* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download The Data of Macroeconomics

Survey

Document related concepts

Transcript

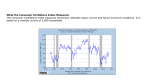

The Data of Macroeconomics Chapter 2 of Macroeconomics, 7th edition, by N. Gregory Mankiw ECO62 Udayan Roy Chapter Overview • What do the following macroeconomic variables represent? How are they measured? – Gross Domestic Product (GDP) – The Consumer Price Index (CPI) – The Unemployment Rate You’ve seen this before in Introductory Macroeconomics. So, I will try to be brief. GROSS DOMESTIC PRODUCT AND ITS COMPONENTS GDP is both … • Total expenditure on domestically-produced final goods and services. • Total income earned by domestically-located productive resources. Expenditure equals income because every dollar spent by a buyer becomes income to the seller. Final and Intermediate Goods • GDP counts the value of only final goods, not intermediate goods – Intermediate goods are those goods that disappear inside other goods that are produced for sale – Final goods are goods that are not intermediate goods • This way, the value of intermediate goods is counted only once, not twice or thrice. The Circular Flow of Income and Expenditure Income ($) Labor Firms Households Goods Expenditure ($) The expenditure components of GDP • consumption, C • investment, I • government spending, G • net exports, NX The national income identity: Y = C + I + G + NX value of total output aggregate expenditure Consumption (C) Consumption is the value of all goods and services bought by households. It includes: – durable goods last a long time e.g., cars, home appliances – nondurable goods last a short time e.g., food, clothing – services work done for consumers e.g., dry cleaning, air travel U.S. Consumption, 2010 Total Per Person $ billions % of GDP $ Gross domestic product 14526.5 100.0 46844 Personal consumption expenditures 10245.5 70.5 33039 Goods 3387.0 23.3 10922 Durable goods 1085.5 7.5 3500 Nondurable goods 2301.5 15.8 7422 Services 6858.5 47.2 22117 Investment (I) • This is spending on goods bought for future use (i.e., capital goods) • It includes: – Business fixed investment Spending on plant and equipment – Residential fixed investment Spending by consumers and landlords on housing units – Inventory investment The change in the value of all firms’ inventories U.S. Investment, 2010 Total % of Per Person $ billions GDP $ Gross domestic product 14,526.5 100.0 46,844 Gross private domestic investment 1,795.1 12.4 5,789 Fixed investment 1,728.2 11.9 5,573 Nonresidential 1,390.1 9.6 4,483 Structures 374.4 2.6 1,207 Equipment and software 1,015.7 7.0 3,275 Residential 338.1 2.3 1,090 Change in private inventories 66.9 0.5 216 Government spending (G) • G includes all government spending on goods and services. • It excludes transfer payments (e.g., unemployment insurance payments), because they do not represent spending on goods and services. U.S. Government Spending, 2010 Gross domestic product Government consumption expenditures and gross investment Federal National defense Nondefense State and local Total Per Person $ billions % of GDP $ 14,526.5 100.0 46,844 3,002.8 1,222.8 819.2 403.6 1780 20.7 8.4 5.6 2.8 12.3 9,683 3,943 2,642 1,301 5,740 U.S. Net Exports, 2010 Total Per Person $ billions % of GDP $ Gross domestic product 14,526.5 100.0 46,844 Net exports of goods and services -516.9 -3.6 -1,667 Exports 1,839.8 12.7 5,933 Goods 1,277.8 8.8 4,121 Services 562.0 3.9 1,812 Imports 2,356.7 16.2 7,600 Goods 1,947.3 13.4 6,279 Services 409.4 2.8 1,320 Net Exports: NX = EX – IM • It is the value of total exports (EX) minus the value of total imports (IM) 20% NX 16% exports imports 12% 8% 4% 0% -4% -8% 1950 1960 1970 1980 1990 2000 2010 Real and Nominal GDP • GDP is the market value of all final goods and services produced. • nominal GDP measures these values using current prices. – Current prices are the prices that prevailed at the time of production • real GDP