* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download S - Unchain-vu

Marginal utility wikipedia , lookup

Middle-class squeeze wikipedia , lookup

Market penetration wikipedia , lookup

Grey market wikipedia , lookup

General equilibrium theory wikipedia , lookup

Market (economics) wikipedia , lookup

Marginalism wikipedia , lookup

Externality wikipedia , lookup

Supply and demand wikipedia , lookup

Your lecturer today and tomorrow:

Dr Alfred Kleinknecht

CV:

1972-77: Study of Economics in Berlin

1977-84: Junior researcher, Wissenschaftszentrum Berlin and

Free University of Amsterdam

1984-88: Lecturer in economics at Univ. of Maastricht

1988-94: Researcher at Univ. of Amsterdam

1994-97: Professor of Economics, Free Univ. of Amsterdam

Since 1997: Professor, Economics of Innovation, TU Delft

2006: Visiting Professor, Università la Sapienza, Rome

2009: Visiting Professor, Université Panthéon Sorbonne, Paris I

Structure of lectures:

• Introduction to some basic micro-economic

principles

• Application of micro-economic principles to

management decisions

• From micro-economics to innovation theory

• Measuring innovation

• Labour relations and innovation

• Macro-economic aspects of innovation

What is economics (1)?

General Economics:

• Micro-economics (choices made by individual

firms, households or persons)

• Macro-economics (aggregate economy)

• International economics (including

development economics)

• Economics of the public sector (Efficient

taxing and public spending)

• Evolutionary and institutional economics:

innovation

What is economics (2)?

Management economics:

• Accounting (balance sheets, cost estimates,

etc.)

• Finance and investment

• Organisation and strategic management

• Marketing and market research

• Human Resource Management

• Innovation management

Values and political preferences

Positive economics:

• Factual or predictive statements

• (e. g.: "During a hot day, we sell more ice cream")

Normative economics:

• Value judgments (e. g.: "Income distribution should be more

equal")

Is economics a "value-free" science?

• Not in the selection of topics for research (a scarce resource!)

• Political/ideological views can play an (often hidden) role

• Economists involved in policy advice may be too closely

engaged with the subject of their research and with vested

interests

A key difference between economics and natural

sciences:

Economists can not do physical experiments!

Alternative: Economic models

Economic models:

• Concentrate on features considered essential for

understanding reality (ignoring details; using simplifying

assumptions)

• Outcomes from models can be confronted with observed

statistical data → A good 'fit' gives confidence on the model's

suitability for predictions (typical research path: interaction

between data analysis and model building)

• There can be competing models! The choice between models

should not depend (but often it does) on ideological

preferences of the economist

Micro-economics as a theory of choices:

Typical questions:

• How can I spend my money in a way that I get

maximum satisfaction/utility from it?

• How can I distribute my time between work (=

utility of money) and free time (= utility of

leisure)?

• How can I best spend my study time: Reading

a book in a library or attending this lecture?

• How can I distribute my income between

immediate consumption and future

consumption (savings)?

• Etc.

Basic question: How to maximise my utility,

using scarce resources efficiently?

Some standard assumptions:

• Wants are unlimited but resources are

limited

• Self-interested behaviour: I maximise my

individual utility (or my company's profits)

• Personal/individual preferences

• Rational behaviour

• Responsive to incentives (e.g. price change)

• Simplified models with ceteris paribus

assumption ('everything else unchanged')

• Decision in the margin: important is the

decision about the "last unit" (produced /

bought / invested) → "marginal utility versus

marginal costs …"

Opportunity costs: Utility foregone …

Choosing between alternatives:

• A certain quantity of energy can be used for warming

your house or for driving your car → the opportunity

cost of using it for driving is that you can not warm

your house

• This principle applies to every factor of production

• This also applies to allocating your scarce time

• This also applies to the choice between current

consumption and future consumption (consume now

or save?)

• Your choice will be influenced by (changes in)

relative prices, taxes etc.

Price

Demand and supply for apples:

S

Equilibrium Price:

the market can

"clear"

D

Quantity

Equilibrium (market clearing) quantity:

all apples are sold; no unsatisfied

demand

Demand and supply for apples

The demand curve (D) stands for peoples' "willingness to

pay" which depends on personal preferences. People on the

dark green part of the curve have a high preference for

apples and are willing the pay the equilibrium price (they

would have paid even more!)

