* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download M I E ’

Survey

Document related concepts

Transcript

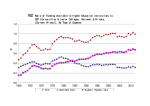

142 SAJEMS NS 15 (2012) No 2 MACROECONOMIC IMPACT OF ESKOM’S SIX-YEAR CAPITAL INVESTMENT PROGRAMME1 Reyno Seymore Department of Economics, University of Pretoria Olusegun A. Akanbi Department of Economics, University of South Africa Iraj Abedian GIBS, University of Pretoria Accepted: February 2012 Abstract This study analyses the impact of an increase in Eskom’s capital expenditure on the overall macro and sectoral economy using both a Time-Series Macro-Econometric (TSME) model and a Computable General Equilibrium (CGE) model. The simulation results from the TSME model reveal that in the long run, major macro variables (i.e. household consumption, GDP, and employment) will be positively affected by the increased investment. A weak transmission mechanism of the shock on the macro and sectoral economy is detected both in the short run and long run due to the relatively small share of electricity investment in total investment in the economy. On the other hand, the simulation results from the CGE reveal similar but more robust positive impacts on the macro economy. Most of the short-run macroeconomic impacts are reinforced in the long run. Key words: capital expenditure, macroeconomic variables, general equilibrium modelling JEL: C01, 32, 51-54, D58 1 Introduction Over the period 1994-2010 the South African economy sustained itself with the existing energy infrastructure built before 1994 without investing in additional capacity to meet the growing demands of the economy. This development has created a huge constraint on the growth prospects of the country. However, the need to increase energy capacity in the country became very urgent fifteen years postdemocracy. The state-owned utility company, Eskom, has drawn up a six-year capital investment programme to increase the energy capacity of the country. In this study, the impact of Eskom’s sixyear capital expenditure on the macro and sectoral economy is explored. Two basic approaches are used in the analysis that follows, namely a Time-Series Macro-Econometric (TSME) model, and a Computable General Equilibrium (CGE) model. The TSME model quantifies the impacts of the Eskom capital expenditure on the economy under a dynamic framework while the CGE model seeks to examine this in a static framework. The static framework (CGE) in this instance may not be able to capture the structural changes that occurred over the years in the economy. On the other hand, the dynamic framework (TSME) may also not be able to capture the impact on the sub-industries component of the economy. In addition, the CGE model takes into consideration the micro implications of any shocks in the system while this is not so explicit in the TSME. These two approaches are expected to complement each other. However, the complementarity of these models is expected to serve as a robustness check for the simulation results. SAJEMS NS 15 (2012) No 2 143 It is important to note that the econometric analysis presented in this study represents a comparative static analysis. This means that the models only take into consideration one particular shock (capital investment) to the system while every other thing remains the same. Therefore, the magnitude and direction of the response variables could have been cushioned by other shocks (monetary and fiscal shocks) in the system. In both the short run and the long run, capital stock/gross investment in the electricity sector is exogenously increased by 18 per cent. In detecting the 18 per cent shock, a base year was set at 2010 when Eskom’s total asset value was R246 135 million (Eskom, 2010). Therefore, the six-year capital expenditure programme after adjusting for inflation (6 per cent) and depreciation rate (10 per cent) is cumulatively added to the asset value leading to an 18 per cent average real growth. The impact of the 18 per cent shock is less in the TSME model, due to its dynamic nature. The share of capital investment in the electricity sector to total capital investment in the economy is very insignificant over time. Therefore, an 18 per cent shock in this sector will not have a significant impact on major macro variables. The rest of the study is structured as follows: Section Two provides a description of the cost of supplying sustainable energy in the South African context; Section Three provides the TSME and CGE models simulations design as well as an analysis of the capital expenditure project; Section Four provides an overall conclusion. 2 Cost of supplying a sustainable energy It is stating the obvious that to provide a sustainable supply of energy more capital investment is needed. For the period up to 2009, the South African economy had been sustaining itself with the stock of energy infrastructure built before 1994. Thereafter not much investment was done in the building of more capacity that would cater for the growing demand, arising from higher economic growth and/or the developmental needs of a modern economy. The failure to invest adequately has created a real constraint to the growth prospects of the country. However, the need to increase energy capacity in the country has become self-evident. In response, Eskom has drawn up a six-year capital investment programme that will increase energy capacity in the country to levels in line with the expected rise in national electricity demand (Table 1). Table 1 Eskom capital expenditure programme Capital expenditure (excl IDC and cost of cover) FY10/11 FY11/12 FY12/13 FY13/14 FY14/15 FY15/16 FY16/17 R'm Generation 63,249 69,563 53,585 34,955 49,119 77,028 89,827 Transmission 14,533 11,327 16,112 16,667 22,099 23,592 24,392 8,654 10,705 12,784 14,893 17,129 20,129 Distribution Corporate (incl ED) 679 Research and development 851 372 423 317 366 529 474 22,187 282 2,706 3,628 2,275 5,630 2,332 TOTAL 87,967 94,673 86,533 69,107 89,241 126,853 139,019 Cumulative 87,967 182,639 269,172 338,279 427,520 554,373 693,392 Source: Eskom Note: These figures are preliminary estimates and are not necessarily the actual figures used by Eskom’s final capex programme. In the process of achieving a sustainable supply and distribution of energy in South Africa, Eskom will need to finance its capital requirements, generating more revenue in order to be able to finance its required capital expenditure. The options available in financing the required capex include: 1) User charges, increases in electricity prices. 144 2) Government capitalisation of Eskom. 3) Private sector investment. 4) A mix of all of the above. Each of these options has its respective pros and cons. SAJEMS NS 15 (2012) No 2 Government capitalisation of Eskom This option has its own systemic implications. At face value, if government capitalises Eskom, it reduces the need for raising user charges. So in the short term, the economy operates along its business as usual trajectory. However, there are implications for this scenario over the medium to long term. Most importantly, the following issues arise: I Government capitalisation of Eskom entails either tax increases or a rise in government debt. Both these developments have a medium- to long-term distortion impact on the stability of the economy. Whilst the arguments here are complex and interrelated, large scale capitalisation of Eskom will constrain the government’s ability in financing key requirements in socio-economic infrastructure. II This approach also delays energy charges becoming cost-reflective, and as such it is not favourable for the long-term efficient utilisation of the country’s resources. Nor is it helpful in promoting the economy’s dynamic global competitiveness. III Government’s adequate capitalisation of Eskom, if it leads to the subsidisation of electricity charges, will also entail social welfare implications. It is likely that it will exacerbate the already highly skew distribution of income in the country. Increasing user charges Financing Eskom’s capex requires considerable increases in electricity charges if they are to earn an adequate return on their investment but the welfare effect may be negative (Collier, 1984:30). Sudden and substantial increases, however, lead to disruptions for many business firms that had not anticipated such sharp increases. Furthermore, business operations that are operating at the margins of profitability cannot absorb substantial cost increases, be it electricity or other costs. A good case in point is the marginal gold mining industries, or some of the manufacturing firms that are hard-hit by a mix of currency appreciation and unfavourable global economic conditions. For