* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download The AD Curve

Full employment wikipedia , lookup

Fei–Ranis model of economic growth wikipedia , lookup

Monetary policy wikipedia , lookup

Non-monetary economy wikipedia , lookup

2000s commodities boom wikipedia , lookup

Long Depression wikipedia , lookup

Ragnar Nurkse's balanced growth theory wikipedia , lookup

Nominal rigidity wikipedia , lookup

Phillips curve wikipedia , lookup

Business cycle wikipedia , lookup

Stagflation wikipedia , lookup

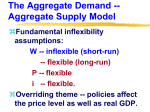

Aggregate Demand, Aggregate Supply, and Modern Macroeconomics Chapter 9 Macro233 - JAFGAC Laugher Curve We adults do have something in common with today’s teenagers. They listen to rock groups and we listen to economists. None of us understands a word they’re saying. Jean Stapleton Macro233 - JAFGAC Introduction Markets unleash individual initiative, increase supply, and bring about growth. But markets can create recessions too. Macro233 - JAFGAC Introduction Macro intervention tools – monetary and fiscal policy – are tools governments use on the aggregate demand side of the economy. Macro233 - JAFGAC The Historical Development of Modern Macroeconomics The Great Depression of the 1930s led to the development of macroeconomics and aggregate demand tools to deal with recessions. Macro233 - JAFGAC The Historical Development of Modern Macroeconomics During the Depression, output fell by 30 percent and unemployment rose to 25 percent. People decided that if the market wasn’t creating jobs for them, the market must be at fault. Macro233 - JAFGAC From Classical to Keynesian Economics Pre-Depression economists are called Classical economists. They focused on long-run issues such as growth. Macro233 - JAFGAC From Classical to Keynesian Economics Depression-era economists are called Keynesians after economist John Maynard Keynes. They began to focus on short-run economic issues. Macro233 - JAFGAC From Classical to Keynesian Economics Keynes is the founder of modern macroeconomics and the author of The General Theory of Employment, Interest and Money. Macro233 - JAFGAC Classical Economics The Classical economists' approach was laissez-faire (leave the market alone). They felt the market was self-adjusting, They concentrated on the long-run and largely ignored the short-run. Macro233 - JAFGAC Classical Economics They used microeconomic supply and demand arguments to explain the Great Depression. Their solution to the high unemployment was to eliminate labor unions and government policies that kept wages too high. Macro233 - JAFGAC The Layperson's Explanation for Unemployment Laypeople believed that the depression was caused by an oversupply of goods that glutted the market. They wanted the government to hire the unemployed even if the work was not needed. Macro233 - JAFGAC The Layperson's Explanation for Unemployment Classical economists opposed deficit spending, arguing that the money to create jobs had to be borrowed. This money would have financed private economic activity and jobs, so everything would cancel out. Macro233 - JAFGAC The Essence of Keynesian Economics Keynes concentrated on the short run rather than the long run. He said: “In the long run we are all dead." By changing this approach, he created the macroeconomic framework that focuses on stabilization policy. Macro233 - JAFGAC The Essence of Keynesian Economics Keynes thought that the economy could get stuck in a rut as wages and price level adjusted to sudden changes in expenditures. Macro233 - JAFGAC The Essence of Keynesian Economics According to Keynes: a decrease in investment demand job layoffs fall in consumer demand firms decrease production more job layoffs further fall in consumer demand, and so forth Macro233 - JAFGAC The Essence of Keynesian Economics Keynes argued that, in times of recession, spending is a public good that benefits everyone. Aggregate demand management – government’s attempt to control the aggregate level of spending in the economy. Macro233 - JAFGAC Equilibrium Income Fluctuates Income is not fixed at the economy's longrun potential income – it fluctuates. For Keynes there was a difference between equilibrium income and potential income. Macro233 - JAFGAC Equilibrium Income