S

Equilibrium Price:

the market can

"clear"

Suppliers on this

part of the curve are

willing to supply:

their marginal costs

of production are

below the

equilibrium price

D

Equilibrium (market clearing) quantity:

all apples are sold; no unsatisfied

demand

Producers on the

green part of the

supply curve (S) are

not willing to supply

as their marginal

costs of production

are higher than

marginal revenues

(= the market

equilibrium price)

People on this red

part of the curve are

not willing to pay the

equilibrium price as

they have a lower

preference for

apples

Price

C

Consumer Surplus: surface

PeBC. People on part C - B

of the demand curve are

lucky as the market price is

lower than what they would

have been willing to pay!

Supply

Producer

surplus:

surface PeAB.

Firms on part

A-B of the

supply curve

are lucky as

they could have

supplied at

prices below

the market

price!

B

Pe

Demand

A

Qe

Quantity

Two types of efficiency:

1.

Productive efficiency: production at lowest

possible costs

2.

Allocative (Pareto) efficiency: Not more and not

less than the amount of goods or services desired

by consumers is produced: the market is fairly

democratic!

How is allocative efficiency achieved?

Allocative efficiency: firms produce what

consumers want

Assume the market for pea nuts is in equilibrium at q e and P e.

Suddenly, sales rise strongly, as newspapers report that pea nuts are

good for your hart.

And what happens if newspapers report that pea nuts cause cancer?

As prices rise,

producers move

along their supply

curve from A to B

B

p*

Extra demand

makes prices rise

D*

pe

A

If pea

nuts

cause

cancer …

Supply of pea nuts

qe

"Pea nuts are good

for your hart" →

demand curve

shifts from D to D *

D = Original demand

For pea nuts

q*

Demand & Supply: Movement along versus shift of the

curves

.

A shift from S to S* can be due to a lower numbers of sellers or higher prices of

production factors, or some exogenous shock (e. g. a bad harvest).

Price

S*

S

D

D*

A shift from D to D* can be due to lower

income, changing preferences or price

reduction of substitute goods

Quantity

A producer's

willingness to supply

increases with price

A buyer's

willingness to pay

declines due to

income and

substitution effects

Demand & Supply:

The market disturbed by government

→What happens if government imposes minimum or

maximum prices?

Examples:

• Minimum prices for agricultural goods in the

European Union to protect peasants

• A maximum milk price to protect poor children

• A minimum wage against excessive exploitation of

labour?

If government imposes maximum prices:

People have to queue up!

S

Equilibrium

Price

Maximum

Price

D

q S*

qe

q D*

Chronic shortage of goods as supply

shrinks and demand expands

If government imposes minimum prices:

Chronic over-production!

Minimum

Price

S

Equilibrium

Price

D

q D*

qe

q S*

Overproduction as supply expands and demand shrinks

The perfect competition model:

An ideal market

Assumptions behind the model:

• A very large number of buyers and sellers: Nobody

has a notable influence on supply, demand or price

• Homogeneous products: All produce the same thing

in the same quality

• Free entry to and exit from markets (resources are

mobile)

• Everybody has adequate knowledge of prices and

technology

• Technology is given exogenously

The perfect competition model: implications

• Nobody has market power

• Everybody is a 'price taker' (accepting the market

price, you can sell as much as you want)

• Demand curves are horizontal (to individuals)

• Everybody tends to earn a 'normal' profit (abovenormal profits lead to entry of new firms; below

normal profits lead to exit)

Question:

Are there markets that fulfil these assumptions?

Summarizing:

• Allocation of scarce resources will be more efficient

to the degree that the assumptions behind the model

of perfect competition are fulfilled

• If the assumptions are fulfilled, markets will always

tend towards equilibrium (no clients queuing up; no

unsold goods: "market clearing")

• If an equilibrium is disturbed (e.g. by a bad harvest),

the market will "from alone" move towards a new

equilibrium → markets are "stable" (=always striving

towards equilibrium)

• Note: Markets not only "clear"; the way this happens

is also efficient (= welfare maximizing!)

• → How?

An example of efficient market clearing: A bad harvest drastically

reduces the supply of apples (Supply curve S shifts to S *)

Efficient solution:

thanks to a higher

price, the "right"

people will stop

buying apples!

