* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Chapter 17 - Aggregate Demand and Aggregate Supply

Survey

Document related concepts

Transcript

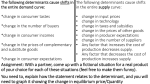

Chapter 17 Aggregate Demand and Aggregate Supply INTRODUCTION TO ECONOMICS 2e / LIEBERMAN & HALL CHAPTER 17 / AGGREGATE DEMAND AND AGGREGATE SUPPLY ©2005, South-Western/Thomson Learning Slides by John F. Hall Animations by Anthony Zambelli Figure 1: The Two-Way Relationship Between Output and the Price Level Aggregate Demand Curve Price Level Real GDP Aggregate Supply Curve Lieberman & Hall; Introduction to Economics, 2005 2 The Price Level and The Money Market First effect of a change in the price level occurs in the money market Rise in the price increases the demand for money and shifts the money demand curve rightward It makes purchases more expensive Drop in the price level • Makes purchases cheaper • Decreases the demand for money • Shifts the money demand curve leftward Rise in the price level causes the interest rate to rise and interest-sensitive spending to fall Equilibrium GDP decreases by a multiple of the decrease in interest-sensitive spending Lieberman & Hall; Introduction to Economics, 2005 3 The Price Level and Net Exports The second effect of a higher price level brings in the foreign sector A rise in the price level causes Net exports to drop and Equilibrium GDP to decrease by a multiple of the drop in net exports Lieberman & Hall; Introduction to Economics, 2005 4 Deriving The Aggregate Demand (AD) Curve Figure 2 plots the price level on a vertical axis and the economy’s real GDP on the horizontal axis If we continued to change the price level to other values we would find that each different price level results in a different equilibrium GDP The aggregate demand (AD) curve tells us the equilibrium real GDP at any price level Lieberman & Hall; Introduction to Economics, 2005 5 Figure 2: Deriving the Aggregate Demand Curve Price Level 140 K J 100 AD 6 Lieberman & Hall; Introduction to Economics, 2005 10 Real GDP ($ Trillions) 6 Movements Along The AD Curve A variety of events can cause the price level to change, and move us along the AD curve It’s important to understand what happens in the economy as we make such a move Opposite sequence of events will occur if the price level falls, moving us rightward along the AD curve Lieberman & Hall; Introduction to Economics, 2005 7 Shifts of The AD Curve The distinction between movements along the AD curve and shifts of the curve itself is very important Always keep the following rule in mind • When a change in the price level causes equilibrium GDP to change, we • move along the AD curve Whenever anything other than the price level causes equilibrium GDP to change, the AD curve itself shifts What are these other influences on GDP? Equilibrium GDP will change whenever there is a change in any of the following • • • • • • Government spending Taxes Autonomous consumption spending Investment spending The money supply curve The money demand curve Lieberman & Hall; Introduction to Economics, 2005 8 Spending Shocks Spending shocks initially affect the economy by changing total spending And then changing output by a multiple of that original change in spending The AD curve shifts rightward when government purchases, investment spending, autonomous consumption spending, or net exports increase, or when taxes decrease The AD curve shifts leftward when government purchases, investment spending, autonomous consumption spending, or net exports decrease, or when taxes increase Lieberman & Hall; Introduction to Economics, 2005 9 Figure 3: A Spending Shock Shifts the AD Curve Price Level 100 H E AD1 10 Lieberman & Hall; Introduction to Economics, 2005 15 AD2 Real GDP ($ Trillions) 10 Changes in the Money Market Changes that originate in the money market will also shift the aggregate demand curve An increase in the money supply shifts the AD curve rightward A decrease in the money supply shifts the AD curve leftward Lieberman & Hall; Introduction to Economics, 2005 11 Figure 4(a): Effects of Key Changes on the Aggregate Demand Curve (a) Price Level Price level ↑ moves us leftward along the AD curve P3 Price level ↓ moves us rightward along the AD curve P1 P2 AD Q3 Lieberman & Hall; Introduction to Economics, 2005 Q1 Q2 Real GDP 12 Figure 4(b): Effects of Key Changes on the Aggregate Demand Curve (b) Price Level Entire AD curve shifts rightward if: • a, IP, G, or NX increases • Net taxes decrease • The money supply increases AD2 AD1 Real GDP Lieberman & Hall; Introduction to Economics, 2005 13 Figure 4(c): Effects of Key Changes on the Aggregate Demand Curve (c) Price Level Entire AD curve shifts leftward if: • a, IP, G, or NX decreases decreases • Net taxes increase • The money supply decreases AD1 AD2 Real GDP Lieberman & Hall; Introduction to Economics, 2005 14 The Aggregate Supply Curve On the one hand, changes in the price level affect output On the other hand, changes in output affect the price level This relationship—summarized by the aggregate supply