* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download International Trade - Shanghai University

Survey

Document related concepts

Transcript

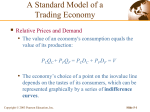

International Trade Cheng Ming 程铭 School of Economics, Shanghai University Chapter One Comparative Advantage --- The Ricardian Model 1. The Concept of Comparative Advantage Two basic reasons for International Trade Countries can benefit from doing things they do well Reaching economies of scale in production • David Ricardo, in his 1817 book “The Political Economy and Taxation” put forward the theory of Comparative Advantage • A company has a comparative advantage in producing a good if the opportunity cost in terms of other goods is lower. • Each country can benefit from the exporting the goods in which it has a comparative advantage. 2. A One-factor Economy In Ricardian model, international trade is SOLELY due to the differences in the productivity of labor An Economy – Home Two Goods – Wine & Cheese One Factor – Unit labor requirement We define: aLW – unit labor requirement in wine aLc – unit labor requirement in cheese L – total labor supply Production Possibility Slop: opportunity cost of cheese in terms of wine aLC/aLW Production Possibility Frontier Relative Prices and Supply • PPF illustrates the mixture of goods the economy can produce • The actual production mix is based on the relative prices (no profits in One-factor model) • If Pc/Pw > aLC/aLW, specialize in the production in cheese • If Pc/Pw = aLC/aLW, both goods will be produced • The economy will produce cheese if the relative price exceeds it opportunity cost 3. Trade in a One-factor World We assume: Home country is less productive than Foreign in Wine, but more productive in Cheese Therefore: aLC/aLW < a*LC/a*LW Or, equivalently, that aLC/a*LC < aLW/ a*LW Therefore, Home country has comparative advantage in Cheese Determining the Relative Price after Trade Relative price of Cheese a*LC/a*L Rs 1 2 aLC/aL R RD Q L/aL L/a*LW Relative Quantity of Cheese Point 1, the intersection of demand curve R and RS curve, where the relative price of cheese is between the two countries’ pretrade prices. Each country will specialize in the production of the good in which it has a comparative advantage. Point 2, the world relative price after trade is the same as the opportunity cost of cheese in terms of wine in Home, Home economy need not specialize, while Foreign does specialize in producing wine. The Gains from Trade The First Way -- to think of trade as an indirect method of production, i.e. Home can produce wine directly and trade with Foreign for cheese (produce indirectly) -- for an hour of labor, direct production 1/aLW wine, or 1/aLC cheese and be trade with wine -- if (1/aLC)(PC/PW) > 1/aLW, or PC/PW > aLC/aLW trade will be beneficial The second way – how trade will affect the possibilities for consumption. Trade Expands Consumption Possibilities Quantity of wine, Qw Quantity of wine, Qw T F P F P T Quantity Quantity of cheese, Qc (a) Home of cheese, Qc (b) Foreign Relative Wages Political discussion of international trade often focus on comparisons of wage rates in different countries. Unit Labor Requirements Cheese Wine aLC = 1hr per pound aLW = 2hr per gallon Foreign a*LC = 6 hr a*LW = 3hr Home • Since, aLC/aLW < a*LC/a*LW • So, Home will produce Cheese, Foreign produce Wine • Suppose a unit of cheese and wine both sell for $12, Home worker will earn $12 per hour, while Foreign worker will earn $4 • As long as the relative price of cheese to wine is 1, the wage of Home workers will be 3 times that of Foreign workers. • Home still has a comparative advantage in producing cheese since this wage rate lies between the ratios of the two countries productivities in the two countries. 4. Misconceptions about Comparative Advantage Productivity and Competitiveness Myth 1: Free trade is beneficial only if your country is strong enough to stand up to foreign competition. The Pauper Labor Argument Myth 2: Foreign competition is unfair and hurts other countries when it is based on low wages. Exploitation Myth 3: Trade exploits a country and makes it worse off if its workers receive much lower wages than workers in othernations. 