These are the true apple

lovers! They derive so

much utility from apples

that they are willing to

pay Price P *

These people derive enough

utility from apples to buy at

the equilibrium price, but not

enough utility to pay price P *

S*

P * = New

equilibrium

price

S

These people derive

so little utility from

apples that they are

not willing to pay the

equilibrium price!

P e = Initial

equilibrium

price

D

q*

qe

Efficient (welfare maximizing) solution: Scarce apples

go to those that derive the highest utility from them!

Imagine, the harvest was abundant; the market is

flooded by apples! How will the market solve this?

The abundant harvest shifts supply from S to S *.

Prices decline from P e to P *.

At price P *, people on the green part of the Demand curve become

willing buying apples, hence the extra supply (Q e - Q *) can be sold

S

Pe

S*

P*

Qe

Q*

Extra apples from

marvellous harvest

People deriving

lower utility from

apples start

buying, thanks to

the lower price

Another example: the market for savings and credit. The market is

in equilibrium (at i e and q e), but suddenly people become scared

about the future and start saving excessively → the supply curve

shifts to the right (from S to S *)

These people

have a high

preference for

credit: They are

willing to pay

interest rate ie

These people have a moderate preference for credit.

As the interest rate declines, they start taking credit

and absorb the extra savings

Initial supply of savings

Initial

interest

rate i e

New

interest

rate i *

New supply of savings

Low preference for

credit: they are not

even willing to pay

the new interest

rate

S

Demand for credit

S*

qe

q*

Quantity

An opposite example: there is suddenly a great

demand for credit (shift from D to D *)

Due to rising interest rates,

banks supply more credit

D*

New interest

rate i *

Banks'

supply of

credit

D

New demand

for credit

Initial

interest rate

ie

Initial demand

for credit

qe

q*

Quantity

Another example: The labour market for professors

in full employment equilibrium

Professors'

Wages

Equilibrium

wage W e

As professors become

cheaper, universities

buy more of them (as

with apples!)

Question: How could we

get long-lasting (mass)

unemployment among

professors?

S = Supply of professors

As wages rise, more people

exchange the utility of free

time against the utility of

earning a professor's salary

D= Demand for professors

Quantity of professors

to be traded

Market clearing equilibrium quantity: Every professor who is

willing to work at wage We can be employed; every university

ready to pay We can find professors

?

Professors get unemployed as their wages are too high!

Overcoming unemployment?

Follow the green arrows!

Professors'

wages

determined by

aggressive trade

unions

S = Supply of

professors

Market

clearing

wage for

professors

Due to high wages,

universities demand

fewer professors

D = Demand for

professors

qe

Unemployed

professors

Q

Due to too high wages, supply of

professors is too high

Summarizing (continued)

• We think of an economy as a large number of markets (socalled 'partial' markets)

• There are markets for (almost) everything: steel and potatoes,

savings and credit; labour; shares and bonds, land, houses,

art, services, marriages, etc.

• Micro-economics tends to analyse these markets in isolation

from each other (interaction between markets → macroeconomics)

• Under perfect competition, all markets tend towards

equilibrium → general equilibrium

• Problem: How to explain major crises (business cycles;

depressions; financial crises)?

Discussion:

More revenues through lower prices?

The London city council discusses about how to reduce

the public transport company's losses by raising

more revenues:

→The Tories argue that ticket prices should be

increased in order to raise more revenues

→The Labour Party suggests the opposite: Attract more

people to public transport with cheaper tickets!

How to decide who is right or wrong?

Price Elasticity of Demand (PED): Percentage

change in quantity demanded divided by

percentage change in price

Inelastic demand (or low elasticity of demand):

• Weak reaction of quantity sold to price change

Highly elastic demand:

• Strong reaction of quantity to price change

Note:

→As a rise in prices usually leads to a decline in

demand, PED has a negative sign)

Effects of price changes on Total Revenues (TR = P x

Q) depend on Price Elasticity of Demand (PED)!

TR gained through

price increase

TR lost through

lower price

P

P

P*

S

S

Po

P0

P*

D

D

Q

TR lost through

price increase

Highly inelastic demand:

The Tories are right!

Q

TR gained through

lower price

Highly elastic demand:

Labour is right!

What influences price elasticities of demand?