such firms, it is not the increase per se that matters, rather it is the quantum of increases in the short term that leaves them with little or no degrees of freedom to absorb the production cost increases. In such cases, business firms have no option but to scale down operations, lay off workers and in some extreme cases even close down. Increasing user charges however has distinct benefits too. Key amongst them are the Private-sector investment following: Whilst this option is clearly part of the a It creates a platform for sustainable and medium- to long-term solution, it is constrained reliable electricity generation in the country. by the following factors: b It helps set electricity prices at costI There is no guarantee that private-sector reflective levels. In the long term, this is investment would entail lower increases in a pre-condition for an efficient allocation user charges. In fact, the contrary might be of resources within the economy. The true, at least in the short term. country’s dynamic global competitiveness requires that we ensure all resources used II It is safe to argue that in the short term the regulatory framework for private-sector are as cost-reflective as possible. participation is not in place. As such, this c Economic stability over the long term option remains a viable one over the medium necessitates sustainable use of all resources, to long term. electricity included. d Cost-reflectivity will also open up oppor- III In general, private-sector investment should be encouraged with a view to diversifying tunities for alternative energy options. This the sources of national energy supply. In the in turn will diversify sources of energy in process, care should be taken that costthe country, and lead to further stability reflectivity is not compromised and market arising for diversification. contestability is encouraged. SAJEMS NS 15 (2012) No 2 A mix of all options In reality, Eskom’s investment programme is partly financed via National Treasury’s capitalisation and partly with the help of usercharge increases. Whilst politically this might be inevitable, it is important that the key elements of long-term sustainability are not undermined in the process. 3 Empirical analysis 3.1 Simulation results: time-series macro-econometric (TSME) approach This approach looks at the short- and long-run impacts of an increase in Eskom’s capital expenditure on the economy in a dynamic system. It takes into consideration the dynamic adjustment processes and provides a contemporaneous feedback of any shock to the entire system. A more detailed explanation of the model specification and closures, data and methodology can be seen in Appendix 1. The analysis presented in this study reveals the impact of a shock in a particular variable (capital investment) on the entire macro economy. The estimated coefficients in each of the behavioural equations (as presented in Appendix 1) represent an average value over the period covered in the macro model which has captured the entire dynamic features embedded in the system. There is a high expectation that these dynamic features will reoccur in future. In other words, it is assumed that there will be no major change in the structure of the economy in the short- to medium-term period that will cause a huge change in the magnitude of the estimated coefficients. The estimated coefficients, however, show both the short-run and long-run path of the economy and, therefore, a shock on a particular variable will be reflected through them. Given the trend path of the economy, the impact of any present and future shocks to the system will be captured. In order to capture the impact of Eskom’s capital expenditure on the entire economy, fixed investment in the electricity, gas and water sector is assumed to be exogenous in the model – over 80 per cent of fixed investment 145 in this sector comes from electricity. The idea being that capital expenditure will translate into some form of capital stock over time and given the fact that the current capital stock is the sum of existing capital stock (taking into consideration the rate of depreciation) and current investment. The short-run and long-run simulations are tested by shocking fixed investment in electricity, gas and water sector by 18 per cent per year over a six-year period. Due to the lag values included in the short-run dynamic equations (error correction model), the entire model simulations covers 1974-2009. However, the six-year (18 per cent per year) dynamic shock on fixed investment was applied from 1974 through to 1979 while its impact on the macro system filtered through the entire period covered in the model2. All the results are reported as percentage changes (elasticity) from the baseline scenario. In other words, the results are not forecasts of various economic variables, but rather deviations from its shortand long-run path due to increases in the capital expenditure. The elasticities are computed by comparing every response variable’s baseline simulation path with its shocked simulation path. Elasticity is defined as the percentage change in the response variable relative to the percentage of the shock applied. The dynamic elasticities are determined along the simulation path, whereas elasticities at convergence are the long-run elasticity (Klein, 1982:135). Given the small sample size it is difficult to ensure convergence within the sample. To facilitate the detection of convergence, HodrickPrescott (HP) filters were applied and the smoothed dynamic elasticities were graphed. However, the first value of the HP filter represents the short-run impact and the last value represents the long-run impact (Akanbi & Du Toit, 2011; Du Toit, 1999). The time paths of elasticities of the major response variables for a particular shock are presented in Appendix 1. To test the stability of the macro-econometric model and whether the behavioural equations estimated are robust, the actual and fitted (estimated) series of the major macro variables are plotted in Appendix 2. Close to a perfect fit was detected, suggesting that the estimated 146 SAJEMS NS 15 (2012) No 2 coefficients in the model are robust and accurate for predicting the impact of any policy actions3. Economy-wide econometric sensitivity analysis In this section, the short-run and long-run impact of an increase in capital expenditure by Eskom on some major macro variables in the economy is analysed. As mentioned earlier, the explicit assumption made in this study is the exogenous nature of fixed investment in the electricity, gas and water sector. Table 2 presents the short- and long-run impact of an increase in capital expenditure by18 per cent per year over a six-year period. As expected, the impacts are positive on the major macroeconomic variables except for some short- run impacts, which could be attributed to the slow adjustment processes embedded in the system. The positive impact of an increase in capex was found to be less significant than the negative impacts of an electricity price increase4. The reason for this is that the price increases have a direct impact on inflation and serve as a linkage between the demand side and supply side of the economy. On the other hand, the capex increase has an indirect impact on inflation via excess demand (difference between domestic expenditure and production) in the economy. Table 2 Economy-wide impacts of an increase in Eskom’s capital expenditure Long run Short run Employment 0.01% 0.002% Output 0.07% 0.01% Investment 0.06% 1.8% Household consumption 0.09% 0.004% Real wages 0.05% 0.04% Exports 0% 0.007% Imports 0.07% 0.01% Exchange rate (R/$) -0.18% -0.12% Consumer inflation -0.1% -0.11% Source: Author’s calculations Note: The long-run values are depicted using the Hodrick-Prescott trend value. Negative values represent a decline while positive values represent an increase. In the long run, total investment will rise by about 0.06 per cent leading to an output (GDP) increase of about 0.07 per cent as a result of an 18 per cent capex increase over a six-year period. Due to this, employment and real wages will increase by about 0.01 per cent and 0.05 per cent respectively. Consumer inflation will deviate from its long-run path by about 0.1 per cent. This is attributed to the much higher impact on GDP than domestic expenditure, which resulted in a declining excess demand. As inflation shrinks and GDP rises, the exchange rate (rand) will appreciate by about 0.18 per cent in the long run. Given the net impact of falling inflation and rand appreciation the long-run exports will remain unchanged while imports will rise by about 0.07 per cent due to output increases. The short-run impacts on total