* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download HO3e_ch05 - University of San Diego Home Pages

Survey

Document related concepts

Transcript

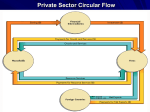

Chapter 5: Externalities, Environmental Policy, and Public Goods Copyright © 2010 Pearson Education, Inc. Publishing as Prentice Hall · Economics · R. Glenn Hubbard, Anthony Patrick O’Brien, 3e. 1 of 30 Chapter 5: Externalities, Environmental Policy, and Public Goods Copyright © 2010 Pearson Education, Inc. Publishing as Prentice Hall · Economics · R. Glenn Hubbard, Anthony Patrick O’Brien, 3e. 2 of 30 CHAPTER 5 Chapter 5: Externalities, Environmental Policy, and Public Goods Externalities, Environmental Policy, and Public Goods How should government policy deal with the problem of pollution? Can economic analysis help in formulating more efficient pollution policies? Prepared by: Fernando Quijano Copyright © 2010 Pearson Education, Inc. Publishing as Prentice Hall · Economics · R. Glenn Hubbard, Anthony Patrick O’Brien, 3e. 3 of 30 CHAPTER 5 Chapter Outline and Learning Objectives Chapter 5: Externalities, Environmental Policy, and Public Goods Externalities, Environmental Policy, and Public Goods 5.1 Externalities and Economic Efficiency Identify examples of positive and negative externalities and use graphs to show how externalities affect economic efficiency. 5.2 Private Solutions to Externalities: The Coase Theorem Discuss the Coase theorem and explain how private bargaining can lead to economic efficiency in a market with an externality. 5.3 Government Policies to Deal with Externalities Analyze government policies to achieve economic efficiency in a market with an externality. Four Categories of Goods Explain how goods can be categorized on the basis of whether they are rival or excludable, and use graphs to illustrate the efficient quantities of public goods and common resources. 5.4 Copyright © 2010 Pearson Education, Inc. Publishing as Prentice Hall · Economics · R. Glenn Hubbard, Anthony Patrick O’Brien, 3e. 4 of 30 Chapter 5: Externalities, Environmental Policy, and Public Goods Externalities, Environmental Policy, and Public Goods Externality A benefit or cost that affects someone who is not directly involved in the production or consumption of a good or service. Copyright © 2010 Pearson Education, Inc. Publishing as Prentice Hall · Economics · R. Glenn Hubbard, Anthony Patrick O’Brien, 3e. 5 of 30 5.1 LEARNING OBJECTIVE Externalities and Economic Efficiency Identify examples of positive and negative externalities and use graphs to show how externalities affect economic efficiency. The Effect of Externalities Chapter 5: Externalities, Environmental Policy, and Public Goods Private cost The cost borne by the producer of a good or service. Social cost The total cost of producing a good, including both the private cost and any external cost. Private benefit The benefit received by the consumer of a good or service. Social benefit The total benefit from consuming a good or service, including both the private benefit and any external benefit. Copyright © 2010 Pearson Education, Inc. Publishing as Prentice Hall · Economics · R. Glenn Hubbard, Anthony Patrick O’Brien, 3e. 6 of 30 5.1 LEARNING OBJECTIVE Externalities and Economic Efficiency Identify examples of positive and negative externalities and use graphs to show how externalities affect economic efficiency. The Effect of Externalities How a Negative Externality in Production Reduces Economic Efficiency Chapter 5: Externalities, Environmental Policy, and Public Goods FIGURE 5-1 The Effect of Pollution on Economic Efficiency Because utilities do not bear the cost of acid rain, they produce electricity beyond the economically efficient level. Supply curve S1 represents just the marginal private cost that the utility has to pay. Supply curve S2 represents the marginal social cost, which includes the costs to those affected by acid rain. If the supply curve were S2, rather than S1, market equilibrium would occur at price PEfficient and quantity QEfficient, the economically efficient level of output. But when the supply curve is S1, the market equilibrium occurs