curve—is the focus of this section The effect of changes in output on the price level is complex, involving a variety of forces Lieberman & Hall; Introduction to Economics, 2005 15 Costs and Prices Price level in economy results from pricing behavior of millions of individual business firms In any given year, some of these firms will raise their prices, and some will lower them Often, all firms in the economy are affected by the same macroeconomic event Causing prices to rise or fall throughout the economy To understand how macroeconomic events affect the price level, we begin with a very simple assumption A firm sets price of its products as a markup over cost per unit Lieberman & Hall; Introduction to Economics, 2005 16 Costs and Prices Percentage markup in any particular industry will depend on degree of competition there In macroeconomics, we are not concerned with how the markup differs in different industries But rather with average percentage markup in economy • Determined by competitive conditions • Competitive structure changes very slowly, so average percentage markup should be somewhat stable from year-to-year But a stable markup does not necessarily mean a stable price level, because unit costs can change In short-run, price level rises when there is an economy-wide increase in unit costs • Price level falls when there is an economy-wide decrease in unit costs Lieberman & Hall; Introduction to Economics, 2005 17 GDP, Costs, and the Price Level Why should a change in output affect unit costs and price level? As total output increases • Greater amounts of inputs may be needed to produce a unit of output • Price of non-labor inputs rise • Nominal wage rate rises A decrease in output affects unit costs through the same three forces, but with opposite result Lieberman & Hall; Introduction to Economics, 2005 18 The Short Run All three of our reasons are important in explaining why a change in output affects price level They operate within different time frames Our third explanation—changes in nominal wage rate—is a different story For a year or more after a change in output, changes in average nominal wage are less important than other forces that change unit costs Lieberman & Hall; Introduction to Economics, 2005 19 The Short Run Some of the more important reasons why wages in many industries respond so slowly to changes in output Many firms have union contracts that specify wages for up to three years Wages in many large corporations are set by slowmoving bureaucracies Wage changes in either direction can be costly to firms Firms may benefit from developing reputations for paying stable wages Lieberman & Hall; Introduction to Economics, 2005 20 The Short Run Nominal wage rate is fixed in short-run We assume that changes in output have no effect on nominal wage rate in short-run Since we assume a constant nominal wage in short-run, a change in output will affect unit costs through the other two factors In short-run, a rise (fall) in real GDP, by causing unit costs to increase (decrease), will also cause a rise (decrease) in price level Lieberman & Hall; Introduction to Economics, 2005 21 Deriving the Aggregate Supply Curve Figure 5 summarizes discussion about effect of output on price level in short-run Each time we change level of output, there will be a new price level in short-run Giving us another point on the figure If we connect all of these points, we obtain economy’s aggregate supply curve • Tells us price level consistent with firms’ unit costs and their percentage markup at any level of output over short-run A more accurate name for AS curve would be “short-run-price-level-at-each-output-level” curve Lieberman & Hall; Introduction to Economics, 2005 22 Figure 5: The Aggregate Supply Curve Price Level AS 130 B 100 80 Starting at point A, an increase in output raises unit costs. Firms raise prices, and the overall price level rises. A C Starting at point A, a decrease in output lowers unit costs. Firms cut prices, and the overall price level falls. 6 Lieberman & Hall; Introduction to Economics, 2005 10 13.5 Real GDP ($ Trillions) 23 Movements Along the AS Curve When a change in output causes price level to change, we move along economy’s AS curve What happens in economy as we make such a move? As we move upward along AS curve, we can represent what happens as follows Lieberman & Hall; Introduction to Economics, 2005 24 Shifts of the AS Curve Figure 5 assumed that a number of important variables remained unchanged Unit costs sometimes change for reasons other than a change in output In general, we distinguish between a movement along AS curve, and a shift of curve itself, as follows When a change in real GDP causes the price level to change, we move along AS curve • When anything other than a change in real GDP causes price level to change, AS curve itself shifts What can cause unit costs to change at any given level of output? Changes in world oil prices Changes in the weather Technological change Nominal wage, etc. Lieberman & Hall; Introduction to Economics, 2005 25 Figure 6: Shifts