Fluctuates Equilibrium income – the level toward which the economy gravitates in the short run because of the cumulative cycles of declining or increasing production. Macro233 - JAFGAC Equilibrium Income Fluctuates Potential income – the level of income that the economy technically is capable of producing without generating accelerating inflation. Macro233 - JAFGAC Equilibrium Income Fluctuates Keynes felt that at certain times the economy needed help to reach its potential income. He believed that market forces would not work fast enough and not be strong enough to get the economy out of a recession Macro233 - JAFGAC The Paradox of Thrift If a large number of people in the economy suddenly decided to save more and consume less, total spending would fall and unemployment would rise. Macro233 - JAFGAC The Paradox of Thrift Incomes would fall as people lost their jobs causing both consumption and saving to fall as well. The economy would reach a new equilibrium which could be at an almost permanent recession. Macro233 - JAFGAC The Paradox of Thrift This paradox of thrift is important to the Keynesian story. Paradox of thrift – an increase in savings can lead to a decrease in expenditures, decreasing output and causing a recession. Macro233 - JAFGAC The AS/AD Model The AS/AD model consists of three curves: The short-run aggregate supply curve. The aggregate demand curve. The long-run aggregate supply curve. Macro233 - JAFGAC The AS/AD Model The AS/AD model is fundamentally different from the microeconomic supply/demand model. Macro233 - JAFGAC The AS/AD Model Microeconomic supply/demand curves concern the price and quantity of a single good. Price is measured on the vertical axis and quantity is measured on the horizontal axis. The shapes are based on the concepts of substitution and opportunity cost. Macro233 - JAFGAC The AS/AD Model In the AS/AD model the price of everything is on the vertical axis and aggregate output is on the horizontal axis. Macro233 - JAFGAC The AS/AD Model The AS/AD model is an historical model that starts at a point in time and says what will happen when changes affect the economy. Macro233 - JAFGAC The Aggregate Demand Curve The aggregate demand (AD) curve shows how a change in the price level changes aggregate expenditures on all goods and services in an economy. It shows the level of expenditures that would take place at every price level in the economy. Macro233 - JAFGAC The Slope of the AD Curve The AD is a downward sloping curve. Aggregate demand is composed of the sum of aggregate expenditures. Expenditures = C + I + G +(X - M) Macro233 - JAFGAC The Slope of the AD Curve The slope of the AD curve is determined by the wealth effect, the interest rate effect, the international effect, and the multiplier effect. Macro233 - JAFGAC The Wealth Effect Wealth effect – a fall in the price level will make the holders of money and other financial assets richer, so they buy more. Most economists accept the logic of the wealth effect, however, they do not see the effect as strong. Macro233 - JAFGAC The Interest Rate Effect Interest rate effect – the effect a lower price level has on investment expenditures through the effect that a change in the price level has on interest rates. Macro233 - JAFGAC The Interest Rate Effect The interest rate effect works as follows: a decrease in the price level increase of real cash banks have more money to lend interest rates fall investment expenditures increase Macro233 - JAFGAC The International Effect International effect – as the price level falls (assuming exchange rates do not change), net exports will rise. Macro233 - JAFGAC The International Effect The international effect works as follows: a decrease in the price level in the U.S. the fall in price of U.S. goods relative to foreign goods U.S. goods become more competitive internationally U.S. exports rise and U.S. imports fall Macro233 - JAFGAC The Multiplier Effect Initial changes in expenditures set in motion a process in the economy that amplifies the initial effects. Multiplier effect – the amplification of initial changes in expenditures. Macro233 - JAFGAC The Multiplier Effect The multiplier effect works as follows: an increase in the price level in the U.S. U.S. exports fall and U.S. imports rise U.S. firms