* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Price-searcher markets with low entry barriers

Survey

Document related concepts

Transcript

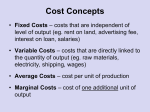

Monopolistic Competition aka P rice S eekers W ith L ow B arriers to E ntry Characteristics • Firms face low entry barriers • Differentiated Products -they face a downward sloping demand curve -no Long Run Profits -Non-price Competition • Price Taker • Many Small Firms Product Differentiation • Price-searchers produce differentiated products – products that differ in design, dependability, location, ease of purchase, etc. • Rival firms produce similar products (good substitutes) and therefore each firm confronts a highly elastic demand curve. McHits or McMisses? Hulaburger - 1962 Filet o Fish - 1963 Strawberry shortcake - 1966 Big Mac - 1968 Big Mac Hot Apple Pie - 1968 Big N Tasty Egg McMuffin - 1975 Big N Tasty w/ Cheese Quarter Pounder w/ Cheese Drive Thru - 1975 Double Quarter Pounder w/ Cheese Chicken Chicken McNuggets - 1983Crispy McGrill Extra Value Meal - 1991 Chicken Filet-O-Fish Double Cheeseburger McLean Deluxe - 1991 Cheeseburger Arch Deluxe - 1996 Hamburger McNuggets (4) 55-cent Special - 1997 Chicken Chicken McNuggets (6) Chicken McNuggets (9) Big Xtra - 1999 Shaker Chef Salad McRib, Sundaes and others McSalad McSalad Shaker Garden Salad ?? McSalad Shaker Grilled Chicken Caeser Salad Double Jr. Cheesebur 1/4 lb.* ger Single Deluxe Baconator ® 1/2 lb.* Double with Cheese Jr. Jr. Bacon Hamburge Cheesebur r ger Jr. Double Cheesebur Stack ger Homestyle Grilled Chicken Chicken Go Wrap Go Wrap Deluxe Double Stack Spicy Chicken Go Wrap Chicken Club Ultimate Chicken Grill Spicy Chicken Sandwich 10-piece Chicken Nuggets Premium Fish Fillet Sandwich Crispy Chicken Sandwich 3/4 lb.* Triple with Cheese Fish Supreme Chicken Parmesan Sandwich Jr. 2/3 lb. Monster Thickburger® Cheesebur 1/3 lb. Low Carb Thickburger® ger Little Thick Cheeseburger 1/4 lb. Little Thickburger® Deluxe 1/3 lb. Cheeseburger Chili Cheese Thickburger® Triple 1/3 lb. Original Thickburger® Stack 1/3 lb. Mushroom 'N' Swiss Thickburger® 1/3 lb. Bacon Cheese Thickburger® Big Chicken Fillet Sandwich Crispy Charbroiled Chicken Club Sandwich Chicken Charbroiled BBQ Chicken Sandwich Deluxe Big Hot Ham 'N' Cheese™ Regular Hamburger Homestyle Regular Cheeseburger Chicken Double Cheeseburger Fillet 5-Piece Chicken Breast Strips 7-Piece Chicken Breast Strips Big Shef Double Jr. Cheeseburger Deluxe 1/4 lb.* Single 1/2 lb.* Double with Cheese 3/4 lb.* Triple with Cheese Baconator® Jr. Hamburger Jr. Bacon Cheeseburger Jr. Cheeseburger Deluxe Jr. Cheeseburger Double Stack Deluxe Double Stack Triple Stack Homestyle Chicken Go Wrap Grilled Chicken Go Wrap Spicy Chicken Go Wrap Crispy Chicken Deluxe Chicken Club Ultimate Chicken Grill Spicy Chicken Sandwich Homestyle Chicken Fillet 10-piece Chicken Nuggets Premium Fish Fillet Sandwich Crispy Chicken Sandwich Price and Output • A profit-maximizing price searcher will expand output as long as marginal revenue exceeds marginal cost. • Price will be lowered and output expanded until MR = MC • The price charged by a price searcher will be greater than its marginal cost. Marginal Revenue of a Price Searcher • Initial price P1 & output q1. Total revenue (TR) = P1 * q1. Price 1. As price falls from P1 to P2, output increases from q1 to q2, Reduction in Total Revenue two conflicting influences on TR. 1. TR will rise because of an increase in the number of units sold (q2 - q1) * P2. Increase in Total Revenue P1 P2 2. TR will decline [(P1 - P2) * q1] as q1 units once sold at the higher price (P1) are now sold at the lower price (P2). • Depending on the size of the shaded regions, total revenue may increase or decrease. d MR q1 q2 Quantity/time Total Price Marginal Output Total Marginal Quantity Cost ATC (AR) Cost RevenueRevenue 0 0 0 120 50 ___ 110 30 ___ ___ 1 ___ 110 1 110 80 80 ___ 90 10 ___ 2 ___ ___ 200 2 100 90 45 ___ 70 20 ___ 3 110 ___ ___ 270 3 90 37 ___ 50 30 ___ 4 140 ___ 320 4 80 35 ___ 30 40 ___ ___ 5 180 ___ 350 5 70 36 ___ 10 50 ___ ___ 6 230 360 6 60 38 ___ ___ -10 60 ___ ___ 7 290 ___ 350 7 50 41 ___ -30 70 ___ ___ 8 360 ___ 320 8 40 45 ___ -50 80 ___ ___ 9 440 ___ ___ 270 9 30 49 ___ -70 90 ___ 10 530 ___ 200 10 20 53 ___ Marginal Quantity Marginal Cost ATC Revenue 0 30 110 1 80 10 90 2 45 20 70 3 37 30 50 4 35 40 30 5 36 50 10 6 38 60 -10 7 41 70 -30 8 45 80 -50 9 49 90 -70 10 53 Price (AR) 120 110 100 90 80 70 60 50 40 30 20 120 Cost 110 100 90 80 70 60 50 40 30 20 10 0 1 2 3 4 5 6 7 8 9 10 Output 120 Cost 110 100 90 80 70 60 50 40 30 20 10 0 1 2 3 4 5 6 7 8 9 10 Output 1. Firm’s profit maximizing output? 2. What price will they charge? 3. Firm’s revenue? Total Cost? Total Profit? 4. How will things change in time? MC Price 24 ATC 10 8 MR 0 30 D = AR 45 50 Quantity Price and Output: Short Run Profit Price • A monopolistic competitor maximizes profits by producing where MR = MC, at output level q and charges a price P along the demand curve for that output level. • At q the average total cost is C. P • What impact will economic profits have if this is a typical firm? C MC Economic Profits ATC d • Because the price is greater than the average total cost per unit (P > C) the firm is making economic profits equal to the area ([P - C]*q) MR q Quantity/time Profits and Losses in the Long Run • Economic profits attract competition. • New firms will expand supply and lower price. • Individual demand curves will shift inward until the economic profits are eliminated. • Economic losses cause firms to leave the market. • Demand for the remaining firms’ output will rise until the losses have been eliminated, ending the incentive to exit. • Firms can make either profits or losses in the short run, but only zero economic profit in the long run. Price and Output: Long Run • Because entry and exit are free, competition will eventually drive Price prices down to the level of ATC. MC • When profits (losses) are present, the demand curve will shift inward (outward) until the zero profit equilibrium is restored. C=P ATC • The price searcher establishes its output level where MC = MR. • At q the average total cost is equal to the market price. Zero economic profit is present. No incentive for firms to either enter or exit the market is present. d MR q Quantity/time Case 1: Prices rise Profits Entry or Exit? Supply 1. Increased Demand, Price goes up 2. Firms enter, Demand faced Price $6 by each firm decreases ATC MC $5 $4 SR Profits $3 $2 $1 0 3. Price goes down 4. No LR Profits 10 20 30 40 Demand 50 60 Quantity Case 2: Prices fall Profits Entry or Exit? Supply 1. Demand falls, Price goes down Price 2. Firms leave, Demand faced $6 by each firm increasesATC MC $5 $4 $3 $2 $1 0 Demand SR Losses 3. Price goes up 4. No LR Losses 10 20 30 40 50 60 Quantity Comparing Price Taker Markets • LR equilibrium for both. • P = ATC and there are no economic profits. • In monopolistic competition, firms face a downward-sloping demand curve, its profitmaximizing price exceeds MC. • In Monopolistic Competition, output is too small to minimize ATC in long-run equilibrium. Pure Comp Price Mono comp Price MC MC ATC d P1 ATC P2 d q1 Quantity/Time MR q2 Quantity/Time Comparing Price Taker Markets • Even though the two markets have the same cost structure, the price in the monopolistic competitor’s market is higher than that in the price-taker’s market ( P2 > P1 ). • Some consider this price discrepancy a sign of inefficiency; others perceive it as a premium society pays for variety and convenience (product differentiation). Pure Comp Price Mono comp Price MC MC ATC d P1 ATC P2 d q1 Quantity/Time MR q2 Quantity/Time Allocative Efficiency • Allocative efficiency is achieved when the most