investment will be more robust at about 1.8 per cent due to the direct capex injection. The impact on the exchange rate and inflation will also be positive and in line with its long-run path. Sectoral econometric sensitivity analysis The response of major sectoral variables to the shock in Eskom’s capital expenditure will depend on the relative share of inputs (labour and capital) used in the production process. Table 3 presents the result of an 18 per cent increase in capital expenditure on sectoral variables over a six-year period. Given the indirect linkage between investment in the electricity sector and investment in the other sectors, the impact of the shock on other major variables was not strong. In other words, the impact of the shock on other sectors is felt through aggregate demand and supply. Sectors that tend to response stronger in the long run in terms of investment are also those that have SAJEMS NS 15 (2012) No 2 147 the highest energy intensity. The financial service and construction sector investment will in the long run increase by only about 0.05 per cent and 0.03 per cent, respectively. These are the sectors with the lowest energy intensity. Table 3 Sectoral impacts of an increase in Eskom’s capital expenditure Long-run Employment Exports Imports 0.01% 0.07% 0.08% 0.07% -0.01% 0.08% -0.004% 0.03% 0.15% 0.02% 0.03% 0.07% Agricultural sector 0.004% 0.07% 0.12% 0.06% 0.01% 0.05% Construction sector 0.002% 0.001% 0.03% 0% Electricity, gas & water sector 1.5% 1.8% 1.5% -0.2% 6% Wholesale & retail trade sector 0.02% 0.05% 0.08% 0.04% -0.01% 0.04% Transport & communication sector -0.003% 0.04% 0.13% 0.03% Financial service sector -0.01% 0.03% 0.05% 0.03% 0.001% Manufacturing sector Mining sector Output Investment Real wages 0% -0.03% 0.005% 0.03% Short-run Manufacturing sector 0.01% 0.05% Mining sector -0.1% 0.006% -0.14% -0.07% 0.2% -0.01% Agricultural sector -0.04% -0.09% -0.4% -0.02% -0.02% -0.01% 0.02% 0.05% -0.1% 0.06% Construction sector 0% 0% 0% Electricity, gas & water sector 0.14% 0.1% 0.16% 0.5% Wholesale & retail trade sector 0.03% 0.06% 0.3% 0.05% 0.02% 0.02% Transport & communication sector 0.16% 0.07% 0.08% 0.2% 0.01% -0.01% Financial service sector 0% 0% 0.02% 0% -0.02% 0.05% -0.3% Source: Author’s calculations The long-run values are depicted using the Hodrick-Prescott trend value. Negative values represent a decline while positive values represent an increase. Based on the above scenario, the long-run output in the electricity sector will increase by about 1.8 per cent due to the direct impact of the investment shock. The impact on output in the different sectors of the economy will indirectly feed in through falling inflation as excess demand shrinks. Therefore, the price block (inflation) serves as a linkage between the various sectors in the economy and the sensitivity on inflation from each sector will partly be reflected in output. Output in the agricultural and manufacturing sectors will increase by about 0.07 per cent each in the long run. Output responses in other sectors of the economy will not be economically significant with the construction sector posing almost no impact in the long run. Employment and real wages in the electricity sector will rise by about 1.5 per cent each in the long run. Given the small impact on output in other sectors, long-run employment change will be negligible. The impact of real wages will follow the direction of output as increased output leads to increased productivity. Exports will decline in the sectors where the effect of the exchange rate is stronger than that of inflation. Although the impacts are relatively insignificant, exports in the manufacturing, wholesale and retail and financial sectors will decline in the long run by about 0.01 per cent and 0.03 per cent, respectively. On the other hand, imports will be much more driven by the trend in output. The negative impact of the shock on employment in some sectors (i.e. mining, transport & communication and financial services) reflects the larger negative effect of higher real wages in their employment function. The short-run implications also remain negligible and, due to the slow adjustment process embedded in the system, the impacts may not be easily visible. The response of the 148 shock in the mining and agricultural sector was negative across the board while no change in output, employment and real wages will be recorded in the construction and financial sectors. 3.2 Simulation results: computable general equilibrium (CGE) approach This section looks at the short- and long-run impacts of the capital expenditure programme on the economy in a static system. The UPGEM model for South Africa is used in these simulations, and is formulated and solved using GEMPACK, a flexible system for solving computable general equilibrium (CGE) models. The UPGEM model is designed for comparativestatic analysis of policy issues and is similar to the ORANI-G model of the Australian economy, which is fully presented and explained by Horridge (2000). A typical short-run closure is applied where the rate of return on capital is allowed to change while the capital stock is fixed. Furthermore, the supply of land is fixed. Aggregate investment, inventories and government consumption are exogenous, but the trade balance and consumption are endogenous. Also, rigidities in the labour market are allowed for by holding real wages fixed. The length of the short run is not explicit, but usually seen as between 1 and 3 years (Horridge, 2000). In the long run, fixed rates of return are maintained, while capital stocks are free to adjust. The exception is capital stocks in the electricity sector, which are exogenously increased. There is no link between domestic saving and capital formation and an open capital market is therefore implicitly assumed. Also, real skilled wages adjust, while skilled employment is fixed. In other words, the rate of skilled unemployment and the labour force of skilled labour are in the long run determined by mechanisms outside of the model. However, unskilled labour is allowed to vary in the long run due to the high structural unemployment of unskilled workers in South Africa. Also, aggregate real government demand is seen as determined by mechanisms outside of the model. In both the short run and the long run, capital stock in the electricity sector is SAJEMS NS 15 (2012) No 2 exogenously increased by 18 per cent. The impacts of capital expenditure in the electricity sector on the macro and sectoral economy are considered. As was the case in the previous section, all the results are reported as percenttage point changes from the base scenario. In other words, the results are not forecasts of various economic variables, but rather deviations due to increases in the capital expenditure. Economy-wide computable general equilibrium analysis Table 4 shows the short-run and long-run macroeconomic impact of capital expenditure increases on the South African economy. In the short run, increased capital expenditure will result in a real devaluation of the currency. Increased capital expenditure will increase the demand for imports, especially inputs used in the capital-expenditure process. This increased demand will result in an increased supply of rand, weakening the real value of the currency. However, in the long run, the increased capital expenditure is expected to increase the productive capacity of the country, improving the competitiveness of industries in South Africa, and therefore in the long run an appreciation of the currency is expected. The terms of trade, which is the ratio between export prices and import prices, will weaken in the short run as well as in the long run. The real devaluation in the short run will lead to an increase in the domestic currency received for exports. This will, for exporting industries, counter the price impacts of increased capital expenditure. However, the real devaluation will increase the price of imports, in terms of the domestic currency, and therefore the price of imported inputs in the production process, as well as the price of imported household products. The net impact will be that relative import prices will increase more than the relative increase in export prices. In the long run, the real appreciation of the currency, as well as higher real household consumption, will increase the demand for imports. Also, the real appreciation will decrease the rand value received for exports, and the net impact will be a weakening in the terms of trade. SAJEMS NS 15 (2012) No 2 149 Table 4 Economy-wide impacts of an increase in electricity prices Long-run 18 per cent Real devaluation -0.18 Terms of trade -0.13 Gross operating surplus 0.56 Real