• Availability of (close) substitutes

• Time needed by consumer to adjust to price change

(long-run PED is higher than short-run PED)

• Costs incurred for switching to a substitute product

(lock-in through standards? Earlier investments that

may be lost?)

• Relative importance of a good (as a percentage of

your total budget)

Income elasticity of demand

→Percentage change in goods demanded divided by

percentage change in income

→Note that income growth will lead to more demand.

Other than the price elasticity of demand, income

elasticity for typical goods has an upward slope

→Law on diminishing marginal utility: increasing

consumption of a good will lead to lower utility from

the last unit consumed

→You arrange your consumption such that the last

Euro spent on each good gives you the same utility

as the last Euro spent on any other good (this

explains why the demand curve slopes down: with

falling prices you rearrange your choices)

Cross (price) elasticity of demand

→Demand of a good not only depends on its 'own'

(positive) income elasticity of demand and it's 'own'

(negative) price elasticity of demand, but also on

prices of other (substitute or complementary) goods

Example:

• Rising prices for potatoes will lead to more demand

for rice and pasta (cross elasticity is positive)

Definition:

• Percentage change in demand for potatoes, divided

by percentage change in price of (substitute) good

(rice or pasta).

The opposite holds for complementary goods:

• Complementary goods: e.g. automobiles and

motorways

→If the price of one good increases (e.g. higher road

tolls), the complementary good will also be less in

demand (higher road tolls lead to lower car sales)

→The cross price elasticity of complementary goods is

negative

→The cross price elasticity of substitute goods is

positive

Choices in using scarce resources – e. g.

allocating scarce health services

→Suppose you are a doctor in a jungle hospital, and

you have medicines for treating 5 people, but 10

heavily sick people reached your hospital: How to

decide which of the 5 people you treat and which

you let die?

• On a first-come, first-served basis? ('bureaucratic

solution')

• Auctioning to the highest bidder? ('market solution')

• Other criteria? (e.g. discrimination by age, sex or

education?)

Reasons for market failure

Market failure due to externalities:

→Positive external effects: somebody else takes

advantage from your effort without paying for it (e.g.

costless imitation of your invention)

→Negative external effects: somebody else has a

disadvantage from your activities without being

compensated for it (e.g. you pollute the environment

for free)

An example of positive external effects: vaccination

Crucial assumption: vaccines are traded on a free market; in your

decision to pay for vaccination, you only think of your own individual

utility derived from being vaccinated (you do not take into account that

your vaccination also protects others!)

.

Under-investment in

vaccination

D * = Desired

demand curve for

vaccinations from

society's viewpoint

(taking account of

individual and social

benefits)

P

S

D*

D

Q

Amount of vaccinations

individuals would choose

D = Willingness to

pay for vaccination,

based on individual

benefits

Welfare maximizing amount of

vaccinations

An example of a negative external effect: Pollution

N.B.: In your individual decision to pollute, you do not take into account that

your pollution has a negative utility for others!

Overproduction if

pollution is for free

Price

when

pollution

is

charged

to firm

Price

when

pollution

is for

free

Quantity of production if

costs of pollution are

charged to the firm

Optimum supply curve

for society if costs of

pollution are charged

to the firm

S*

S

Supply curve of firms

that can pollute for

free

D

Quantity of production if

pollution is for free

Economic effects of externalities:

• Positive external effects lead to under-production (or underinvestment)

• Negative external effects lead to over-production (or overinvestment)

"Under-production" from society's

viewpoint – for the individual firm

it's the right amount as it receives

no compensation for externality

"Over-production" from society's

viewpoint – for the individual firm

it's the right amount as pollution is

for free

Cures?

• Regulation by governments (emission standards, fees, tradable

emission rights)

• Pigouvian subsidies or taxes

• Negotiation (only among small groups; Coase)

Another source of market failure:

"Asymmetric information" (= one party in a market

knows much more than the other)

Examples:

• Doctors know more about treatments and health than

patients → as suppliers they can largely determine

demand for their services!

• Insurance companies can be easily cheated by their

clients (e.g. with travel insurances)

• Lawyers know more than their clients know and they

want to maximize their declarations …

• Second hand cars: the seller knows about hidden

deficiencies of the car - but will he tell the buyer?

