* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Sum_Up

Survey

Document related concepts

Steady-state economy wikipedia , lookup

Business cycle wikipedia , lookup

Islamic economics wikipedia , lookup

Ragnar Nurkse's balanced growth theory wikipedia , lookup

Economy of Italy under fascism wikipedia , lookup

Non-monetary economy wikipedia , lookup

Transcript

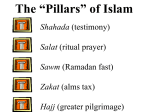

MBF707: Monetary and Fiscal Framework in Islamic Finance COMSATS Institute of Information Technology (Virtual Campus) Lecture 32 Summary of the Course (Part 2) 2 Fiscal Policy Introduction Elements of FP Constraints Three Sector Model Allocation Function Role of the Government 3 Main Elements of the Theory 1. Islamic economy is a three-sector economy, (the private sector, the voluntary sector, and the public sector). The three sectors working in conjunction, furnish the institutional framework of an Islamic economy. 2. Zakah provides the base of the fiscal system and defines its scope of operation within the general institutional framework of the Islamic economy. 4 Main Elements of the Theory 3. The allocation, distribution and stabilization functions of an Islamic economy are processed and implemented through all these sectors jointly. 4. Public sector’s role is minimal but crucial in so far as it operates continuously to ensure an optimal allocation of community’s resources, rectifies suboptimal distribution of income, and introduces an element of stability. 5 Is a Fiscal Policy Possible in an Islamic State? The socio-economic policy goals of an Islamic state are as follows: 1. Justice and equity. 2. Provision of the socio-economic needs of the community or socioeconomic welfare. 3. Enhancement of the community’s economic resources or economic growth. 4. Improvement in the cultural milieu of the community. 6 Is a Fiscal Policy Possible in an Islamic State? Zakah is the most important fiscal and distributive mechanism of an Islamic economy. But Zakah may generate certain incidental effects on the economy, which can be redressed only by an appropriate mechanism of secular levies. A situation may arise where Zakah levies may lead to such a diversion of resources that is not desirable from the point of view of general socio-economic goals of the society. 7 System Constraints on Taxation The transfer of resources may exert an upward pressure on the price level. Taxation policy will be suitably adjusted to arrest the price spiral. Zakah levies may cause a sudden diversion of resources from savings to overspending; from investment in Zakah-able to Zakah-free economic activities whose overall impact on the economy is likely to be detrimental to general welfare of the Islamic community, tax policy will have to be readjusted. 8 ISLAMIC ECONOMY: A THREESECTOR MODEL Modern economies offer two institutions to tackle the allocation and distribution problems, (market & government or the private and the public sectors). Private sector is characterized by the forces of demand and supply, price and profit motive. The public sector acts as a corrective mechanism and as a supplement to it. 9 FP-Automatic Stablizers Automatic stabilizers a)Progressive & Proportional Taxes b)Price Ceiling & Price Flooring Discretionary fiscal policy a)Contractionary Fiscal Policy b)Expansionary Fiscal Policy 10 The Beginning of FP Classical economy Classical economic theory has always claimed that the economy is always at full-employment. Guarantee that, all output produced by firms will be taken up by consumers on the principles that, supply creates its own demand. In the short-run there will be temporary disequilibrium in the capital, labor and product market, but in long run the economy is always in equilibrium or full employment. The market is therefore perfect and there is no need for government to interfere in the economy. However classical economy was proven wrong as the US economy got into the Great Depression in the 1930’s. There was huge amount of unemployment due to business shut downs and bank failures. It clearly shows that something went wrong with the market. 