desired goods are produced at the lowest possible cost. • The Minimum point on the ATC curve: • ATC > marginal cost at the minimum point • No allocative efficiency in Monopolistic Competition. Price Discrimination • Sellers may gain from price discrimination by charging: • higher prices to groups of customers with more inelastic demand • lower prices to groups of customers with more elastic demand • Price discrimination generally leads to more output and additional gains from trade. The Economics of Price Discrimination • Consider a hypothetical market for airline travel where the Marginal Cost per traveler is $100. • If the airline charges all customers the same price, profits will be maximized where MC = MR. Here the airline charges everyone $400 and sells 100 seats. • This generates Net Operating Revenue of $30,000 or (total revenues) $40,000 – (operating costs) $10,000. Price $700 Net operating revenue ($300*100) = $30,000 $600 $500 $400 $300 $200 MC $100 Single price MR 100 D Quantity/time The Economics of Price Discrimination • By charging higher prices to consumers with less elastic demand and lower prices to those with more elastic demand it will increase net operating revenue. • If the airline charges $600 to business travelers (who have a highly inelastic demand) and $300 to other travelers (who have a more elastic demand), it can increase its Net Operating Revenue to $42,000. Price Price $700 Net operating revenue ($300*100) = $30,000 $700 $600 $600 $500 $500 $400 $400 $300 $300 $200 $200 MC $100 Single price MR 100 D Quantity/time $100 60 Price Discrim. Net operating revenue from business travelers ($500*60) = $30,000 Net operating revenue from all others ($200*60) = $12,000 MC D 120 Quantity/time Right after you graduate, you get a job in production management and you are responsible for the entire company on weekends. Here are the costs of production for the company: Quantity Average Total Cost 500 $200 501 $201 Your current level of production is 500 units and all 500 have been ordered by regular customers. One weekend, the phone rings. It is a customer who wants to buy one unit of your product. This means increasing production to 501 units. The customer offers to buy it for $450. Should you accept the offer? What is the net change in the firm’s profit? Marginal Revenue = ?? Quantity 500 501 Marginal Cost = ?? Average Total Cost $200 $201 Total Cost (Q x ATC) $100,000 $100,701 $100,701 - $100,000 = $701 Marginal Cost = $701 Marginal Revenue = $450 Profit or Loss L o s s You’re Fired!!! In a competitive price-searcher market, the firms will a. be able to choose their price, and the entry barriers into the market will be low. b. be able to choose their price, and the entry barriers into the market will be high. c. have to accept the market price for their product, and the entry barriers into the market will be low. d. have to accept the market price for their product, and the entry barriers into the market will be high. A profit-maximizing price searcher will expand output to the point where a. total revenue equals total cost. c. price equals average total cost. b. marginal revenue equals marginal cost. d. price equals marginal cost. In the long run, neither competitive price takers nor competitive price searchers will be able to earn economic profits because a. b. c. d. entry barriers into these markets are high, raising the costs of each firm. the government will dictate moderate prices for these firms. competition will force prices down to the level of per-unit production costs. marginal revenue is always less than marginal cost when barriers to entry are low. If a market is in long-run equilibrium, which of the following conditions will be present in a competitive price-taker market but absent from a competitive pricesearcher market? a. P = ATC b. MR = MC c. P = MC d. MR < P As long as a market is