* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Chapter 12

Survey

Document related concepts

Transcript

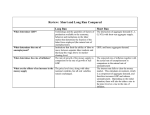

12.0 The Basic Macro Model 12.1.1 Each micro concept has an analogous macro concept price : Price Level (P) quantity exchanged: real GDP (Y) The Macro Picture P AS P* AD Y* YF Figure 12.1.1 - Our Macro Picture Y In this picture, Price level is on the vertical axis Real GDP is on the horizontal axis YF is full employment or full GDP 12.1.2 AD - aggregate demand AS - aggregate supply The intersection of these curves represents the current conditions in the macroeconomy More inflation P Y More real GDP More employment Less unemployment 12.1.3 - A preview Great Depression caused by a great fall in AD More on the specifics later, but look what happens P AS Fall in AD P P' AD AD' Y2 Y1 YF Figure 12.1.2 - Fall in AD and the Great Depression Y After Pearl Harbor war means big increase in AD, for reasons we’ll also see later P Rise in AD AS P*' P* AD' AD Y1 YF Y2 Figure 12.1.3- World War II and Expanding AD Y Further, it is not just AD which can move AS moves due to changes in input prices, as you will see in greater detail later Ex. Oil shocks of the 1970’s AS' P AS Shift up in AS P*' P* AD Y2 Y1 YF Figure 12.1.4 - Oil Price Shocks and AS Shifting Up Y This should give you some idea about how useful this macro picture can be in explaining the world We now need to look at each line in detail 12.2.1 Aggregate Demand (AD) is the sum of all the stuff that individuals and firms and governments are prepared to buy in a given year How much they actually demand depends on how much things cost The total amount planned to be spent is called Aggregate Expenditure (AE) AE is a nominal measure measured in current dollars The AD line represents the relationship between real GDP demanded and the price level for a given level of aggregate expenditure In functional form Y = AD (P | AE) AD slopes downward given constant AE because as price level (P) falls, constant AE buys more real GDP (Y) AE is the shift variable more AE shifts AD to the right P P3 P2 P1 AD' AD Y3 Y2 Y3' Y1 Y2' Y1' Figure 12.2.1 - Increase in AE Shifting AD to the Right Y 12.2.2 AE is a huge number There are six components of AE AE = C + I + G - T + X - M Consumption (C) nominal value of spending done by households (stuff you buy) Investment (I) nominal amount spent by firms on plants, equipment Government Spending (G) nominal amount government spends planes, tanks, schools, etc. Taxes (T) money taken out of hands of households by government this represents net taxation - doesn’t count transfer payments like Social Security where gov’t passes resources from one group to another (G-T) is the government budget position Exports (X) money spent by foreigners on U.S. products Imports (M) money spent by U.S. citizens on foreign goods (X-M) is the trade balance 12.2.3 Y = AD (P | AE) while AE = C + I + (G - T) + (X - M) so Y = AD (P | C, I, G, T, X, M) a change in any of these six variables shifts AD An increase in C, G, I, or X will move AD right if P stays the same, Y will increase as each of these three increases Ex. An increase in G P AD AD´ Y The same is true for an increase in C, I or X The reverse is true for T or M because they have a negative sign in front of them What moves AD? AD moves right when: AD moves left when: Increase in C,G,I,X Decrease in T,M Decrease in C,G,I,X Increase in T,M Example - Great Depression Year 1929 1930 1931 1932 1933 Investment (I) 34.2 23.3 14.7 3.3 3.7 Real GDP (Y) 175.9 159.2 147.7 125.3 123.4 Unemployment rate 3.2 8.7 15.9 23.6 24.9 Decrease in I moves AD left, ceteris paribus P Collapse of Investment Contributes to Huge AD Fall AS AD AD' Y' Y Figure 12.2.3 - The Great Depression YF Y 12.2.4 Outbreak of WWII after Pearl Harbor Huge increase in G moves AD right, ceteris paribus P War Production Demand Pushes AD Way Out AS AD' AD Y YF Y' Figure 12.2.4 - From The Great Depression to World War II Y This push moved the economy beyond sustainable capacity people and machines can’t keep up that pace forever notice what happens to price level as you move further and further right inflation starts to become an issue 12.3.1 Aggregate supply