* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Chapter Ten - lhu.edu.tw

Survey

Document related concepts

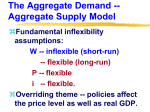

Economic bubble wikipedia , lookup

Modern Monetary Theory wikipedia , lookup

Fiscal multiplier wikipedia , lookup

Nominal rigidity wikipedia , lookup

Monetary policy wikipedia , lookup

Virtual economy wikipedia , lookup

Exchange rate wikipedia , lookup

Full employment wikipedia , lookup

Real bills doctrine wikipedia , lookup

Ragnar Nurkse's balanced growth theory wikipedia , lookup

Money supply wikipedia , lookup

Fei–Ranis model of economic growth wikipedia , lookup

Interest rate wikipedia , lookup

Transcript

Chapter Ten The IS-LM Model 1 The purposes This chapter is to introduce a basic macroeconomic model to help us analyze the short-run economic fluctuations, business cycles. We then adopt this model to explain why business cycles take place, their outcomes, and how policies can be used to cure these problems. 2 The origin of the IS-LM model The IS-LM model was developed in 1937 by Nobel laureate Sir John Hicks, who intended to interpret the ideas of Keynes in the book, The General Theory of Employment, Interest, and Money, by graphs. 3 The meaning of the IS-LM model The IS-LM model represents the simultaneous equilibrium of the goods and services market and the asset market. I represents investment, S represents saving, L represents real money demand, and M represents money supply. During equilibrium, I=S, L=M. 4 The idea of the IS-LM model The IS-LM model originally reflected the idea that prices and wages are rigid in the short run. It represented the Keynesian ideas and approaches. This model can also be adapted easily to discuss classical approaches. The IS-LM model can be used to derive the more general aggregate demand and aggregated supply model. 5 The IS-LM model This model uses graphs on the coordinates of the real interest rate, r, and the real income, Y, to represent the combinations of the real interest rate and the real income that give rise to the equilibria in the goods market (the IS curve) and in the asset market (the LM curve). 6 The IS curve The IS curve represents all the combinations of the real interest rate and the real income that equate the demand for goods and services and the supply of goods and services ( the equilibrium of goods and services market), given other things being equal. Y C I G ( in a closed economy) 7 The IS curve The goods market equilibrium can be expressed as Y C Gc I Gi S I Gi National saving equals total domestic investment. 8 The slope of the IS curve For any pair of the real income levels, Y1 and Y2, Y1 Y2 , we want to know the relative levels of the corresponding real interest rates that give rise to the equilibrium of the goods market. If r1 r2, then the IS curve has a positive slope. If r1 r2, then the IS curve has a negative slope. 9 r I Gi S (Y2 ) S (Y1 ) r IS curve r2 r2 r1 r1 I Gi , S Y2Y1 Y 10 The slope of the IS curve When the real income is increased, the national saving curve will move to the right. In order to restore the equilibrium in the goods market, the real interest rate must fall to stimulate the investment. The IS curve is a downward slopping curve. (negative slope) 11 Factors that shift the IS curve Given the real income level, any factor that will make the equilibrium real interest rate to rise (fall) will shift the IS curve to the right (left). 12 Factors that shift the IS curve Expected future marginal product of capital Effective tax rate on capital Government investment Expected future output Wealth Government consumption Taxes. 13 Expected future marginal product of capital When expected future marginal product of capital, MPK, increases, firms’ desired investment will increase. The total investment curve moves to the right, and the equilibrium real interest rate increases. So the IS curve shifts to the right. 14 Effective tax rate on capital When effective tax rate on capital increases, firms’ desired investment will fall. The total investment curve moves to the left, and the equilibrium real interest rate decreases. So the IS curve shifts to the left. 15 Government investment When government investment increases, the total investment curve moves to the right, and the equilibrium real interest rate increases. So the IS curve shifts to the right. 16 Expected future output When expected future output increases, people’s desired consumption will increase and national saving will fall. The national saving curve moves to the left, and the equilibrium real interest rate increases. So the IS curve shifts to the right. 17 Wealth When wealth increases, people’s desired consumption will increase, and the national saving will fall. The national saving curve moves to the left, and the equilibrium real interest rate increases. So the IS curve shifts to the right. 18 Government consumption When government consumption increases, the national saving will fall. The national saving curve moves to the left, and the equilibrium real interest rate increases. So the IS curve shifts to the right. 19 Taxes When taxes increase, people’s desired consumption will fall (people do not consider the future effect). The national saving will increases and moves the national saving curve to the right. The equilibrium real interest rate falls. So the IS curve shifts to the left. 20 Factors that shift the IS curve Given the real income level, any factor that raises (reduces) the aggregate demand for goods and services will shift the IS curve to the right (left). 21 The LM curve The LM curve represents all the combinations of the real interest rate and the real income that equate the demand for assets and the supply of assets ( the equilibrium of assets market), given other things being equal. 22 The LM curve The LM curve represents all the combinations of the real interest rate and the real income that equate the demand for real money and the supply of real money ( the equilibrium of the money market), given other things being equal. M L(Y , i ) P 23 The slope of the LM curve For any pair of the real income levels, Y1 and Y2, Y1 Y2 , we want to know the relative levels of the corresponding real interest rates that give rise to the equilibrium of the asset market. If r1 r2, then the LM curve has a positive slope. If r1 r2, then the LM curve has a negative slope. 