household consumption 1.22 Aggregate capital stock 0.52 Real GDP 0.75 Average real wage 1.05 Unskilled employment 0.79 Short-run 18 per cent Real devaluation Terms of trade 0.13 -0.14 Gross operating surplus 0.39 Real household consumption 0.46 Aggregate real government demands 0.45 Real GDP 0.45 Skilled employment 0.40 Unskilled employment Source: Author’s calculations The increase in capital expenditure will, in the short run (0.39 per cent) and in the long run (0.56 per cent) increase gross operating surplus. Capital is variable in the long run, thus the impact on the gross operating surplus is somewhat strengthened due to the ability to move capital to higher yielding industries, or by increasing investment. Real household consumption will increase by 0.46 per cent in the short run, mainly due to the positive employment (number of workers) impacts. As industries increase their output (Table 3.5), more workers will be employed. In the long run, skilled labour is exogenous, but skilled wages are allowed to adjust. This will then reinforce the real household consumption increase in the long run (1.22 per cent) as unskilled employment (the number of workers) as well as skilled wages increase. Because the gross operating surplus and real household consumption will increase, government revenue will also increase in the short run. If we assume a neutral government budget, real government demands will also increase. For an 18 per cent increase in capital stock in the electricity sector, aggregate net capital stock in the economy is expected to increase 0.55 by 0.52 per cent in the long run. The impact on real GDP should be positive, since consumer spending, gross operating surplus, aggregate capital stock and government demands are expected to increase. The impact of a capital expenditure increase of 18 per cent on the real gross domestic product (GDP) will be an increase of about 0.45 per cent in the short run and 0.75 per cent in the long run. Sectoral computable general equilibrium analysis All sectors use electricity, directly or indirectly, as an input, therefore increased capital expenditure in the electricity sector, leading to increased capacity to produce electricity, will have an impact on all the industries of the economy. Furthermore, various industries will be directly affected through an increased demand for inputs used in capital expenditure as well as increased demand for the inputs used to produce electricity. It is therefore expected that some structural changes will take place in the economy. (Complete descriptions of industries and detailed results are provided in Appendix 3). Due to the multi-industry disaggregation in the CGE approach, the 150 SAJEMS NS 15 (2012) No 2 effects of the capital expenditure are presented according to variable changes by sector. Output (GDP) impacts Table 5 provides an impact range, with an upper- and a lower- bound impact, based on sub-industry impacts, of the capital expenditure increases in the nine Standard Industrial Classification (SIC) sectors. Disaggregated 39 sub-industry output changes are provided in Appendix 3. Table 5 Sectoral output impacts Long-run Impact range 18 per cent Agriculture, hunting, forestry and fishing Upper Lower 0.75 0.19 Mining and quarrying Upper Lower 1.82 0 Manufacturing Upper Lower 4.07 -0.25 Electricity, gas and water supply Upper Lower 5.88 0.87 Construction 0.15 Wholesale and retail trade; repair of motor vehicles, motor cycles and personal and household goods; catering and accommodation Upper Lower 0.89 0.35 Transport, storage and communication Upper Lower 1.11 0.82 Financial intermediation, insurance, real-estate and business services Upper Lower 0.96 0.56 Community, social and personal services Upper Lower 1.42 0.62 Short-run Impact range 18 per cent Agriculture, hunting, forestry and fishing Upper Lower 0.21 0.09 Mining and quarrying Upper Lower 1.34 0.1 Manufacturing Upper Lower 2.6 0.1 Electricity, gas and water supply Upper Lower 5.65 0.4 Construction 0.12 Wholesale and retail trade; repair of motor vehicles, motor cycles and personal and household goods; catering and accommodation Upper Lower 0.41 0.18 Transport, storage and communication Upper Lower 0.34 0.25 Financial intermediation, insurance, real-estate and business services Upper Lower 0.29 0.06 Community, social and personal services Upper Lower 0.45 0.38 Source: Author’s calculations In the short run, all industries are expected to increase output as a result of the increased capital expenditure in the electricity sector. In the Agriculture, Hunting, Forestry and Fishing sector, the impact will be positive, but marginal, with output increasing between 0.09 per cent and 0.21 per cent. In the Mining and quarrying sector, coal output is expected to increase 0.75 per cent, as the increased output in electricity increases the demand for coal. Gold production, an electricity-intensive industry, is expected to increase by 1.34 per cent as electricity supply is increased. In the Manufacturing sector, labour-intensive industries are SAJEMS NS 15 (2012) No 2 expected to increase output marginally between 0.1 per cent and 0.3 per cent. However, electricity-intensive industries will increase output up to 2.6 per cent (Iron and Steel). Also, the increased demand for iron and steel as a direct result of the capital expenditure programme will increase the profitability of this industry. The increase in capital expenditure is expected to increase electricity sold by 5.65 per cent ceteris paribus, while construction is bound to benefit directly from the expenditure and increase output in the short run by 0.12 per cent. This relatively small increase might be an indication of some crowding out in the construction sector. The capital expenditure in the electricity sector could be expected to increase construction prices, thereby moderating construction demand in other sectors. General government spending (0.45 per cent) is positively affected, given the assumption that government adjusts spending based on revenue collected. Revenue collected will be higher due to the employment impacts (see the next section), higher economic growth, as well as higher gross operating profit. In the long run, output in 37 of the 39 industries is expected to increase if increases in real capital expenditure are analysed. Also, short-run output increases are reinforced in the long run in 31 of the 39 industries. In the long run, capital stocks are allowed to adjust, and to move to higher-yielding industries. As electricity becomes more abundant it could be expected that capital stocks might flow towards more electricity-intensive industries. This is evident as the eight industries that perform better in the short run than in the long run, are relatively less electricity-intensive than the other industries in that specific SIC sector. Other mining (-0.004 per cent) and Other manufacturing (-0.25 per cent) will, in the long run, reduce output. Industries that will increase output in the long run by less than the increase in output in the short run are Textiles (0.14 per cent), Other Non-metallic Mineral products (0.25 per cent), Other Metal Products (0.34 per cent), Other Machinery (0.22 per cent), Electrical Machinery (0.35 per cent) and Transport Equipment (0.3 per cent). On the other hand, industries that will increase output by more than two percentage points in the long run are Iron and Steel (4.07 per cent), Non-ferrous 151 Metal (3.51 per cent) and the Electricity industry (5.88 per cent) ceteris paribus. Employment and wage impacts Employment impacts will follow the changes in output, induced by the increase in capital expenditure in the electricity sector. Industries will increase output due to increased availability of electricity, and as a result employ more workers. In the short run, industries that will increase employment by more than 1 per cent for an 18 per cent increase in capital expenditure are the coal industry (1.82 per cent), the Gold industry (2.04 per cent), Iron and Steel industry (5.31 per cent), Non-ferrous Metal industry (3.5 per cent) and Water industry (2.01 per cent). Coal is an important input in the production of electricity, and the increase in electricity production will increase the demand for coal. The next three industries are electricityintensive industries which will directly benefit from increased electricity production, while water is also an important input in mining and heavy industries. The increased production in these industries will increase the demand for water. The only industry recording a marginal decrease in employment is the construction industry (-0.1 per cent). This reflects the possible crowding-out effect due to higher construction