• Noisy flats: the seller knows it but for the buyer it's

hard to know

Market failure through asymmetric information:

Consequences and cures

• Markets for automobiles and flats can become

"lemon" markets! (Cure: Guarantee rules)

• As clients cheat, there will be overproduction of

insurance services (Cure …?)

• Profit maximizing doctors may "over-treat" their

patients; the same holds for lawyers (unnecessary

law suits). (Cures …?)

Adverse selection:

The problem of "good" and "bad" risks

• Mainly people with high risks (e.g. chronically sick

people) buy insurances; healthy people may choose

to carry risks themselves → insurances may become

too expensive for those who really need them.

• 'Bad' goods drive out 'good' ones: mainly noisy flats,

or Monday-morning cars are offered for sale ('lemon

markets')

Cures?

• Everybody is obliged to take an insurance and

insurance companies have to accept everybody

• Guarantees for cars

Moral hazard

• There may be over-supply of insurance services (e.g.

for theft insurances) since people (once insured)

become less careful against theft

• Patients will not complain against over-treatment by

doctors, as their insurance will pay for it

• People with an insurance for lawyers' costs will

more easily sue somebody

Types of costs

Fixed costs (FC):

• FC do not vary with output (e. g. start-up costs,

costs of fire insurance or lease contracts)

Variable costs (VC):

• FC vary with output (e. g. raw materials, energy

costs)

Total costs (TC): FC + VC

Note: Variable costs (VC) change according to the "law

of increasing costs": given a certain level of fixed

costs (FC) incurred, adding more and more VC will (in

the short-run) result in diminishing returns to VC (VC

will grow more quickly than production)

Illustration:

• Assume, there is one machine (FC), and the

management can choose how many workers to add

to the machine → There will be diminishing returns

to adding more and more workers; each worker

added may still increase production, but at a

diminishing rate (see illustration in Heather p. 100)

Average costs:

Average Fixed Costs (AFC) = FC / Q

(Q = quantity produced)

Average Variable Costs (AVC) = VC / Q

Average Total Costs (ATC)

= TC / Q = AFC + AVC

Marginal Costs (MC) and Marginal Revenues

(MR)

Marginal Cost (MC):

Extra costs per additional unit of output, i.e.:

MC = change in Total Costs / change in Q

Marginal Revenue (MR):

Extra revenue per additional unit of output, i.e.:

MR = Change in Total Revenue / change in Q

Short-run costs of a hypothetical firm. Hint: Study this

table carefully and try to draft the figures in a plot

TVC

MC

(=∆TVC)

AVC

(TVC/q)

TFC

0

0

--

--

1.000

TC

(TVC+

TFC)

1.000

1

10

10

10

1.000

2

18

8

9

3

24

6

4

32

5

AFC= ATC (TC/q)

(TFC/q)

--

--

1.010

1.000

1.010

1.000

1.018

500

509

8

1.000

1.024

333

341

8

8

1.000

1.032

250

258

42

10

8.4

1.000

1.042

200

208.4

…

…

…

…

…

…

…

…

500

8000

20

16

1.000

9.000

2

18

Choosing the profit maximizing output: The relevance of one more

unit of product ('decision in the margin').

Marginal Costs;

Marginal Revenues

A firm's

marginal cost

curve (= costs of

one extra unit of

product)

Stop expanding

production!

A firm's marginal

revenue curve =

revenues from

one extra unit of

product =

(market price

under perfect

competition)

Output

Profit-maximizing output (marginal costs = marginal

revenues): the costs of producing one more unit are

equal to the revenues of that unit

Broader applications of the MR = MC rule:

• Protecting the environment: The marginal revenues ( =

marginal utility) derived from the last Euro spent on abatement

of pollution should at least equal one Euro (= marginal costs)

• Training & education: The marginal costs of an extra

investment (e.g. hiring one extra teacher) should at least be

equal to the marginal revenue (= marginal utility) of the extra

education & training

Question for discussion: Why is it, from an

economic viewpoint, not desirable that

criminality is reduced to zero?

From short-run to long-run costs

Costs per unit

N.B.: In the long run, labour and capital can be changed (shortrun: only labour can be changed, capital is fixed)

Short-run average total cost curves

Long-run

average

cost curve

(combining

the sort-run

curves)

Firm enjoys

economies of

scale!

Firm suffers from

diseconomies of

scale!

