* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Monetary Policy in the Post-Crisis Period A. Hakan Kara

Survey

Document related concepts

Transcript

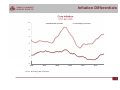

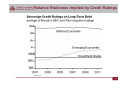

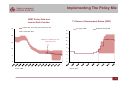

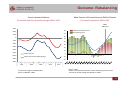

Monetary Policy in the Post-Crisis Period A. Hakan Kara Research and Monetary Policy Department Koç University-TUSIAD ERF Conference October 10, 2011 Contents I. Changing View of Central Banking II. Capital Flows to Emerging Markets III. Reflections on the Turkish Economy IV. Policy Measures and Outcomes 2 Emerging consensus after the global crisis More emphasis on financial stability, especially from a systemic risk and macro perspective Monetary policy should not ignore financial cycles and asset price booms. 3 Changing view of central banking Before crisis: single objective (price stability) single instrument (short term policy rate) After Crisis: multiple objectives (price stability, financial stability), multiple instruments (credit, liquidity and interest rate policy) Question: What does this imply for Emerging Market (EM) policy frameworks? 4 Post Crisis Dynamics, Global Imbalances, and Factors Driving Capital Flows to EMs 5 Growth Differentials GDP Growth Rates (YoY, per cent) 10 Advanced countries Developing countries 8 6 4 2 0 -2 -4 -6 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 Source: Bloomberg, CBRT calculations. 6 Inflation Differentials Core Inflation (YoY, per cent) 6 Advanced countries Developing countries 5 4 3 2 1 0 2006 2007 2008 2009 2010 2011 Source: Bloomberg, CBRT calculations. 7 Policy Rates Policy Rates (per cent) Advanced countries 12 Developing countries 10 8 6 4 2 0 2006 2007 2008 2009 2010 2011 Source: Bloomberg, CBRT calculations. 8 Quantitative Easing Central Bank Balance Sheets 2,300 ECB (billion euro) 3,000 FED (billion USD) 2,100 2,500 1,900 1,700 2,000 1,500 1,300 1,500 1,100 900 1,000 700 500 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 500 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 Source: ECB, FED. 9 Relative Riskiness Implied by Credit Ratings Source: IIF 10 Relative Riskiness Implied by the Market CDS Rates for Selected Countries 700 700 600 600 500 500 Emerging Economies 400 400 Mature Economies 300 300 200 200 100 100 0 0911 0910 1110 0111 0311 0511 0711 0909 1109 0110 0310 0510 0710 0908 1108 0109 0309 0509 0709 0907 1107 0108 0308 0508 0708 0906 1106 0107 0307 0507 0707 0106 0306 0506 0706 0 Source: Bloomberg, CBRT calculations. Mature economies include Germany, France, Italy, Spain and Japan. Emerging economies include Brazil, Chile, Colombia, Peru, Mexico, Hungary, Poland, Russia, Turkey, Thailand, Indonesia, Philippines, China and Malaysia. 11 Resulting Dynamics in Emerging Markets Surging capital inflows Real exchange rate appreciation Rapid credit growth 12 Reflections on the Turkish Economy and the Policy Response of the CBRT 13 Macro Financial Risks Monthly Imports and Exports (Seasonally Adjusted, Million USD) Main Sources of Current Account Deficit Finance (12‐months Cumulative, Billion USD) 70 20000 Exports (excluding gold) Imports 18000 60 Portfolio and Short‐Term* FDI and Long Term Current Account Deficit 50 16000 40 14000 30 20 12000 10 10000 ‐10 6000 ‐20 2007:01 2007:03 2007:05 2007:07 2007:09 2007:11 2008:01 2008:03 2008:05 2008:07 2008:09 2008:11 2009:01 2009:03 2009:05 2009:07 2009:09 2009:11 2010:01 2010:03 2010:05 2010:07 2010:09 2010:11 8000 *Source: TurkStat. 2007:01 2007:03 2007:05 2007:07 2007:09 2007:11 2008:01 2008:03 2008:05 2008:07 2008:09 2008:11 2009:01 2009:03 2009:05 2009:07 2009:09 2009:11 2010:01 2010:03 2010:05 2010:07 2010:09 2010:11 0 *Short-term capital movements are sum of banking and real sectors' short term net credits and deposits in banks. Source: CBRT. Global imbalances combined with the post-crisis dynamics led to a divergence between external and domestic demand and a surge in short term capital inflows. 14 Defining the Problem Financial stability from a macro perspective: How to reduce the risk of a sudden stop? Main Task: Engineer a soft-landing without hampering the price stability objective. 