prices as discussed in the previous section. In the long run, skilled employment is fixed and the change in the number of workers is in the unskilled categories. In 29 of the 39 industries, the employment impact will be smaller in the long run than in the short run. This is due to labour-market differentiation where skilled labour is fixed and skilled wages are adjusted upwards. Industries that will increase unskilled employment in the long run by a higher percentage than in the short run are industries that will experience a capital inflow in the long run, mainly service industries and consumer goods industries. Two industries will reduce unskilled employment in the long run, namely Other Mining and Other Manufacturing, following the reduction in output in the long run. The model specifies a Constant Elasticity of Substitution (CES) relationship between primary factors. In the model, rates of return (in the 152 SAJEMS NS 15 (2012) No 2 short run) and capital stock (in the long run) are allowed to vary. CES is seen as an appropriate functional form in all industries except the electricity industry. In the electricity industry, the capital stock is exogenously increased in the short run and in the long run, and the model will yield a reduction in employment in the electricity sector as labour is replaced by capital. However, it is more likely that the relationship will follow the Leontief functional form, where labour will increase if the use of capital increases. As a result, employment impacts in the electricity sector cannot be adequately explained by the model and the cumulative positive employment impact presented in this chapter could be seen as a conservative estimation of employment gains. Table 6 Sectoral employment impacts Long-run Impact range 18 per cent Agriculture, hunting, forestry and fishing Upper Lower 0.59 0.01 Mining and quarrying Upper Lower 2.04 -0.12 Manufacturing Upper Lower 3.78 -0.5 Electricity, gas and water supply Upper Lower 0.34 n/a Construction -0.3 Wholesale and retail trade; repair of motor vehicles, motorcycles and personal and household goods; catering and accommodation Upper Lower 0.57 0.08 Transport, storage and communication Upper Lower 0.91 0.65 Financial intermediation, insurance, real-estate and business services Upper Lower 0.69 0.37 Community, social and personal services Upper Lower 0.8 -0.1 Short-run Impact range 18 percent Agriculture, hunting, forestry and fishing Upper Lower 0.6 0.35 Mining and quarrying Upper Lower 2.04 0.18 Manufacturing Upper Lower 5.31 0.2 Electricity, gas and water supply Upper Lower 2.01 n/a Construction 0.2 Wholesale and retail trade; repair of motor vehicles, motor cycles and personal and household goods; catering and accommodation Upper Lower 0.72 0.51 Transport, storage and communication Upper Lower 0.7 0.53 Financial intermediation, insurance, real-estate and business services Upper Lower 0.38 0.33 Community, social and personal services Upper Lower 0.83 0.5 Source: Author’s calculations In the long run wages are the market clearing agent for skilled employment. In other words, the number of skilled workers is fixed. This reflects the idea that skilled labour is determined by factors outside the model. On the other hand, unskilled workers and unskilled SAJEMS NS 15 (2012) No 2 153 wages are allowed to vary due to the high unemployment of unskilled workers in South Africa. It could therefore be expected that the wage impact due to capital expenditure on skilled labour would be higher than the impact on the wages of unskilled labour. This is reflected in Table 7. Statistics South Africa (StatsSA), in the national Social Accounting Matrix (SAM), classifies all occupations into eleven groups (StatsSA, 2004). This is in accordance with the South African Standard Classification of Occupations (SASCO). This analysis follows the same classification and a full description of all occupations is available in StatsSA (2004). In Table 7 it is shown that skilled workers will experience real wage increases between 1.2 per cent and 1.6 per cent for an 18 per cent increase in capital stock in the electricity sector. Unskilled real wages are expected to increase by between 0.6 per cent and 0.9 per cent. Table 7 Wage impacts by occupation Long-run 18 per cent Legislators 1.55 Professionals 1.6 Technicians 1.58 Clerks 1.59 Service workers 1.16 Skilled agricultural workers 1.4 Craft workers 0.9 Plant and machine operators 0.86 Elementary occupations 0.78 Domestic workers 0.68 All Unspecified occupations 0.72 Source: Author’s calculations The wage impacts by population group are shown in Table 8. As a larger percentage of African and Coloured workers are economically active as unskilled labour, the positive impact on their wages would be the smallest (around 1.13 per cent). Table 8 Wage impacts by population group Long-run 18 per cent African 1.13 Coloured 1.12 Indian 1.26 White 1.34 Source: Author’s calculations On the other hand, as a larger percentage of white workers are economically active as skilled workers, the impact on their wages (1.34 per cent) would be the largest for the population groups under consideration. Wage impacts, by population group, are disaggregated to skilled-wage impacts in Table 9. As discussed, the impacts on skilled labour across all population groups are larger than the wage impacts on unskilled labour across all population groups. White skilled workers would, for an 18 per cent increase in capital stock, experience a 1.42 per cent increase in skilled wages, while 154 SAJEMS NS 15 (2012) No 2 Table 9 Skilled wage impacts by population group Long-run 18 per cent African 1.28 Coloured 1.33 Indian 1.43 White 1.42 Source: Author’s calculations African workers would experience a 1.28 per cent increase. Coloured and Indian workers would experience a 1.33 per cent and 1.43 per cent increase, respectively. Given the fixed long-run skilled employment, the short-run employment changes by occupation, as a result of increased capital expenditure, are shown in Table 10. Employment across all occupations will be affected positively if capital expenditure is above the inflation rate. Table 10 Occupational employment impacts Long-run 18 per cent Legislators 0.41 Professionals 0.44 Technicians 0.38 Clerks 0.42 Service workers 0.49 Skilled agricultural workers 0.47 Craft workers 0.24 Plant and machine operators 0.65 Elementary occupations 0.57 Domestic workers 0.49 All Unspecified occupations 0.46 Source: Author’s calculations All eleven occupational groups will have a net positive impact on employment, ranging between 0.24 per cent (Craft workers) and 0.65 per cent (Plant and Machine operators) for an 18 per cent increase. This employment breakdown is in line with employment and output production changes by sector. For example, gold and coal mining will significantly increase output and employment, in line with the 0.65 per cent increase in plant and machine operators. On the other hand, the construction industry will marginally increase output and marginally decrease employment, in line with the relatively low increase of 0.24 per cent in craft-worker employment. Table 11 shows the employment impact of electricity price increases by population group. The employment impact will be positive across all population groups. In the short run, employment for the African group of workers will increase the most (0.5 per cent) of all the population groups. Approximately 47.5 per cent of African workers are employed in the Government, Health and Social Services, Manufacturing and Mining industries. These industries would increase output relatively more than the other industries due to the capital-expenditure increases in the electricity sector. SAJEMS NS 15 (2012) No 2 155 Table 11 Employment impacts by population group Long-run 18 per cent African 0.5 Coloured 0.41 Indian 0.41 White 0.4 Source: Author’s calculations 4 Conclusion This study analysed the impact of an increase in Eskom’s capital expenditure on the overall macro and sectoral economy using both the TSME and CGE models. The simulation results from the TSME model revealed the macro implications of the six-year capital expenditure programme. In the long run, major macro variables (i.e. household consumption, GDP, and employment) will be positively affected by the increased investment. Although the positive impacts of the shock is very insignificant, due to the relatively small share of electricity investment in total investment in the economy. The price block, which serves as a linkage between the different segments of the economy, is not directly linked to investment in electricity. However, a weak transmission mechanism of the shock on the macro and sectoral economy is detected both