* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download LEC2

Survey

Document related concepts

Fei–Ranis model of economic growth wikipedia , lookup

Ragnar Nurkse's balanced growth theory wikipedia , lookup

Steady-state economy wikipedia , lookup

Production for use wikipedia , lookup

Uneven and combined development wikipedia , lookup

Okishio's theorem wikipedia , lookup

Transcript

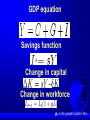

The Neoclassical Growth Model Dr. Imtithal AL-Thumairi Webpage:http://www-users.york.ac.uk/~iaat100/ The Exogenous growth model, also known as the Neo-classical model or Solow growth model is a term used to sum up the contributions of various authors to a model of long-run economic growth within the framework of neoclassical economics. The most important contribution was probably the work done by Robert Solow; in 1956, Solow and T.W.Swan. developed a relatively simple growth model which fit available data on US economic growth with some success. Solow received the 1987 Nobel Prize in Economics for his work on the model. Solow extended the HarrodDomar model by: Adding labour as a faactor of production; Requiring diminishing returns to labour and capital separately, and constant returns to scale for both factors combined; Introducing a time-varying technology variable distinct from capital and labor. Short run implications Policy measures like tax cuts or investment subsidies can affect the steady state level of output but not the long-run growth rate. Growth is affected only in the short-run as the economy converges to the new steady state output level. The rate of growth as the economy converges to the steady state is determined by the rate of capital accumulation. Capital accumulation is in turn determined by the savings rate (the proportion of output used to create more capital rather than being consumed) and the rate of capital depreciation. Long run implications In neoclassical growth models, the long-run rate of growth is Exogenously determined - in other words, it is determined outside of the model. A common prediction of these models is that an economy will always converge towards a steady state rate of growth, which depends only on the rate of technological progress and the rate of labor force growth. A country with a higher saving rate will experience faster growth, e.g. Singapore had a 40% saving rate in the period 1960 to 1996 and annual GDP growth of 5-6%, compared with Kenya in the same time period which had a 15% saving rate and annual GDP growth of just 1%. Assumptions Capital is subject to diminishing returns. Given a fixed stock of labor, the impact on output of the last unit of capital accumulated will always be less than the one before. Empirical evidence A key prediction of neoclassical growth models is that the income levels of poor countries will tend to catch up with or converge towards the income levels of rich countries. The evidence is stronger for convergence within countries. For instance the per-capita income levels of the southern states of the United States have tended to converge to the levels in the Northern states. Criticisms of the model failure to take account of other issues can affect economic growth as the strength of institutions (which facilitate economic growth). it does not explain how or why technological progress occurs This failing has led to the development of endogenous growth theroy, which endogenizes technological progress and/or knowledge accumulation. Graphical representation of the model The model starts with a neoclassical production function Y/L = F(K/L), rearranged to y = f(k), which is the orange curve on the graph. From the production function; output per worker is a function of capital per worker. The production function assumes diminishing returns to capital in this model, as denoted by the slope of the production function. The model and changes in the saving rate an increase in the saving rate shifts the function up. Saving per worker is now greater than population growth plus depreciation, so capital accumulation increases, shifting the steady state from point A to B. output per worker correspondingly moves from y0 to y1. The model and changes in population the population has now increased from n to n1 The production function and the saving rate do not change As there is now a bigger labour force, but the same amount of investment (saving), saving per worker decreases, and therefore the steady state shifts down from A to B. Capital per worker has decreased from k0 to k1, saving per worker has decreased from sy0 to sy1, and output per worker has correspondingly decreased from y0 to y1 Mathematical framework The Solow growth model can be described by the interaction of five basic macroeconomic equations: Macro-production function GDP equation Savings function Change in capital Change in workforce Macro-production function This is a Cobb-Douglas function where Y represents the total production in an economy. A represents multifactor productivity (often generalized as technology), K is capital and L is labour. GDP equation Savings function Change in capital Change in workforce gL is the growth function for L.