of the Aggregate Supply Curve AS2 Price Level 140 100 AS1 L A 10 Lieberman & Hall; Introduction to Economics, 2005 When unit costs rise at any given real GDP, the AS curve shifts upward–e.g., an increase in world oil prices or bad weather for farm production. Real GDP ($ Trillions) 26 Figure 7(a): Effects of Key Changes on the Aggregate Supply Curve (a) Price Level AS Real GDP ↑ moves us rightward along the AS curve P3 Real GDP ↓ moves us leftward along the AS curve P1 P2 Q2 Lieberman & Hall; Introduction to Economics, 2005 Q1 Q3 Real GDP 27 Figure 7(b): Effects of Key Changes on the Aggregate Supply Curve (b) Price Level AS2 AS1 Entire AS curve shifts upward if unit costs ↑ for any reason besides an increase in real GDP Real GDP Lieberman & Hall; Introduction to Economics, 2005 28 Figure 7(c): Effects of Key Changes on the Aggregate Supply Curve (c) Price Level AS1 AS2 Entire AS curve shifts downward if unit costs ↓ for any reason besides an decrease in real GDP Real GDP Lieberman & Hall; Introduction to Economics, 2005 29 AD and AS Together: Short-Run Equilibrium Where will the economy settle in short-run? Where is our short-run macroeconomic equilibrium? • In equilibrium, economy must be at some point on AD curve • Short-run equilibrium requires economy be operating on its AS curve Only when economy is at point E—on both curves—will we have reached a sustainable level of real GDP and the price level Lieberman & Hall; Introduction to Economics, 2005 30 Figure 8: Short-Run Macroeconomic Equilibrium AS Price Level B 140 E 100 F AD 6 Lieberman & Hall; Introduction to Economics, 2005 10 14 Real GDP ($ Trillions) 31 What Happens When Things Change? Our short-run equilibrium will change when either AD curve, AS curve, or both, shift An event that causes AD curve to shift is called a demand shock An event that causes AS curve to shift is called a supply shock In earlier chapters, we’ve used phrase spending shock A change in spending by one or more sectors that ultimately affects entire economy Demand shocks and supply shocks are just two different categories of spending shocks Lieberman & Hall; Introduction to Economics, 2005 32 An Increase in Government Purchases Shifts AD curve rightward Can see how it affects economy in short-run Process we’ve just described is not entirely realistic Assumes that when government purchases rise, first output increases, and then price level rises In reality, output and price level tend to rise together Lieberman & Hall; Introduction to Economics, 2005 33 Figure 9: The Effect of a Demand Shock AS Price Level 130 115 100 H J E AD1 10 Lieberman & Hall; Introduction to Economics, 2005 13.5 12.5 AD2 Real GDP($ Trillions) 34 An Increase in Government Purchases Can summarize impact of price-level changes When government purchases increase, horizontal shift of AD curve measures how much real GDP would increase if price level remained constant • But because price level rises, real GDP rises by less than horizontal shift in AD curve Lieberman & Hall; Introduction to Economics, 2005 35 An Decrease in Government Purchases Lieberman & Hall; Introduction to Economics, 2005 36 An Increase in the Money Supply Although monetary policy stimulates economy through a different channel than fiscal policy Once we arrive at AD and AS diagram, two look very much alike Can represent situation as follows Lieberman & Hall; Introduction to Economics, 2005 37 Other Demand Shocks A positive demand shock—shifts AD curve rightward Increases both real GDP and price level in shortrun A negative demand shock—shifts AD curve leftward Decreases both real GDP and price level in short-run Lieberman & Hall; Introduction to Economics, 2005 38 An Example: The Great Depression U.S. economy collapsed far more seriously during 1929 through 1933—the onset of the Great Depression—than it did at any other time What do we know about demand shocks that caused Great Depression? Fall of 1929, bubble of optimism burst Stock market crashed, and investment and consumption spending plummeted Demand for products exported by United States fell Fed reacted by cutting money supply sharply • Each of these events contributed to a leftward shift of AD curve Causing both output and price level to fall Lieberman & Hall; Introduction to Economics, 2005 39 Demand Shocks: Adjusting to the Long-Run In Figure 9, point H shows new equilibrium after a positive demand shock in short-run—a year or so after the shock But point H is not necessarily where economy will end up in long-run In short-run, we treat wage rate as given But in long-run, wage rate can change When output is above full employment, wage rate will rise, shifting AS curve upward When output is below full employment, wage rate will fall, shifting AS curve downward Lieberman & Hall; Introduction to Economics, 2005 40 Demand Shocks: Adjusting to the Long Run Increase in government purchases has no effect on equilibrium GDP in long-run Economy returns to full employment, which is just where it started This is why long-run adjustment process is often called economy’s self-correcting