in the short run and long run. At the sectoral level, the electricity sector will boost employment by about 1.5 per cent in the long run. Impacts on other sectors in terms of job creation will remain negligible. The same trend also goes with GDP impact but with a higher magnitude. On the other hand, the simulation results from the CGE revealed similar but more robust positive impacts on the macro economy. Overall, in the short run, real gross domestic product increased, the currency appreciated, gross operating surplus was higher, aggregate real household consumption increased, and skilled as well as unskilled unemployment increased. Most of the short-run macroeconomic impacts were reinforced in the long run, with a real appreciation in the currency, strengthening in the terms of trade, increase in gross operating surplus, and increase in real household consumption, as well as a increase in real gross domestic product, wages and employment. Endnotes 1 2 3 4 The study forms part of the final research project commissioned by Eskom (entitled: The Impact of Electricity Price Increases and Eskom’s Six-Year Capital Investment Programme on the South African Economy) to Pan-African Investment & Research Services. However, reference to the main document may be mentioned when necessary. The views expressed in this study are those of author(s) and do not necessarily represent those of Eskom or Eskom policy. The authors gratefully acknowledge Eskom’s consent to draw heavily on the aforementioned research report for the preparation of this paper. Since the macro economy has been predicted to follow a particular trend over the years captured through the estimated coefficients and to detect the dynamic effects over a longer period of time, the shocks were applied from the beginning of the simulation (Akanbi & Du Toit, 2011; Du Toit, 1999). The characteristics of the actual underlying data (Stationarity tests) used in the study are presented in the main documents submitted to Eskom. Important Note: The analysis presented in this paper is part of the integrated study submitted to Eskom, which includes separate partial analysis on electricity price hikes. Detailed results of the electricity price hikes impacts, as well as the net impact of the price hikes and the increases in capex, are presented in the main document submitted to Eskom. The results revealed that the net impact of an increase in electricity prices and Eskom’s capital expenditure will continue to be negative on major macro variables (i.e. GDP, employment and investment) in the economy. 156 SAJEMS NS 15 (2012) No 2 References AKANBI, O.A. & DU TOIT, C.B. 2011. Macro-econometric modelling for the Nigerian economy: a growthpoverty gap analysis. Economic Modelling, 28:335-350. ALLEN, C.B., & NIXON, J. 1997. Two concepts of the NAIRU. In Allen, C.B. & Hall, S.G. (eds.) Macroeconomic modelling in a changing world: towards a common approach. Chichester: John Wiley and Sons. COLLIER, H. 1984. Developing electric power: thirty years of World Bank experience. Washington, D.C: John Hopkins University Press. DORNBUSCH, R. 1980. Exchange rate economics: where do we stand? Brookings Papers on Economic Activity, 1980(1):143-185. DORNBUSCH, R. 1976. Expectations and exchange rate dynamics. Journal of Political Economy, 84(6): 1161-76. DU TOIT, C.B. 1999. A supply-side model of the South African economy: critical policy implications. Unpublished doctoral thesis. Pretoria: University of Pretoria. DU TOIT, C.B., & MOOLMAN, E. 2004. A neoclassical investment function of the South African economy. Economic Modelling, 21:647-660. ENDERS W. 2004. Applied econometric time series (2nd ed.) New York: John Wiley and Sons. ENGLE, R. & GRANGER, C. 1987. Cointegration and error correction: representation, estimation, and testing. Econometrica, 55:251-76. ESKOM. 2010. Annual report 2010. Eskom. FRANKEL, J.A. 1979. On the mark: a theory of floating exchange rates based on real interest differentials. American Economic Review, 69(4):610-622. HORRIDGE, M. 2000. ORANI-G: A generic single-country computable general equilibrium model. CoPS Working Paper OP-93, Centre of Policy Studies, Monash University. KLEIN, L.R. 1982. The supply-side of the economy: a view from the prospective of the Wharton model. In Fink, R.F. (ed.) Supply-side economics: a critical appraisal. Maryland: University Publications of America. LAYARD, R. & NICKELL, S. 1986. Unemployment in Britain. Economica, 53:S12-S169. PRETORIUS, C.J. 1998. Gross fixed investment in the macroeconometric model of the Reserve Bank. Quarterly Bulletin-March 2002, no.207. Pretoria, South African Reserve Bank. STATISTICS SOUTH AFRICA. 2004. Overview of the 1998 social accounting matrix. Pretoria: Statistics South Africa. Appendix 1: TSME model specification, core structural equations, closure, methodology and data description The model captures both the short-run and long-run dynamic properties of the economy. As mentioned earlier, four segments of the economy were captured and include the real segment, the external segment, the monetary segment, and the Government (public) segment. This line of thought has also been followed in Akanbi and Du Toit (2011). The real segment consists of aggregate supply, aggregate demand and the price block. The aggregate supply determines real domestic output by estimating the production function, domestic investment, labour demand, and real wages. Aggregate demand determines aggregate household real consumption expenditure in the economy while the price block estimates producer and consumer prices. The external segment identifies the major components in the current account of the balance of payment and the variation in the level of exchange rate. It estimates the real exports of goods and services, the real imports of goods and services and the Rand/ US dollar nominal exchange rate. The model estimates the monetary supply while assuming that the interest rate is exogenously determined in the system. This is done by following the principle that monetary SAJEMS NS 15 (2012) No 2 authority directly controls interest rates. Government revenue is estimated in the model while government expenditure is assumed to be exogenously determined by the political leadership. The important inter-linkages and feedbacks of the various macroeconomic variables and estimated equations in the system are revealed in the model closure. The type of closure reveals the features of the model developed and how the various policy simulations/ scenarios would feed back into the entire system. The production function (GDP) is estimated by making the supply side of the economy more active than the demand side. Therefore, the price (producer and consumer) equations serve as the link between the demand side and the supply side of the economy through excess demand and capacity utilisation. This is presented as: GDP = f ( L, K , T ) Excess Demand = GDE / GDP GDE = C + I + G Capacity Utilisation = GDP / GDP_POTENTIAL where L is labour employment, K is capital stock, T is technology, GDE is gross domestic expenditure, C is household consumption expenditure, I is domestic investment, G is total government expenditure, Z is the imports of goods & services, and GDP_POTENTIAL is the potential level of GDP. The potential level of output in the economy is estimated by using the coefficients of labour and capital from the production function with the potential level of capital stock, labour employment and total factor productivity. These variables are generated using the Hodrick-Prescott (HP) Filter technique. This is a smoothing method that is widely used among macroeconomists to obtain a smooth estimate of the long-term trend component of a series (Akanbi & Du Toit, 2011; Du Toit, 1999). The long-run core structural equations estimated from the four segments of the economy are presented as follows: The real segment This sector consists of the aggregate supply, the aggregate demand and the price block. The aggregate supply determines the real domestic output by estimating the production function, the domestic investment, labour demand, and 157 real wages. The aggregate demand determines the aggregate household real consumption expenditure in the economy while the price block estimates the producer and consumer prices. Production function: The standard production function is estimated for the South African economy and is presented as: + + Yt = f ( N t , K t ) (1) where Yt is the Gross Domestic Product (GDP), N t is the labour employment and K t is the capital stock. Domestic investment (real gross capital formation): This study considered the neoclassical approach (Jorgenson, 1963) in estimating the domestic investment function, since it incorporates