lose sales and cut output U.S. incomes fall U.S. households buy less U.S. firms cut back again and so on Macro233 - JAFGAC The Multiplier Effect The multiplier effect amplifies the initial wealth, interest rate, and international effects, making the AD curve flatter than it would have been. Macro233 - JAFGAC The AD Curve Price level Wealth, interest rate, and international effects P0 Multiplier effect P1 Aggregate demand Y0 Y1 Macro233 - JAFGAC Ye Real output How Steep Is the AD Curve Most economists agree that small changes in the price level result in relatively small changes in expenditures. This gives the AD curve a very steep slope. Macro233 - JAFGAC Shifts in the AD Curve Except for a change in the price level, anything that changes aggregate expenditures shifts the AD curve. Macro233 - JAFGAC Shifts in the AD Curve The main shift factors of aggregate demand are: Foreign income. Expectations about future output or prices. Exchange rate fluctuations. The distribution of income. Government policies. Macro233 - JAFGAC Foreign Income When U.S. trading partners go into a recession, the demand for U.S. goods (exports) will fall. The U.S. AD curve shifts to the left. Macro233 - JAFGAC Foreign Income A rise in foreign income leads to an increase in U.S. exports and a rightward shift of the U.S. AD curve. Macro233 - JAFGAC Exchange Rates When a currency loses value relative to other currencies: Export goods produced in that country become less expensive. Imports into that country become more expensive. Macro233 - JAFGAC Exchange Rates Foreign demand for its goods increases. Its demand for foreign goods decreases. The AD curve will shift to the right. When a currency gains value, the AD curve shifts to the left. Macro233 - JAFGAC Expectations About Future Output If businesses expect demand to be high in the future, they will want to increase their capacity to produce. The demand for investment will increase. The AD curve will shift to the right. Macro233 - JAFGAC Expectations About Future Output When consumers expect the economy to do well in the future, they will spend more now. The AD curve shifts to the right. Macro233 - JAFGAC Expectations of Future Prices It pays to buy now if you expect prices to rise in the future. The AD curve will shift to the right. The is most acutely felt in a hyperinflation. Macro233 - JAFGAC Distribution of Income Wage earners tend to spend a greater percentage of their income than earners of profit income. It is likely that AD will shift to the right if the distribution of income moves from earners of profit to wage earners. Macro233 - JAFGAC Monetary and Fiscal Policy Macro policy makers think they can control the AD curve to some extent. If the federal government spends lots of money, AD shifts to the right. If it raises taxes, household incomes will fall, they will spend less, AD shifts to the left. Macro233 - JAFGAC Monetary and Fiscal Policy When the Federal Reserve Bank expands the money supply, it can often lower interest rates. AD will shift to the right. Macro233 - JAFGAC Monetary and Fiscal Policy Macro policy – deliberate shifting of the AD curve. Expansionary macro policy shifts the curve to the right. Contractionary macro policy shifts it to the left. Macro233 - JAFGAC Multiplier Effects of Shift Factors Because of the multiplier effect, a change in a shift factor of the AD curve moves the curve by more than the initial shift. Macro233 - JAFGAC Effect of a Shift Factor on the AD Curve Price level Initial effect 100 200 Multiplier effect P0 Change in total expenditures AD0 300 AD1 Initial effect Real output Macro233 - JAFGAC Effect of a Shift Factor on the AD Curve Initial effect Price level P0 Multiplier effect 100 200 AD0 Change in total expenditures = 300 AD1 Real output Macro233 - JAFGAC The Short-Run Aggregate Supply Curve The short-run aggregate supply (SAS) curve specifies how a shift in the aggregate demand curve affects the price level and real output in the short run, other things constant. Macro233 - JAFGAC Price level The Short-Run Aggregate Supply Curve SAS Real output Macro233 - JAFGAC The Slope of the SAS Curve The SAS curve is upward-sloping. The SAS curve reflects two different types of microeconomic markets in our economy. Auction markets – markets represented