* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download price elasticity - Gregory C. Mason

Survey

Document related concepts

Transcript

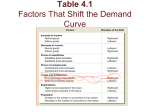

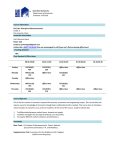

Introduction to microeconomics Demand relationships Chapter 4 Learning Goals • Understand the nature of demand • Identify optimum spending for a good in the face of a budget constraint • Define the price elasticity of demand • Describe the effects of a change in price and income (substitution and income effects) • Calculating market demand • Define income and cross-price elasticity The Law of Demand • Demand curve is a relationship between the quantity demanded and its price. • The Law of Demand – Other things remaining equal, price and quantity demand will be inversely related. – the cost of consuming good or service is the sum of all the sacrifices needed to consume – The price of good A is the amount of another good (B)needed to gain the exclusive right to consume – Most often use a common good B to measure price (money) LO3: Derive a Demand Curve Ch4 -3 © 2012 McGraw-Hill Ryerson Limited Utility • Utility – the satisfaction derived from consuming a good or service. • Utility Maximization – economists assume people try to allocate choose a set of goods to maximize their satisfaction. • Util – a fictional unit of pleasure or utility obtained from an item. LO1: Derive Rational Spending Rule Ch4 -4 © 2012 McGraw-Hill Ryerson Limited Marginal utility typically declines and then becomes negative Total utility increases and then falls Cone quantity (cones/hour) Total utility (utils/hour) 0 0 1 100 2 150 3 175 4 187 5 184 Marginal utility switches from + to – at the same point where total utility starts to decline. Total utility increases with each cone eaten, up to the fourth cone/per hour. The marginal utility of ice cream consumption (cones/hour) declines with number of cones eaten per hour LO1: Derive Rational Spending Rule © 2012 McGraw-Hill Ryerson Limited Total Utility from Ice Cream Consumption Marginal utility = change in utility/change in consumption Cone quantity (cones/hour) Total utility (utils/hour) 0 0 1 100 2 150 3 175 4 187 5 184 Marginal utility (utils/cone) 100 50 25 150 utils - 100 utils 2 cones - 1 cone 50 utils/cone marginal utility 12 -3 marginal utility Why do we need cones/hour and not just cones? Utility Cones d (U ) / d ( c ) What does the marginal marginal utility measure? LO1: Derive Rational Spending Rule Ch4 -6 © 2012 McGraw-Hill Ryerson Limited Diminishing marginal utility – As the consumption of a good or service increases, the additional utility gained from an extra unit of the commodity tends to decline. – Based on the cost-benefit principle, you continue to order cones as long as the marginal utility from an additional cone is greater or equal to zero. – This assumes no budget constraint or any other good (substitute – chocolate cake) or complement (apple pie) You have an income of $10 per week to spend on two types of ice-cream. Cones costs $1; Sundaes costs $2 The Optimal combination of goods is the Affordable combination that delivers maximum total utility LO1: Derive Rational Spending Rule Cone/sundae combinations Total utility (utils/week) 10 cones, 0 sundaes 80 + 0 = 80 8 cones, 1 sundae 82 + 50 = 132 6 cones, 2 sundae 80 + 80 = 160 4 cones, 3 sundae 68 + 105 = 173 2 cones, 4 sundae 50 + 120 = 170 0 cones, Ch4 -8 5 sundaes 2012 McGraw-Hill 0 +© 130 = 130 Ryerson Limited The Rational Spending Rule I • The marginal utility for the 3rd sundae is 25 utils (105-80 = 25 utils), and the marginal utility per dollar is 12.5 utils (25/$2 = 12.5). • If you spends $2 for cones instead (buying the 5th and the 6th cone), it will increase your total utility by 12 utils ( 5th cone: 75-68 = 7 utils; 6th cone: 8075 = 5 utils). •You are is getting more utils per dollar from the last sundae you purchases LO1: Derive © 2012 McGraw-Hill than Rational from the last cone, then you willCh4 buy -9 more sundae. Spending Rule Ryerson Limited The Rational Spending Rule II • Allocate spending across goods so that the marginal utility per dollar is the same for each good. MUC