Units of output

Economies of scale:

• Constant costs: An expansion of output does not

lead to changes in costs

• Economies of scale: An expansion of output leads to

lower costs

• Diseconomies of scale: An expansion of output

leads to higher costs

Note that in the previous figure, the firm first enjoys

economies and then diseconomies of scale

Reasons for economies of scale:

In larger plants (or a chain of plants):

• Specialization and division of labour

• Indivisibilities: certain investments require a minimum

scale (e.g. combine harvester in agriculture; R&D)

• The container principle: the larger, the cheaper per

unit

• Greater efficiency of large machines

• By-products: With large-scale production there may be

sufficient waste products to make by-products

• Market power (discounts) when buying inputs

• Economies of scope: A 'family' of related products

allows to spread costs of R&D, marketing etc. over

more products

Reasons for diseconomies of scale:

• Managerial diseconomies: Coordination problems

increase as the organization becomes larger and

more complex and lines of communication get

longer

• Personnel may feel 'alienated' as they become an

invisibly small part of a large organization→

Motivation? Shirking?

• Complex interdependencies in a mass-production

system can lead to great disruptions through holdups in any part

Minimum efficient scale (MES)

½ MES = Smaller scale of

production at higher costs

LRAC

MES = Minimum Efficient

Scale: The point where

further extension of

production gives hardly

any further cost savings

Long-run

average

total costs

(LRAC)

Output

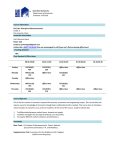

An illustration: MES in Great Britain.

Note that MES has an impact on market structure!

MES as % of

production in

UK:

MES as % of

production in

EU:

% additional

costs at ½

MES:

Cellulose fibres

125

16

3

Rolled aluminium semi-manufactures

114

15

15

Refrigerators

85

11

4

Steel

72

10

6

Electric motors

60

6

15

TV sets

40

9

9

Cigarettes

24

6

1.4

Ball bearings

20

2

6

Beer

12

3

7

Nylon

4

1

12

Bricks

1

0.2

25

Tufted carpets

0.3

0.04

10

Shoes

0.3

0.03

1

Product:

Source: C.F. Pratten: 'A survey of the economies of scale' in: Research on the 'Costs of nonEurope', Vol. 2 (Office for Official Publications of the European Community, 1988).

Another application of the "marginal cost

versus marginal benefit" principle: Sunk costs

Remember we had two types of costs:

• Variable costs (total, average, marginal): they

vary as your production varies

• Fixed costs (total, average, marginal): they

are independent of what you produce →

these fixed costs can still be split into two

types

Fixed costs can be sunk

(= specific, irreversible)

Two types of

Fixed Costs

Costs that are fixed

but not sunk: they can

be recovered if the

project fails (or if the

business relationship

is terminated) e.g. a

factory building

Fixed costs that are sunk are

irreversible as they are specific to

a project (e.g advertising): They

can only be recovered it the project

succeeds or if the business

relationship is maintained (e.g.

sunk costs by a subcontractor)

Sunk costs have implications for decision-making,

applying again the "decision in the margin" principle

→Imagine that you and your partner are planning a

holiday in Spain or Greece. In a spontaneous

impulse, you book an arrangement for two persons

in Greece for 500 euro, all-in. In the evening, your

partner tells you that he also booked something

similar in Spain (for 800 euro) – unfortunately in the

same week! The booking cannot be cancelled and

you cannot sell it to somebody else, as the airplane

tickets are on your names. You both feel that Greece,

although cheaper, is probably nicer, as the hotel

seems to look better.

Let bygones be

bygones!

You are free to choose: Greece or Spain?

Another example of decision-making with the

sunk cost principle:

→As a subcontractor, you bought a special machine to

produce front windows for the new Volkswagen Golf.

You estimate that, at a price of 400 euro per window,

you can regain your full (fixed and variable) costs,

and earn a satisfactory profit. Your variable costs

(raw materials, energy, wages, etc.) are 200 euro per

window. In a tough price negotiation, Volkswagen

offers you 220 euro per window ('take it or leave it!').

• You take it or leave it?

Let bygones be

bygones!