at price PMarket and quantity QMarket, where there is a deadweight loss equal to the area of the yellow triangle. Because of the deadweight loss, this equilibrium is not efficient. Copyright © 2010 Pearson Education, Inc. Publishing as Prentice Hall · Economics · R. Glenn Hubbard, Anthony Patrick O’Brien, 3e. 7 of 30 5.1 LEARNING OBJECTIVE Externalities and Economic Efficiency Identify examples of positive and negative externalities and use graphs to show how externalities affect economic efficiency. The Effect of Externalities How a Positive Externality in Consumption Reduces Economic Efficiency Chapter 5: Externalities, Environmental Policy, and Public Goods FIGURE 5-2 The Effect of a Positive Externality on Efficiency People who do not consume college educations can still benefit from them. As a result, the marginal social benefit from a college education is greater than the marginal private benefit seen by college students. Because only the marginal private benefit is represented in the market demand curve D1, the quantity of college educations produced, QMarket, is too low. If the market demand curve were D2 instead of D1, the level of college educations produced would be QEfficient, which is the efficient level. At the market equilibrium of QMarket, there is a deadweight loss equal to the area of the yellow triangle. Copyright © 2010 Pearson Education, Inc. Publishing as Prentice Hall · Economics · R. Glenn Hubbard, Anthony Patrick O’Brien, 3e. 8 of 30 5.1 LEARNING OBJECTIVE Externalities and Economic Efficiency Identify examples of positive and negative externalities and use graphs to show how externalities affect economic efficiency. Chapter 5: Externalities, Environmental Policy, and Public Goods Externalities and Market Failure Market failure A situation in which the market fails to produce the efficient level of output. What Causes Externalities? Property rights The rights individuals or businesses have to the exclusive use of their property, including the right to buy or sell it. Copyright © 2010 Pearson Education, Inc. Publishing as Prentice Hall · Economics · R. Glenn Hubbard, Anthony Patrick O’Brien, 3e. 9 of 30 Private Solutions to Externalities: The Coase Theorem 5.2 LEARNING OBJECTIVE Discuss the Coase theorem and explain how private bargaining can lead to economic efficiency in a market with an externality. The Economically Efficient Level of Pollution Reduction FIGURE 5-3 Chapter 5: Externalities, Environmental Policy, and Public Goods The Marginal Benefit from Pollution Reduction Should Equal the Marginal Cost If the reduction of sulfur dioxide emissions is at 7.0 million tons per year, the marginal benefit of $250 per ton is greater than the marginal cost of $175 per ton. Further reductions in emissions will increase the net benefit to society. If the reduction of sulfur dioxide emissions is at 10.0 million tons, the marginal cost of $225 per ton is greater than the marginal benefit of $150 per ton. An increase in sulfur dioxide emissions will increase the net benefit to society. Only when the reduction is at 8.5 million tons is the marginal benefit equal to the marginal cost. This level is the economically efficient level of pollution reduction. Copyright © 2010 Pearson Education, Inc. Publishing as Prentice Hall · Economics · R. Glenn Hubbard, Anthony Patrick O’Brien, 3e. 10 of 30 5.2 LEARNING OBJECTIVE Making the Chapter 5: Externalities, Environmental Policy, and Public Goods Connection The Clean Air Act: How a Government Policy Reduced Infant Mortality Discuss the Coase theorem and explain how private bargaining can lead to economic efficiency in a market with an externality. The benefit of reducing air pollution in 1970 was much higher than the benefit from a proportional reduction in air pollution would be today, when the level of pollution is much lower. In the two years following passage of the Clean Air Act, there was a sharp reduction in air pollution and also a reduction in infant mortality YOUR TURN: Test your understanding by doing related problem 2.8 at the end of this chapter. Copyright © 2010 Pearson Education, Inc. Publishing as Prentice Hall · Economics · R. Glenn