycle is identified as a sequence of four phases: Contraction (a slowdown in the pace of economic activity) Trough (The lower turning point of a business cycle, where a contraction turns into an expansion) Expansion (A speedup in the pace of economic activity. It has two parts recovery and boom. The boom starts when the level of real GDP rises above the level of its previous peak) Peak (The upper turning of a business cycle) A recession occurs if the level of the real GDP declines during the contraction. The standard definition of a recession is a decline in the Gross Domestic Product for two or more consecutive quarters. A deep trough is called a slump or a depression. The difference between a recession and a depression is marked by the change in the level of real GDP. While during the recession it falls, during the depression the decline in aggregate demand stops and stays at a low level for more than two consecutive quarters.1 The standard phases are presented on Figure 1. GDP (AD) peak recession peak boom recession recovery trough trough time Fig. 1. The phases of the business cycle. 2. Economic indicators of the business cycle The phases of the business cycle describe the behaviour of a variety of economic indicators which reflect basic business conditions. To achieve precision these data are taken weekly or monthly; together they trace out a reference cycle which maps the congruence of peaks and troughs in an attempt to indicate average business cycle behaviour. The business cycle indicators are classified into three groups: 1 There is an old joke among economists that states: A recession is when your neighbor loses his job. A depression is when you lose your job. a) Leading: Leading economic indicators are indicators which change before the economy changes. Stock market returns are a leading indicator, as the stock market usually begins to decline before the economy declines and they improve before the economy begins to pull out of a recession. Leading economic indicators are the most important type for investors as they help predict what the economy will be like in the future. b) Coincident: A coincident economic indicator is one that simply moves at the same time the economy does. The Gross Domestic Product is a coincident indicator. c) Lagged: A lagged economic indicator is one that does not change direction until a few quarters after the economy does. The unemployment rate is a lagged economic indicator as unemployment tends to increase for 2 or 3 quarters after the economy starts to improve. Main Leading Indicators Hours of production workers in manufacturing New claims for unemployment insurance New orders for plant and equipment Building permits for private houses Car sales Change in inventories Change in commodity prices Money growth rate Main Coincident Indicators Real GDP Consumption Exports GDP defaltor Nonagricultural employment Index of industrial production Personal income Personal savings rate Manufacturing and trade sales Main Lagging Indicators Unemployment rate Commercial and industrial loans Ratio of consumer debt to personal income In Cyprus exports and construction contracts are the most important indicators because of the export orientation of the economy and the important role played by the construction industry in the economy. 3. The business cycle in the real sector and in the financial markets During the recovery and the boom, aggregate demand is greater than aggregate supply. Firms are happy to sell more and make greater profits. They increase production and order more raw materials from their suppliers. Everybody has optimistic expectations about the future, unemployment falls, income rises and aggregate demand rises even further. The higher profitability in the real sector raises prices of the firms and their shares become more expensive. The increase in production and income raises the demand for durables (machines, equipment, housing, etc.) and the demand for credit rises too. The optimistic expectations push upwards the prices of securities in the financial markets. This is a bull market. Everyone expects the demand to increase further and securities increase in price. Everyone is trying to make money on speculation – buy now in order to sell later at a higher price. Everyone wants to invest more in such deals in order to get greater profits. Often, the money invested is borrowed from the banks. Thus, the prices of the financial assets go much beyond the value of the real goods, presented by the securities. The increase in aggregate demand drives up the aggregate supply. However, supply cannot grow forever. Resources are scarce. Firms have limited production capacity and when they operate above their full capacity, the cost of production starts rising. Because of the high demand for labor and high employment rate workers would work more if only their wages and salaries are raised. Any further increase in production involves greater costs and prices start rising faster than production and income. Aggregate demand falls below aggregate supply. Firms cannot sell as much as they have expected and their inventories increase. They reduce their orders of new supplies and all firms start producing less. Unemployment rises, income falls and demand decreases even more. This is the recession. The first signals for the recession come usually from the financial markets. The increase in the cost of production and oversupply creates pessimistic expectations about the future and prices of securities fall sharply. This is a bear market. Investors loose money and they are not able to pay for the losses. Everyone needs money from the banks. The banks have difficulties to collect the credits and to serve their clients. This could lead to bankruptcy. Since banks offer and borrow money from each other, the bankruptcy of one bank creates risks for the entire financial system. The confidence in the financial markets is lost. Everyone is reluctant to put money in the financial system. Everyone prefers liquidity (real money), not securities. Shortly, this is the picture in the financial markets today. It started with the inability of many American households to pay for their mortgage loans. It is not a big deal for the society if some people cannot pay back their loans. They lose their houses, cars, etc. However, when it comes to many households and firms, which cannot pay, the financial institutions that have landed the money cannot survive either. Here comes the crisis. The current situation in the financial markets is so critical, because during the boom period money was too cheap. It was very easy and cheap to borrow and optimistic expectations pumped the financial balloon too much. If the central banks had raised the price of the money a few years ago, the speculative demand for securities and real estate would have not gone that away from the real value of the assets and the losses would be much lower. Anyway, the contraction could not have been prevented, but the slow down in the level of economic activity might have been quite smaller. The recession is the most important phase of the business cycle. It sweeps away the inefficient businesses and motivates technological progress.