11 The Beginning of FP Keynesian economics In criticizing the classical economist, J.M Keynes (1936) says that there is not enough demand in the market. In his explanation of short run, it is the demand for goods and services that will determine the level of GDP, rather than the supply of factor inputs. The Great Depression was a result of low spending by consumer and business. The spendings were not enough to bring back the economy to full employment. The only way to raise demand and GDP is increasing government spending. 12 Solving for Y Y C I G equilibrium condition Y C I G in changes C G MPC Y G Collect terms with Y on the left side of the equals sign: (1 MPC) Y G because I exogenous because C = MPC Y Solve for Y : 1 Y G 1 MPC THE GOVERNMENT PURCHASES MULTIPLIER Definition: the increase in income resulting from a $1 increase in G. In this model, the govt Y 1 purchases multiplier equals G 1 MPC Example: If MPC = 0.8, then Y 1 5 G 1 0.8 An increase in G causes income to increase 5 times as much! An increase in taxes E Initially, the tax increase reduces consumption, and therefore E: E =C1 +I +G E =C2 +I +G At Y1, there is now an unplanned inventory buildup… C = MPC T …so firms reduce output, and income falls toward a new equilibrium Y E2 = Y2 Y E1 = Y1 Supply-side Economics In 1980’s American economy was hit by stagflation. Most of the economists blamed over-regulation, decreasing productivity and motivation to increase output among producers. Neoclassical economic thinking surfaced in the disguise of supply-side economics calling for changes in taxes to produce more output than increasing economic activity. 16 Fiscal Policy in Islamic Perspective Quran has guides what a good fiscal policy should be like. Surah Yusuf (12:43-49) tells the story of a Pharaoh in Egypt who had a strange dream. The king of Egypt shares his horrible dream with his subjects but none of them could interpret it.. Then Yousuf, the holy prophet of Allah was contacted to interpret it. The Prophet of Allah forecast famine for couple of years in the future. The king surrendered and handed over the kindom to Yousuf to manage the situation which he did very successfully. . 17 Traditional Revenue Sources of Islamic State Zakat Special levy or tax on wealth and agriculture products. Kharaj Land tax Jizya Poll tax on non-Muslims Ghanimah Spoils of war Fay’ Properties received from enemies without actual fighting ‘Ushur Custom duties 18 FISCAL POLICY: Empirical Approach 19 Distribution of Zakat The 8 categories of people, 1. The poor, One who has neither material assets nor means of livelihood; 2. the needy, one with insufficient means of livelihood to meet basic needs; 3. Zakat administrator, one who is appointed to collect and administer Zakat-efficiency. 4. New convert, one who has converted to Islam; 20 Distribution of Zakat The 8 categories of people, 4. New convert, one who has converted to Islam; 5. slave, one person who wants to free himself from bondage or the shackles of slavery; 6. debtor, individual who is in debt when he/she borrows money to buy basic needs consisting of halal expenditure; 7. path of Allah, one who fights for the cause of Allah; 8. finally, a wayfarer, one who is stranded in a journey. 21 The market for goods & services: Conventional Approach Aggregate demand: C (Y T ) I (r ) G Aggregate supply: Y F (K , L ) Equilibrium: Y = C (Y T ) I (r ) G The real interest rate adjusts to equate demand with supply. The loanable funds market: Conventional Approach A simple supply-demand model of the financial system. One asset: “loanable funds” – demand for funds: investment – supply of funds: saving – “price” of funds: real interest rate Demand for funds: Investment: Conventional Approach The demand for loanable funds… – comes from investment: Firms borrow to finance spending on plant & equipment, new office buildings, etc. Consumers borrow to buy new houses. – depends negatively on r, the “price” of loanable funds (cost of borrowing). Types of saving: Conventional Approach private saving = (Y – T) – C public saving = T – G national saving, S = private saving + public saving = (Y –T ) – C + T – G = Y – C – G Conventional Approach For any variable X, X = “the change in X ” is the Greek (uppercase) letter Delta Examples: If L = 1 and K = 0, then Y = MPL. Y More generally, if K = 0, then MPL . L (YT ) = Y T , so C = MPC (Y T ) = MPC Y MPC T THE AGGREGATE OUTPUT EXPENDITURE ANALYSIS In recent years there have been numerous studies focusing on Islamic banking and financial sector. These studies introduce instruments of fiscal policy as Zakat, without considering in the macroeconomic model to pursue the objectives of fiscal policy Zangeneh (1995) formulates a neoclassical macroeconomics model for an interest free economics system. The model shows that saving and investment do not necessarily fall in an Islamic economic system, an Islamic economic system is viable and the model also provides unique solutions for income, employment, and prices. Metwally (1983) finds that Zakat expenditure has the ability to increase the aggregate consumption since the marginal propensity to consume of the Zakat payers is lower than that of 27 Zakat recipients. THE AGGREGATE OUTPUT EXPENDITURE ANALYSIS Zakat expenditure has a role in the national income determination; the higher the Zakat expenditures the higher the increase in the equilibrium output. Tahir (1989) introduces Zakat in an Islamic macroeconomic model focusing on the determination of aggregate output associated with the degree of inequalities in an Islamic economy. He finds that the aggregate output depends on autonomous expenditures, income distribution, and Zakat flows. Awad (1997) advocates a Zakat-based tax structure as a means to stimulate growth, stabilize the economy, and promotes social cohesion. 28 THE AGGREGATE OUTPUT EXPENDITURE ANALYSIS In this lecture the population is divided into two groups: those who pay Zakat and those who receive Zakat as transfer payments. This lecture discusses equations for consumption, Zakat, and taxes and then derive the reduced form consumption equation and the Zakat multipliers from which we infer the impact of Zakat on national income determination and its efficacy as stabilization policy. 29 THE ZAKAT, TAXES, INVESTMENT AND GOVERNMENT SPENDING MULTIPLIERS 30 Review GDP = Y = C1+ CZ + I + G + X – M (1) C = C1+ CZ , personal consumption expenditure, The three sources of income, we obtain the national income as Y = Yw + YA + Yπ (2) GDP is obtained by adding the indirect taxes and depreciation, that is, GDP = Yw + YA + Yπ + TIND + δ (3) Use of national income (GDP) as: Y = C1 + S + Z + T (4) Consumption of the Zakat Payer, C1, is C1 = C01 + c1( Y – Z - T) , 0 < c1 < 1 (5) Consumption of the recipients of Zakat is CZ, CZ = C0z+ cz ZE , 0 < cz < 1 (6) ZE = Zakat disbursed by the government. When cz = 1 (6) becomes CZ = C0z+ ZE (6b) 31 Sum-up This Zakat identity holds ZE = Cz + Sz (6c) Thus 1 = dCz/dZE+ dSz/dZE = MPCz + MPSz. The aggregate consumption, C, is C = C1 + Cz = C01 + c1 ( Y – Z - T) + C0z+ cz ZE (7) If cz = 1 then C = C01 + c1( Y – Z - T) + C0z+ ZE (7b) We shall use consumption equation (3) in the subsequent analysis. The Zakat collection from individuals’ wages and salaries, Zw, is Zw = zw(Yw- C0w - C0n ) (8) C0n = nisab (min consumption determined by Islamic State). C0w = the exemption to the Zakat payers for basic needs, zw = Zakat rate. 32 Sum-up (Yw – C0w - C0n ) = zakatable income. A0 = Assets at period 0 rA= rate of return on assets (A) Asset at the end of that year is: A1 = A0 ( 1 + rA) zA. = zakat rate (a) If rA ≥ zA at least sufficient income to pay Zakat. (b) If rA < zA asset’s owner has to liquidate asset to pay Zakat. Zakat collection from the asset from all individuals, ZA , is ZA = zA(A1 – C0A- C0n) (9) 33 Sum-up (Review) Substituting A1 = A0 ( 1 + rA) and let YA = rA A0 , equation (9) can be written as ZA = zAA0+ zAYA - zA (C0A + C0n ) (10) C0A = exemption to the individuals earning income from the transactions of assets. zAA0 = does not contribute toward the production of currently produced goods and services and therefore excluded from GDP. Income generated by the assets, YA , is included in GDP. Zakat collection on profits, Zπ , is Zπ =zπ ( Π – C0π - C0n ) (11) C0π = exemption; C0n = nisab level; C0π = exemption for R&D, training etc. 34 Review (Zakat Collection) Z = Zw + Z A + Zπ Substituting for Zw , Z A , and Zπ , we have Z = zw (Yw – C0w - C0n ) + zA(YA- C0A - C0n )+ zπ(Yπ - C0π - C0n ) + zAA0 (12) Let zw = zA = zπ, then equation (12) reduces to Z = z(Y – C0E - C0N ) + z A0 (13) where Y = Yw+ Yπ +YA , C0E = C0w+C0A + C0π , and C0N = C0n+C0n + C0n . 