MU S PC PS MU • The marginal utility per dollar = P • Follows directly from the cost /benefit (here the benefit/cost)principle. • To maximize benefit (utility), the ratio of marginal utility to price must be the same for each good the consumer buys. LO1: Derive Rational Spending Rule Ch4 -10 © 2012 McGraw-Hill Ryerson Limited A demand curve emerges from constrained choices • If income rises from $10 to $14 per week, then …? – Extra income stimulates demand by enlarging the set of affordable combinations. • If the price of cones rises to $2 rather than $1, then …? – At $1 per cone, marginal utility per dollar is 8 utils/dollar and you buy 4 cones/week. – At $2 per cone, marginal utility per dollar is 4 utils/dollar, you only buy 1 cone/week. By applying the rational spending rule to price changes, a demand curve emerges As price of the cone increases from $1 to $2, applying the rational spending rule to the utility schedule, the demand for cone has decreased from 4 to 1. Price ($/cone) Demand for Vanilla Cones 2.00 1.50 1.00 D 1 2 3 4 Quantity (cones/week) LO3: Derive a Demand Curve Ch4 -12 © 2012 McGraw-Hill Ryerson Limited Income and Substitution Effect • Income effect: the change in quantity demanded of a good that occurs because a change in the price of the good changes the effective income of the purchaser. – A cone at $1, allows you to maximize total utility by spending $10 to purchase 4 cones and 3 sundaes per week. – A cone at $2, requires $14 to buy the previous combination, therefore effective income falls. • Substitution effect: the change in quantity demanded of a good whose relative price has changed while a consumer’s real income is held constant. – When the price of a cone increases, rational consumers substitute the good that has the relatively lower price. LO4: Income and Substitution Effect Ch4 -13 © 2012 McGraw-Hill Ryerson Limited Individual and Market Demand Curves - Tuna Market demand curve © 2012 McGraw-Hill Ryerson Limited Private good (consumption) • Total market demand for a private good is the “horizontal” sum of individual demand. • Utility for the consumer is derived solely from his/her personal consumption • Private goods involve no sharing of utility (or disutility) among consumers – The smell of tuna on Smith’s breath does not repel Wong – Wong is not overjoyed at finding a fellow tuna eater – Singh does not worry that Smith and Wong are eating an endangered species Equation for a Straight Line Demand Curve QD c dPD • PD is for the price of the good. • QD is for the quantity demanded. • c is the horizontal intercept of the demand curve or….? ----------> • Consumption when price (PD) is zero (free). – -d represents the reciprocal of the slope. LO3: Derive a Demand Curve Ch4 -16 © 2012 McGraw-Hill Ryerson Limited The Market Demand Curve for Canned Tuna slope rise / run 1 / 2 QD 12 2PD LO3: Derive a Demand Curve Ch4 -17 © 2012 McGraw-Hill Ryerson Limited Total Expenditure • Total Expenditure equals – The number of units bought multiplied by the price of the good. • Total Expenditure of consumers = Total Revenue of Producers LO3: Derive a Demand Curve Ch4 -18 © 2012 McGraw-Hill Ryerson Limited FIGURE 4.7 The Demand Curve for Movie Tickets An increase in price from $2 to $4 per ticket increases total expenditure on tickets Price ($/ticket) 12 10 8 6 New area gained > old area lost 4 2 0 D 1 2 3 4 5 6 Quantity (100s of tickets/day) Common area LO3: Derive a Demand Curve Ch4 -19 © 2012 McGraw-Hill Ryerson Limited 14 14 12 12 10 8 6 4 2 0 10 8 6 4 2 1 2 3 4 5 6 0 Quantity (100s of tickets/day) (a) Increase in total expenditure Losses in total expenditure Price ($/ticket) Price ($/ticket) FIGURE 4.8 The Demand Curve for Movie Tickets 1 2 3 4 5 6 Quantity (100s of tickets/day) (b) An Increase in price from $8 to $10 per ticket results in a fall in total expenditure on tickets. Ch4 -20 © 2012 McGraw-Hill Ryerson Limited Own Price Elasticity of Demand Definition: The percentage change in the quantity of a good demanded resulting from a one-percent change in its own price. • Elastic Demand – price elasticity is greater than one. – Price increases/decreases, quantity demanded falls/rises • Inelastic Demand – price elasticity is less than one. – Price increases/decreases, quantity demanded rises/falls • Unitary elastic demand – price elasticity equals one – A transition point on every demand LO5: Interpret Elasticities Ch4 -21 © 2012 McGraw-Hill Ryerson Limited Price Elasticity and Expenditures • Price elastic products: Quantity demanded is highly responsive to price changes. • Price inelastic: Quantity demanded is not responsive to price changes. ε>1 P ↑ R↓ P↓ R↑ ε=1 P ↑ R→ P ↓ R→ ε<1 P ↑ R↑ P ↓ R↓ • Inelastic demand: Apple iPhone 5 • Elastic demand: Fast Food LO5: Interpret Elasticities Ch4 -22 © 2012 McGraw-Hill Ryerson Limited Will a higher tax on cigarettes curb teenage smoking? • • • • Peer influence is the most important determinants of teen smoking. Most teenagers have small disposable incomes, cigarettes are usually large share of a teenage smoker’s budget. The price elasticity of demand for teens is likely to be fairly high Therefore: A higher tax should make smoking less affordable for some teenagers. How does this apply to hard drugs? Are these price elastic or inelastic? What does a company do to reduce the elasticity of demand for its products? What does government do to increase the price elasticity of demand for cigarettes? View notes page Some Representative Elasticity Estimates Good or service Price elasticity Green peas 2.80 Restaurant meals 1.63 Automobiles 1.35 Electricity 1.20 Beer 1.19 Movies 0.87 Air travel (foreign) 0.77 Shoes 0.70 Coffee 0.25 Theatre, opera 0.18 LO5: Interpret Elasticities Ch4 -24 Why are green peas elastic? Why are theatre tickets so inelastic? © 2012 McGraw-Hill Ryerson Limited Price elasticity of demand is defined as: – the percentage change in the quantity of a good demanded resulting from a one-percent change in its price. • Price elasticity = % change in quantity demanded / % change in price. • ε = (ΔQ/Q)/(ΔP/P). – Since the slope of the demand curve is ΔP/ΔQ, another way to express it is: • ε = (P/Q)(1/slope). LO6: Calculate Elasticities Ch4 -25 © 2012 McGraw-Hill Ryerson Limited Graphical Interpretation of Price Elasticity of Demand LO6: Calculate Elasticities Ch4 -26 © 2012 McGraw-Hill Ryerson Limited Calculating Price Elasticity of Demand ε = (P/Q)(1/slope) Slope is the ratio of its vertical intercept to its horizontal intercept. Slope = 20/5 = 4 εA = (8/3)(1/4) = 2/3 εB = (12/2)(1/4) = 3/2 The elasticity of demand varies along the demand curve It is lowest (less elastic or more inelastic) at higher than lower prices Slope (“steepness” of the demand) is only part of the story. © 2012 McGraw-Hill Ryerson Limited LO6: Calculate Elasticities Ch4 -27 Elasticity and Total Expenditure • The slope of a straight line demand curve is constant. • The price-quantity ratio declines as we move down the demand curve. • Price elasticity declines as we move down the demand curve. • As price increases, quantity demanded increases as does total expenditures until it reaches a maximum when elasticity equals one. • Total expenditure begins to decreases as quantity continues to increases, until it reaches zero. LO6: Calculate Elasticities © 2012 McGraw-Hill Ryerson Limited Price Elasticity of Demand and Total Expenditure As price declines, quantity demanded increases, total expenditure increases until it reaches a maximum of $18, then decreases until price is zero. LO6: Calculate Elasticities Ch4 -29 © 2012 McGraw-Hill Ryerson Limited The Relationship between Slope and Elasticity • When Price and quantity are the same, price elasticity of demand is always less for the steeper of the two demand curves. At point A, P/Q is the same for both curved; but D2 is steeper, D2 is less elastic than D1 at point A LO6: Calculate Elasticities Ch4 -31 © 2012 McGraw-Hill Ryerson Limited Three Special Cases • Perfectly Elastic demand – Price elasticity of demand is infinite. – Even the slightest change in price leads consumers to find substitutes. (All fast food is equally disgusting) • Perfectly Inelastic demand – Price elasticity of demand is zero. – Consumers do not switch to substitutes even when price increases dramatically (Often substitutes do not exist). • Unit Elastic