* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Medium Term Strategies

Survey

Document related concepts

Transcript

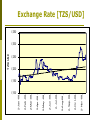

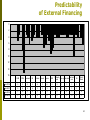

Budget Strategy in a Changing Macroeconomic Environment Presentation to the GBS Annual Review – 2008 Ministry of Finance and Economic Affairs 1 Outline The Context – national development goals Macroeconomic framework The Challenges The Macro-fiscal Strategy 2 The Context 3 Vision 2025 The Tanzania Development Vision 2025 projects that, by 2025, Tanzania will have five major attributes: High quality livelihood. Peace, stability and unity. Good governance. A well-educated and learning society. A competitive economy capable of producing sustainable growth and shared benefits. Overarching description: Middle Income Country 4 Medium Term Strategies They define medium term priorities in implementing the Vision PRS 1 (2001 – 2004) MKUKUTA (2005/06 – 2009/10) Millennium Development Goals (MDGs) 5 The Annual Government Budget a description of short term (one year) priorities towards the long term development goals. exploits available opportunities must respond to immediate challenges and threats 6 Macroeconomic Framework 7 The economy is growing, and accelerating Re a l GDP Grow th: 199 - 2008 9% 8% 8% 7% 7% 6% 6% 5% 5% 4% 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 Growth based mostly on impact of structural reforms and corresponding improvement in resource use. Economy still vulnerable to shocks, including weather and external shocks. Benefits reaching a wider population 8 O ct- 08 J ul- 08 Apr- 08 J an-0 8 O ct- 07 J ul- 07 Apr- 07 J an-0 7 O ct- 06 J ul- 06 Apr- 06 J an-0 6 O ct- 05 J ul- 05 Apr- 05 J an-0 5 O ct- 04 J ul- 04 Apr- 04 J an-0 4 O ct- 03 J ul- 03 Apr- 03 J an-0 3 Inflation Inflation Developmenerts (Monthly) 12.0 11.0 10.0 9.0 8.0 7.0 6.0 5.0 4.0 3.0 9 2-Nov-08 2-Oct-08 2-Sep-08 2-Aug-08 2-Jul-08 2-Jun-08 2-May-08 2-Apr-08 2-Mar-08 2-Feb-08 2-Jan-08 TZS/USD Exchange Rate [TZS/USD] 1,350 1,300 1,250 1,200 1,150 1,100 10 Exchange Rate Daily Changes Exchange rate has been fairly stable over the past year Exceptions in April (oil prices) and October (global financial meltdown) 11/2/2008 10/2/2008 9/2/2008 8/2/2008 7/2/2008 6/2/2008 5/2/2008 4/2/2008 3/2/2008 2/2/2008 1/2/2008 3% 2% 2% 1% 1% 0% -1% -1% -2% -2% -3% 11 Ja Ja n, n, 20 07 14 200 -F 7 eb -0 7 28 -M 7 M a ar r-0 ch 7 18 , ,A 200 pr 7 il 2 9, M 007 a 30 y 2 ,M 00 20 ay 7 Ju 20 07 n 11 e, 2 Ju 00 7 l 01 y, 2 Au 00 7 22 g, 2 A u 00 19 g, 7 Se 200 7 p 10 t, 2 O 007 c 31 t, 2 O 007 c 21 t, 2 No 00 7 19 v, 2 0 D ec 07 ,2 9 Ja 007 20 n, 2 F e 00 b, 8 2 Ap 200 8 r 14 il, 2 M 00 8 ay ,2 00 8 24 03 Weighed Average Yield to Maturity Interest Rates Interest Rate Structure of Treasury bills Jan 2007 to May 2008 20.0 18.0 16.0 14.0 12.0 10.0 8.0 6.0 4.0 2.0 0.0 182-day T. bills 364-day T. bills 12 Exogenous Global financial markets’ turmoil Global recession Oil and other commodity prices Threatening short term variables and medium term growth 13 The Challenges Going Forward 14 Restoring Price Stability Fiscal policy to compliment monetary policy more strongly: reduced liquidity injection by the Government address high cost of production Monetary policy interventions Contain growth of (M2 and M3) money supply Maintain market determined interest and exchange rates, with interventions to smooth their path 15 Growth Scenarios vis-à-vis Vision 2025 Current level of growth is below the trajectory required for achieving