* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Powerpoint Templates

Survey

Document related concepts

Transcript

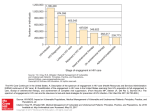

BUY Recommendation: Gilead Sciences (GILD) Company Overview • Gilead Sciences, Inc. is a research-based biopharmaceutical company found in 1987 that discovers, develops and commercializes innovative medicines in areas of unmet medical need. Current Portfolio HIV/AIDS Number of Product 6 In Development 3 Liver Disease 2 8 Cardiovascular 3 3 Respiratory 2 3 Other 3 5 Type HIV vs Hepatitis Characteristic HIV Hepatitis C U.S Death Annually 12,700 15,000 Infected Population Worldwide 34 Million 170 Million HIV Drug -Stribild (QUAD): First HIV treatment regimen that combine drugs from the same company. -4 in one pill -#1 HIV regimen in the US Company Profile • In 2012, Gilead was ranked #2 in Fortune magazine’s list of fastest-growing corporations by 10-year profits • In 2012, Harvard Business Review ranked Gilead’s Chairman and chief executive officer, John C. Martin, #5 on its list of the 100 best-performing CEOs in the world, as well as the top-ranked health care CEO. Medicine Patent Pool (MPP) Gilead is the first pharmaceutical company to sign an agreement with the Medicines Patent Pool, which is working to increase global access to high-quality, lowcost antiretroviral therapy through the sharing of patents. The Patent Pool has been granted similar licensing terms for Gilead HIV medicines as our generic manufacturing partners. Gilead has Medicines Patent Pool the right to develop and distribute its in 100 developing countries. Medicine Patent Pool (MPP) Medicine Patent Pool (MPP) HIV vs Hepatitis Characteristic HIV Hepatitis C Risk of reinfection Reinfection with HIV happens. In many cases it may not have serious implications unless the new virus is drug resistant Reinfection with hepatitis C occurs, and being reinfected with a different genotype may make it more difficult to treat. How infectious outside the body HIV is a fragile virus. Dies quickly when outside of the human body HCV is a tougher virus. Can live for days outside of the human body. Speed of progression People can live with HIV for many years without symptoms (average 5-8 without treatment). People can live with HCV for many years without symptoms (average over 10-15 for people with coinfection). Sofosbuvir vs Competitors • Gilead’s Sofosbuvir is all-oral treatment that has 100% cure rate through 2 stages of clinical trail. • Sofosbuvir is a once a day, single pill treatment that eliminates the need for interferon Sofosbuvir vs Competitors • Bristol Myers Squibb Co. (BMY) made its own big hep-C acquisition, but the experimental drug turned out to cause one patient death and complications with others, forcing the company to drop development. • Idenix Pharmaceuticals, Inc. (IDIX) had two of its hep-C prospects put on clinical holds back in November due to safety concerns. Idenix discontinued their clinical development programs for 2 hep-C drug candidates in February Sofosbuvir vs Competitors • Vertex Pharmaceuticals Incorporated (VRTX) and Merck & Co., Inc. (MRK) ’s Hep-C treatment require intravenous administration and can cause flu-like symptoms for nearly a year during treatment. Vertex’s Hep-C drug had 79% cure rate through 3 stages of clinical trail. Sofosbuvir vs Competitors Striblid approved Analyst Opinion: 20 Buy, 2 hold, 0 sell GILD’s nearest nine competitors averaged 54% buys Investment Information Striblid approved Prev Close: 47.72 1y Target 49.23 Est: 52wk Range: 22.67 – 49.48 Avg Vol (3m): 9,559,490 Market Cap: P/E (ttm): EPS (ttm): Div & Yield: Forward P/E: GILD vs S&P Biotechnology Index 74.99B 30.03 1.64 N/A 30.03 Portfolio Placement / Recommendation • • • • • Sector : Healthcare Current Holdings: ABT, ABBV, HLF, XLV Target Sector Allocation: 6% Current Sector Allocation: ~4.9% Remaining Allocation:~ 1.1%, ~$6000 • BUY 125 shares of SGYP at market value (approx. $6000, 21% of portfolio) • Holding Period/Exit Strategy: 2-3 years. Aiming for long-term profitability and potential