measure these values using constant prices (the prices during the base year). NOW YOU TRY: Real and Nominal GDP 2006 2007 2008 P Q P Q P Q good A $30 900 $31 1,000 $36 1,050 good B $100 192 $102 200 $100 205 Nominal GDP Real GDP Compute nominal GDP in each year. Compute real GDP in each year using 2006 as the base year. NOW YOU TRY: Real and Nominal GDP 2006 2007 2008 P Q P Q P Q good A $30 900 $31 1,000 $36 1,050 good B $100 192 $102 200 $100 205 Nominal GDP (30 900) + (100 192) = $46,200 (31 1000) + (102 200) = $51,400 (36 1,050) + (100 205) = $58,300 Real GDP (30 900) + (100 192) = $46,200 (30 1000) + (100 200) = $50,000 (30 1,050) + (100 205) = $52,000 GDP Deflator: overall price level 2006 GDP Deflator good A P $30 Q 100 900 2007 2008 P 100 Q 51,400/50,000 = $31102.8 1,000 P 100 Q 58,300/52,000 $36 1,050 = 112.1 Average prices compared to base year good B $100 Same192 $102 200 2.8% higher $100 205 12.1% higher Nominal GDP (30 900) + (100 192) = $46,200 (31 1000) + (102 200) = $51,400 (36 1,500) + (100 205) = $58,300 Real GDP (30 900) + (100 192) = $46,200 (30 1000) + (100 200) = $50,000 (30 1,500) + (100 205) = $52,000 U.S. Nominal and Real GDP, 1929-2010 U.S. Gross Domestic Product per capita 50000 45000 40000 35000 30000 25000 20000 15000 10000 5000 1929 1931 1933 1935 1937 1939 1941 1943 1945 1947 1949 1951 1953 1955 1957 1959 1961 1963 1965 1967 1969 1971 1973 1975 1977 1979 1981 1983 1985 1987 1989 1991 1993 1995 1997 1999 2001 2003 2005 2007 2009 0 Source: bea.gov National Income and Product Accounts Tables, Table 7.1. Income in chained (2005) dollars. Growth Rate: computation Value for the year value for previous year Growth Rate 100 value for previous year 2006 2007 2008 NOW YOU TRY: Real and Nominal GDP Nominal $46,200 $51,400 $58,300 GDP Growth Rate % Real GDP $46,200 $50,000 $52,000 Growth Rate % Value for the year value for previous year Growth Rate 100 value for previous year 2006 2007 2008 NOW YOU TRY: Real and Nominal GDP Nominal $46,200 $51,400 $58,300 GDP Growth Rate % 11.26 Real GDP $46,200 $50,000 $52,000 Growth Rate % 8.23 13.42 [(51,400 – 46,200) / 46,200] ✕ 100 = 11.26 4.00 Value for the year value for previous year Growth Rate 100 value for previous year 2006 2007 2008 NOW YOU TRY: Real and Nominal GDP Nominal $46,200 $51,400 $58,300 GDP Growth Rate % 11.26 Real GDP $46,200 $50,000 $52,000 Growth Rate % 8.23 4.00 1.028 1.121 2.80 9.06 GDP Deflator Growth Rate % 1.00 13.42 GDP Deflator = Nominal GDP / Real GDP It is a measure of the overall price level Its growth rate is a measure of the rate of inflation As an approximation, the GDP Deflator’s growth rate = growth rate of Nominal GDP – growth rate of Real GDP Where to find US data • Bureau of Economic Analysis, U.S. Department of Commerce: http://bea.gov • Federal Reserve Bank of St. Louis: http://research.stlouisfed.org/fred2/categorie s/18 International Comparisons • When the GDP numbers for various countries’ are being compared, the same currency units must be used • There are two ways of converting from national countries to a common currency, such as the US dollar – Use market exchange rates – Use a common set of prices (PPP) GDP per capita, in US dollars PPP Market Exchange Rates 44063.34 44063.34 United Kingdom 33849.18 40237.54 Japan 32051.81 34263.64 Uruguay 10584.77 6036.12 Ukraine 6269.05 2324.32 China 5815.12 4657.28 2891.94 2021.97 India 2317.19 762.14 Bangladesh 1223.01 417.66 724.61 202.05 333.45 170.88 United States Albania Ethiopia Liberia Source: World Economic Outlook 2008 database, IMF Chain-Weighted Real GDP • Over time, relative prices change, so the base year should be updated periodically. • In essence, chain-weighted real GDP updates the base year every year, so it is more accurate than constant-price GDP. • Your textbook uses constant-price real GDP, because: – the two measures are highly correlated – constant-price real GDP is easier to compute. GROWTH RATE MATH Two arithmetic tricks for working with percentage