the Vision 2025 3,500 3,000 2,500 2,000 1,500 1,000 500 8% Grow th 12% Grow th Middle Income Status (Low ) Middle Income Status (High) 10% Grow th 2030 2029 2028 2027 2026 2025 2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 - 2008 GDP Per Capita (US$) 4,000 16 Implications of Insufficient Growth Reversal of gains in social services Peace, stability and unity Significant regional implications 17 Needs Strategies - Not Just Endowments Income per capita 15441 •Ivory Coast and Mauritius are both coastal and resource poor countries. 10000 15000 PPP adjusted, 1996 international $ •They pursued very different development paths. 5000 Mauritius 3084 1624 Cote d'Ivoire •with very different outcomes. 0 1606 1960 1970 1980 year 1990 2000 Income per capita 10000 PPP adjusted, 1996 international $ 6000 8000 8936 •Zambia and Botswana are neighbours, both landlocked and resource rich. 4000 •Pursued different approaches to managing resource rents. 2000 Botswana 1167 902 Zambia 0 984 1960 1970 1980 year 1990 2000 •To very different results. 18 Constraints to Growth 19 Energy Costs and Power Outages Figure 3.3 Energy costs and power outages 60 50 40 30 20 10 0 Kenya Uganda Tanzania Zambia Energy, % of firm costs (average) Senegal Benin Morocco China Power outages, % output lost (average) Source: World Bank Enterprise Surveys, 2001-2005 20 21 Quality and Cost of Labour 22 Predictability of the Medium Term Budget Framework Improving domestic revenue collection. Challenges remain in relation to external financing Baskets and Project funding main culprits Variable performance by individual GBS donors 23 Predictability of External Financing 0 2 4 6 8 10 12 14 16 Netherla Sw itzerl Norw ay Sw eden nds and UK World Bank 3 3 4 4 3 3 3 3 4 3 4 6 3 3 10 3 3 ADB CIDA Denmark EU Finland Ireland Japan KfW Total 07/08 0 0 3 5 4 3 6 9 3 3 3 Total 06/07 5 8 4 4 3 3 3 8 4 3 Total 05/06 3 15 3 4 3 3 3 7 4 Total 04/05 0 15 6 3 4 7 5 3 4 24 The Macro-fiscal Strategy 25 Recap Significant challenges from the global economic environment Domestic inflation pressures calling for fiscal (and monetary) policy response Need to scale up the rate of growth, toward Vision 2025 targets Infrastructure and skills emerging as the centre pin of forward strategy 26 Macro-fiscal Strategy Macro stability: Strengthening macro modelling capacity Need to limit expenditures that enhance aggregate demand I the economy Scale up food production and marketing Growth: MKUKUTA II ought to be “The Tanzania Medium Term Growth Strategy” Macro modelling to include growth scenarios and poverty analysis Scale up investment in infrastructure and labour skills Improve project selection (MPIP) Poverty Reduction: Incorporate “opportunities to create wealth”, not just Government handouts (except for the very vulnerable) Sustain quality of services delivery Address inequality in service standards Value for money (audits, expenditure tracking, PETS) MTEF reliability: Sustain growth of domestic revenue Limit growth of inflexible expenditures DPs to increase aid predictability 27 Implications for the Budget Increased domestic revenue collection, complemented by growing external financing Increasing share of pro-growth (infrastructure) budget, particularly on high import content projects Contain growth of the inflexible budget, including wage bill Predictability of medium term external financing essential 28 Expenditure Efficiency Improving expenditure planning at central and MDAs’ level Strengthening oversight for VFM Strengthening procurement capacity 29