5.Comparative Advantage with many goods • With many goods, we label aLi and a*Li as labor requirement for Home and Foreign, and rearranged as: aL1/a*L1< aL2/a*L2 < aL3/a*L3 < …< aLN/a*LN • Let w and w* be the wage rate per hour in Home and Foreign, respectively • We know that it would produce cheaper in Home if waLi < w*a*Li, and it can be rearranged to yield a*Li/aLi > w/w* Home and Foreign Unit Labor Requirements Relative Home Good Home Unit Labor Foreign Unit Labor Productivity Requirements(aLi) Requirements(a*Li) Advantage(a*Li/aLi) Apples Bananas Caviar Dates Enchiladas 1 5 3 6 12 10 40 12 12 9 10 8 4 2 0.75 6. Adding Transport Cost and Nontraded Goods There are three reasons why specialization in the real international economy is not the extreme: The existence of more than one factor Countries sometimes protest industries from foreign competitions It is costly to transport goods and services. i.e. because of the transport cost, there exists nontraded goods Chapter Two Specific Factors and Income Distribution 1.The Specific Factors Model • Although international trade is beneficial to both of the countries, it is, however, has strong effects on the distribution of income. While trade may benefit a nation as a whole, it often hurts significant groups within the country, at least in the short run. • We use the specific factors model to explain. • Assumption of the Model: -- an economy produce two goods: manufactures and food. -- three factors: labor(L), capital(K), and land(T) -- labor is the Mobil factor, while K and T are specific factors for manufactures and food, respectively -- so, QM = Q M(K,LM) QF = QF(T,LF) LM + LF = L Production Possibilities The Production Function for Manufactures Output, QM The more labor input, the larger the output. Because of the diminishing returns, the successive input will has less output. Reflected by a flatter Curve. QM=QM(K,LM) Labor Input,LM The Marginal Product of Labor The marginal product of labor equal to the slop of the production function Marginal product of labor, MPLM MPLM Labor Input,LM The Production Possibility Frontier in the Specific Factors Model Output of food, QF, (increasing ) QF=QF(T,LF) 1’ QF L Labor input In food, LF (increasing QM LF 1 ) LM Economy’s Production Possibility Frontier(PPF) PP Output of Manufactures, QM (increasing ) L Labor input In manufacturers, LM (increasing ) OM=QM(K,LM) In the Specific Factors Model, the PPF is an convex line (reflecting diminishing returns to labor), while in the Ricardian Model, it is a straight line (reflecting constant returns) The slop of the production possibility curve = - MPLF/MPLM The slop represents the opportunity cost for manufactures in terms of food. Price, Wages, and Labor Allocation Each sector will hire labor to the point until to the point where the value produced by an additional person-hour equals to the cost of employing that hour. In manufacturing sector, for instance: MPLM хPM = W, because of the diminishing returns, MPLM is a downward curve, giving the constant price of the manufactures. We can also consider the above equation as the demand curve. • • • • Since MPLM хPM = MPLF хPF = w, therefore, - MPLF/MPLM = - PM/PF The result tells us that at the production point the production possibility frontier QF Slop = must be tangent to a line whose -(PM/PF) slop is minus the price of manufactures divided by that of food. QM An equal proportional increase in the prices of manufactures and food Wage Rate, w 2 PF хMPLF 1 10% Wage increase w2 PF хMPLF PM Increase 10% PF Increase 10% 2 2 PM хMPLM w1 1 Labor used in Manufactures, LM 1 PM хMPLM Labor used In food,LF If both goods’ prices increase by 10%, the labor demand curves will both shift up by 10%. The allocation of labor between the sectors and the outputs of the two goods do not change. So it generates a general principle: changes in the overall price level have no real effects, that is, do not change any physical quantities in the economy. Only changes in relative prices -- affect welfare or the allocation of resources. A change in relative prices Wage Rate,w 1 PF хMPLF 7% upward Shift in labor demand 2 W1 2 PMхMPLM Wage rate Rises by Less than