35 Sum-up Tax collection Tw = T0w + tw[ Yw– Zw] (14) Net tax collection from profits, TП, is Tπ = Tπ0 + tπ[ Yπ - Zπ] (15) Net tax collection from asset income, TA, is TA = TA0 + tA( YA – ZA ) (16). where Tw0, TП0 , and TA0 are the lump-sum taxes. 36 Review (Zakat & Tax Collection Tax collection T = Tw+ Tπ+ TA Substituting for Tw , Tπ and TA, we have T = T0 + tw[ Yw– Zw] + tA[ YA – ZA] + tπ[ Yπ - Zπ] (17) whereT0 = Tw0+ TП0 + TA0. The terms in the brackets are the taxable income which are the income after Zakat from wages and salaries, asset income, and profits respectively. Substituting equation (17) for Zw, ZA, and Zπ , we obtain T =T0 + tw [Yw– zw ( Yw – C0w - C0n )] + tA [YA - zA(YA - C0A - C0n ) ] tA z A0 + tπ [Yπ - zπ(Yπ - C0π - C0n)] (17b) 37 Sum-up (Total Zakat Collection) Tax collection tw = tA = tπ = t and that the Zakat rates are also equal to zw = zA = zπ = z. Y = Yw+ Yπ +YA. Thus (17b) can be simplified to T =T0 + tY– tzY + tz C0N + tz C0E - t zA0 (18) 38 Sum-up (Total Zakat Collection) Tax collection Substituting the tax equation (18) into the consumption equation (7) we obtain, C = C01+ C0z + c1Y– c1Z – c1T0 - c1tz C0E - c1tz C0N - c1t Y + c1z t Y + czZE + c1 t z A0 (19) Substituting Z = z(Y - C0E - C0N) into (19), aggregate consumption function in reduced form is C = C01+C0z + (c1– c1z - c1t + c1z t)Y + (c1z - c1tz)C0E + (c1z - c1tz)C0N – c1T0 + czZE + c1 t z A0 (20) 39 Sum-up (Total Zakat Collection) From 20 aggregate consumption in an Islamic economy depends on: 1. Income, 2. Exemption levels, 3. Taxes, 4. Zakat expenditure, 5. Asset holdings of individuals. Taking total differential of (20), dC = dC01+ dC0z + (c1– c1z - c1t + c1z t)dY + (c1z - c1tz)dC0E + (c1z-c1tz)dC0N–c1dT0 + czdZE + c1tzdA0 (20a) 40 Sum-up (Total Zakat Collection) Determinants of consumption are as follows: Effect of Income: ∂C/∂Y = [c1– (c1z + c1t )+ c1z t] > 0 Since c1 > 0; 0 < c1 < 1, 0 < z < 1, 0 < t < 1 and therefore the term (c1t +c1z) is expected to be smaller than c1. Effect of Exemption: ∂C/∂C0E = (c1z - c1tz) > 0 Since 0 < c1 < 1 ; 0< z < 1; 0 < t < 1, therefore (c1z > c1tz) 41 Sum-up (Total Zakat Collection) Effect of taxes, ∂C/∂T0 = – c1< 0 Zakat expenditure ∂C/∂ZE = cz > 0 Effect of wealth ∂C/∂A0 = c1 t z > 0 42 Sum-up-Review (Multipliers) Y=C+I+G (21) G = G0 is the government spending from taxes, I = I0 is the gross private investment (exogenous). The Zakat, taxes, investment, and government spending multipliers is derived by substituting the consumption (20) into the national income identity (21) to obtain Y = C01+C0z + (c1– c1z - c1t + c1z t)Y + (c1z - c1tz)C0E + (c1z - c1tz)C0N – c1T0 + cz ZE + c1tz A0 + I0 + G0 43 Sum-up-Review (Multipliers) Rearranging and simplifying, Y = [1/(1- c1+ c1t - c1tz + c1z)] [C01+ C0z + (c1z - c1tz)C0E + (c1z - c1tz)C0N – c1T0+czZE+c1tzA0+I0+G0 ] (22) The total differential of (22) is dY = [1/(1- c1+ c1t - c1tz + c1z)] [dC01+ dC0z + (c1z - c1tz)dC0E + (c1z - c1tz) dC0N – c1 dT0 + cz dZE+c1tz dA0 + dI0 + dG0 (23) Since C0N is fixed therefore dC0N = 0. The multipliers for C01 , C0z , T0, I0, G0 and ZE are obtained by taking partial derivatives of (23) with respect to each of the variables. 