by the supply/demand model. Posted-price markets – prices are set by the producers and change only infrequently. Macro233 - JAFGAC The Slope of the SAS Curve Posted-price markets are often called quantity-adjusting markets. Quantity-adjusting markets – markets in which firms respond to changes in demand primarily by modifying their output instead of changing their prices. Macro233 - JAFGAC The Slope of the SAS Curve Prices change in quantity-adjusting markets for two reasons. Markups in posted-price markets are not totally fixed. Because raw materials are often sold in auction markets, a change in AD will change input prices. Macro233 - JAFGAC Shifts in the SAS Curve The AS curve shifts when a shift factor changes – other things are not constant: Changes in input prices. Changes in expectations of inflation. Productivity. Excise and sales taxes. Import prices. Macro233 - JAFGAC Changes in Input Prices When input prices are raised, the curve shifts up. When input prices are lowered, the curve shifts down. Macro233 - JAFGAC Changes in Expectations of Inflation Expectations of inflation is a shift factor that works through wages. If workers expect 2 percent inflation, they will push for a wage increase of at least 2 percent. Macro233 - JAFGAC Changes in Factor Productivity An increase in productivity reduces the cost of production and shifts the AS curve down. A decrease in productivity shifts the curve up. Macro233 - JAFGAC Changes in Import Prices Import prices are a component of an economy’s price level. The SAS curve shifts up when import prices rise. It shifts down when import prices fall. Macro233 - JAFGAC Changes in Excise and Sales Taxes Higher sales taxes shift the SAS curve up. Lower sales taxes shift the curve down. Macro233 - JAFGAC Input Prices and Labor Productivity Economists use a rule of thumb combining the wage component of input prices and labor productivity. % change in the price level = % change in wages – % change in productivity Macro233 - JAFGAC Price level Shifts in the SAS Curve SAS1 Input prices increase SAS0 Real output Macro233 - JAFGAC The Long-Run Aggregate Supply Curve The long-run aggregate supply curve shows the long-run relationship between output and the price level. Macro233 - JAFGAC The Long-Run Aggregate Supply Curve The LAS is vertical. At potential output, a rise in the price level means that all prices, including input prices rise. Macro233 - JAFGAC Price level The Long-Run Aggregate Supply Curve Long-run aggregate supply (LAS) Real output Macro233 - JAFGAC A Range for Potential Output and the LAS Curve The position of the long-run aggregate supply curve is determined by potential output. Potential output – the amount of goods and services an economy can produce when both labor and capital are fully employed. Macro233 - JAFGAC A Range for Potential Output and the LAS Curve Potential output is considered to be a range of values. Resources are likely to be underutilized at points on the SAS to the left of the LAS. Factor prices would likely fall and the SAS curve would shift down. Macro233 - JAFGAC A Range for Potential Output and the LAS Curve Potential output is considered to be a range of values. Resources are likely to be overutilized at points on the SAS to the right of the LAS. Factor prices would likely rise and the SAS curve would shift up. Macro233 - JAFGAC A Range for Potential Output and the LAS Curve Real output LAS A Underutilized resources Low-level potential output Macro233 - JAFGAC C B SAS Overutilized resources High-level Real output potential output Shifts in the LAS Curve The LAS curve will shift whenever there is a changes in: Capital. Available resources. Growth-compatible institutions. Technological development. Entrepreneurship. Macro233 - JAFGAC Equilibrium in the Aggregate Economy Changes in the SAS, AD, and LAS curves affect short-run and long-run equilibrium. Macro233 - JAFGAC Short-Run Equilibrium Short-run equilibrium is where the AS and AD curves intersect. Macro233 - JAFGAC Short-Run Equilibrium Increases (decreases) in aggregate demand lead to higher (lower) real output and higher (lower) price level. Upward (downward) shift the SAS curve lead to lower (higher) real output and higher (lower) price level. Macro233 - JAFGAC Price level Short-Run