Hubbard, Anthony Patrick O’Brien, 3e. 11 of 30 Private Solutions to Externalities: The Coase Theorem 5.2 LEARNING OBJECTIVE Discuss the Coase theorem and explain how private bargaining can lead to economic efficiency in a market with an externality. The Basis for Private Solutions to Externalities FIGURE 5-4 Chapter 5: Externalities, Environmental Policy, and Public Goods The Benefits of Reducing Pollution to the Optimal Level Are Greater Than the Costs Increasing the reduction in sulfur dioxide emissions from 7.0 million tons to 8.5 million tons results in total benefits equal to the sum of the areas A and B under the marginal benefits curve. The total cost of this decrease in pollution is equal to the area B under the marginal cost curve. The total benefits are greater than the total costs by an amount equal to the area of triangle A. Because the total benefits from reducing pollution are greater than the total costs, it’s possible for those receiving the benefits to arrive at a private agreement with polluters to pay them to reduce pollution. Don’t Let This Happen to YOU! Remember That It’s the Net Benefit That Counts YOUR TURN: Test your understanding by doing related problem 2.6 at the end of this chapter. Copyright © 2010 Pearson Education, Inc. Publishing as Prentice Hall · Economics · R. Glenn Hubbard, Anthony Patrick O’Brien, 3e. 12 of 30 5.2 LEARNING OBJECTIVE Making the The Fable of the Bees Discuss the Coase theorem and explain how private bargaining can lead to economic efficiency in a market with an externality. Chapter 5: Externalities, Environmental Policy, and Public Goods Connection If there are positive externalities in both apple growing and beekeeping, the market may not supply enough apple trees and beehives. Government intervention, however, may not be necessary because beekeepers and apple growers arrive at private agreements. Some apple growers and beekeepers make private arrangements to arrive at an economically efficient outcome. YOUR TURN: Test your understanding by doing related problem 2.9 at the end of this chapter. Copyright © 2010 Pearson Education, Inc. Publishing as Prentice Hall · Economics · R. Glenn Hubbard, Anthony Patrick O’Brien, 3e. 13 of 30 5.2 LEARNING OBJECTIVE Private Solutions to Externalities: The Coase Theorem Discuss the Coase theorem and explain how private bargaining can lead to economic efficiency in a market with an externality. Chapter 5: Externalities, Environmental Policy, and Public Goods The Problem of Transactions Costs Transactions costs The costs in time and other resources that parties incur in the process of agreeing to and carrying out an exchange of goods or services. The Coase Theorem Coase theorem The argument of economist Ronald Coase that if transactions costs are low, private bargaining will result in an efficient solution to the problem of externalities. Copyright © 2010 Pearson Education, Inc. Publishing as Prentice Hall · Economics · R. Glenn Hubbard, Anthony Patrick O’Brien, 3e. 14 of 30 5.3 LEARNING OBJECTIVE Government Policies to Deal with Externalities Analyze government policies to achieve economic efficiency in a market with an externality. FIGURE 5-5 Chapter 5: Externalities, Environmental Policy, and Public Goods When There Is a Negative Externality, a Tax Can Bring about the Efficient Level of Output Because utilities do not bear the cost of acid rain, they produce electricity beyond the economically efficient level. If the government imposes a tax equal to the cost of acid rain, the utilities will internalize the externality. As a consequence, the supply curve will shift up, from S1 to S2. The market equilibrium quantity changes from QMarket, where an inefficiently high level of electricity is produced, to QEfficient, the economically efficient equilibrium quantity. The price of electricity will rise from PMarket—which does not include the cost of acid rain—to PEfficient—which does include the cost. Consumers pay the price PEfficient, while producers receive a price P, which is equal to PEfficient minus the amount of the tax. Copyright © 2010 Pearson Education, Inc. Publishing as Prentice Hall · Economics · R. Glenn Hubbard, Anthony