demand – Regardless of the price selected, total expenditure is unchanged. LO5: Interpret Elasticities Ch4 -32 © 2012 McGraw-Hill Ryerson Limited Perfectly Elastic, Perfectly Inelastic, and Unit Elastic Demand Curves QD = 1/PD LO5: Interpret Elasticities Ch4 -33 © 2012 McGraw-Hill Ryerson Limited Income Elasticity of Demand The percentage amount by which the quantity demanded changes in response to a one-percent change in income. Income elasticity percentage change in quantity demanded Q I / percentage change in income Q I – Normal good: a good with a positive income elasticity of demand. – Inferior good: a good with negative income elasticity of demand. – Luxury good: a good with an income elasticity of demand greater than one; a subset of normal good. Ch4 -34 LO6: Calculate Elasticities © 2012 McGraw-Hill Ryerson Limited The strange story of the Giffen good • Giffen good: people consume more as the price rises, apparently violating the law of demand. • In most cases, substitution dominates demand – price rises lead to reductions in quantity demanded • For a Giffen good, income effects dominate – price rises reduce effective income, and in certain cases where the good is a necessity (staple foods for low income families) • Example: If the price of Kraft dinner rises, a low income family experiences a loss of effective income, and to maintain calories, cuts back on the consumption more expensive goods. As Mr. Giffen has pointed out, a rise in the price of bread makes so large a drain on the resources of the poorer labouring families and raises so much the marginal utility of money to them, that they are forced to curtail their consumption of meat and the more expensive farinaceous foods: and, bread being still the cheapest food which they can get and will take, they consume more, and not less of it. Source: A. Marshall, Principles of Economics, 3rd ed. All Giffen goods are inferior goods but not all inferior goods are Giffen goods. Why not? Experience, credence, post-experience and Veblen goods • Experience good: A good whose value can only be determined on consumption (Example: restaurant meal) • Search Good: A good whose value can be determined in advance of consumption (Example: computer) • Credence goods: Goods that are hard to assess even on consumption (repairs, medical treatment, vitamin supplements…) • Veblen goods: Goods consumed as status symbols (a form of luxury good). Cross Price Elasticity of Demand – The percentage amount by which the quantity demanded of one good changes in response to a one-percent change in the price of another good Cross - price elasticity percentage change in quantity good X percentage change in price of good Y Q x Qx PY / PY – Substitutes: two goods whose cross-price elasticity is positive – Complements : two goods whose cross-price elasticity is negative LO6: Calculate Elasticities Ch4 -37 © 2012 McGraw-Hill Ryerson Limited Chapter Summary • Price increase will – – • • • Price elasticity varies with price and along the demand curve Price change is the main independent variable Price changes have two main effects – – • • • Conmsumers increase spending on a good as long as marginal utility is higher than price Spending is allocated among goods to equate the ratios of respective marginal utilities to prices Total expenditure on a good reaches a maximum when price elasticity of demand is equal to one. The price elasticity of demand at a point – • Income effect (price increases/decreases lead of decreases/increases in effective income) Substitution effects (price increases/decreases force the consumer to manage a fixed income by decreases/increases) in consumption Benefit/cost principle of consumer demand – – • increase total expenditure if demand is inelastic but reduce it if demand is elastic. ε = (ΔQ/Q)/(ΔP/P) or ε = (P/Q)(1/slope). Income elasticity of demand is the percentage change in quantity demanded of good that arises from a 1 percent change in income. Cross-price elasticity of demand is the percentage change in quantity demanded of a good that arises from a 1 percent change in the price of a different good. Chapter Summary Ch4 -38 © 2012 McGraw-Hill Ryerson Limited