all cost minimizing and profit maximizing decision making processes by firms. This approach has also been adopted in Du Toit, 1999; Du Toit and Moolman, 2004; Pretorius, 1998; and Akanbi and Du Toit, 2011. The long-run domestic investment function for South Africa is modelled as a function of output, user cost of capital, and capacity utilisation and is presented below as: + − + I t = f (Yt , ucct , cu t ) (2) where I t is the gross domestic investment, cu t is the level of capacity utilisation, and ucct is the user cost of capital. Labour demand and real wage determination: In modelling the labour market, the standard labour-demand equation and a wage-adjustment equation are defined and estimated. However, the long-run labour-demand function is presented as: − + N t = f (rwt , Yt ) (3) where rwt is the real wage rate. The real wage equation follows Allen and Nixon (1997:147) and is specified in this study as: + rwt = f (labprodt , unempt ) (4) where labprod t is the labour productivity and unempt is unemployment. Household real consumption expenditure: The long-run household consumption is a function of real disposable income, real 158 SAJEMS NS 15 (2012) No 2 wealth, and the real interest rate and this is specified as: + + + hh _ rcon expt = f (hh _ dis _ inct , rwealtht , r int t ) (5) where hh _ rcon expt is the household real consumption expenditure, hh _ dis _ inct is the household real disposable income, rwealtht is the real wealth (proxy by real domestic credit), and r int t is the real rate of interest. Consumer and producer prices: The production price equation follows Layard and Nickell (1986) and the long-run specification is presented as: + + + + + p Pt = f (wt , cu t , ucct , elect _ pt , petrol _ pt ) (6) p where wt is the nominal wage rate, Pt is the production price index, petrol _ pt is pump petrol prices and elect _ pt is the electricity prices. Consumer prices which are directly related to production+ prices are also specified as: + + + Ctp = f ( Pt p , imptp , excessd t , excht ) (7) p t where C t is the consumer price, imp is the import price on consumption goods, excht is the exchange rate and excessd t is the excess demand. p The external segment The external sector identifies the major components in the current account of the balance of payments and the variation in the level of exchange rate. It estimates the real exports of goods and services, the real imports of goods and services and the naira/ US dollar nominal exchange rate. Real exports of goods and services: The demand for real exports of goods and services in the long run is mainly driven by the level of world income, the exchange rate and the relative prices of goods and services. The real exports function is, however, specified as: _ + + r expt = f (wYt , relpt , excht ) (8) where r exp t is the real exports of goods and services, wYt is the real world (US) income, relpt is the relative price of goods and services (the ratio of domestic prices to US prices). Real imports of goods and services: The demand for real imports of goods and services in the long run is mainly driven by the level of domestic income, the exchange rate and the relative prices of goods and services. The real imports function is therefore specified as: + + − rimpt = f (Yt , relpt , excht ) (9) where rimpt is the real imports of goods and services. Nominal Exchange Rate: The underlying theory for the specification of the nominal exchange rate equation follows Dornbusch (1976, 1980) and Frankel (1979). The long-run nominal exchange rate is specified as follows: − − + excht = f (relYt , rel int t , relpt ) (10) where relYt is the relative income (the ratio of domestic GDP to US GDP), and rel int t is the relative interest rate (the ratio of domestic interest rate to US interest rate). Monetary segment The model estimates the money supply while assuming that interest rate is exogenously determined in the system. This is done following the principle that the monetary authority directly controls interest. Money supply: The money-supply equation is assumed to be an inverted interest-rate function. This is derived as: − + RMst = f (int t , Yt ) (11) where RMst is the real monetary aggregate. The government segment In this study, the government sector is assumed to be exogenously determined. Government revenue is estimated as a function of GDP and exchange rate, since about 95 per cent of revenue comes from taxes. This is derived as: + + govtrevt = f (excht , Yt ) (12) where govtrevt is total government revenue. The summary of the entire model is presented in the form of the flow chart in Figure 1.1. The chart highlights the major contemporaneous feedback processes of the interactions between the segments investigated in the model. SAJEMS NS 15 (2012) No 2 159 Figure 1.1 A flow chart of the model Real sector Supply Demand Prices Monetary sector cuExternal gde sector Public sector Source: Akanbi & Du Toit, (2011) As shown in the flow chart above, the price block serves as a major linkage between the supply side and aggregate demand side through capacity utilisation and excess demand. Changes in these variables cause fluctuations in price, which affect production and demand and also cause changes in the other sectors of the economy. The monetary, external and public segments are linked directly to the supply side and demand side of the economy through changes in the interest rate, government spending and exchange rate. The institutional characteristics of the economy, with its associated policy behaviour, are incorporated through the public and monetary segment, whereas the interaction with the rest of the world is captured through the external segment. In view of the above discussion, the production function and other behavioural equations are estimated using Engle and Granger (1987) techniques. This procedure is widely accepted in the macro-econometric literature as it avoids the common problem of spurious regressions that gives an incorrect impression of an existing long-run relationship between two or more variables. As laid out in Enders (2004:335), Engle and Granger’s proposed four-step procedure is followed. Given the disaggregated sectoral model adopted in the study, all the behavioural equations were estimated for each of the eight (8) sectors except for cases where disaggregation was not possible (i.e. money supply, exchange rate, government revenue, CPI, PPI, and household consumption expenditure). All the data used in the study were obtained from the South African Reserve Bank (SARB), IFS (International Financial Statistics), World Bank database: African Development Indicators and World Development Indicators, and Quantec database. Annual data series, which cover the period 1970-2009, were used to estimate the parameters of the model and where appropriate the variables were transformed into real figures using the GDP deflator (2005=base year). The following graphs depict the long-run path of an increased Eskom capital expenditure on major macro variables in the economy. Figures 1.1-10 depict the long-run path of capital expenditure increases. As mentioned earlier, the first value represents the short-run impact while the last value represents the longrun impact. All the results are reported as percentage changes (elasticity) from the baseline scenario. 160 SAJEMS NS 15 (2012) No 2 Figure 1.2 Economy-wide 18 per cent over a 6-year period Consumer Infl ati on Employment Exchange Rate (R/$) . 15 . 025 . 08 . 10 . 020 . 04 . 05 . 015 . 00 . 010 -.05 . 005 -.10 . 000 . 00 -.04 -.08 -.15 -.12 -.16 -.005 75 80 85 90 95 00 05 -.20 75 80 85 Exports 90 95 00 05 75 80 GDP . 02 . 01 . 10 . 12 . 08 . 10 90 95 00 05 . 08 . 06 . 00 85 Househol d Consumpti on . 06 . 04 . 04 -.01 . 02 -.02 . 02 . 00 -.03 . 00 -.02 75 80 85 90 95 00 05 -.02 75 80 85 Imports 90 95 00 05 75 80 85 Investment . 10 2.0 . 08 1.5 . 06 1.0 . 04 0.5 . 02 0.0 90 95 00 05 00 05 Real Wages . 06 . 05 . 04 . 03 . 00 . 02 . 01 -0. 5 75 80 85 90 95 00 05 . 