44 Sum-up-Review (Multipliers) Autonomous consumption (Zakat Payer): ∂Y/∂C01 = [1/(1- c1 + c1t + c1z - c1t z)] > 0 (23b) Autonomous consumption (Zakat recipient): ∂Y/∂C0z = [1/(1- c1 +c1t + c1z - c1t z)] > 0 (23C) Exemption Level: ∂Y/∂C0E = [1/(1- c1 +c1t + c1 z - c1 t z)] [c1z -c1tz ] > 0 (24) The tax multiplier: ∂Y/∂T0 = [- c1 /(1- c1 +c1t + c1 z - c1t z)] < 0 (25) Autonomous investment multiplier: ∂Y/∂I0 = [1/(1- c1 +c1t + c1 z - c1 t z)] > 0 (26) 45 Sum-up-Review (Multipliers) Government Spending Multiplier: ∂Y/∂G0 = [1/(1- c1 +c1t + c1 z - c1 t z)] > 0 (27) Multiplier for assets: ∂Y/∂A0 = [1/(1- c1+c1t + c1 z - c1t z)] > 0 (27b) Zakat multiplier (cz < 1 ): ∂Y/∂ZE = [cz /(1- c1 +c1t + c1 z - c1 t z)] > 0 Zakat multiplier (cz = 1 ): ∂Y/∂ZE = [1 /(1- c1 +c1t + c1 z - c1tz)] > 0 (28) (29) 46 Sum-up-Review (Aggregate Consumption) When Zakat collection is not equal to Zakat disbursement: C = C01+ C0z + c1Y– c1Z – c1T0 - c1tz C0E - c1tz C0N - c1t Y + c1z t Y + czZE + c1 t z A0 (19) When Zakat fund is spent then Z = ZE: C = C01+ C0z + c1Y– c1ZE – c1T0 - c1tz C0E - c1tz C0N - c1t Y + c1z t Y + czZE + c1 t z A0 Simplifying, we obtain C = C01+ C0z + (c1- c1t + c1z t) Y + (cz – c1)ZE – c1T0 - c1tz C0E - c1tz C0N + c1t z A0 (19b) 47 Sum-up-Review (Multipliers) Substituting for C of (19b) in national income identity (21) and taking the total differential, we obtain dY = [1/(1- c1 +c1t -c1t z)] [dC01+ c1tz dC0E + dC0z – c1dT0 + (cz - c1)dZE + dI0 +dG0] (30) Multiplier for the autonomous consumption for the Zakat payers: ∂Y/∂C01 = [1/(1- c1 +c1t - c1 t z)] > 0 (31) Multiplier for the autonomous consumption for the Zakat recipients: ∂Y/∂C0z = [1/(1- c1 +c1t - c1 t z)] > 0 (32) Multiplier for exemption: ∂Y/∂C0E = [1/(1- c1 +c1t - c1 t z)] [c1t z ] > 0 (33) The tax multiplier ∂Y/∂T0 = [- c1 /(1- c1 +c1t - c1t z)] < 0 (34) 48 Sum-up-Review (Multipliers) Investment multiplier: ∂Y/∂I0 = [1/(1- c1 +c1t - c1 t z)] > 0 (35) Multiplier for government spending: ∂Y/∂G0 = [1/(1- c1 +c1t - c1 t z)] > 0 (36) Balanced Zakat multiplier ∂Y/∂ZE = [(cz – c1) /(1- c1 +c1t - c1 t z)] > 0 (37) Zakat multiplier (when cz = 1) ∂Y/∂ZE = [(1 – c1) /(1- c1 +c1t - c1t z)] > 0 (38) Since 0 < c1< 1, the Zakat multiplier for this special case is positive. 49 CONCLUSIONS In these lectures we incorporate Zakat into a simple macroeconomic model of an Islamic economy to analyze the impact of Zakat on the determination of equilibrium income and see how Zakat plays its role in the demand management policy. We derive the aggregate consumption function in reduced form and found that the determinants of consumption are: Zakat expenditure, taxes, income, and asset holdings of individuals. We cannot change the Zakat rate to dampen the macroeconomic fluctuations. 50 CONCLUSIONS The role of Zakat in the demand management policy is through the non-discretionary (built-in stabilizer) and discretionary policy. The built-in stabilizer mechanism occurs when Zakat collection is automatically reduced during recession giving more money to people to spend which tends stimulate the economy; During the boom period more Zakat is collected, reducing the ability of the people to spend which tends to dampen economic activities. These reduce macroeconomic fluctuations. 51 CONCLUSIONS In the case of discretionary fiscal policy, the government varies the disbursement of Zakat to the recipients and the exemption levels to the Zakat payers whenever necessary during the phases of the business cycle. During the expansion phase of a business cycle the government may want to decrease Zakat disbursement and exemption levels to reduce aggregate spending of Zakat payers and thus prevent the economy from overheating. This action coupled with the fall in the number of eligible Zakat recipients will help increase the Zakat surplus in the Baitul-Mal. 52 CONCLUSIONS Zakat disbursement and exemption levels could be increased when the economy is in the downswing to spur aggregate spending and economic activities. Since the number of eligible Zakat recipients increases during recession, the government could disburse more Zakat by using the Zakat surplus accumulated from the boom periods. The ulama’ have unanimously agreed that an Islamic State may impose taxes when its revenues are insufficient to cover its spending implying that taxation and government spending are compatible with Islam. Therefore Zakat, government spending, and taxation complement each other as stabilization policy. 53 Thank You 54