* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download market equilibrium

Survey

Document related concepts

Transcript

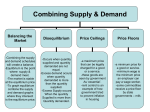

6.1 Price, Quantity, and Market Equilibrium SLIDE 1 6 Market Forces 6.1 Price, Quantity, and Market Equilibrium 6.2 Shifts of Demand and Supply Curves 6.3 Market Efficiency and Gains from Exchange CONTEMPORARY ECONOMICS © Thomson South-Western 6.1 Price, Quantity, and Market Equilibrium SLIDE 2 CONSIDER How is market competition different from competition in sports and in games? Why do car dealers usually locate together on the outskirts of town? What’s the difference between making stuff right and making the right stuff? Why do government efforts to keep rents low usually lead to a housing shortage? Why do consumers benefit nearly as much from a low price as from a zero price? CONTEMPORARY ECONOMICS © Thomson South-Western 6.1 Price, Quantity, and Market Equilibrium Objectives Understand how markets reach equilibrium. Explain how markets reduce transaction costs. CONTEMPORARY ECONOMICS © Thomson South-Western 6.1 Price, Quantity, and Market Equilibrium Key Terms market equilibrium surplus shortage transaction cost CONTEMPORARY ECONOMICS © Thomson South-Western 6.1 Price, Quantity, and Market Equilibrium SLIDE 5 Market Equilibrium When the quantity that consumers are willing and able to buy equals the quantity that producers are willing and able to sell, that market reaches market equilibrium. CONTEMPORARY ECONOMICS © Thomson South-Western 6.1 Price, Quantity, and Market Equilibrium SLIDE 6 Equilibrium in the Pizza Market Figure 6.1 CONTEMPORARY ECONOMICS © Thomson South-Western 6.1 Price, Quantity, and Market Equilibrium SLIDE 7 Surplus Forces the Price Down At a given price, the amount by which quantity supplied exceeds quantity demanded is called the surplus. As long as quantity supplied exceeds quantity demanded, the surplus forces the price lower. CONTEMPORARY ECONOMICS © Thomson South-Western 6.1 Price, Quantity, and Market Equilibrium SLIDE 8 Shortage Forces the Price Up At a given price, the amount by which quantity demanded exceeds quantity supplied is called the shortage. As long as quantity demanded and quantity supplied differ, this difference forces a price change. CONTEMPORARY ECONOMICS © Thomson South-Western 6.1 Price, Quantity, and Market Equilibrium SLIDE Market Forces Lead to Equilibrium Price and Quantity 9 The equilibrium price, or market-clearing price, equates quantity demanded with quantity supplied. Because there is no shortage and no surplus, there is no longer any pressure for the price to change. CONTEMPORARY ECONOMICS © Thomson South-Western 6.1 Price, Quantity, and Market Equilibrium SLIDE 10 Market Exchange Markets answer the questions What to produce How to produce it For whom to produce it CONTEMPORARY ECONOMICS © Thomson South-Western 6.1 Price, Quantity, and Market Equilibrium SLIDE 11 Adam Smith’s Invisible Hand Although each individual pursues his or her own self-interest, the “invisible hand” of market competition promotes the general welfare. CONTEMPORARY ECONOMICS © Thomson South-Western 6.1 Price, Quantity, and Market Equilibrium SLIDE 12 Market Exchange Is Voluntary Neither buyers nor sellers would participate in the market unless they expected to be better off. Prices help people recognize market opportunities to make better choices as consumers and as producers. CONTEMPORARY ECONOMICS © Thomson South-Western 6.1 Price, Quantity, and Market Equilibrium SLIDE 13 Markets Reduce Transaction Costs Transaction costs are the cost of time and information needed to carry out market exchange. The higher the transaction cost, the less likely the exchange will take place. CONTEMPORARY ECONOMICS © Thomson South-Western

![[A, 8-9]](http://s1.studyres.com/store/data/006655537_1-7e8069f13791f08c2f696cc5adb95462-150x150.png)