* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Document

Survey

Document related concepts

Transcript

Fundamental

Economic Concepts

Chapter 2

Fundamental Economic Concepts

Demand, Supply, and Equilibrium Review

Total, Average, and Marginal Analysis

Finding the Optimum Point

Present Value, Discounting & Net Present

Value

Risk and Expected Value

Probability Distributions

Standard Deviation & Coefficient of Variation

Normal Distributions and using the z-value

The Relationship Between Risk & Return

Law of Demand

A decrease in the price of a good, all other

things held constant, will cause an increase in

the quantity demanded of the good.

An increase in the price of a good, all other

things held constant, will cause a decrease in

the quantity demanded of the good.

Change in Quantity Demanded

Price

An increase in price

causes a decrease in

quantity demanded.

P1

P0

Q1

Q0

Quantity

Change in Quantity Demanded

Price

A decrease in price

causes an increase in

quantity demanded.

P0

P1

Q0

Q1

Quantity

Demand Curves

Individual Demand

Curve the greatest

quantity of a good

demanded at each

price the consumers

are willing to buy,

holding other

influences constant

$/Q

$5

20

Q /time unit

Sam

+

Diane

=

Market

The Market

Demand Curve is

the horizontal sum

of the individual

demand curves.

4

3

7

The Demand

Function includes Q = f( P, Ps, Pc, Y, N PE)

- +

? + +

all variables that

influence the

P is price of the good

S is the price of substitute goods

P

quantity demanded C

P is the price of complementary goods

Y is income, N is population,

PE is the expected future price

Determinants of the

Quantity Demanded

i.

ii.

iii.

iv.

v.

vi.

vii.

viii.

xi.

x.

price, P

price of substitute goods, Ps

price of complementary goods, Pc

income, Y

advertising, A

advertising by competitors, Ac

size of population, N,

expected future prices, Pe

adjustment time period, Ta

taxes or subsidies, T/S

The list of

variables that

could likely affect

the quantity

demand varies

for different

industries and

products.

The ones on the

left are tend to

be significant.

Change in Demand

An increase in demand refers

to a rightward shift in the

market demand curve.

Price

P0

Q0

Q1

Quantity

Change in Demand

A decrease in demand refers to

a leftward shift in the market

demand curve.

Price

P0

Q1

Q0

Quantity

Figure 2.3 Shifts in Demand

Law of Supply

A decrease in the price of a good, all other

things held constant, will cause a decrease in

the quantity supplied of the good.

An increase in the price of a good, all other

things held constant, will cause an increase in

the quantity supplied of the good.

Change in Quantity Supplied

A decrease in price

causes a decrease in

quantity supplied.

Price

P0

P1

Q1

Q0

Quantity

Change in Quantity Supplied

An increase in price

causes an increase in

quantity supplied.

Price

P1

P0

Q0

Q1

Quantity

Supply Curves

Firm Supply Curve -

the greatest quantity

of a good supplied at

each price the firm is

profitably able to

supply, holding other

things constant.

$/Q

Q/time unit

The Market

Supply Curve is

the horizontal sum

of the firm supply

curves.

The Supply

Function includes

all variables that

influence the

quantity supplied

Acme Inc. + Universal Ltd. = Market

4

3

7

Q = g( P, PI, RC, T, T/S)

+

-

-

+

?

Determinants of the Supply Function

i.

ii.

iii.

iv.

v.

vi.

vii.

viii.

ix.

x.

price, P

input prices, PI, e.g., sheet metal

Price of unused substitute inputs, PUI, such as fiberglass

technological improvements, T

entry or exit of other auto sellers, EE

Accidental supply interruptions from fires, floods, etc., F

Costs of regulatory compliance, RC

Expected future changes in price, PE

Adjustment time period, TA

taxes or subsidies, T/S

Note: Anything that shifts supply can be included and varies for

different industries or products.

Change in Supply

An increase in supply refers to a

rightward shift in the market

supply curve.

Price

P0

Q0

Q1

Quantity

Change in Supply

A decrease in supply refers to a

leftward shift in the market

supply curve.

