* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download 09-Elasticities

Survey

Document related concepts

Transcript

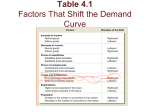

Elasticities Elasticities are measures of responsiveness – – – – The response of one variable to changes in another Can be positive or negative If “close” to zero, relative unresponsive If “far” from zero, relatively responsive Calculated as the ratio of two percentage changes: E = (%∆Y)/(%∆X) – This is said to be “the elasticity of Y with respect to X” Consider this relationship The elasticity of grades with respect to Study Time/week time spent studying – Likely positive – Ε = (%∆G)/(%∆S) > 0 – If E > 1, we say “elastic” (relatively responsive) – If E < 1, we say “inelastic” (relatively unresponsive) 0 Grade Another example The elasticity of grades with respect to alcohol consumption Alcohol Consumption/week – Likely negative – E = (%∆G)/(%∆A) < 0 – If |E| >1, we say “elastic” (relatively responsive) – If |E| < 1, we say “inelastic” (relatively unresponsive) 0 Grades The (own) Price Elasticity of Demand Measures the responsiveness of quantity demanded to changes in the price of the good itself – Defined thus: ε = [(%∆in quantity demanded)/(%∆ in price)] Or ε = [(%∆Qd)/(%∆P)] Note that ε must be negative (Law of Demand) Sometimes convenient to refer to the absolute value |ε| so we can ignore the negative sign Examples of demand elasticities Suppose a 10% rise in the price of a good causes a 20% reduction in the quantity demanded in a measured time period ε = -20%/+10% = -2 Suppose a 15% decline in the price of a good causes a 10% increase quantity demanded in a measured time period ε = +10%/-15% = -0.67 Categories of demand elasticities “Elastic” demand Elastic demand – elasticity > 1 Price – Qd relatively responsive to price Demand – Price change leads to spending change in opposite direction – Thus, Higher price → lower spending Lower price → higher spending Q/time When is a good likely to have sensitive elasticity? If a product is not unique so it has many close substitutes and consumers know about the alternatives. When buyers’ expenditures are a large part of their income so they shop more carefully— buying a home. The product is an input in production that is price sensitive, so the producer will keep close watch on input prices. Demand elasticity . . . “Inelastic” demand Inelastic demand – elasticity < 1 Price – Qd relatively unresponsive to price – Price change leads to spending change in same direction – Thus, Higher price → higher spending Lower price → lower spending Demand Q/time When is elasticity likely to be less sensitive? When comparisons to substitutes is difficult. Examples: Door-to-door sales. Complex products that are hard to compare. When consumers pay only a fraction of the cost. Ex.: When insurance covers most of the bill. When the cost of switching would be high. Example: When the user has developed expertise in using a product (software). When a product is used with another product that the consumer uses. Example: Ink cartridges in printers. Some uses of demand elasticities More Accurate Pricing – Use of UPC bar codes to aid in pricing products (e.g., Wal-Mart and other retailers data) Trying to Maximize Profits – A higher price is no guarantee of higher revenue (will study below) Plan ahead – If you know about future events — plan more precisely (hotels and conventions) No close substitutes? In 2006, SCI, the largest firm in the U.S. funeral business, with 14% of total industry revenue, increased its average revenue per service (its product price) by 9%. At the same time, the number of funeral services fell by 5.8 percent. The price elasticity of demand for its services is – (-5.8/9) = 0.64. Its price and quantity demanded suggest that its demand is inelastic—and we know from this calculation that its total revenue increased from these services increases. Was the price increase sensible? Real World Elasticities (all negative numbers) Product or Service Lamb Bread Coffee Tires Auto Repairs Theatre & Opera Movies Foreign Travel by U.S. Residents Public Transportation Electricity Jewelry & Watches Alcohol and Tobacco Recreation Estimated Elasticity Short Run Long Run 2.65 0.15 0.16 0.8 1.4 0.2 0.9 0.1 0.6 0.1 0.4 0.3 1.1 ---1.2 2.4 0.3 3.7 1.8 1.2 1.8 0.6 0.9 3.5 Example ESPN football videogame: 2003 price: $40 2004 price: $20 (50% decrease) 2003 Qd: 400,000 2004 Qd: 2.7 million (575% increase) E = 575%/50% = 11.5 Note: major competitor, Madden football, did not change price; its sales rose less than 10% from 2003 to 2004 How a market changes when prices change Hong Kong had 80% tariff on wine, so high wine prices. 2008: tariff abolished; retail prices fell 3050%. Sales rose: 34% in ’09; 73% in ‘10 and 40% in ‘11. Elasticity appears near 1. What else changed? Little impact in restaurants since they have large markup already. Sale increase was at stores. Expanded volume meant increase need for warehouse space, HK became largest wine auction site in world in ‘11 (quarter billion in auction sales). Wine expos. Greater employment. Smuggling ended. Cross-price elasticities Cross-price elasticity of demand – Measure of responsiveness of demand to changes in prices of substitutes and complements: (%∆ Dx) / (%∆ Py) – If positive, goods are substitutes, by definition – If negative, goods are complements, by definition Estimates of Cross Elasticities These are estimates of cross elasticities of various goods (goods that are substitutes) in the U.S.: Electricity and natural gas Beef and Pork Natural gas and fuel oil Margarine and butter 0.20 (weak substitutes) 0.20 0.44 0.81 (strong substitutes) Income Elasticity of Demand – Measure of responsiveness of demand to changes in income: (%∆ Dx) / (%∆ l) – If positive, good is normal (>1, superior) – If negative, good is inferior, by definition Recession in U.S.—Incomes down 4%: ‘08-09—Budweiser down 7.4%; Busch up 5.3% Saks down 26%; Wal-Mart up 3.5% 2010: Concert Ticket Sales fell 15% in U.S. Lowe’s: home repair projects over $500 way down. Estimates of Income Elasticities Estimates of income elasticities from different studies in the U.S.: Flour -0.36 (inferior good) Margarine -0.20 (inferior good) Milk and cream 0.07 (little change) Beef 0.51 to 1.05 Apples 1.32 Dental Services 1.41 (highly responsive to Restaurant meals 1.48 income increases) Personal air travel 1.8 Is Bud in Trouble? Sales down. What else you want to know about 08-11? Operating margins up ~ 40%. So cut price? Elasticity A study of gasoline sales found that price elasticity for regular gasoline was -.6 and for premium gasoline was -.3. What does that mean?