15 Methodology Modifying the conventional IT framework: Enrich the set of policy instruments Supplementary objective: Financial Stability Rebalance the economy through a slowdown in credit growth and a realignment of the exchange rate 16 Multiple Instruments, Multiple Goals Liquidity Policy Credit Policy •Reserve requirements One-week repo rate •Other macroprudential tools •Interest rate corridor •Other liquidity facilities Instruments Transmission Channels PRICE STABILITY FINANCIAL STABILITY Goals Selected Items from the CBRT Policy Toolkit ¾ One-week Repo Rate ¾ TL Required Reserve Ratios Remuneration strategy of TL required reserves Differentiating across maturities Changing the scope of liabilities subject to reserve requirements Flexibility in the currency denomination of required reserve balances ¾ FX Required Reserve Ratios ¾ Interest Rate Corridor ¾ Other Liquidity Facilities Changes in liqudity management strategies and operational rules ¾ FX Liquidity Facilities FX Purchasing/Selling Auctions • Changes in the auction methods according to liquidity conditions Adjustments in the FX liquidity provision facilities Changes in the export rediscount credit facilities Challenge: Communicating the New Approach 1. No clear definition of financial stability 2. Uncertain transmission mechanisms Solution: Communicate in terms of observables Current account deficit and its financing Exchange Rate Credit growth Rebalancing Strategy Step 1: Keep short term rates as low as possible and use interest rate corridor to discourage short term capital inflows to allow an orderly realignment in exchange rates. Step 2: Tighten through macro prudential instruments to curb credit growth and domestic absorption ( in coordination with other authorities). Implementing The Policy Mix CBRT Policy Rate and Interest Rate Corridor 25 TL Reserve Requirement Ratios (RRR) O/N Lending ‐ Borrowing Interest Rate Corridor The range of RRR Weighted average RRR 18 1‐ week Repo Rate 16 20 14 Adoption of 1‐week repo rate as the policy rate 15 12 10 8 10 6 4 5 2 0 0 Source: CBRT. Source: CBRT. 21 Impact of the Policy Mix on Exchange Rates TL and Other EM Currencies Against USD* (11 Nov. 2010=1) 1.3 CBRT Measures TL 1.1 EM Average 0.9 Appreciation 1 Depreciation 1.2 Average of EM countries: Brazil, Chile, Czech Republic, Hungary, Mexico, Poland, S. Africa, Indonesia, South Korea and Colombia. Latest observation: October 4, 2011. Source: CBRT and Bloomberg. 22 Impact of the Policy Mix on Consumer Credit Consumer Loans (Annualized growth, percent, 4 weeks moving average) 70 RRR Hikes BRSA Measures 60 50 40 2006‐2011 average 30 20 2011 10 0 Source: CBRT 23 Outcome: Rebalancing Current Account Balance Main Sources of Current Account Deficit Finance (Seasonally Adjusted, Quarterly Average, Million USD ) (12‐months Cumulative, Billion USD) CBRT Measures 3000 80 2000 70 Portfolio and Short‐Term* FDI and Long Term 1000 60 0 50 -1000 40 -2000 30 -3000 20 -4000 10 -5000 Current Account 0 -6000 ‐10 Current Account (Excluding Energy) -7000 ‐20 -8000 1 2 3 2007 4 1 2 3 2008 4 1 2 3 2009 *Forecast for August and September. Source: TURKSTAT, CBRT. 4 1 2 3 2010 4 1 2 3* 2011 Source: CBRT. *Short‐term capital movements consist of banking and real sector short term net borrowing and deposits in banks. 24 Outcome: Inflation and Inflation Expectations Inflation Medium Term Inflation Expectations 30 30 10 12-Month 25 25 9 20 20 8 15 7 10 10 6 5 5 5 0 4 15 Turkey 24-Month Source: CBRT and Bloomberg. Average of EM countries: Brazil, Mexico, Czech Rep., Hungary, Poland, S. Africa, China, India, Russia. 0911 0611 0311 1210 0910 0610 0310 1209 0909 0609 0309 1208 0103 0603 1103 0404 0904 0205 0705 1205 0506 1006 0307 0807 0108 0608 1108 0409 0909 0210 0710 1210 0511 0 0908 EM Average * CBRT Survey of Expectations. Source: CBRT. 25 Conclusion Post crisis dynamics have highlighted the crucial role of financial stability, leading central banks to be more "creative" in the conduct of monetary policy. The CBRT has formulated and implemented a new strategy to deal with macro financial risks posed by extraordinary global circumstances. The new policy mix has been effective in rebalancing the economy while controlling inflation expectations. 26 Monetary Policy in the Post-crisis Period A. Hakan Kara Research and Monetary Policy Department Koç University-TUSIAD ERF Conference October 10, 2011