Price

P0

Q1

Q0

Quantity

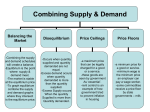

Market Equilibrium

Market equilibrium is determined at

the intersection of the market

demand curve and the market

supply curve.

The equilibrium price causes

quantity demanded to be equal to

quantity supplied.

Equilibrium: No Tendency to Change

S

Superimpose

P

demand and supply

Willing

If No Excess

& Able

Demand and No in crosshatched

Excess Supply . . .

Then no tendency to

Pe

change at the

equilibrium price, Pe

D

Q

Dynamics of Supply and Demand

If quantity demanded is greater than quantity

supplied at a price, prices tend to rise.

The larger is the difference between quantity

supplied and demanded at a price, the greater is

the pressure for prices to change.

When the quantity demanded and supplied at a

price are equal at a price, prices have no

tendency to change.

Equilibrium Price Movements

Suppose there is an

P

S

P1

e1

D

Q

increase in income

this year and

assume the good is

a “normal” good

Does Demand or

Supply Shift?

Suppose wages

rose, what then?

Comparative Statics

& the supply-demand model

P

Suppose that

e2

e1

S

D’

D

Q

demand Shifts to

D’ later this fall…

We expect prices

to rise

We expect

quantity to rise

as well

Market Equilibrium

Price

D0

D1

S0

An increase in demand will

cause the market

equilibrium price and

quantity to increase.

P1

P0

Q0

Q1

Quantity

Market Equilibrium

Price

D1

D0

S0

A decrease in demand will

cause the market

equilibrium price and

quantity to decrease.

P0

P1

Q1

Q0

Quantity

Market Equilibrium

Price

D0

S0

P0

S1

An increase in

supply will

cause the

market

equilibrium

price to

decrease and

quantity to

increase.

P1

Q0

Q1

Quantity

Market Equilibrium

Price

D0

S1

P1

S0

A decrease in

supply will

cause the

market

equilibrium

price to

increase and

quantity to

decrease.

P0

Q1

Q0

Quantity

Break Decisions Into Smaller Units:

How Much to Produce ?

Graph of output and

profit

GLOBAL

MAX

profit

Possible Rule:

Expand output until

profits turn down

But problem of

local maxima vs.

global maximum

MAX

A

quantity B

Average Profit = Profit / Q

PROFITS

Slope of ray from the origin

MAX

C

Rise / Run

Profit / Q = average profit

Maximizing average profit

doesn’t maximize total

profit

B

profits

Q

quantity

Marginal Profits = /Q

Q1 is breakeven (zero profit)

maximum marginal profits occur at the

inflection point (Q2)

Max average profit at Q3

Max total profit at Q4 where marginal

profit is zero

So the best place to produce is where

marginal profits = 0.

FIGURE 2.8 Total, Average, and

Marginal Profit Functions

Present Value

Present

value recognizes that a dollar received

in the future is worth less than a dollar in hand

today.

To compare monies in the future with today,

the future dollars must be discounted by a

present value interest factor, PVIF=1/(1+i),

where i is the interest compensation for

postponing receiving cash one period.

For dollars received in n periods, the discount

factor is PVIFn =[1/(1+i)]n

Net Present Value (NPV)

Most business decisions are long term

capital budgeting, product assortment, etc.

Objective: Maximize the present value of profits

NPV = PV of future returns - Initial Outlay

NPV = t=0 NCFt / ( 1 + rt )t

where NCFt is the net cash flow in period t

NPV Rule: Do all projects that have positive net

present values. By doing this, the manager maximizes

shareholder wealth.

Good projects tend to have:

1.

2.

3.

high expected future net cash flows

low initial outlays

low rates of discount

Sources of Positive NPVs

Brand preferences 5.

for established

brands

6.

2. Ownership control

over distribution

7.

3. Patent control over

products or

techniques

4. Exclusive ownership

over natural

resources

1.