line represents the relationship between the Price level and real GDP produced by the economy Actually, there are two different lines Long-run aggregate supply Represents situation when all micro adjustments have been completed under the nice assumptions Most efficient condition – biggest pie Full GDP – Full employment The LAS line Vertical line at full employment Full, sustainable capacity is determined by Initial endowment – that society’s natural resources, labor, and capital It is vertical because in the long-run, real GDP is independent of the price level P LAS YF Figure 12.3.1 - Long Run Aggregate Supply (LAS) Y 12.3.2 In the very long run endowment changes can shift LAS Population growth, new innovations, new natural resources can move LAS steadily rightward Natural disasters, war can move LAS leftward We will assume That the LAS remains stationary in order to focus on the long run macroeconomy We will use LAS as our orientation line for full employment 12.3.3 Short-run aggregate supply line (AS) In the short run, we assume that not all markets have had time to adjust Specifically, factor markets have not adjusted Along an AS line, factor prices (like wages) are constant P LAS YF Figure 12.3.2 - Short Run Aggregate Supply AS Y 12.3.4 The AS line has three distinct segments They are labeled k, l, and m P LAS AS m k l YF Figure 12.3.3 - AS Line Divided Into Segments Y k-segment is significantly below full-employment real GDP large quantities of idle factors exist Under these circumstances, you can hire more people and increase production without the price level increasing 12.3.5 l-segment real GDP approaches, and then meets sustainable full employment GDP Bottlenecks may begin to occur, because not all industries might reach capacity at the same time Cost pressures might lead to higher output prices Shape of l-segment is important to understanding inflation 12.3.6 m-segment economy reaches limit of short-term capacity These three distinct segments make up the AS curve You can surge beyond what is sustainable for a while, but people and machines can not work 24 hours a day forever. Ex. Wartime Further production pressure just increases the price level because exhausted, unproductive workers are being paid double- or triple-time to work those extra hours Chart p.187 shows WWII effect Inflation only stopped by gov’t price controls 12.3.7 AS curves shift due to changes in factor prices These factor price changes are the exogenous variables in this relationship These exogenous shocks are called aggregate supply shocks Ex. Oil prices, wages P AS' AS A Shift Up in AS Due to Rising Factor Prices Y Figure 12.3.4 - A Shift Up in AS Due to Rising Factor Prices 12.4.1 Combining AD, LAS, and AS Putting the tool kit together LAS P Falling AD AS AD AD' Y' Y YF Figure 12.4.1 - Increasing Unemployment Due to Falling Aggregate Demand Y P LAS AS AS' P P' AD Y Y' YF Figure 12.4.2 - Falling Unemployment and Falling Price Level As AS Shifts Down Due to Falling Factor Prices Y Effect of Falling Factor Prices AS' P LAS AS Effect of Rising Factor Prices P' P AD Y' Y YF Y Figure 12.4.3 - Increasing Unemployment and Rising Price Level As AS Shifts Up Due to Rising Factor Prices LAS P AS P' AD' P AD Y YF Y' Figure 12.4.4 - Falling Unemployment and Rising Price Level Due to Increasing Aggregate Demand Y 12.4.2 More complex case – a wage/price spiral As inflation occurs, workers lose value if their nominal wage remains the same They take steps to account for inflation by demanding wage increases in order to maintain their standard of living This is easier to do when unemployment is low (who else are you going to get, boss?) This is called a tight labor market Inflation set off by expanding AD sets off a wage response When wages increase, AS shifts up If AD continues to shift outward the net result after several of these is as follows: LAS P AS' AS O 3 O 1 O 4 O 2 AD" AD' AD YF Figure 12.4.5 - A Wage-Price Spiral Y People would often index their wages to the CPI in labor contracts, Making this spiral even more likely Wage/price spirals can become very persistent 12.4.3 Now that we have a tool to represent various macro conditions We can look at the forces that cause the curves to move