* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download WELFARE ANALYSIS - Shaler Area School District

Survey

Document related concepts

Transcript

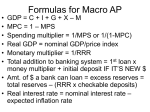

Chapter 21 AGGREGATE EXPENDITURE and EQUILIBRIUM OUTPUT Mrs. Eskra AE Model: John Maynard Keynes Keynes’ model considers all spending in the economy (consumer, business, and government spending). Y* = Current level of production (real GDP) Y axis: AE (C+I+G) X axis: Real GDP 45 degree line: shows where these two are equal. AE: At Full Employment Y* = Current level of production (real GDP) It’s WHERE WE ARE. FE = Level of spending that would get us to full employment. It’s WHERE WE WANT TO BE! On this graph, you can see that we are in equilibrium at full employment. This means that unemployment is right around 5%. AE: Below Full Employment (Recession) Y* = Current level of production (real GDP) It’s WHERE WE ARE. FE = Level of spending that would get us to full employment. It’s WHERE WE WANT TO BE! On this graph, you can see that we are in equilibrium below full employment. This means that people are not spending enough money for our economy to be fully employed. Unemployment is greater than 5%, and we are in a recession. AE: Beyond Full Employment (Inflation) Y* = Current level of production (real GDP) It’s WHERE WE ARE. FE = Level of spending that would get us to full employment. It’s WHERE WE WANT TO BE! On this graph, you can see that we are in equilibrium beyond full employment. This means that people are spending too much money too quickly, and our economy is “overheated.” Unemployment is temporarily less than 5%, and we are experiencing inflation. Expansionary Fiscal Policy: Multiplier Effect Y=C+I+G • If the government increases spending, this could have a multiplied effect by encouraging greater consumer and business spending (C & I as well). – Say I get hired as government employee as a result of increased spending. – I now have money to go out and spend in restaurants, on vacations, etc. – Those places of business will now have more money to pay their workers, and those workers will in turn have more money to spend elsewhere! Expansionary Fiscal Policy: Multiplier Effect Y=C+I+G • How much will the multiplied effect be? – It really depends on how much I am going to spend versus save my new income. – If I save it all, I will create no multiplied effect in the economy. – The more I spend, the greater the multiplied effect. Multiplier Effect: Consumption Multiplier • Here’s how we find the potential multiplied effect: Consumption Multiplier = 1/(1-MPC) MPC = consumers’ marginal propensity to consume (% of all income that is being spent in the economy). Multiplier Effect: Consumption Multiplier • Say the government wants to increase GDP. They spend $10 billion on new programs. The MPC is 0.75. What overall effect will this have on the economy? – What does this MPC of .75 tell us? Economy-wide: People will spend 75% of additional income they receive. Individual: If I make an additional $100 this paycheck, I will spend $75 of it and save $25. Multiplier Effect: Consumption Multiplier • Say the government wants to increase GDP. They spend $10 billion on new programs. The MPC is 0.75. What overall effect will this have on the economy? – Consumption Multiplier = 1/(1-MPC) Multiplier = 1/.25 = 4 If government spending increases by $10 billion, then this could generate an additional $40 billion in economic activity (Y). Multiplier Effect: Taxation Multiplier • If the government cuts taxes by $10 billion, now we have to look at the impact this will have on consumption. – It will increase consumption by MPC x amount of tax benefit: .75 x $10 billion = $7.5 billion increase in consumption $7.5 billion x 4 (multiplier) = $30 billion increase in economic activity as a result of a $10 billion tax cut. Multiplier Effect: Taxation Multiplier • Here’s how we find the potential multiplied effect when the government changes taxes: Taxation Multiplier = -MPC/ MPS MPC = .75, so MPS = .25 and the multiplier = -3 $-10 billion x -3 (multiplier) = $30 billion increase in economic activity as a result of a $10 billion tax cut.