Inability of new firms to acquire

factors of production

Superior access to financial

resources

Economies of large scale or

size from either:

a. Capital intensive processes,

or

b. High start up costs

Appendix 2A

Differential Calculus Techniques in

Management

A function with one decision variable,

X, can be written as Y = f(X)

The marginal value of Y, with a small

increase of X, is My = Y/X

For a very small change in X, the

derivative is written:

dY/dX = limit Y/X

X B

Marginal = Slope = Derivative

The slope of line C-D

is Y/X

The marginal at point

C is My is Y/X

The slope at point C is

the rise (Y) over the

run (X)

The derivative at point

C is also this slope

D

Y

Y

X

C

X

Finding the maximum flying range for

the Stealth

Bomber is an optimization problem.

Calculus teaches that when the first derivative is zero,

the solution is at an optimum.

The original Stealth Bomber study showed that a

controversial flying V-wing design optimized the

bomber's range, but the original researchers failed to

find that their solution in fact minimized the range.

It is critical that managers make decision that

maximize, not minimize, profit potential!

Quick Differentiation Review

Name

Function

Constant Y = c

Derivative

dY/dX = 0

Y=5

dY/dX = 0

dY/dX = c

Y = 5•X

dY/dX = 5

Functions

A Line

Y = c•X

Power Y = cXb

Functions

Example

dY/dX = b•c•X b-1 Y = 5•X2

dY/dX = 10•X

Quick Differentiation Review

Sum of Y = G(X) + H(X)

Functions

example Y = 5•X + 5•X2

Product of

dY/dX = dG/dX + dH/dX

dY/dX = 5 + 10•X

Y = G(X)•H(X)

Two Functions

dY/dX = (dG/dX)H +

(dH/dX)G

example Y = (5•X)(5•X2 )

dY/dX = 5(5•X2 ) + (10•X)(5•X) = 75•X2

Quick Differentiation Review

Quotient of Two

Y = G(X) / H(X)

Functions

dY/dX = (dG/dX)•H - (dH/dX)•G

H2

Y = (5•X) / (5•X2) dY/dX = 5(5•X2) -(10•X)(5•X)

(5•X2)2

= -25X2 / 25•X4 = - X-2

Chain Rule

Y = G [ H(X) ]

dY/dX = (dG/dH)•(dH/dX) Y = (5 + 5•X)2

dY/dX = 2(5 + 5•X)1(5) = 50 + 50•X

Applications of Calculus in

Managerial Economics

maximization problem: A profit function might

look like an arch, rising to a peak and then declining at even

larger outputs. A firm might sell huge amounts at very low

prices, but discover that profits are low or negative.

At the maximum, the slope of the profit function is zero. The

first order condition for a maximum is that the derivative at

that point is zero.

If = 50·Q - Q2, then d/dQ = 50 - 2·Q, using the rules of

differentiation.

Hence, Q = 25 will maximize profits where 50 - 2•Q = 0.

More Applications of Calculus

minimization problem: Cost minimization supposes that

there is a least cost point to produce. An average cost curve

might have a U-shape. At the least cost point, the slope of the

cost function is zero.

The first order condition for a minimum is that the derivative at

that point is zero.

If C = 5·Q2 - 60·Q, then dC/dQ = 10·Q - 60.

Hence, Q = 6 will minimize cost where 10•Q - 60 = 0.

More Examples

Competitive Firm: Maximize Profits

where = TR - TC = P•Q - TC(Q)

Use our first order condition:

d/dQ = P - dTC/dQ = 0.

TC a function of Q

Decision Rule: P = MC.

Problem 1

l

Max = 100•Q - Q2

100 -2•Q = 0 implies

Q = 50 and = 2,500

Problem 2

l

Max= 50 + 5•X2

So, 10•X = 0 implies

Q = 0 and= 50

Second Derivatives and the

Second Order Condition:

One Variable

If the second derivative is negative, then it’s

a maximum

If the second derivative is positive, then it’s a

minimum

Problem 1

lMax

= 100•Q -

Problem 2

Q2

100 -2•Q = 0

second derivative is: -2 implies Q

=50 is a MAX

lMax=

50 + 5•X2

10•X = 0

second derivative is: 10 implies Q

= 0 is a MIN

Partial Differentiation

Economic relationships usually involve several

independent variables.

