* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Document

Competition law wikipedia , lookup

Market penetration wikipedia , lookup

Grey market wikipedia , lookup

General equilibrium theory wikipedia , lookup

Comparative advantage wikipedia , lookup

Market (economics) wikipedia , lookup

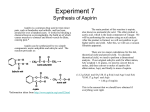

Supply and demand wikipedia , lookup

Chapter 8: Structure, Conduct, Performance, and Market Analysis Health Economics Outline Defining perfect competition. Market equilibrium. Comparative statics. Applications. Characteristics of Perfect Competition Consumers pay the full price of the product. Consumers will respond to differences in prices among sellers. All firms maximize profits. Firms have incentives to satisfy consumer wants and produce efficiently. Characteristics of Perfect Competition (cont.) There is a large number of buyers and sellers, each of which is small relative to the total market. No one buyer or seller is powerful enough to influence or manipulate the market price of a product. All firms in the same industry produce a homogeneous product. A consumer can easily find substitutes for the product of any given firm. Characteristics of Perfect Competition (cont.) No barriers to entry or exit exist. New firms can enter the industry. All economic agents possess perfect information. Consumers and firms can make informed choices. All firms face nondecreasing average costs of production. Rules out a “natural monopoly.” Market Equilibrium Given the demand and supply curve for any given product, one can determine how many goods will be exchanged, and at what price. The equilibrium, or market-clearing price and output are at the point where the demand and supply curves intersect. Market Equilibrium (cont.) Dollars per bottle Supply P0 Demand Q0 Market output of generic aspirin (Q) Market Equilibrium (cont.) Equilibrium occurs when no tendency for further change exists. At the equilibrium price of P0, consumers are willing to purchase Q0 bottles of aspirin. Aspirin manufacturers are willing to sell Q0 bottles of aspirin at P0. Market Equilibrium (cont.) If the price of aspirin is above the equilibrium level, there will be a surplus, or excess supply of aspirin. If the price of aspirin is P1 on the following graph, sellers will want to sell QB bottles of aspirin, but consumers will only want to purchase QA bottles. The distance between QA and QB represents the amount of excess supply of aspirin. Market Equilibrium (cont.) Dollars per bottle Supply P1 Demand QA Excess Supply QB Market output of generic aspirin (Q) Market Equilibrium (cont.) If the price of aspirin is below the equilibrium level, there will be a shortage, or excess demand of aspirin. If the price of aspirin is P2 on the following graph, consumers will want to buy QF bottles of aspirin, but sellers will only want to sell QE bottles. The distance between QE and QF represents the amount of excess demand of aspirin. Market Equilibrium (cont.) Dollars per bottle Supply P2 Demand QE QF Excess Demand Market output of generic aspirin (Q) Comparative Statics How does the market react to events that influence the demand for or supply of medical services? Recall that changes in factors other than output price will cause the demand or supply curve to shift. An increase in consumer income will cause the demand curve for physician visits to shift to the right. An increase in the wage of nurses will cause the supply curve for hospital stays to shift to the left. Comparative Statics These shifts in the demand or supply curves will lead to a change in equilibrium price and quantity. Predicting such changes is referred to as comparative static analysis. Comparative Statics (Example 1) Suppose consumer income increases by a significant amount. This increase in income causes the demand curve to shift to the right. This rise in demand leads to a temporary shortage in aspirin, illustrated by the distance EF on the following graph. Comparative Statics (Example 1) Dollars per bottle S P0 E F D1 D0 Q0 Excess demand Market output of generic aspirin (Q) Comparative Statics (Example 1) The consumers who are willing, but not able to buy aspirin at P0 will bid the price of aspirin upwards. i.e. They will offer sellers more than P0 to buy a bottle of aspirin. Because sellers are being offered a higher price than P0, they will increase their output of aspirin above Q0. Comparative Statics (Example 1) As the price of aspirin begins to rise above P0, consumers reduce their demand for aspirin. This process will continue until the market reaches a new equilibrium. Comparative Statics (Example 1) Dollars per bottle S New