w2 7% 1 1 PM хMPLM Labor used in Manufactures, LM Amount of labor shifted from food to manufactures Labor used In food, LF Two important facts about the results of the shift of the labor in the above diagram First, although the wage rate rises, it rises by less than the increase in the price of manufactures. Second, when only PM rises, in contrast to the case of a simultaneous rise in PM and PF, labor shifts from the food sector to the manufacturing sector and the output of manufactures rises while that of food falls. (This is why w dose not rise as much as PM: because manufacturing employment rises, the marginal product of labor in that sector falls. Relative prices and the distribution of Income Let’s discuss the the results of the shifts of labor for the incomes of three groups: 1) Workers – their wage rate has risen, but less than in the proportion to the rise in PM. Thus, their real wage in terms of manufactures (w/PM) falls, while (w/PF) rises. So, the warfare of workers are uncertain, depending upon their preferences of consumption. 2) Owners of capital, are definitely better off. The real wage rate in terms of manufactures has fallen, so that the profits of capital owners in terms of what whey produce rises. 3) Owners of land are definitely worse off. The lose for two reason: --- the real wage in terms of food rises, squeezing their income, and --- the rise in manufactures prices reduces the purchasing power of any given income. 2. International Trade in the Specific Factors Model We know that an increase in the supply of manufactures (or land) would increase manufactures (food) output and reduce the food (manufactures) output. Now we suppose that American has a larger supply of land than Japan; while Japan has a larger supply of capital than American. We also suppose that under any PM/PF, the demand of two countries is the same, i.e. trade is occurred only because of the difference of the relative supply Therefore, the relative price of manufactures is determined by the world relative supply RSworld and world relative demand Rdword. Relative price Of manufactures, PM/PF RSA RSworld (PM/PF)A RSj (PM/PF)world (PM/PF)j RDworld Relative quantity Of manufactures, QM/QF Trade pattern and Budget constraint In a closed economy, output equals to consumption, so DM = QM, DF = QF Although trade makes it possible for a country to consume the different mix of manufactures and food, the value of consumption must be equal to the value of production, so PM хDM + PF хDF = PM хQM + PF хQF, or DF – QF = (PM/PF) х(QM – DM) The budget constraint for a trading economy Consumption of food, DF Output of food, QF Point 1 represents the economy’s Production. The economy’s consumption must lie along a line that Passes through point 1 and has a Slope equal to minus the relative 1 Price of manufacturers. Budget constraint (slope = - PM/PF) 1 QF Production Possibility frontier 1 QM Consumption of Manufacturers,DM Output of Manufacturers, QM 3. Income distribution and the gains from trade After trade, it leads to a convergence of relative prices. Trade benefits the factor that is specific to the export sector of each country but hurts the factor specific to the import-competing sectors, with ambiguous effects on mobile factors. Do the gains outweight the losses? Through the diagram in the next page, we find that trade potentially benefits a country since it expends the economy’s choices of consumption. Trade expands the economy’s consumption possibilities Consumption of food, DF Output of food, QF Before trade, economy’s production and consumption were at Point 2 on its production possibilities frontier (PP). After trade, The economy can consume at any point on its budet constraint in the colored region consists of feasible posttrade consumption choices with consumption of both goods higher than at the pretrade point 2. 