contestable, then even if it has only a few sellers, the a. threat of new firms will prevent the prices from rising above the competitive level b. producers will be able to charge prices that are high enough to produce long-run economic profits. c. producers will not face new competition because the barriers to entry are high. d. market will never be expected to come close to the competitive result. If firms in a competitive price-searcher market are currently earning economic losses, then in the long run, a. new firms will enter the market, and the current firms will experience a decrease in demand for their products until zero economic profit is again restored. b. new firms will enter the market, and the current firms will experience an increase in demand for their products until zero economic profit is again restored. c. some existing firms will exit the market, and the remaining firms will experience an increase in demand for their products until zero economic profit is again restored. d. some existing firms will exit the market, and the remaining firms will experience a decrease in demand for their products until zero economic profit is again restored. Compared to the outcome when the firms are price takers, competitive pricesearcher markets will result in a. a wider variety of products and higher prices. b. less product variety and higher prices. c. a wider variety of products and lower prices. d. less product variety and lower prices. What price should this competitive price-searcher firm charge in order to maximize profits? a. $5 b. $7 c. $8 a. $0 b. $20 c. $30 d. $10 What is the maximum economic profit this firm depicted in Figure 2 will be able to earn? d. $100 If the cost and demand conditions of this competitive price-searcher firm, what will happen in the future? a. Firms will go out of business, and the market price will rise. b. The current market price will tend to persist into the future. c. New firms will enter the market, and demand facing this firm will decline. d. The firms in this industry probably will collude in order to increase their profitability. The average variable cost (AVC) and average total cost (ATC) for a firm are indicated in Figure 3. If the marginal cost curve were constructed, at what output would it cross the AVC curve? a. 2 b 3 c. 4 d. 5 At what output would a properly constructed marginal cost curve cross the ATC curve? a. 3 b 4 c. 5 d. 6 Calculate the total cost of producing four units. a. $10 b. $15 c $60 d. $75 Calculate the total variable cost of producing three units. a. $10 b. $15 c. $30 d. $45 Which output level would be most closely associated with the point where diminishing marginal returns have begun? a 4 b. 5 c. 6 d. 8 Which output minimizes per-unit cost? a. 4 b. 6 c. 7 d 8 Which of the following is true? a. Firms in this industry begin to experience diminishing returns to their variable factors at output q1. b. Between q1 and q2, firms in this industry experience economies of scale. c Firms producing output rates less than q1 or more than q2 will find it difficult to survive. d. The largest firms in this industry have the lowest per-unit cost. The graph illustrates a firm a. capable of earning economic profit. b. that is only able to break even when it maximizes profit. c taking economic losses. d. that should shut down immediately. When price rises from P2 to P3, the firm finds that a. marginal cost exceeds marginal revenue at a production level of Q2. b. if it produces at output level Q3 it will earn a positive profit. c expanding output to Q4 would leave the firm with losses. d. it could increase profits by lowering output from Q3 to Q2. When price falls from P3 to P1, the firm finds that a. fixed cost is higher at a production level of Q1 than it is at Q3. b. it should produce Q1 units of output. c. it should produce Q3 units of output. d it should shut down immediately.