equilibrium P1 P0 E F D1 D0 Q0 Q1 Market output of generic aspirin (Q) Comparative Statics (Example 2) Suppose manufacturers develop a technology that lowers the marginal cost of making aspirin This cost-saving technology causes the supply curve for aspirin to shift out. This increase in supply leads to a temporary surplus of aspirin, illustrated by the distance AB on the following graph. Comparative Statics (Example 2) Dollars per bottle S0 P0 A S1 B D0 Q0 Excess supply Market output of generic aspirin (Q) Comparative Statics (Example 2) The firms that are willing, but not able to sell aspirin at P0 will lower the price they charge for aspirin. i.e. They will offer charge consumers a price of aspirin which is below P0. Because consumers are being offered a higher lower than P0, they will increase their quantity of aspirin demanded above Q0. Comparative Statics (Example 2) As the price of aspirin begins to fall below P0, firms reduce their supply of aspirin. This process will continue until the market reaches a new equilibrium. Comparative Statics (Example 2) Dollars per bottle P0 S0 A S1 B New equilibrium P1 D0 Q0 Q1 Market output of generic aspirin (Q) Comparative Statics (Long run) In the short run, firms cannot enter or exit a given market. i.e. In the short run, no firms producing generic aspirin can exit the market, and no new firms can start producing aspirin. In the long run, new firms will enter a perfectly competitive market if there are any profits to be made. Entry occurs until = 0. Comparative Statics (Long run) In the mid-1980s, the AIDs epidemic led to an increase in the demand for latex gloves among health care workers. The epidemic led to a shift to the right in the demand curve for latex gloves. Excess demand for gloves developed, leading to a temporary shortage of gloves. Comparative Statics (Long run) Dollars per pair S P0 E F D1 D0 Q0 Excess demand Market output of latex gloves (Q) Comparative Statics (Long run) The shortage of gloves led buyers to bid the price of gloves upwards. As the price bid for gloves rose, sellers increased their quantity supplied of gloves. This process continued until a new shortrun equilibrium was reached. From 1986 to 1990, annual sales of latex gloves increased by ~58%. Comparative Statics (Long run) Dollars per pair S P1 P0 D1 D0 Q0 Q1 Market output of latex gloves (Q) Comparative Statics (Long run) Before the epidemic, each glove maker was earning 0 profits. The increase in equilibrium price after the epidemic implies that all glove makers are earning positive profits. = (P1 x Q1) – (Q1 x ATC(Q1)) Comparative Statics (Long run) Dollars per pair MC ATC P1 d1 = MR1 P0 d0 = MR0 Q0 Q1 Market output of latex gloves (Q) Comparative Statics (Long run) Other medical suppliers made plans to build new manufacturing plants to make gloves, in the hopes of making profits. In 1988, 116 permits were pending in Malaysia for building latex glove factories. Entry of the new plants into the market increased the supply of latex gloves in the long run. The supply curve for gloves shifted out. Comparative Statics (Long run) Dollars per pair S0 S1 P1 P0 D1 D0 Q0 Q1 Q2 Market output of latex gloves (Q) Comparative Statics (Long run) As the supply curve for gloves shifts out, the price of gloves begins to fall. Note that the quantity of gloves sold on the market also increases. As the price of gloves fall, profits also fall. The process continues, until the price of gloves falls back to P0, where profits for all glove makers are again equal to 0. Comparative Statics (Long run) Dollars per pair MC ATC P1 d1 = MR1 P0 d0 = MR0 Q0 Q1 Market output of latex gloves (Q) Characteristics of Perfect Competition Briefly recall some of the features of a perfectly competitive market: Many sellers. Homogeneous product. No barriers to entry. Under perfect competition, each individual firm is a price taker. Each firm faces horizontal demand and marginal revenue curve. Monopoly Model In contrast, a monopoly market has the following features: One seller Homogeneous or differentiated product. Complete barriers to entry. Because there is only one firm, that firm faces the market demand curve, which is downward sloping. Monopoly Model (cont.) What is the profit-maximizing price and quantity for a monopolist? Recall that all firms will maximize profits where MR=MC. We have already seen that the marginal cost curve for a firm depends on its production function and input prices. What does the firm’s MR curve look like? Monopoly Model (cont.) We know that TR = P x Q What is the MR = change in TR if output is increased by 1 unit? A monopolist faces a downward sloping demand curve. To increase