2 1 QF 1 Budget constraint (slope = - PM/PF) PP 1 QM Consumption of Manufacturers, DM Output of Manufacturers, QM 4. The political economy of trade: a preliminary review Optimal trade policy In spite of the real importance of income distribution, most economists remain strongly in favor of more or less free trade, reasons are: a. Income distribution effects are not specific to international trade. b. It is always better to allow trade and compensate those whose who are hurt by it than to prohibit the trade. • c. Those who stand to lose from increased trade are typically better organized than those who stand to gain. This imbalance creates a bias in the political process that requires a counterweight Income distribution and trade politics in most of the countries, including the U.S.A., those who want trade limited are more effective politically than those who want it extended. Typically, those who gain from trade in any particular product are a much less concentrated, informed, and organized group than those who lose. Chapter Three: Resources and Trade – The Heckscher-Ohlin Model 1. A model of Two-factor Economy The economy produce two goods – cloth and food Two factors – labor and land aTC = acres of land used to produce one unit of cloth aLC = hours of labor used to produce one unit of cloth aTF = acres of land used to produce one unit of food aLF = hours of labor used to produce one unit of food L and T = supply of labor and land Input Possibilities in food production Unit land input aTF, in acres A farmer can Produce a unit of Food with less land If he or she uses more Labor,and vice versa. Input combinations that produce one unit of food II Unit land input aLF,in hours What he or she will actually use? It depends on the relative cost of land and labor -- factor prices: w/r (wage rate per hour of labor/ cost of one unit of land) It is represented by the Figure as the curve FF. There is a corresponding relationship between w/r and the land-labor ratio in cloth production. As showed by the curve CC. Curve CC lies to the left of FF, indicating production of food uses a higher ratio of land to labor than the production of cloth. Factor prices and input choices Wage-rental ratio, w/r 在每个部门,生产中所使用的土 地与劳动的比例取决于劳动与土 地的相对价格,即w/r。图中的 FF曲线表示在粮食生产中的土 地-劳动比的选择,CC曲线则表 示在棉布生产中的土地-劳动比 率。对于任何一个给定的工资租金比,粮食生产会使用较高的 土地-劳动比率。在这种情况下, 我们称粮食生产为土地密集型 (land intensive),棉布生产为劳 动密集型(labor intensive). CC FF Land-labor Ratio, T/L Factor prices and goods prices Relative price of Cloth, PC/PF SS 由于棉布生产是劳动密集型的,粮 食生产是土地密集型的,要素相对 价格w/r与商品相对价格PC/PF存 在着一 一对应的关系. 劳动的相 对成本越高,劳动密集型产品的相 对价格就越高. 图中的SS曲线显 示了这种关系. Wage-rental ratio, w/r 从商品价格到要素投入的选择 From Goods Prices to Input Choices Relative Price of cloth PC/PF CC FF 2 w/r 1 w/r 2 PC/PF 1 PC/PF Increasing 1 2 1 TC/LC TC/LC TF/LF Increasing 2 TF/LF LandLabor Ratio T/L 给定棉布的相对价格,工资与地租 的比例一定等于(w/r)1. 对应于这一工资—地租比例,棉布和粮 食生产中的土地与劳动比例分别是(TC/LC)1和(TF/LF)1. 如果棉 布的相对价格上升到(PC/PF)2, 工资—地租比就一定会上升到 (w/r)2,从而造成两个部门生产中使用的土地– 劳动比例提高. The allocation of resources Increasing Labor used in food production OC C 1 F Increasing Land used in food production Land used in cloth production OF Labor used in cloth production Increasing What will be happen, if the economy resources change, say, by increasing the offer of land. We notice that an increase the economy’s supply of land will lead to a fall in the output of the labor intensive good, with the rise of the output of the land intensive good. That is, there is a biased expansion of production possibilities. Resources and Production Possibilities Output of food,QF 资源供给的变动对生产可能 Slope= -PC/PF 2 2 性的偏向性效应是理解资源 QF 差异如何导致国际贸易的关 键. 土地供给的增加使一国 的生产可能性向偏向于粮食 Slope= 生产的方向扩张,而劳动的 -PC/PF 增加使生产可能性向偏于棉 TT2 1 布生产的方向扩张. 因此, 土 1 地对劳动的相对供给比较高 QF 的国家在生产粮食生产上具 TT1 有相对优势.一般说来,一个 1 2 国家生产本国相对充裕资源 QC Output of cloth, QC QC 密集型的产品具有比较优势. -- known as the “Rybcznski effect” (罗布津斯基效应) 2. Effects of International Trade Between Two-Factor Economies Relative prices and the Pattern of Trade -- since Home is the labor-intensive economy, Home tends to produce a higher ratio of cloth to food. -- When Home and Foreign trade, their relative prices converge. -- Since Home is abundant in labor, cloth production uses a higher ratio of labor to land in its production than food, that is cloth is labor-intensive, Home will export cloth and import food. Trade Leads to a Convergence of Relative Prices 贸易前,点1是本国的均衡 Relative price 点,即本国的相对需求曲线 of cloth, PC/PF RD和相对供给曲线RS的 交点. 同理,点3是外国贸易 前的均衡点. 