* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Some Practical Questions

Survey

Document related concepts

Transcript

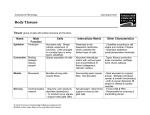

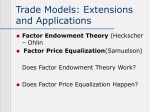

Some Practical Questions 1 Is there such a thing called complete specialization? Some Practical Questions 2 Is the North-South volume of trade flow larger than that of the North-North flow? Some Practical Questions 3 Why do governments interfere in the free flow of goods if free international trade is welfare improving? Some Practical Questions 4 What is the sources of comparative advantage (the source of differences in opportunity cost)? The Neo-Classical Explanation of Trade The Hecksher-Ohlin (H-O) Theory of International Trade History Eli Heckscher (1919); 1949 ; Bertil Ohlin (1924; 1933) The HO …… 1 Countries no longer differ in the level of technology, but in the amount of factors with which they are endowed (Factor Endowment) The HO ..… i.e., Compared to its trading partner, a country is either labor abundant or capital abundant. Depends upon the relative capital labor ratios The HO ..… 2 Goods differ in the amount of factors they require to be produced (i.e., in factor intensity) Goods are either Capital or Labor intensive… The HO Theory A country should produce (and thus export) good (s), the production of which, requires an intensive use of the factor which is relatively abundant in that country The HO Theory i.e., countries will have a comparative advantage in the production of good (s) which uses the country’s relatively abundant factor more intensively The HO Theory International Trade is based on resource availability ( Factor Abundance); Not technological difference Example… Suppose we are concerned with trade between: Autos U.S.A. Textiles MEXICO Example…Data USA: 50 Machines (K) & 100 Workers (L) Mexico: 25 Machines (K) & 75 Workers (L) Assume that Autos are K intensive and Textile is Labor intensive…. Question…. In which country should each product be produced? Solution…. The HO theory says: K intensive goods should be produced in K abundant countries; and L intensive goods should be produced in L abundant countries Question…. Determine… Which country is K abundant? Which country is L abundant? Solution…. Capital Labor Ratios (K/L) U.S.A. 50/100 =1/2 = 0.50 Mexico 25/75 Note that … =1/3 = 0.33 Autos are K Intensive Textile is L Intensive Solution…. Is Capital (K) abundant Autos …. Is LaborTextile (L) abundant … Autos are K Intensive Textile is L Intensive Some Real World Data 1. Is the U.S.A. capital or labor abundant country? 2. Which industries are K intensive? Capital Stock per Worker in Selected Countries-1990 Country Year-1990 Germany Sweden Japan USA Mexico 50,116 39,409 36,480 34,705 12,900 . . Kenya Nigeria 907 702 Capital Labor Ratios across US Industries Industry K/L(1980) K/L(2000) Chemicals 58.9 85.9 Petroleum and Coal 161.2 266.7 Electrical Machines 13.0 35.3 Food Industries 22.5 36.8 Textiles 31.9 100.1 Source: Husted and Melvin, 2004 Why should a country produce the good which uses its relatively abundant factor? Why would the USA has to produce Autos and Mexico textiles? The Rationale behind HO… Differences in relative factor price ratios… If country A ( say, the USA ) is K abundant, it must be that the ratio of the returns to capital (i.e., rents) to that of labor (i.e., wages)…is lower in that country than the other. …because capital (K) is abundant and hence cheaper, whereas Labor (L) is scarce and hence expensive. The Rationale behind HO… Differences in relative factor price ratios… • Similarly, if country B ( say, Mexico) is Labor abundant, it must be that the ratio of Rents to Wages (R/W) is higher in Mexico than the U.S.A. … because capital is scarce and hence expensive and labor is abundant and hence cheaper. Implications…. The basis of trade (comparative advantage) is autarky relative factor price differentials, which gives rise to differences in opportunity cost Implications…. Comparative Advantage Relative Factor Abundance Relative Factor Price Difference The HO and Classical Theory: Differences 1 Under HO, there is no complete specialization… … factors are imperfect substitutes, and firms face increasing opportunity cost of completely transferring resources fro one sector to the other. The HO and Classical Theory: Differences 2 Under HO, factor price equalization (resulting from adjustments in excess demand and supply), … not product price equalization The HO and Classical Theory: Differences 3 Under HO, there are restriction on demand…tastes and preferences are assumed to be identical, … not under classical