Equilibrium: Shift in Aggregate Demand SAS P1 P0 E F AD1 AD0 Y0 Macro233 - JAFGAC Y1 Real output Price level Short-Run Equilibrium: Shift in Aggregate Supply P1 SAS1 G SAS0 E P0 AD Y1 Macro233 - JAFGAC Y0 Real output Long-Run Equilibrium Long-run equilibrium is where the AD and long-run aggregate supply curves intersect. In the long run, output is fixed and the price level is variable. Macro233 - JAFGAC Long-Run Equilibrium Aggregate demand determines the price level. Increases (decreases) in aggregate demand lead to higher (lower) prices. Macro233 - JAFGAC Long-Run Equilibrium: Shift in Aggregate Demand Price level P1 P0 LAS H E AD1 AD0 Y0 Macro233 - JAFGAC Real output Integrating the Short-Run and Long-Run Frameworks The economy is in both short-run and longrun equilibrium when all three curves intersect in the same location. Macro233 - JAFGAC Integrating the Short-Run and Long-Run Frameworks The ideal situation is for aggregate demand to grow at the same rate as aggregate supply and potential output. Unemployment and growth are at their target rates with no inflation. Macro233 - JAFGAC Long-Run Equilibrium Price level LAS P0 E SAS AD YP Macro233 - JAFGAC Real output The Recessionary Gap A recessionary gap is the amount by which equilibrium output is below potential output. Macro233 - JAFGAC The Recessionary Gap If the economy remains at this level for a long time, there would be an excess supply of factors of production. Costs and wages would tend to fall. Macro233 - JAFGAC The Recessionary Gap As factor prices fall, the SAS curve will shift down to eliminate the recessionary gap. Macro233 - JAFGAC The Recessionary Gap Price level LAS P0 P1 A B SAS1 AD Recessionary gap Y1 Macro233 - JAFGAC SAS0 YP Real output The Inflationary Gap The inflationary gap occurs when the economy is above potential that exists at the current price level. Factor prices rise causing the SAS curve to shift up. The price level rises, and the inflationary gap is eliminated. Macro233 - JAFGAC The Inflationary Gap Price level LAS D P2 P0 SAS2 C SAS0 AD Inflationary gap YP (c) Macro233 - JAFGAC Y2 Real output The Economy Beyond Potential When the economy operates below its potential, firms can hire additional factors of production without increasing production costs. Once the economy reaches its potential output, that is no longer possible. Macro233 - JAFGAC The Economy Beyond Potential As firms compete for resources, costs rise beyond productivity increases. The short-run AS curve shifts up and the price level rises. Macro233 - JAFGAC The Economy Beyond Potential The economy will slow down by itself or the government will step in with a policy to contract output and eliminate the inflationary gap. Macro233 - JAFGAC Aggregate Demand Policy Fiscal policy – the deliberate change in either government spending or taxes to stimulate or slow down the economy. Macro233 - JAFGAC Aggregate Demand Policy Expansionary fiscal policy is appropriate if aggregate income is too low. The deficit should be increased by decreasing taxes or increasing government spending. The AD curve shifts to the right. Macro233 - JAFGAC Aggregate Demand Policy Contractionary fiscal policy is appropriate if aggregate income is too high. The deficit should be decreased by increasing taxes or decreasing government spending. The AD curve shifts to the left. Macro233 - JAFGAC Expansionary Fiscal Policy Price level LAS P1 P0 AS Y0 Macro233 - JAFGAC AD1 A YP AD0 Real output Contractionary Fiscal Policy Price level LAS B P2 AS AD0 AD2 YP Macro233 - JAFGAC Y2 Real output Some Additional Policy Examples Unemployment is 12 percent and there is no inflation. What policy would you recommend? Use expansionary fiscal policy to shift the AD curve out to its potential income. Macro233 - JAFGAC Expansionary Fiscal Policy Price level P1 P0 LAS B SAS AD1 A AD0 Y0 Macro233 - JAFGAC YP Real output Some Additional Policy Examples Unemployment is at its target rate and it is likely that consumer expenditures will rise. What policy would you recommend? Use contractionary fiscal policy to shift the AD curve inward to counteract the expected increase in AD. Macro233 - JAFGAC Contractionary Fiscal Policy Price level LAS B P1 SAS AD0 AD2 YP Macro233 - JAFGAC Y1 Real output Some Additional Policy Examples What