A partial derivative is like a controlled

experiment -- it holds the “other” variables

constant

Suppose price is increased, holding the

disposable income of the economy constant

as in Q = f (P, I ), then Q/P holds income

constant.

Example

Sales are a function of advertising in

newspapers and magazines ( X, Y)

Max S = 200X + 100Y -10X2 -20Y2 +20XY

Differentiate with respect to X and Y and set

equal to zero.

S/X = 200 - 20X + 20Y= 0

S/Y = 100 - 40Y + 20X = 0

solve for X & Y and Sales

Solution: 2 equations & 2 unknowns

200 - 20X + 20Y= 0

100 - 40Y + 20X = 0

Adding them, the -20X and +20X cancel, so

we get 300 - 20Y = 0, or Y =15

Plug into one of them:

200 - 20X + 300 = 0, hence X = 25

To find Sales, plug into equation:

S = 200X + 100Y -10X2 -20Y2 +20XY = 3,250

Most decisions involve a gamble

Probabilities can be known or unknown, and

outcomes possibilities can be known or unknown

Risk -- exists when:

Possible outcomes and probabilities are known

Examples: Roulette Wheel or Dice

We generally know the probabilities

We generally know the payouts

Uncertainty if probabilities and/or payouts are unknown

Concepts of Risk

When probabilities are known, we can analyze risk

using probability distributions

Assign a probability to each state of nature, and be

exhaustive, so that pi

Strategy

States of Nature

Recession

p = .30

Expand Plant

Don’t Expand

=1

- 40

- 10

Economic Boom

p = .70

100

50

Payoff Matrix

Payoff Matrix shows payoffs for each state of nature,

for each strategy

Expected Value =

r = ri

pi

_

r = ri pi = (-40)(.30) + (100)(.70) = 58 if Expand

_

r = ri pi = (-10)(.30) + (50)(.70) = 32 if Don’t

Expand

Standard Deviation = =

(r

i

-

r )- 2. pi

Example of

Finding Standard Deviations

expand = SQRT{ (-40 - 58)2(.3) + (100-58)2(.7)}

= SQRT{(-98)2(.3)+(42)2 (.7)}

= SQRT{ 4116} = 64.16

don’t = SQRT{(-10 - 32)2 (.3)+(50 - 32)2 (.7)}

= SQRT{(-42)2 (.3)+(18)2 (.7) }

= SQRT{ 756 } = 27.50

Expanding has a greater standard deviation (64.16),

but also has the higher expected return (58).

FIGURE 2.9 A Sample Illustration of Areas

under the Normal Probability Distribution

Curve

Coefficients of Variation

or Relative Risk

Coefficient of Variation (C.V.) =

/ r.

_

C.V. is a measure of risk per dollar of expected return.

Project T has a large standard deviation of $20,000

and expected value of $100,000.

Project S has a smaller standard deviation of $2,000

and an expected value of $4,000.

CVT = 20,000/100,000 = .2

CVS = 2,000/4,000 = .5

Project T is relatively less risky.

Projects of Different Sizes:

If double the size, the C.V. is not changed!!!

Coefficient of Variation is good for comparing

projects of different sizes

Example of Two Gambles

A:

Prob

.5

.5

X }

10

20

B:

Prob

.5

.5

X

20

40

R = 15

}

= SQRT{(10-15)2(.5)+(20-15)2(.5)]

}

= SQRT{25} = 5

C.V. = 5 / 15 = .333

}

R = 30

}

= SQRT{(20-30)2 ((.5)+(40-30)2(.5)]

}

= SQRT{100} = 10

C.V. = 10 / 30 = .333

What Went Wrong at LTCM?

Long Term Capital Management was a ‘hedge

fund’ run by some top-notch finance experts

(1993-1998)

LTCM looked for small pricing deviations

between interest rates and derivatives, such as

bond futures.

They earned 45% returns -- but that may be due

to high risks in their type of arbitrage activity.

The Russian default in 1998 changed the risk

level of government debt, and LTCM lost $2

billion

Table 2.10 Realized Rates of Returns and Risk

Which had the highest return? Why?