* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Chapter 3

Pensions crisis wikipedia , lookup

Economic democracy wikipedia , lookup

Transformation in economics wikipedia , lookup

Welfare capitalism wikipedia , lookup

Non-monetary economy wikipedia , lookup

Refusal of work wikipedia , lookup

Participatory economics wikipedia , lookup

Economic calculation problem wikipedia , lookup

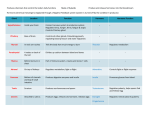

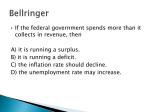

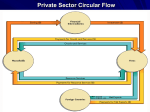

Economics Chapter 3 American Free Enterprise American Free Enterprise A tradition that encourages people to try out their business ideas and compete in the public market Basic Principles of American Free Enterprise Economic Freedom Competition Contracts Voluntary Exchange American Free Enterprise Profit Motive Private Property Self Interest These basic features of free enterprise are so familiar to us that we tend to take them for granted. Voluntary Exchange Act of buyers and sellers freely and willingly engaging in market transactions Private Property The concept that people have the right and the privilege to control their possessions as they wish The government has the right to imminent domain Self-Interest Means buyers and sellers are focused on personal gain It motives consumers to buy the goods and services they want at the lowest possible price Profit Motive Driving force that encourages people and organizations to improve their material well-being People are free to risk their savings or any part of their wealth in a business venture with hopes of earning a profit Contracts A legal agreement between two or more parties, specifying the actions to be taken and the payments to be made by each party Freedom to engage in any type of contract Competition Rivalry among producers or sellers of similar goods to win more business by offering the lowest—prices or better quality Government regulates competition Economic Freedom The freedom of households to own factors of production and firms to produce and distribute goods and services American Constitution U. S. Constitution guarantees important rights in business activities • • • Property rights Limits Taxation Enforcing Contracts Role of Consumers In a capitalist system private individuals own the factors of production and decide how to use them within the limits of the law Form Special Interest Groups Special Interest Groups A private organization that tries to persuade public officials to act or vote according to the group’s interests Four Important Functions of Government 1. 2. 3. 4. Regulating Economic Activity Ensuring Economic Stability Providing Public Goods Redistributing income Role of Government in Regulating Economic Activity Government carries out their constitutional responsibilities through creation of regulations and regulatory agencies on • Public disclosure • Protecting Health, Safety and Well-being Major Functions of Government Regulations Protecting Consumers Promoting Competition Supervising Labor and Management Relations Regulating Negative By-products of the Production Process Federal Regulatory Agencies in the United States 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. Interstate Commerce Commission Food and Drug Administration Federal Trade Commission Federal Communication Commission Securities and Exchange Commission National Labor Relations Board Federal Aviation Administration Equal Employment Opportunity Commission Environmental Protection Agency National Highway Traffic Safety Administration Occupational Safety and Health Administration Consumer Product Safety Nuclear Regulatory Commission Federal Energy Regulatory Commission Interstate Commerce Commission (ICC) 1887 Regulates rates and other aspects of commercial transportation by railroad, highway, and waterway Food and Drug Administration (FDA) 1906 Enforces laws to ensure purity, effectiveness, and truthful labeling of food, drugs, and cosmetics Inspects production and shipment of these products Federal Trade Commission (FTC) 1934 Administers antitrust laws forbidding unfair competition, pricefixing, and other deceptive practices Regulates product warranties and fraud in advertising Federal Communication Commission (FCC) 1934 Licenses and regulates radio and television stations Regulates interstate telephone, telegraph rates and services Creates and enforces rules of behavior for broadcasting Most recently, regulates satellite transmissions and cable TV Securities and Exchange Commission (SEC) 1934 Regulates and supervises the sale of listed and unlisted securities and the brokers, dealers, and bankers who sell them National Labor Relations Board (NLRB) 1935 Administers federal labor-management relations laws Settles labor disputes Prevents unfair labor practices Federal Aviation Administration (FAA) 1958 Regulates air commerce Sets standards for pilot training, aircraft maintenance and air traffic control Controls U.S. Airspace Equal Employment Opportunity Commission (EEOC) 1964 Investigates and rules on charges of discrimination by employers and labor unions Environmental Protection Agency (EPA) 1970 Coordinates federal environmental programs to fight air and water pollution National Highway Traffic Safety Administration (NHTSA) 1970 Sets and enforces laws to promote motor vehicle safety and to protect drivers, passengers, and pedestrians Sets safety and fuel economy standards for new motor vehicles produced or sold in the U.S. Occupational Safety and Health Administration (OSHA) 1970 Investigates accidents at the workplace Enforces regulation to protect employees at work Consumer Product Safety Commission (CPSC) 1972 Sets and enforces safety standards for consumer products Nuclear Regulatory Commission (NRC) 1974 Regulates the nuclear power industry Licenses and oversees the design, construction, and operation of nuclear power plants Federal Energy Regulatory Commission (FERC) 1977 Fixes rates and regulates the interstate transportation and sale of electricity, oil, and natural gas Issues permits and licenses for hydroelectric projects and gas pipelines Supervises mergers and stock issues of electric power and natural gas Sets rates for interstate transportation of oil by pipeline Deregulation Process of removing government restrictions on businesses This deregulation started with Jimmy Carter and continues under the Bush administration The results of deregulation have been quite good because prices have been held down by competition among long-haul trucking firms, the long-distance phone companies, and the airlines Role of Government in Promoting Economic Stability Encouraging and promoting economic stability means smoothing the ups and downs in the nation’s overall business activity They do this by using basic economic principles Two Levels of Economics Macroeconomics deals with the economy as a whole • • • • National output Employment Money Supply Government Spending Microeconomics