Patrick O’Brien, 3e. 15 of 30 5.3 LEARNING OBJECTIVE Solved Problem 5-3 Chapter 5: Externalities, Environmental Policy, and Public Goods Using a Tax to Deal with a Negative Externality Analyze government policies to achieve economic efficiency in a market with an externality. YOUR TURN: For more practice do related problem 3.7 at the end of this chapter. Copyright © 2010 Pearson Education, Inc. Publishing as Prentice Hall · Economics · R. Glenn Hubbard, Anthony Patrick O’Brien, 3e. 16 of 30 Government Policies to Deal with Externalities 5.3 LEARNING OBJECTIVE Analyze government policies to achieve economic efficiency in a market with an externality. FIGURE 5-6 Chapter 5: Externalities, Environmental Policy, and Public Goods When There Is a Positive Externality, a Subsidy Can Bring about the Efficient Level of Output People who do not consume college educations can benefit from them. As a result, the social benefit from a college education is greater than the private benefit seen by college students. If the government pays a subsidy equal to the external benefit, students will internalize the externality. The subsidy will cause the demand curve to shift up, from D1 to D2. The result will be that market equilibrium quantity shifts from QMarket, where an inefficiently low level of college educations is supplied, to QEfficient, the economically efficient equilibrium quantity. Producers receive the price PEfficient, while consumers pay a price P, which is equal to PEfficient minus the amount of the subsidy. Copyright © 2010 Pearson Education, Inc. Publishing as Prentice Hall · Economics · R. Glenn Hubbard, Anthony Patrick O’Brien, 3e. 17 of 30 Chapter 5: Externalities, Environmental Policy, and Public Goods Government Policies to Deal with Externalities 5.3 LEARNING OBJECTIVE Analyze government policies to achieve economic efficiency in a market with an externality. Pigovian taxes and subsidies Government taxes and subsidies intended to bring about an efficient level of output in the presence of externalities. Command and Control versus Market-Based Approaches Command-and-control approach An approach that involves the government imposing quantitative limits on the amount of pollution firms are allowed to emit or requiring firms to install specific pollution control devices. Copyright © 2010 Pearson Education, Inc. Publishing as Prentice Hall · Economics · R. Glenn Hubbard, Anthony Patrick O’Brien, 3e. 18 of 30 5.3 LEARNING OBJECTIVE Making the Chapter 5: Externalities, Environmental Policy, and Public Goods Connection Can a Cap-and-Trade System Reduce Global Warming? Analyze government policies to achieve economic efficiency in a market with an externality. Policymakers and economists have debated the mechanism by which reductions in CO2 emissions should occur. The United States has favored a global system of tradable emission permits for CO2 that would be similar to the system for sulfur dioxide discussed earlier in this chapter. YOUR TURN: Test your understanding by doing related problem 3.11 at the end of this chapter. Copyright © 2010 Pearson Education, Inc. Publishing as Prentice Hall · Economics · R. Glenn Hubbard, Anthony Patrick O’Brien, 3e. 19 of 30 5.4 LEARNING OBJECTIVE Chapter 5: Externalities, Environmental Policy, and Public Goods Four Categories of Goods Explain how goods can be categorized on the basis of whether they are rival or excludable, and use graphs to illustrate the efficient quantities of public goods and common resources. Rivalry The situation that occurs when one person’s consuming a unit of a good means no one else can consume it. Excludability The situation in which anyone who does not pay for a good cannot consume it. Copyright © 2010 Pearson Education, Inc. Publishing as Prentice Hall · Economics · R. Glenn Hubbard, Anthony Patrick O’Brien, 3e. 20 of 30 5.4 LEARNING OBJECTIVE Four Categories of Goods Explain how goods can be categorized on the basis of whether they are rival or excludable, and use graphs to illustrate the efficient quantities of public goods and common resources. FIGURE 5-7 Chapter 5: Externalities, Environmental Policy, and Public Goods Four Categories of Goods Goods and