changes 1. For any variables X and Y, percentage change in (X Y ) percentage change in X + percentage change in Y Example: If your hourly wage rises 5% and you work 7% more hours, then your wage income rises approximately 12%. Two arithmetic tricks for working with percentage changes 2. percentage change in (X/Y ) percentage change in X percentage change in Y Example: GDP deflator = 100 NGDP/RGDP. If NGDP rises 9% and RGDP rises 4%, then the inflation rate is approximately 5%. • The growth rate of the ratio of two variables equals the difference of their growth rates. • The growth rate of the product of two variables equals the sum of their growth rates. • The growth rate of a variable raised to an exponent, is the growth rate of the variable times the exponent. If Z = X × Y then gz = gx + gy z new zold z new gz 1 zold zold z new xnew ynew 1 gz zold xold yold 1 g z (1 g x )(1 g y ) 1 gz 1 gx g y gx g y gz gx g y gx g y gz gx g y The growth rates here are in decimal form: for example, if X grows at the rate of 5%, then gx = 0.05. The product of two decimals is small enough to be ignored: for example, 0.05 × 0.04 = 0.0020. If Z = X ÷ Y then gz = gx – gy x z y z y x gz gy gx gz gx g y If Z = Xa then gz = a × gx zx x x x a a times gz gx gx gx a gx a times CONSUMER PRICE INDEX (CPI) Consumer Price Index (CPI) • It is a measure of the overall level of prices • It is published by the Bureau of Labor Statistics (BLS) • The CPI is used to: – track changes in the typical household’s cost of living – adjust many contracts for inflation (“COLAs”) – allow comparisons of dollar amounts over time How the BLS constructs the CPI Survey consumers to determine composition of the typical consumer’s “basket” of goods 2. Every month, collect data on prices of all items in the basket; compute cost of basket 3. CPI in any month equals 1. Cost of basket in that month 100 Cost of basket in base period The composition of the CPI’s “basket” Food and bev. 17.4% Housing Apparel 6.2% 5.6% 3.0% 3.1% 3.8% 3.5% Transportation Medical care Recreation 15.1% Education Communication Other goods and services 42.4% NOW YOU TRY: Compute the CPI Typical consumer’s basket: 20 pizzas, 10 compact discs prices: 2002 2003 2004 2005 pizza $10 $11 $12 $13 CDs $15 $15 $16 $15 For each year, compute the cost of the basket the CPI (use 2002 as the base year) the inflation rate from the preceding year NOW YOU TRY: Compute the CPI and Inflation Rate Typical consumer’s basket: 20 pizzas, 10 compact discs 2002 2003 2004 2005 pizza $10 $11 $12 $13 CDs $15 $15 $16 $15 cost CPI inflation Cost of typical consumer' s basket in current period CPI 100 Cost of typical consumer' s basket in base period NOW YOU TRY: Compute the CPI and Inflation Rate Typical consumer’s basket: 20 pizzas, 10 compact discs 2002 2003 2004 2005 pizza $10 $11 $12 $13 CDs $15 $15 $16 $15 cost $350 $370 $400 $410 CPI inflation Cost of typical consumer' s basket in current period CPI 100 Cost of typical consumer' s basket in base period NOW YOU TRY: Compute the CPI and Inflation Rate Typical consumer’s basket: 20 pizzas, 10 compact discs 2002 2003 2004 2005 pizza $10 $11 $12 $13 CDs $15 $15 $16 $15 cost $350 $370 $400 $410 CPI 100 105.71 114.29 117.14 inflation Cost of typical consumer' s basket in current period CPI 100 Cost of typical consumer' s basket in base period NOW YOU TRY: Compute the CPI and Inflation Rate Typical consumer’s basket: 20 pizzas, 10 compact discs 2002 2003 2004 2005 pizza $10 $11 $12 $13 CDs $15 $15 $16 $15 cost $350 $370 $400 $410 CPI 100 105.71 114.29 117.14 inflation 5.71 8.11 2.50 Cost of typical consumer' s basket in current period CPI 100 Cost of typical consumer' s basket in base period CPI in current period CPI in preceding period Inflation 100 CPI in preceding period U.S. Inflation (%) 20 15 10 5 2010 2007 2004 2001 1998 1995 1992 1989 1986 1983 1980 1977 1974 1971 1968 1965 1962 1959 1956 1953 1950 1947 1944 1941 1938 1935 1932 1929 1926 1923 1920 1917 1914 0 -5 -10 -15 