operates on the level of individual business firms • Profit and satisfaction maximization of firms and consumers Gross Domestic Product (GDP) The nation’s expenditure on all the final goods and services produced during the year at market prices Used to measure growth or decline in the economy C+I+G+X Business Cycles GDP is used to predict business cycles Business cycles are periods of expansion followed by periods of decline Government Macroeconomic Goals THREE MAJOR ECONOMIC GOALS High Employment Providing jobs for everyone who is able to work Steady Growth Enabling each generation to enjoy a higher standard of living than previous generations Stable Prices Preventing sudden shifts in prices Government economists use a variety of policies in their attempt to achieve these three major goals High Standard of Living Ways to maintain a higher standard of living is by increasing productivity through American Work Ethic Technology Vs. Work Ethic A commitment to the value of work and purposeful activity The Protestant work ethic is a biblically based teaching on the necessity of hard work, perfection and the goodness of manual labor. It is part of old American culture of the 1800's and is seen as one of the cornerstones of American prosperity Technology The body of knowhow about materials, techniques of production and operation of equipment, based on the application of scientific knowledge Patents and Copyright To promote the progress of science and useful arts, the Constitution of the United States gives Congress the right to grant: • Patents • Copyrights Patent A legal protection for the inventor of a product or process that gives the person or company sole right to produce the product or use the process for up to 17 years. • Polaroid film Copyright Arts and literary works are protected through the issuance of a copyright It gives authors or artists the exclusive right to publish, sell, or reproduce their work for their lifetime plus 50 years • Beatles Role of Government in Providing Public Goods A public good is a shared good or service for which it would be inefficient or impractical to make consumers pay individually • Roads • Dams • National Defense Advantages of Public Good The benefit to each individual is less than the cost that each would have to pay if it were provided privately The total benefits to society are greater than the total cost Public vs. Private Sector Public Sector is the part of the economy that involves transactions of the government • Benefits Society Private Sector is the part of the economy that involves the transactions of individuals and business • Profit motivation Free Rider A phenomenon associated with public goods Someone who would not choose to pay for a certain good or service, but would get the benefits of it anyway if it were provided as a public good Market Failure Situations in which the free market does not efficiently provide resources to solve a problem These situations can result in government intervention Externalities Economic side effect that either benefits or harms a third party not directly involved in the activity • Positive externalities • Negative externalities Positive Externalities Occurs when some of the benefits derived from the production or consumption of some good or service are enjoyed by a third party • Airport Expansion can cause an increase in jobs in the area Negative Externalities Occurs when the production or consumption of some good or service inflicts costs on a third party without compensation • Airport Expansion can cause an increase in noise in the area after the runways are built Government Goals in Externalities Encourages the creation of positive externalities • Education increases productivity in workers Aims to limit negative externalities • Pollution regulations Is a Dam a Public Good? Example A: Market Failure Occurs Example B: Public Good is Created Proposal: Farmers want a local river to be dammed Benefit: The dam will provide irrigation water for the farmers crops Cost: If the cost were shared, the cost to each farmer would outweigh the benefits to each farmer Decision: No The farmers need a dam but won’t pay for it Proposal: The government considers funding the dam Benefit : The dam will provide hydroelectric power for the region, Irrigation, tourism, an artificial lake Decision: Yes The farmers need a dam but won’t pay for it Result Cost If the cost is shared among all taxpayers the cost to each person will be less than the benefit to each person The benefits of the dam extend to so many people that their collective benefits exceeds the total cost of the dam Poverty Threshold The minimum level of income, as determined by the government, that is needed to support a household To ease poverty the government • Collects taxes • Redistributes taxes in the form of Welfare Role of Government in Redistributing Income Because the free market system tends to distribute wealth unevenly the government runs programs to help people in need • • • • • Cash transfers In-Kind Benefits Medical Benefits Education Faith-Based Initiatives Cash Transfers Direct payments of money to poor, disabled and retired people by the federal and state governments • TANF • Social Security • Unemployment Insurance • Worker’s Compensation Temporary Assistance for Needy Families (TANF) Federal money goes to states to design and run their own welfare program Aims to move people from welfare dependence to the work force Establishes a life time limit Social Security Provides cash transfers of retirement income to the elderly and living expenses to disabled Americans The program collects payroll taxes from the current workers and then redistributes that money to current recipients Unemployment Insurance Insurance that employers pay for through payroll taxes Nearly all American workers who lose their jobs through no fault of their own can collect this insurance Workers who are fired because of misconduct or who quit without good reason generally cannot collect it Workers’ Compensation Provides a cash transfer of state funds to workers injured on the job Most employers must pay workers’ compensation insurance to cover any future claims their employees might make In-Kind Benefits Goods and Services provided for free or at very low prices • • • • Food Stamps Subsidized Housing Food Giveaways Legal Aid Medical Benefits Another important social service that the government provides is health insurance Medicare • Covers Americans over age 65 as well as disabled Medicaid • Assists the poor who are unemployed or not covered by their employer’s insurance Education Federal and State governments fund programs from preschool to college Education programs add to the nation’s human capital Faith-Based Initiatives President Bush’s initiative to rely on non-governmental support for people in need Bill was passed in 2003 in the next step to welfare reform that allows faith-based organizations to compete for federal funds