mechanism If a demand shock pulls economy away from full employment Change in wage rate and price level will eventually cause economy to correct itself and return to full-employment output Lieberman & Hall; Introduction to Economics, 2005 41 Figure 10: The Long-Run Adjustment Process Price Level AS2 AS1 P4 K J P3 P2 P1 H E AD2 AD1 YFE Y3 Y2 Lieberman & Hall; Introduction to Economics, 2005 Real GDP 42 Demand Shocks: Adjusting to the Long Run For a positive demand shock that shifts AD curve rightward, self-correcting mechanism works like this Lieberman & Hall; Introduction to Economics, 2005 43 Figure 11: Long-Run Adjustment After a Negative Demand Shock Price Level AS1 AS2 P1 P2 E N P3 M AD1 AD2 Y2 Lieberman & Hall; Introduction to Economics, 2005 YFE Real GDP 44 Demand Shocks: Adjusting to the Long Run Complete sequence of events after a negative demand shock looks like this Lieberman & Hall; Introduction to Economics, 2005 45 Demand Shocks: Adjusting to the Long Run Can summarize economy’s self-correcting mechanism as follows Whenever a demand shock pulls economy away from full employment • Self-correcting mechanism will eventually bring it back When output exceeds its full-employment level, wages will eventually rise • Causing a rise in price level and a drop in GDP until full employment is restored When output is less than its full employment level wages will eventually fall • Causing a drop in price level and a rise in GDP until full employment is restored Lieberman & Hall; Introduction to Economics, 2005 46 The Long-Run Aggregate Supply Curve Self-correcting mechanism provides an important link between economy’s long-run and short-run behaviors Long-run aggregate supply curve also illustrates another classical conclusion An increase in government purchases causes complete crowding out • Rise in government purchases is precisely matched by a drop in consumption and investment spending Leaving total output and total spending unchanged Self-correcting mechanism shows that, in long-run, economy will eventually behave as classical model predicts Notice the word eventually in the previous statement This is why governments around the world are reluctant to rely on self-correcting mechanism alone to keep economy on track Lieberman & Hall; Introduction to Economics, 2005 47 Figure 12: The Long-Run Aggregate Supply Curve Price Level Long-Run AS Curve K E M AD1 AD2 AD3 YFE Lieberman & Hall; Introduction to Economics, 2005 Real GDP 48 Some Important Provisos about the AS Curve Upward-sloping aggregate supply curve we’ve presented in this chapter gives a realistic picture of how economy behaves after a demand shock Story we have told about what happens as we move along AS curve is somewhat incomplete Made assumption that prices are completely flexible—that they can change freely over short periods of time • In fact, however, some prices take time to adjust, just as wages take time to adjust Assumed that wages are completely inflexible in short-run • But in some industries, wages respond quickly More to process of recovering from a shock than adjustment of prices and wages Lieberman & Hall; Introduction to Economics, 2005 49 Short-Run Effects of Supply Shocks Figure 13 shows an example of a supply shock An increase in world oil prices that shifts aggregate supply curve upward, from AS1 and AS2 Called negative supply shock, because of negative effect on output • In short-run a negative supply shock shifts AS curve upward, decreasing output and increasing price level Notice sharp contrast between effects of negative supply shocks and negative demand shocks in short-run Economists and journalists have coined term “stagflation” to describe a stagnating economy experiencing inflation • A negative supply shock causes stagflation in short-run Examples of positive supply shocks include unusually good weather, a drop in oil prices, and a technological change that lowers unit costs In addition, a positive supply shock can sometimes be caused by government policy Lieberman & Hall; Introduction to Economics, 2005 50 Figure 13: The Effect of Supply Shocks Price Level Long-Run AS Curve AS2 AS1 R AS3 P2 P1 E T P2 AD Y2 Lieberman & Hall; Introduction to Economics, 2005 YFE Y3 Real GDP 51 Long-Run Effects of Supply Shocks What about effects of supply shocks in long-run? In some cases, we need not concern ourselves with this question, because some supply shocks are temporary In other cases, however, a supply shock can last for an extended period In long-run, economy self-corrects after a supply shock, just as it does after a demand shock When output differs from its full-employment level • Wage rate changes • AS curve shifts until full employment is restored Lieberman & Hall; Introduction to Economics, 2005 52 Using the Theory: The Recession of 1990-91 Story of 1990-91 recession begins in mid1990, when Iraq invaded Kuwait During this conflict, Kuwait’s oil was taken off world market, as was Iraq’s Reduction in oil supplies resulted in a rapid and substantial increase in price of oil Lieberman & Hall; Introduction to