24 M P r L(Y2 ) L(Y1 ) LM curve r r1 r1 r2 r2 Y2Y1 Y 25 The slope of the LM curve When the real income level increases, the real money demand will increase too. Given the real money supply, the equilibrium real interest rate will rise. The LM curve is an upward slopping curve ( positive slope). 26 Factors that shift the LM curve Given the real income level, any factor that will make the equilibrium real interest rate to rise (fall) will shift the LM curve to the left (right). 27 Factors that shift the LM curve Nominal money supply The price level Wealth Nominal interest rate on nonmoney assets Expected inflation Relative risk of nonmoney assets to money assets. Relative liquidity of nonmoney assets to money assets. 28 Nominal money supply When the nominal money supply increases, the real money supply curve moves to the right and the equilibrium real interest rate falls. So the LM curve shifts to the right. 29 The price level When the price level increases, the real money supply falls and the real money supply curve moves to the left. The equilibrium real interest rate rises. So the LM curve shifts to the left. 30 Wealth When the wealth increases, the real money demand will increase. The real money demand curve moves to the right and the equilibrium real interest rate rises. So the LM curve shifts to the left. 31 Nominal interest rate on nonmoney assets When the nominal interest rate on nonmoney assets increases, the real money demand falls and the real money demand curve moves to the left. The equilibrium real interest rate falls. So the LM curve shifts to the right. 32 Expected inflation When the expected inflation increases, the real money demand falls and the real money demand curve moves to the left. The equilibrium real interest rate falls. So the LM curve shifts to the right. 33 Relative risk of nonmoney assets to money assets When the relative risk of nonmoney assets to money assets increases, the real money demand rises and the real money demand curve moves to the right. The equilibrium real interest rate increases. So the LM curve shifts to the left. 34 Relative liquidity of nonmoney assets to money assets When the relative liquidity of nonmoney assets to money assets increases, the real money demand falls and the real money demand curve moves to the left. The equilibrium real interest rate decreases. So the LM curve shifts to the right. 35 Factors that shift the LM curve Given the real income level and the real money supply, any factor that raises (reduces) the demand for real money will shift the LM curve to the left (right). Given the real income level, any factor that raises (reduces) the supply of real money will shift the LM curve to the right (left). 36 The IS-LM model We can put the IS curve and the LM curve together to determine the aggregate demand for goods and services, given the price level. For a fixed price level, the intersection of the IS and the LM curves determines the equilibrium real income of an economy in the short run. 37 r LM curve IS curve Y d Y 38 Business cycles determination In the short run, if the price level is fixed as suggested by the Keynesian, any factor that will shift the IS curve or the LM curve will make the short-run equilibrium output to change. These fluctuations are called business cycles. Those factors can be regarded as the causes of business cycles. 39 Keynesian’s animal spirit Keynes thought that if the confidence of the public is weak about the future perspective of the economy, the desire of the business investment will be low. This shifts the IS curve to the left and the intersection of the IS and LM curves will move to the left. The equilibrium output is reduced in the short run. 40 Technological advancement When there is technological advancement, the marginal product of capital will increase, and the desired business investment will increases too. This shifts the IS curve to the right and the intersection of the IS and LM curves to the right as well. The equilibrium output rises in the short run. 41 Monetary contraction If the central bank reduces the money supply, the LM curve will shift to the left. The equilibrium output will reduce accordingly in the short run. 42 The FE curve The FE curve represents all the combinations of the real interest rate and the real income that equate the demand for labor and the supply of labor ( the equilibrium of the labor market), given other things being equal. 43 The FE curve The FE curve is called the full employment curve. The full employment level of employment in the labor market gives rise to the full employment output Y , given the capital stock and the production function. 44 The FE curve The full employment level and the full employment output do not depend on the real interest rate, so the FE curve is a vertical line at the full employment output, Y . 45 r FE curve Y Y 46 The General equilibrium of an economy When all the markets, the labor market, the goods and services market, and the asset market, are in equilibrium, it is said that the entire economy reaches the general equilibrium. When the FE curve, the IS curve, and the LM curve intersect on the same point, the general equilibrium reaches. 47 r r FE curve IS curve LM curve * Y Y 48 Determination of the long run equilibrium Given the full employment level of employment and the production function, the position of the FE curve stays at the full employment output Y . If the IS curve or the LM curve shifts, the original equilibrium is broken. The three curves no longer intersect at the same point. 49 r FE curve IS curve Y LM curve Y 50 When the price level is fixed in the short run If the price level is fixed in the short run as the Keynesian is suggested, the equilibrium d output is determined by the Y aggregate demand , which is the output corresponding to the intersection of the IS and LM curves. 