sales by 1 unit, the price charged per unit (for each unit sold) must be lowered. Monopoly Model (cont.) Dollars per unit If a monopolist wishes to increase its output sold from Q0 to Q1, it will need to lower the price it charges from P0 to P1. P0 P1 Demand Q0 Q1 Quantity Monopoly Model (cont.) Dollars per unit When reducing its price from P0 to P1, the monopolist loses the difference between P0 and P1 for all units of output up to Q0. P0 revenue loss P1 Demand Q0 Q1 Quantity Monopoly Model (cont.) Dollars per unit However, the monopolist also gains the value of P1 for each increase in output from Q0 to Q1. P0 P1 $ g a i n Q0 Q1 Demand Quantity Monopoly Model (cont.) The marginal revenue from increasing sales from Q0 to Q1 is represented by the revenue gain, minus the revenue loss depicted in the 2 previous graphs. In numerical terms: MR = P + Q • (P/Q) revenue gain revenue loss Monopoly Model (cont.) MR = P + Q • (P/Q) Because the second term in this formula represents a revenue loss, it is always negative. Thus, at each level of output, marginal revenue is always lower than price. The marginal revenue curve lies under the demand curve. Monopoly Model (cont.) Dollars per unit MR Demand Quantity Monopoly Model (cont.) We are now ready to find the profitmaximizing output for a monopolist. The monopolist sets output at a level where MR=MC. On a graph, find the level of Q where the MR and MC curves intersect. To determine the price the monopolist will charge, locate the price on the demand curve at this same output level. Monopoly Model (cont.) Dollars per unit MC P* MR Q* Demand Quantity Monopoly Model (cont.) The monopolist’s level of profits can then be determined by adding its average total cost curve to the graph. Profits will be the difference between P* and ATC, multiplied by Q*. Monopoly Model (cont.) Dollars per unit MC P* ATC Profits ATC* MR Q* Demand Quantity Contrast to Perfect Competition Dollars per unit Under perfect competition, the market equilibrium would MC instead be where P=MC. ATC PC MR QC Demand Quantity The higher price and lower output in a monopolized market is why economists claim that competition is better for social welfare. Monopoly Model (cont.) A monopoly only maintains its status if there are no substitutes for the product it sells. There must be barriers to entry, so that other firms cannot enter the market to compete. The two most common barriers to entry: Economies of scale. Legal restrictions. Monopoly Model (cont.) Economies of scale If a monopoly is producing output at a level where long run average costs are declining, then new firms cannot compete on a cost basis. A monopoly hospital in a small town may have substantial economies of scale if it can meet demand with only 40-50 beds. Unless a new hospital could take away a substantial share of the existing hospital’s patients, it could not match the existing hospital in costs (and therefore profits as well). Monopoly Model (cont.) Legal restrictions Physicians require a license to practice medicine. Many states require that providers obtain a Certificate of Need to offer a new service. Drug companies obtain patents for new pharmaceutical products. The Market Structure Continuum We have talked about 2 extremes of the market structure continuum. Perfect Competition. Pure Monopoly Along this continuum, there are 2 more levels of competitiveness that we will encounter in the health care sector. The Market Structure Continuum Perfect Competition Oligopoly Monopolistic Competition Monopoly Monopolistic Competition Many sellers. Differentiated product. No barriers to entry. Examples Breakfast cereals. Ibuprofin (Advil, Motrin, etc.). Cigarettes. Monopolistic Competition (cont.) Because products are differentiated across firms, each seller has some ability to control price. Each seller faces a slightly downward sloping demand curve. Sellers have an incentive to “differentiate” their product from competitors. Doing so is likely to raise demand for their product. Monopolistic Competition (cont.) Dollars per Unit Demand under monopolistic competition Demand under perfect competition 2 potential demand curves for an individual firm. Output Oligopoly Few, dominant sellers. Homogeneous or differentiated product. Substantial barriers to entry. Examples Tertiary services at teaching hospitals. Many prescription drugs. Oligopoly Because there are only a few dominant sellers, actions of any one firm can change the overall market price. Like monopoly, oligopoly will lead to lower output and higher prices than would be observed under perfect competition. Regulators are concerned about consumer welfare in oligopolistic markets.