Economics, 2005 53 Using the Theory: The Recession of 2001 Story of 2001 recession was quite different This time, there was no spike in oil prices and no other significant supply shock to plague economy Rather, there was a demand shock, and a Federal Reserve policy during the year before the recession that might have made it a bit worse During late 1990s, Fed had become concerned that investment boom and consumer optimism were shifting AD curve rightward too rapidly Creating a danger that we would overshoot potential GDP and set off higher inflation Fed responded by tightening money supply and raising interest rate Effects of this policy may have continued into early 2001, exacerbating decrease in investment that was occurring for other reasons • In this way, rate hikes themselves may have contributed to a further leftward shift of AD curve Lieberman & Hall; Introduction to Economics, 2005 54 Figure 14(a): An AD and AS analysis of Two Recessions 1. In 1990, a supply shock from (a)higher oil prices shifted the AS curve leftward . . . Price Level AS1991 AS1990 R P2 E P1 2. causing output to fall . . . AD1990 3. and the price level to rise. Lieberman & Hall; Introduction to Economics, 2005 Y2 YFE Real GDP 55 Figure 14(b): An AD and AS analysis of Two Recessions 4. In 2001, a demand shock from (b) factors caused the AD several curve to shift leftward . . . Price Level AS2000 P2 E R P1 5. causing output to fall . . . AD2000 6. and the price level to fall. AD2001 Y2 Lieberman & Hall; Introduction to Economics, 2005 YFE Real GDP 56 Figure 15(a/b): GDP and the Price Level in Two Recessions The 1990-91 Recession (b) Real GDP ($ Trillions) (a) 6.75 CPI 140 6.72 135 6.69 6.66 130 6.63 125 6.60 120 1989:3 1990:2 1991:1 Year and Quarter Lieberman & Hall; Introduction to Economics, 2005 1989:3 1990:2 1991:1 Year and Quarter 57 Figure 15(c/d): GDP and the Price Level in Two Recessions The 2001 Recession (d) Real GDP ($ Trillions) (c) 9.35 CPI 178 9.30 176 9.25 9.20 174 9.15 172 9.10 2000:1 2001:1 Year and Quarter Lieberman & Hall; Introduction to Economics, 2005 2000:1 2001:1 Year and Quarter 58 Using the Theory: Jobless Expansions After a recession, economy enters expansion phase of business cycle But in our two most recent recessions, economy experienced abnormal, prolonged periods during which employment did not grow at all Figure 16 illustrates behavior of employment during our two most recent recession Employment usually grows rapidly during this period as well Called trough of recession Vertical axis shows an employment index—employment divided by employment at the trough Blue line shows that employment falls during the contraction phase of average cycle Rises rapidly during the first year of the expansion phase But red and pink lines show what happened in first year of our most recent expansions—during 1992 and 2002 In both cases, employment drifted slightly downward, telling us that total number of jobs decreased during year Lieberman & Hall; Introduction to Economics, 2005 59 Figure 16: The Average Expansion Versus Two Recent Jobless Expansions Employment 1.04 Index (Trough = 1) 1.03 After Average Recession 1.02 After 2001 Recession 1.01 1.00 After 1991 Recession 0.99 -6 -4 -2 0 +2 +4 +6 +8 +10 +12 Months Before and After the Trough Lieberman & Hall; Introduction to Economics, 2005 60 Explaining Jobless Expansions Since story is similar for both of these expansions, let’s focus on period from late 2001 to late 2002— the first year of expansion after our most recent recession Using equation for economic growth • Real GDP = productivity x average hours x (emp/pop) x population But equation can be used in different ways Now we’re using equation to account for deviations in employment away from full employment in short-run For this purpose, we’ll need to make some adjustments to equation Real GDP = productivity x average hours x employment Lieberman & Hall; Introduction to Economics, 2005 61 Explaining Jobless Expansions Let’s convert equation to percentage changes %Δ real GDP = %Δ productivity + %Δ employment Finally, rearranging %Δ employment (-0.3%) = %Δ real GDP (2.9%) %Δ productivity (3.2%) Numbers in parentheses show actual percentage changes for each of these variables during 2002 Lieberman & Hall; Introduction to Economics, 2005 62 Explaining Jobless Expansions Why didn’t real GDP growth keep up with productivity? Because growth in real GDP was unusually low Productivity grew at about the same rate as average expansion, in spite of the low growth in output Throughout period, firms were reluctant to hire full-time, permanent workers • Created uncertainty about strength and duration of expansion • Instead, business expanded output by hiring part-time and temporary workers Why would this boost productivity? Enabled firms to adjust their workforce more easily to fluctuations in production Phrase “jobless expansion” refers to just part of expansion phase Eventually, employment catches up—even to higher levels of output made possible by productivity growth Lieberman & Hall; Introduction to Economics, 2005 63