Yet another example of decision-making with

the sunk costs principle:

→You are responsible for a Research & Development

project with a budget of 2 million euro. The sales

expectations of the new product to be developed

would justify a maximum of 2.5 million spending on

R&D. In the meanwhile, half of the budget is

consumed and it turns out that, due to unforeseen

difficulties, the project is more expensive than

expected. A reliable estimate says that, above the

one million that is already consumed, you need

another two million euro to finalise the project.

• Make a 'stop or go' decision!

Let bygones be

bygones!

General conclusion:

Let bygones be bygones! (accept your loss!)

• Sunk investments from the past should play no role

in your decision about the future! Just ignore them!

• The only rational consideration is: What are the

costs and revenues from now on?

• In fact, this is a version of decision-making "in the

margin": What counts is the decision about the next

units.

Transaction costs can make market

transactions inefficient

Definitions:

External transaction costs:

• All costs of transactions via the (external) market.

These include all costs of collecting relevant market

information, negotiating and preparing contracts,

monitoring whether partners fulfil contracts, and the

taking of sanctions if they do not.

Internal transaction costs:

• Costs of coordination and management of

transactions within hierarchical organisations

The problem behind transaction costs:

→In principle, every activity of a firm could be

contracted out

Question:

→Which activities should be contracted out (market

transaction) or done internally (hierarchical

transaction?) →The famous 'make-or-buy?' problem

Questions:

• Why not contracting out everything?

• Why do (large) organizations exist at all?

• Why does not everybody have her own company?

A simple criterion for handling the 'make-orbuy' problem:

• If costs of internal, hierarchical transaction are

higher than external (market) transaction costs, then

contract out ('buy')

• In the opposite case: 'make'

But this requires some refinements …

Factors favouring 'make' (instead of 'buy'):

•

The existence of uncertainty (e.g. in judging the

quality of a good or service) creates strong

possibilities of opportunistic behaviour which

increase costs and risks of market transactions

•

Asset specificity: Assets can have higher economic

value inside than outside a particular transactional

relationship, e. g. sunk costs by a subcontractor; or

dependence on a specialised supplier who achieves

some monopoly power. Opposite case: if there are

many suppliers of standardized goods, market

transactions are to be preferred.

Factors favouring 'make' (instead of 'buy'):

• Frequency of transaction: Frequency influences the

relative costs of market versus hierarchical

governance. Repeated market transactions among a

small number of participants offer wide possibilities

of opportunistic behaviour

• Turbulence in an environment may require frequent

changes of contracts for market transactions and

struggle about how to interpret incomplete contracts

• Incentives: Where other contract parties have

incentives to act against the interests of the

contracting firm, costs of contracting, control and

sanctions can multiply (e.g. contracting out R&D)

Summarizing:

Is there an imperfect market?

… In other words, is there:

• Information asymmetry? (quality of product)

• Turbulence? (incompletely specified contracts)

• Has the other party some market power?

• … or possibilities for opportunistic behaviour?

• Are you vulnerable as you made sunk costs?

• Has the other party a motive to act against your

interests? (e.g. leaking of knowledge to your

competitor?)

→ If yes, do not contract out!

… and when should you choose for

contracting out?

Ideal situation:

• The other party operates in a market with

transparent quality

• There are many suppliers

• They deliver standardized products

• They are fiercely competing (e.g. cleaning or

catering)

An important motive for "buy" instead of "make":

If you choose for "make", you often experience the

principal-versus-agent problem!

A typical example: Supporting services in large conglomerates:

Heads of supporting services tend towards budget

maximization → they want to have large "Royal Courts" of

personnel!

Painstaking problems for you:

Are they indeed doing their best? (How can we curb overhead

costs?)

Heads of departments benefit from information asymmetry!

(they know more about their work than you can know)

Benchmarking through contracting out can help!

Forms of collaboration

Type of

collaboration:

Typical

duration

Advantages (rationale)

Disadvantages

(transaction costs)

Subcontracting

Short

term

Cost and risk reduction,

reduced lead time

Search costs;

quality?

Licensing

Fixed

term

Technology acquisition

Contract costs and

constraints

Consortia

Medium Expertise, standards, share Knowledge leakage

term

funding

Strategic

alliance

Flexible Low commitment; market

access

Joint

Venture

Long

term

Complementary know-how; Strategic drift;

dedicated management

cultural mismatch

Network

Long

term

Dynamic learning potential

Potential lock-in;

knowledge leakage

Static inefficiencies