贸易后, 世界 相对价格位于贸易前两国 均衡点之间,如点2所示. RS* RS 3 .2 RD 1 Relative quantity of cloth, QC+QC* QF+QF* Trade and Distribution of Income Owners of a country’s abundant factors gain from trade, but owners of a country’s scarce factors lose. We find that factors of production that are “stuck” in an import-competing used intensively by the import-competing industry are hurt by the opening of trade. The distinction between income distribution effects due to immobility and those due to differences in factor intensity also reveals that there is frequently a conflict between shortterm and long-term interests in trade. Factors Price Equalization There is a tendency toward the equalization of factor prices. However, we find the assumption do not meet the the real world: reasons --- we assume countries produce both goods -- countries have the same technologies -- factor price equalization depends on the complete convergence of the prices of the goods which is not the fact. 3.Empirical Evidence on the H-O Model Leontief Paradox H-O model has been less successful at explaining the actual patterns of international trade than one might hope, it remains vital for understanding the effects of trade, especially its effects on the income distribution. Chapter Four The Standard Trade Model Ricardian Model has conveyed the essential idea of comparative advantage, but difficult for discussing the distribution of income. The Specific Model is effective in explaining the income distribution, however, awkward for discussing the trade pattern. The H-O Model is helpful in deeper understanding of the trade pattern due to the differences of resources. 1. A Standard Model of Trading Model All of the above models can be viewed as special cases of a more general model of a trading economy. The Standard Model is much more effective in explaining the issues such as: -- the effects of shifts in world supply resulting from economic growth; -- shifts in world demand resulting from foreign aid; -- simultaneous shifts in supply and demand resulting from tariffs and export subsidies. Production Possibilities and Relative Supply The basic assumption of the model: two goods – food (F) and cloth (C), with a smooth PPF(TT). We know that the actual mix of production is determined by the relative price PC/PF. Any economy will maximize the value of output: V = PCQC + PFQF, or QF = V/PF – (PC/PF)QC Isovalue lines – lines along which the value of output is constant. Relative Prices Determine the Economy’s Output Food Production, QF An economy whose Production possibility frontier is TT will produce at Q, which is on the highest possible isovalue line. Isovalue lines .Q TT Cloth Production, QC Relative Prices and Demand • Giving any economy, • PCQC + PFQF = PCDC + PFDF = V • The economy’s choice of a point on the isovalue line depends on the tastes of its consumers – represented by a series of indifference curves. • Please note the three characteristics of the indifference curves (P95) How an Increase in the Relative Price of Cloth Affects Relative Supply Food Production, QF The isovalue lines become steeper when the relative price of cloth rises from VV1(PC/PF)1 to VV2(PC/PF)2. As a result , the economy produces more cloth and less food and the equilibrium output shifts form Q1 to Q2 Q1 . Q2 . VV1(PC/PF)1 VV2(PC/PF)2 Cloth Production,QC Production,Consumption, and Trade in the Standard Model The economy produces at QF point Q, where the production possibility frontier is tangent to the Food highest possible isovalue line. It consumes at point D, import where that isovalue line is tangent to the highest possible indifference curve. The economy produces more cloth than it consumes and therefore export cloth; correspondingly, it consumes more food than it produces and therefore imports food. Indifference curves . D .Q Isovalue lines TT QC Cloth exports Effects of a Rise in the Relative Prices of Cloth QF The slop of the isovalue lines is equal to minus the relative price of cloth PC/PF, so when that relative prices rises all isovalue lines become steeper. In particular, the maximumvalue line rotates from VV1 to VV2. Production shifts from Q1 to Q2, consumption shifts from D1 to D2. . D1 . D2 . Q1 . Q2 TT VV1(PC/PF)1 VV2(PC/PF)2 QC The Welfare Effect of Changes in the Terms of Trade When PC/PF increases, a