services can be divided into four categories on the basis of whether people can be excluded from consuming them and whether they are rival in consumption. A good or service is rival in consumption if one person consuming a unit of a good means that another person cannot consume that unit. Copyright © 2010 Pearson Education, Inc. Publishing as Prentice Hall · Economics · R. Glenn Hubbard, Anthony Patrick O’Brien, 3e. 21 of 30 5.4 LEARNING OBJECTIVE Four Categories of Goods Explain how goods can be categorized on the basis of whether they are rival or excludable, and use graphs to illustrate the efficient quantities of public goods and common resources. Chapter 5: Externalities, Environmental Policy, and Public Goods 1. Private good. A good that is both rival and excludable. 2. Public good. A good that is both nonrivalrous and nonexcludable. Free riding Benefiting from a good without paying for it. 3. Quasi-public goods. Goods that are excludable but not rival. 4. Common resource. A good that is rival but not excludable. Copyright © 2010 Pearson Education, Inc. Publishing as Prentice Hall · Economics · R. Glenn Hubbard, Anthony Patrick O’Brien, 3e. 22 of 30 5.4 LEARNING OBJECTIVE Making the Chapter 5: Externalities, Environmental Policy, and Public Goods Connection Should the Government Run the Health Care System? Explain how goods can be categorized on the basis of whether they are rival or excludable, and use graphs to illustrate the efficient quantities of public goods and common resources. Because health care is so important to consumers and because health care spending looms so large in the U.S. economy, the role of the government in the health care system is likely to be the subject of intense debate for some time to come. YOUR TURN: Test your understanding by doing related problem 4.9 at the end of this chapter. Copyright © 2010 Pearson Education, Inc. Publishing as Prentice Hall · Economics · R. Glenn Hubbard, Anthony Patrick O’Brien, 3e. 23 of 30 5.4 LEARNING OBJECTIVE Four Categories of Goods The Demand for a Public Good Explain how goods can be categorized on the basis of whether they are rival or excludable, and use graphs to illustrate the efficient quantities of public goods and common resources. FIGURE 5-9 Chapter 5: Externalities, Environmental Policy, and Public Goods Constructing the Market Demand Curve for a Private Good The market demand curve for private goods is determined by adding horizontally the quantity of the good demanded at each price by each consumer. For instance, in panel (a), Jill demands 2 hamburgers when the price is $4.00, and in panel (b), Joe demands 4 hamburgers when the price is $4.00. So, a quantity of 6 hamburgers and a price of $4.00 is a point on the market demand curve in panel (c). Copyright © 2010 Pearson Education, Inc. Publishing as Prentice Hall · Economics · R. Glenn Hubbard, Anthony Patrick O’Brien, 3e. 24 of 30 Four Categories of Goods The Demand for a Public Good 5.4 LEARNING OBJECTIVE Explain how goods can be categorized on the basis of whether they are rival or excludable, and use graphs to illustrate the efficient quantities of public goods and common resources. FIGURE 5-10 Chapter 5: Externalities, Environmental Policy, and Public Goods Constructing the Market Demand Curve for a Public Good To find the demand curve for a public good, we add up the price at which each consumer is willing to purchase each quantity of the good. In panel (a), Jill is willing to pay $8 per hour for a security guard to provide 10 hours of protection. In panel (b), Joe is willing to pay $10 for that level of protection. Therefore, in panel (c), the price of $18 per hour and the quantity of 10 hours will be a point on the market demand curve for security guard services. Copyright © 2010 Pearson Education, Inc. Publishing as Prentice Hall · Economics · R. Glenn Hubbard, Anthony Patrick O’Brien, 3e. 25 of 30 5.4 LEARNING OBJECTIVE Four Categories of Goods The Optimal Quantity of a Public Good Explain how goods can be categorized on the basis of whether they are rival or excludable, and use graphs to illustrate the efficient quantities of public goods and common resources. FIGURE 5-10 