51 When the price level is fixed in the short run If the aggregate demand is smaller than the full employment output, that is, the intersection point of the IS and LM curves is at the left of the FE curve, the economy is said to have a recession. If the aggregate demand is greater than the full employment output, that is, the intersection point of the IS and LM curves is at the right of the FE curve, the economy is said to have an expansion. 52 Economic expansion FE curve r The short run equilibrium ' output is Y IS curve LM curve A Point B is the equilibrium in the short run B Y Y ' Y 53 Price adjustment in the long run In the long run, the price level can be adjusted to restore the long run equilibrium, which is the intersection of the three curves, the FE, IS, and LM curves. The long run equilibrium output will again equal the full employment output Y 54 A recession caused by an adverse demand shock If the IS and LM curves intersect at the left of the FE curve due to an adverse demand shock, the aggregate demand is smaller than the full employment output an economy can supply. In the short run, because the price level is fixed, the aggregate demand determines the equilibrium output of the economy. 55 The long run adjustment of the price level Now if the price level can be adjusted as time goes by, the weak aggregate demand will force the price level to go down in the long run. This decline of the price level will shift the LM curve to the right. As long as the aggregate demand is still less than the full employment output, the price adjustment will go on and the LM curve will continue to shift to the right until the three curves intersect at the same point again. The new equilibrium is reached. 56 r FE curve IS curve LM curve P A P B Y Y 57 The adjustment process in the long run (a recession case) Because the aggregate demand is smaller than the full employment output, 1. There is an excess supply situation 2. The price level will decrease over time. 3. The nominal money demand will decrease. 4. People will want to transform the money asset into the nonmoney assets by buying bonds in the bond market. 58 The adjustment process in the long run (a recession case) 5. The bond prices will increase due to higher demand, and the interest rate will fall. 6. The reduced interest rate will stimulate the investment, and the aggregate demand will increase to eliminate the excess supply. The original equilibrium is restored in the long run due to the adjustment of the price level. 59 An expansion due to a positive demand shock If the IS and LM curves intersect at the right of the FE curve, the aggregate demand is greater than the full employment output an economy can supply. In the short run, because the price level is fixed, the aggregate demand determines the equilibrium output of the economy. 60 The long run adjustment of the price level Now if the price level can be adjusted as time goes by, the excess aggregate demand will force the price level to go up in the long run. This rise in the price level will shift the LM curve to the left. As long as the aggregate demand is greater than the full employment output, the price adjustment will go on and the LM curve will continue to shift to the left until the three curves intersect at the same point again. The new equilibrium is reached. 61 r FE curve IS curve B LM curve P A P Y Y 62 The adjustment process in the long run (an expansion case) Because the aggregate demand is greater than the full employment output, 1. There is excess demand 2. The price level will increase. 3. The nominal money demand will increase. 4. People will want to transform the nonmoney assets into the money asset by selling bonds in the bond market. 63 The adjustment process in the long run (an expansion case) 5. The bond prices will decrease due to higher supply, and the interest rate will rise. 6. The higher interest rate will reduce the investment, and the aggregate demand will decrease to eliminate the excess demand. The original equilibrium is restored in the long run due to the adjustment of the price level. 64 The complete crowding-out effect in the long run If the IS curve’s shift to the right is due to an increase in the government purchase, the initial increase in the output in the short run will be eliminated due to the complete crowding-out effect. This will happen because the interest rate increases to crowd out the private investment.The original increases in the output will be completely offset by the equal amount of decrease in the output. 65 The adjustment process due to a money supply increase When the central bank increases the money supply, the people’s money demand does not change. People will want to buy bonds with the additional money supply. So the bond prices increase and the interest rate falls. The reduced interest rate stimulate the private investment and the aggregate demand. If the price level is fixed, the equilibrium output in the short run increases. 66 An expansion case due to an increase in the money supply P r IS curve FE curve LM curve M P B M P Y A Y 67 The adjustment process in the long run Because the aggregate demand is greater than the full employment output, 1. There is excess demand 2. The price level will increase. 3. The nominal money demand will increase. 4. People will want to transform the nonmoney assets into the money asset by selling bonds in the bond market. 68 The adjustment process in the long run 5. The bond prices will decrease due to higher supply, and the interest rate will rise. 6. The higher interest rate will reduce the investment, and the aggregate demand will decrease to eliminate the excess demand. The original equilibrium is restored in the long run due to the adjustment of the price level. 69 Money neutrality in the long run The increase in the money supply will result in an increase in the price level by an equal proportion, and will not change any of the real variables, such as the real output, and the real interest rate. This outcome is called money neutrality. 70