00 75 80 85 90 95 00 05 75 80 85 90 95 Figure 1.3 Manufacturing sector 18 per cent over a 6-year period Em ploym ent Exports .020 .02 .016 .01 .012 .00 .008 -.01 .004 -.02 .000 -.03 1975 1980 1985 1990 1995 2000 2005 1975 1980 1985 GDP 1990 1995 2000 2005 2000 2005 2000 2005 Im ports .08 .10 .08 .06 .06 .04 .04 .02 .00 .02 -.02 .00 -.04 1975 1980 1985 1990 1995 2000 2005 1975 1980 Investm ent 1985 1990 1995 Real W ages .12 .08 .08 .06 .04 .04 .00 .02 -.04 .00 1975 1980 1985 1990 1995 2000 2005 1975 1980 1985 1990 1995 SAJEMS NS 15 (2012) No 2 161 Figure 1.4 Mining sector 18 per cent over a 6-year period Em ploym ent Exports .10 .04 .05 .02 .00 .00 -.05 -.02 -.10 -.04 -.15 -.06 1975 1980 1985 1990 1995 2000 2005 1975 1980 1985 GDP 1990 1995 2000 2005 2000 2005 2000 2005 2000 2005 2000 2005 2000 2005 Im ports .15 .12 .10 .08 .05 .04 .00 .00 -.05 -.04 -.10 -.08 -.15 -.12 1975 1980 1985 1990 1995 2000 2005 1975 1980 1985 Investm ent 1990 1995 Real W ages .12 .3 .2 .08 .1 .04 .0 .00 -.1 -.04 -.2 -.08 -.3 1975 1980 1985 1990 1995 2000 2005 1975 1980 1985 1990 1995 Figure 1.5 Agricultural sector 18 per cent over a 6-year period Em ploym ent Exports .03 .06 .02 .04 .01 .02 .00 .00 -.01 -.02 -.02 -.04 -.03 -.06 -.04 -.08 1975 1980 1985 1990 1995 2000 2005 1975 1980 1985 GDP 1990 1995 Im ports .08 .3 .2 .04 .1 .00 .0 -.04 -.1 -.08 -.2 -.12 -.3 1975 1980 1985 1990 1995 2000 2005 1975 1980 Investm ent 1985 1990 1995 Real W ages .4 .08 .2 .04 .0 .00 -.2 -.04 -.4 -.6 -.08 1975 1980 1985 1990 1995 2000 2005 1975 1980 1985 1990 1995 162 SAJEMS NS 15 (2012) No 2 Figure 1.6 Construction sector 18 per cent over a 6-year period Employment Exports .003 .10 .002 .05 .001 .00 .000 -.05 -.001 -.10 -.002 -.003 -.15 1975 1980 1985 1990 1995 2000 2005 1975 1980 1985 GDP 1990 1995 2000 2005 2000 2005 2000 2005 Imports .012 .3 .008 .2 .004 .1 .000 .0 -.004 -.1 -.008 -.2 1975 1980 1985 1990 1995 2000 2005 1975 1980 1985 Investment 1990 1995 Real Wages .04 .008 .03 .006 .02 .004 .01 .002 .00 .000 -.01 -.002 -.02 -.03 -.004 1975 1980 1985 1990 1995 2000 2005 1975 1980 1985 1990 1995 Figure 1.7 Electricity, gas & water sector 18 per cent over a 6-year period Em ploym ent Exports 3.0 .8 2.5 .6 2.0 .4 1.5 .2 1.0 .0 0.5 -.2 0.0 -0.5 -.4 1975 1980 1985 1990 1995 2000 2005 1975 1980 1985 GDP 8 3 6 2 4 1 2 0 0 -1 -2 1980 1985 1990 1995 2000 2005 2000 2005 Real W ages 3.0 2.5 2.0 1.5 1.0 0.5 0.0 1975 1980 1985 1990 1995 1995 2000 2005 2000 2005 Im ports 4 1975 1990 1975 1980 1985 1990 1995 SAJEMS NS 15 (2012) No 2 163 Figure 1.8 Wholesale & retail trade sector 18 per cent over a 6-year period Em ploym ent Exports .030 .04 .025 .02 .020 .00 .015 -.02 .010 -.04 .005 .000 -.06 1975 1980 1985 1990 1995 2000 2005 1975 1980 1985 GDP 1990 1995 2000 2005 2000 2005 2000 2005 2000 2005 2000 2005 2000 2005 Im ports .08 .040 .035 .06 .030 .04 .025 .02 .020 .015 .00 .010 -.02 .005 1975 1980 1985 1990 1995 2000 2005 1975 1980 1985 Inves tm ent 1990 1995 Real W ages .3 .08 .06 .2 .04 .1 .02 .0 .00 -.1 -.02 1975 1980 1985 1990 1995 2000 2005 1975 1980 1985 1990 1995 Figure 1.9 Transport and communication sector 18 per cent over a 6-year period Em ploym ent Exports .20 .03 .15 .02 .01 .10 .00 .05 -.01 .00 -.02 -.05 -.03 -.10 -.04 1975 1980 1985 1990 1995 2000 2005 1975 1980 1985 GDP 1990 1995 Im ports .08 .05 .04 .06 .03 .04 .02 .02 .01 .00 .00 -.01 -.02 -.02 1975 1980 1985 1990 1995 2000 2005 1975 1980 Investm ent 1985 1990 1995 Real W ages .16 .25 .20 .12 .15 .08 .10 .05 .04 .00 .00 -.05 -.04 -.10 1975 1980 1985 1990 1995 2000 2005 1975 1980 1985 1990 1995 164 SAJEMS NS 15 (2012) No 2 Figure 1.10 Financial sector 18 per cent over a 6 year period Em ploym ent Exports .002 .10 .000 .05 -.002 -.004 .00 -.006 -.05 -.008 -.010 -.10 1975 1980 1985 1990 1995 2000 2005 1975 1980 1985 1990 GDP 1995 2000 2005 2000 2005 2000 2005 Im ports .030 .08 .025 .04 .020 .015 .00 .010 .005 -.04 .000 -.005 -.08 1975 1980 1985 1990 1995 2000 2005 1975 1980 Inves tm ent 1985 1990 1995 Real W ages .06 .04 .03 .04 .02 .02 .01 .00 .00 -.02 -.01 1975 1980 1985 1990 1995 2000 2005 1975 1980 1985 1990 1995 Appendix 2: Actual and fitted values (model simulations) Figure 2.1: GDP (Rmillion) Figure 2.2: Gross fixed investment (Rmillion) 2,000,000 400,000 1,800,000 350,000 1,600,000 300,000 1,400,000 1,200,000 250,000 1,000,000 200,000 800,000 150,000 600,000 400,000 1970 1975 1980 1985 1990 Actual 1995 Fitted 2000 2005 100,000 1970 1975 1980 1985 1990 Actual 1995 Fitted 2000 2005 SAJEMS NS 15 (2012) No 2 165 Figure 2.3: Employment (unit) Figure 2.4: Real wages (Rmillon) 14,000,000 900,000 12,000,000 800,000 10,000,000 700,000 8,000,000 600,000 6,000,000 500,000 4,000,000 400,000 2,000,000 1970 1975 1980 1985 1990 Actual 1995 2000 2005 300,000 1970 1975 1980 1985 Fitted 1990 Actual Figure 2.5: Household expenditure (Rmillion) 1,400,000 1995 2000 2005 Fitted Figure 2.6: Consumer price index 140 120 1,200,000 100 1,000,000 80 800,000 60 600,000 40 400,000 20 200,000 1970 1975 1980 1985 1990 Actual 1995 2000 2005 0 1970 1975 1980 Fitted 1985 1990 Actual Figure 2.7: Producer price index 1995 2000 2005 Fitted Figure 2.8: Exports (Rmillon) 140 550,000 120 500,000 450,000 100 400,000 80 350,000 60 300,000 40 250,000 20 0 1970 200,000 1975 1980 1985 1990 Actual 1995 Fitted 2000 2005 150,000 1970 1975 1980 1985 1990 Actual 1995 Fitted 2000 2005 166 SAJEMS NS 15 (2012) No 2 Figure 2.9: Imports (Rmillion) Figure 2.10: Exchange rate (R/US$) 600,000 12 10 500,000 8 400,000 6 300,000 4 200,000 100,000 1970 2 1975 1980 1985 1990 1995 Actual 2000 2005 0 1970 1975 1980 1985 Fitted 1990 Actual Figure 2.11: Money supply (Rmillion) 1995 2000 2005 Fitted Figure 2.12: Government revenue (Rmillon) 1,600,000 480,000 440,000 1,400,000 400,000 1,200,000 360,000 320,000 1,000,000 280,000 800,000 240,000 200,000 600,000 160,000 400,000 200,000 1970 120,000 1975 1980 1985 1990 Actual 1995 2000 2005 80,000 1970 1975 1980 1985 Fitted 1990 Actual Detailed results Table 3.2 Short-run output changes by sub-industry 18 per cent Irrigated field 0.09 Dry field 0.09 Irrigated horticulture 0.11 Dry horticulture 0.11 Livestock 0.2 Forestry 0.21 Other agriculture 0.21 Coal 0.75 Gold 1.34 Crude, petroleum and gas 0.1 Other mining 0.18 1995 Fitted 2000 2005 SAJEMS NS 15 (2012) No 2 167 Food 0.2 Textiles 0.23 Footwear 0.27 Chemicals and rubber 0.23 Petroleum refineries 0.14 Other non-metallic mineral products 0.28 Iron and steel 2.6 Non-ferrous metal 0.96 Other metal products 0.36 Other machinery 0.33 Electrical machinery 0.37 Radio 0.41 Transport equipment 0.36 Wood, paper and pulp 0.26 Other manufacturing 0.1 Electricity 5.65 Water 0.4 Construction 0.12 Trade 0.29 Hotels 0.18 Transport services 0.34 Communication services 0.25 Financial institutions 0.15 Real estate 0.06 Business activities 0.29 General government 0.45 Health services 0.41 Other service activities 0.38 Table 3.3 Short-run employment changes by sub-industry 18 per cent Irrigated field 0.48 Dry field 0.47 Irrigated horticulture 0.35 Dry horticulture 0.35 Livestock 0.52 Forestry 0.4 Other agriculture 0.6 Coal 1.82 Gold 2.04 Crude, petroleum and gas 0.18 Other mining 0.38 Food 0.46 Textiles 0.27 Footwear 0.43 Chemicals and rubber 0.41 Petroleum refineries 0.42 Other non-metallic mineral products 0.54 168 SAJEMS NS 15 (2012) No 2 Iron and steel 5.31 Non-ferrous metal 3.5 Other metal products 0.54 Other machinery 0.49 Electrical machinery 0.72 Radio 0.51 Transport equipment 0.51 Wood, paper and pulp 0.52 Other manufacturing 0.2 Water 2.01 Construction -0.1 Trade 0.51 Hotels 0.51 Transport services 0.7 Communication services 0.53 Financial institutions 0.38 Real estate 0.38 Business activities 0.33 General government 0.5 Health services 0.83 Other service activities 0.57 Table 3.4 Long-run output changes by sub-industry 18 per cent Irrigated field 0.32 Dry field 0.31 Irrigated horticulture 0.19 Dry horticulture 0.19 Livestock 0.75 Forestry 0.46 Other agriculture 0.65 Coal 1.13 Gold 1.82 Crude, petroleum and gas 0.46 Other mining 0 Food 0.66 Textiles 0.14 Footwear 0.59 Chemicals and rubber 0.38 Petroleum refineries 0.61 Other non-metallic mineral products 0.25 Iron and steel 4.07 Non-ferrous metal 3.51 Other metal products 0.34 Other machinery 0.22 Electrical machinery 0.35 Radio 0.72 Transport equipment 0.3 SAJEMS NS 15 (2012) No 2 Wood, paper and pulp Other manufacturing 169 0.34 -0.25 Water 0.87 Construction 0.15 Trade 0.59 Hotels 0.89 Transport services 0.82 Communication services 1.11 Financial institutions 0.91 Real estate 0.96 Business activities 0.56 Health services 1.42 Other service activities 0.62 Table 3.5 Long-run industry unskilled employment impacts by sub-industry 18 per cent Irrigated field 0.14 Dry field 0.12 Irrigated horticulture 0.01 Dry horticulture 0.01 Livestock 0.72 Forestry 0.39 Other agriculture 0.59 Coal 1.09 Gold 2.04 Crude, petroleum and gas Other mining 0.43 -0.12 Food 0.55 Textiles 0.1 Footwear 0.37 Chemicals and rubber 0.3 Petroleum refineries 0.5 Other non-metallic mineral products 0.06 Iron and steel 3.78 Non-ferrous metal 3.15 Other metal products 0.15 Other machinery 0.05 Electrical machinery 0.08 Radio 0.57 Transport equipment 0.18 Wood, paper and pulp 0.18 Other manufacturing -0.5 Electricity -7.35 Water Construction 0.34 -0.3 Trade 0.37 Hotels 0.53 Transport services 0.65 170 SAJEMS NS 15 (2012) No 2 Communication services 0.91 Financial institutions 0.69 Real estate 0.6 Business activities General government 0.37 -0.1 Health services 0.8 Other service activities 0.29