Chapter 5: Externalities, Environmental Policy, and Public Goods The Optimal Quantity of a Public Good The optimal quantity of a public good is produced where the sum of consumer surplus and producer surplus is maximized, which occurs where the demand curve intersects the supply curve. In this case, the optimal quantity of security guard services is 15 hours, at a price of $9 per hour. Copyright © 2010 Pearson Education, Inc. Publishing as Prentice Hall · Economics · R. Glenn Hubbard, Anthony Patrick O’Brien, 3e. 26 of 30 5.4 LEARNING OBJECTIVE Solved Problem Explain how goods can be categorized on the basis of whether they are rival or excludable, and use graphs to illustrate the efficient quantities of public goods and common resources. 5-4 Determining the Optimal Level of Public Goods JOE Chapter 5: Externalities, Environmental Policy, and Public Goods PRICE (DOLLARS PER HOUR) $20 18 16 14 12 10 8 6 4 2 JILL QUANTITY (HOURS OF PROTECTION) 0 1 2 3 4 5 6 7 8 9 PRICE (DOLLARS PER HOUR) QUANITY (HOURS OF PROTECTION) $20 1 18 16 14 12 10 8 6 4 2 2 3 4 5 6 7 8 9 10 DEMAND OR MARGINAL SOCIAL BENEFIT To calculate the marginal social benefit of guard services, we need to add the prices that Jill and Joe are willing to pay at each quantity PRICE (DOLLARS PER HOUR) $38 34 30 26 22 18 14 10 6 QUANTITY (HOURS OF PROTECTION) 1 2 3 4 5 6 7 8 9 Copyright © 2010 Pearson Education, Inc. Publishing as Prentice Hall · Economics · R. Glenn Hubbard, Anthony Patrick O’Brien, 3e. 27 of 30 5.4 LEARNING OBJECTIVE Solved Problem 5-4 Determining the Optimal Level of Public Goods (continued) Explain how goods can be categorized on the basis of whether they are rival or excludable, and use graphs to illustrate the efficient quantities of public goods and common resources. DEMAND OR MARGINAL SOCIAL BENEFIT Chapter 5: Externalities, Environmental Policy, and Public Goods PRICE (DOLLARS PER HOUR) QUANTITY (HOURS OF PROTECTION) $38 34 30 26 22 18 14 10 6 1 2 3 4 5 6 7 8 9 SUPPLY PRICE (DOLLARS PER HOUR) QUANTITY (HOURS OF PROTECTION) $8 1 10 2 12 3 14 4 16 5 18 6 20 7 22 8 24 9 YOUR TURN: For more practice, do related problem 4.4 at the end of this chapter. Copyright © 2010 Pearson Education, Inc. Publishing as Prentice Hall · Economics · R. Glenn Hubbard, Anthony Patrick O’Brien, 3e. 28 of 30 5.4 LEARNING OBJECTIVE Four Categories of Goods Common Resources Explain how goods can be categorized on the basis of whether they are rival or excludable, and use graphs to illustrate the efficient quantities of public goods and common resources. Tragedy of the commons The tendency for a common resource to be overused. Chapter 5: Externalities, Environmental Policy, and Public Goods FIGURE 5-11 Overuse of a Common Resource For a common resource such as wood from a forest, the efficient level of use, QEfficient, is determined by the intersection of the demand curve—which represents the marginal benefit received by consumers—and S2, which represents the marginal social cost of cutting the wood. Because each individual tree cutter ignores the external cost, the equilibrium quantity of wood cut is QActual, which is greater than the efficient quantity. At the equilibrium level of output, there is a deadweight loss, as shown by the yellow triangle. Copyright © 2010 Pearson Education, Inc. Publishing as Prentice Hall · Economics · R. Glenn Hubbard, Anthony Patrick O’Brien, 3e. 29 of 30 Chapter 5: Externalities, Environmental Policy, and Public Goods AN INSIDE LOOK >> The Carbon Cap Dilemma Using a carbon tax to reduce CO2 emissions. Copyright © 2010 Pearson Education, Inc. Publishing as Prentice Hall · Economics · R. Glenn Hubbard, Anthony Patrick O’Brien, 3e. 30 of 30 Chapter 5: Externalities, Environmental Policy, and Public Goods KEY TERMS Coase theorem Command-and-control approach Common resource Excludability Externality Free riding Market failure Pigovian taxes and subsidies Private benefit Private cost Private good Property rights Public good Rivalry Social benefit Social cost Tragedy of the commons Transactions costs Copyright © 2010 Pearson Education, Inc. Publishing as Prentice Hall · Economics · R. Glenn Hubbard, Anthony Patrick O’Brien, 3e. 31 of 30