would have happened if the government didn’t institute a contractionary fiscal policy? There would be an inflationary gap which would increase factor prices. The SAS curve would shift up until it intersects the AD curve at YP. Macro233 - JAFGAC Economy Above Potential Price level LAS SAS1 E P1 D SAS0 P0 C AD1 AD0 YP Macro233 - JAFGAC Y1 Real output Fiscal Policy in World War II The deficit increased greatly during World War II. Real GDP grew by even more than the increase in the deficit. Wartime wage and price controls prevented the SAS curve from shifting up. Macro233 - JAFGAC Fiscal Policy in World War II Although World War II expanded the economy, that doesn’t mean wars are good for the economy. The production of military goods increased, but the production of consumer goods decreased. Many people were killed or permanently disabled. Macro233 - JAFGAC War Finance: Expansionary Fiscal Policy Year 1937 1938 1939 1940 1941 1942 1943 1944 1945 1946 GDP Deficit (billions of 1958 dollars) (billions of Dollars) $ 90 84 90 99 124 157 191 210 211 208 $ -2.8 -1.0 -2.9 -2.7 -4.8 -19.4 -53.8 -46.1 -45.0 -18.2 McGraw-Hill/Irwin Unemployment rate 14.3% 19.0 17.2 14.6 9.9 4.7 1.9 1.2 1.9 3.9 LAS SAS AD1 AD0 $90 $208 Real output (in billions of dollars) © 2004 The McGraw-Hill Companies, Inc., All Rights Reserved. U.S. Economic Expansion The economy boomed during the late 1990s and early 2000s. The budget went from a large deficit to a large surplus. Macro233 - JAFGAC U.S. Economic Expansion Significant increases in consumer and investment spending offset the contractionary effect of the surplus. The surplus was more due to a booming economy than due to contractionary policy. Macro233 - JAFGAC U.S. Economic Expansion During 2000-2001, political pressures increased government spending and cut taxes which led to a shrinking surplus. The tax cut came just at the right time because the economy moved into a recession in mid-2001. Macro233 - JAFGAC Macro Policy Is More Complicated Than It Looks Using the AS/AD model to analyze the economy is more complicated than it looks. Implementing fiscal policy. Estimating potential output. Effectiveness of fiscal policy. Macro233 - JAFGAC The Problem of Implementing Fiscal Policy There is no guarantee that government will do what the economy needs to be done. Implementing government spending and tax changes is a slow legislative process. Government spending and tax decisions are made for political rather than for economic reasons. Macro233 - JAFGAC The Problem of Estimating Potential Output Increasing AD when the economy is operating at its potential will accelerate inflation by shifting up the SAS curve. Macro233 - JAFGAC The Problem of Estimating Potential Output One way of estimating potential output is to estimate the target rate of unemployment. Target rate of unemployment – the rate below which inflation began to accelerate in the past. Macro233 - JAFGAC The Problem of Estimating Potential Output Unfortunately, the target rate of unemployment fluctuates and is difficult to predict. For example, there is structural but no cyclical unemployment at potential output – it is difficult to differentiate between the two. Macro233 - JAFGAC The Problem of Estimating Potential Output Another way to determine potential output is to add the normal growth factor (3%) the economy’s previous level. Estimating the economy’s potential from past growth rates is complicated by potentially dramatic changes in regulations, technology, and expectations. Macro233 - JAFGAC The Questionable Effectiveness of Fiscal Policy The effectiveness of fiscal policy depends on the government’s ability to perceive a problem and react appropriately to it. Macro233 - JAFGAC The Questionable Effectiveness of Fiscal Policy Countercyclical fiscal policy – fiscal policy in which the government offsets any change in aggregate expenditures that would create a business cycle. Macro233 - JAFGAC The Questionable Effectiveness of Fiscal Policy Most economists agree that the government is unable to fine tune the economy. Fine tuning – fiscal policy designed to keep the economy always at its target or potential level of income. Macro233 - JAFGAC Aggregate Demand, Aggregate Supply, and Modern Macroeconomics End of Chapter 9 Macro233 - JAFGAC