* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Chapter 16: FISCAL POLICY

Survey

Document related concepts

Transcript

FISCAL POLICY

Chapter 16

23/5/2017

Dr. Mazharul Islam

1

What is Government BUDGET?

The government budget is an annual

statement of the revenues, outlays, and

surplus or deficit of the government.

23/5/2017

Dr. Mazharul Islam

2

What is FISCAL POLICY?

Fiscal Policy: fiscal policy is the policy

that use by the government for revenue

collection (taxation) and expenditure

(spending)

to

achieve

the

macroeconomic goals namely sustained

economic growth and full employment.

23/5/2017

Dr. Mazharul Islam

3

The Multiplier Effect of the Fiscal

Policy

Other things remaining the same a

change in any of the items in the

government budget changes aggregate

demand and has a multiplier effect.

Aggregate Demand changes by a

greater amount than the initial change

in the item in the government budget

The Government Expenditure

Multiplier

Government expenditure is a component of

aggregate expenditure, so when government

expenditure increases, aggregate demand increases.

Then real GDP increases and encourages an

increase in consumption expenditure, which brings

a further increase in aggregate expenditure.

The government expenditure multiplier shows

the effect of a change in government expenditure

on goods and services on aggregate demand

23/5/2017

Dr. Mazharul Islam

5

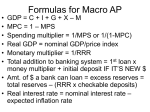

The Tax Multiplier

The tax multiplier shows the effect of

a change in taxes on aggregate demand.

A decrease in taxes increases disposable

income, which increases consumption

expenditure.

The size of tax multiplier is smaller than

the government expenditure multiplier

because “a $1 tax cut generates less than

$1 of additions expenditure.” Tax

multiplier always be negative.

23/5/2017

Dr. Mazharul Islam

6

The Tax Multiplier

1

Simple Tax Multiplier = - MPC X -------MPS

1

= - MPC X -------(1-MPC)

23/5/2017

Dr. Mazharul Islam

7

The Transfer Payments Multiplier

The transfer payments multiplier shows the effect of a

change in the transfer payments on aggregate demand.

This multiplier works like the tax multiplier but in the

opposite direction that means it is always positive.

An increase in transfer payments increases

disposable income, which increases consumption

expenditure.

The size of the transfer payments multiplier is smaller than

the government expenditure multiplier ( it is similar to tax

multiplier).

23/5/2017

Dr. Mazharul Islam

8

The Balance Budget Multiplier

Definition: the effect on aggregate demand of a

simultaneous change in government expenditure and

taxes that leaves the budget balance unchanged.

The balance budget multiplier is not zero.

It is greater than zero because “a $1 increase in

government expenditure injects a dollar more into the

aggregate demand while a $1 tax rise (or decrease in

transfer payments) takes lass than $1 from aggregate

demand.”

So when both government expenditure and taxes

increase by $1, aggregate demand increases.

A Successful Fiscal Stimulus

(expansionary fiscal policy)

If real GDP is below potential GDP, the

government might practice a fiscal stimulus

by:

I. Increasing its expenditure on goods &

services

II. Increasing transfer of payments

III. Cutting taxes (reducing taxes)

Or a combination of all three.

23/5/2017

Dr. Mazharul Islam

10

Fiscal Stimulus: When Real GDP is

low:

23/5/2017

Dr. Mazharul Islam

11

Figure 6.1 :Illustration

In the figure , potential GDP is $ 13 trillion but

real GDP is $ 12 trillion.

The economy is at point {A}

The red-arrow shows the recessionary gap.

To eliminate the recessionary gap and restore full

employment,

the

government

increases

expenditure or cuts taxes , to increase aggregate

expenditure by E

This increase is illustrated in figure 6.2 , where full

employment is achieved.

23/5/2017

Dr. Mazharul Islam

12

Fiscal Stimulus: When Real GDP is

low

23/5/2017

Dr. Mazharul Islam

13

A Successful Contractionary Fiscal

Policy

If real GDP is above potential GDP, the government

practices a contractionary fiscal policy.

Contractionary Fiscal Policy: A decrease in

government expenditure on goods and

services, in transfer of payments, or raise in

taxes to decrease aggregate demand.

23/5/2017

Dr. Mazharul Islam

14

Contractionary Fiscal Policy: Above Full Employment

23/5/2017

Dr. Mazharul Islam

15

Figure 6.3 :Illustration

In the figure , potential GDP is $ 13 trillion but

real GDP is $ 14 trillion.

The economy is at point {A}

The yellow- arrow shows the inflation gap.

To eliminate the inflation gap and restore full

employment, the government decreases

expenditure or rises taxes , to decrease

aggregate expenditure by

E

This decrease is illustrated in figure 6.4 , where

full employment is achieved.

23/5/2017

Dr. Mazharul Islam

16

Contractionary Fiscal Policy: Above Full Employment

23/5/2017

Dr. Mazharul Islam

17

The Supply Side: Potential GDP &

Growth

Fiscal policy can influence the output gap by changing the

aggregate demand and the real GDP relative to the

potential GDP.

But fiscal policy also influences potential GDP and

the growth rate of potential GDP.

These influences rises because the government

provides public goods and services that increase

productivity and because taxes change the

incentives that affect people.

These influences are called SUPPLY-side effects,

operates more slowly than the DEMAND-side

effects.

The Supply Side: Potential GDP &

Growth

In recession: Supply-side effects are ignored as

the focus is on fiscal stimuli and restoring full

employment.

In the long-run: Supply-side effects will dominate

and determine the potential GDP.

First we consider that how, in the absence of

government services and taxes ,the full employment

and potential GDP are determined.

The Supply Side: Full Employment & Potential

GDP

The quantity of labor demanded and supplied

depend on real wage rate.

The higher the wage rate, other things remaining

the same, the smaller is the quantity of labor

demanded and the greater is the quantity of labor

supplied.

When the wage rate is adjusted to equal the

quantity of labor demanded and supplied – there is

full employment.

When it is full employment , the real GDP

is equals potential GDP.

The Supply Side: Full Employment & Potential GDP

With consideration of government services and

taxes:

Both sides of the government budget influence the

potential GDP.

The expenditure side provides the public goods and

services that increases productivity.

This increase in productivity increases the potential GDP.

On the revenue side, taxes modify the incentives and

change the full-employment quantity of labor (i.e. the

equilibrium of demanded and supplied labor), as well as the

amount of saving and investment.

The Supply Side: Public Goods and Productivity

The government provides a legal system and

other infrastructure services – which

increase the nation’s productivity.

Public goods and services financed by

government, increase the real GDP that a

given amount of labor can produce.

This means the provision of public goods

and services increases potential GDP.

The Supply Side:Taxes and Incentives

An increase in taxes drives a wedge between

the price paid by a buyer and the price

received by a seller.

In the labor market income tax drives a

wedge between the cost of labor to

employers and the take-home pay of

workers.

Income tax lowers the incentive to work , save

and invest and decreases the fullemployment quantity of labor. Therefore the

potential GDP becomes lower and the

aggregate supply curve shifts to the left.

The Supply Side:Taxes and Incentives

Taxes on consumption expenditure add to

the tax wedge that lowers the potential GDP.

The reason is that a tax on consumption

expenditure raises the prices paid for

consumption goods and services and is

equivalent to a cut in the real wage rate.

Therefore, the higher the tax on

consumption expenditure, the smaller is the

quantity of goods and services that an hour of

labor can buy and the weaker is the incentive

to the supply labor.