Source: See ftp://ftp.bls.gov/pub/special.requests/cpi/cpiai.txt for historical data and http://bls.gov/news.release/cpi.nr0.htm for latest data. CPI vs. GDP Deflator Prices of non-consumer goods: – included in GDP deflator (if produced domestically) – excluded from CPI Prices of imported consumer goods: – included in CPI – excluded from GDP deflator The basket of goods: – CPI: fixed – GDP deflator: changes every year Two measures of inflation in the U.S. 15% Percentage change from 12 months earlier CPI 10% 5% GDP deflator 0% 1960 1965 1970 1975 1980 1985 1990 1995 2000 2005 2010 UNEMPLOYMENT The Current Population Survey • The Bureau of Labor Statistics (BLS) of the U.S. Department of Labor computes the unemployment rate every month • The data comes from a monthly survey of U.S. households called the Current Population Survey – See http://bls.gov/cps/ • This survey classifies each adult into one of three categories: employed, unemployed, and not in the labor force Three Population Categories • This survey classifies each adult into one of three categories: – employed (working at a paid job) – unemployed (not employed but looking for a job), and – not in the labor force (not employed, not looking for work) • Labor force = employed + unemployed Two important labor market stats • unemployment rate percentage of the labor force that is unemployed • labor force participation rate the fraction of the adult population that is in the labor force U.S. Unemployment Rate (%) 12 10 8 6 4 2 0 Source: See ftp://ftp.bls.gov/pub/special.requests/lf/aat1.txt. for historical data and http://bls.gov/news.release/empsit.toc.htm for latest month’s data. NOW YOU TRY: Computing labor statistics U.S. adult population by group, May 2009 Number employed = 140.57 million Number unemployed = 14.51 million Adult population = 235.45 million Use the above data to calculate the labor force the number of people not in the labor force the labor force participation rate the unemployment rate NOW YOU TRY: Answers data: E = 140.57, U = 14.51, POP = 235.45 labor force L = E +U = 140.57 + 14.51 = 155.08 not in labor force NILF = POP – L = 235.45 – 155.08 = 80.37 unemployment rate U/L x 100% = (14.51/155.08) x 100% = 9.4% labor force participation rate L/POP x 100% = (155.08/ 235.45) x 100% = 65.9% The Current Establishment Survey • The BLS obtains a second measure of employment by surveying businesses, asking how many workers are on their payrolls. – See http://bls.gov/ces/ • Neither measure is perfect, and they occasionally diverge due to: – treatment of self-employed persons – new firms not counted in establishment survey – technical issues involving population inferences from sample data Two measures of employment growth 8% Percentage change from 12 months earlier household survey 6% establishment survey 4% 2% 0% -2% -4% 1960 1970 1980 1990 2000 2010 U.S. Labor Data • Current Population Survey: http://bls.gov/cps/ • ftp://ftp.bls.gov/pub/special.requests/lf/aat1.txt • Current Establishment Survey: http://bls.gov/ces/ • ftp://ftp.bls.gov/pub/suppl/empsit.ceseeb1.txt • ftp://ftp.bls.gov/pub/suppl/empsit.ceseeb2.txt International Labor Comparisons • The BLS presents internationally comparable labor data for many countries at http://bls.gov/fls/home.htm Chapter Summary • Gross Domestic Product (GDP) measures both total income and total expenditure on the economy’s output of goods & services. • Nominal GDP values output at current prices; real GDP values output at constant prices. Changes in output affect both measures, but changes in prices only affect nominal GDP. • GDP is the sum of consumption, investment, government purchases, and net exports. Chapter Summary • The overall level of prices can be measured by either: – the Consumer Price Index (CPI), the price of a fixed basket of goods purchased by the typical consumer, or – the GDP deflator, the ratio of nominal to real GDP • The unemployment rate is the fraction of the labor force that is not employed.