country that initially exports cloth is made better off, since its consumption moved from D1 to D2. The general conclusion: a rise in the terms of trade increases a country’s welfare, while a decline in the terms of trade reduces its welfare. Economic growth(represented by the shift of the RS curve) vs. welfare – is economic growth in other countries good or bad for Home? And is growth in a country more or less valuable when that nation is part of a closely integrated world economy? Growth and the PPF Economic growth means an outward shift of a country’s PPF. Q International trade effects of growth results from the . fact that such growth . has a bias. F TT1 TT2 QC Growth biased toward cloth Relative Supply and the Terms of Trade Suppose Home has a growth strongly biased toward cloth, so the World as a whole the relative output of cloth to food will rise, resulting a decrease in the relative price of cloth. Export-biased growth tends to worsen a growing country’s terms of trade, to the benefit of the rest of the World. PC/PF RS1 RS2 1 (PC/PF)1 . 2 (PC/PF)2 . Cloth –biased growth RD QC+QC* QF+QF* Immiserizing Growth Some analysts suggested that the growth in poorer nations would actually be self-defeating. The export-biased growth would worsen their terms of trade. Jagdish Bhagwati of Columbia University argued that such perverse effects of growth can in fact arise within a rigorously specified economic model. It can be occurred when the export-biased growth combined with very steep RS and RD curves, so that the change in the terms of trade is large enough to offset the initial favorable effects of an increase in a country’s productivity capacity. 2. International Transfers of Income -- effects on a transfer on the terms of trade If Home makes a transfer of its income to Foreign, Home’s income is reduced, and Foreign’s expenditure is increased. It would lead to a shift in world relative demand and thus affect the terms of trade. The shift of the RD curve is the only effect of a transfer of income. The RS curve does not change. However, the terms of trade is also depended on the allocation of the spending. Effects of a transfer on the terms of trade If Home has a PC/PF higher propensity to spend on cloth than Foreign, a transfer of income by Home to Foreign shifts the RD curve left from (PC/PF)1 RD1 to RD2, (PC/PF)2 reducing the equilibrium relative price of cloth. 1 2 . . Qc+QC* QF+QF* therefore, a transfer worsens the donor’s terms of trade if the donor has a higher marginal propensity to spend on its export good than the recipient. Since the actual spending patterns of each country seems to have a relative preference for its own goods, and also there exists the nontrade goods, as well as the effect of barriers to trade, most international economists believe that the transfer of income worsens the donor’s terms of trade. 3. Tariffs and export subsides: simultaneous shifts in RS and RD • If Home imposes a certain percentage of tariff on the value of food, say, 20%, the internal price of food relative to cloth faced by Home producers and consumers will be 20% higher than the external relative price of food on the world market At any given world relative price of cloth, Home will face a lower relative cloth price, and then will produce less cloth and more food. So the world relative supply of cloth will fall, while the relative demand for cloth will rise. Therefore, Home’s terms of trade will improve at the expense of Foreign. Effects of a tariff on the terms of trade Relative price Of cloth,PC/PF An import tariff imposed by Home will both reduces the relative supply of cloth and increase the (PC/PF)2 relative demand of cloth. As result, the relative price of cloth (PC/PF)1 must rise. Home’s terms of trade will improve. RS2 RS1 2 RD2 1 RD1 Relative quantity Of cloth, QC+QC* QF+QF* Effects of an export subsidy • If Home offers a 20% subsidy on the value of any cloth exported. For any given world prices this subsidy will raise Home’s internal price of cloth relative to food by 20%. Therefore, Home will produce more cloth and less food, while leading Home consumers to substitute food for cloth. A Home export subsidy worsens Home’s terms of trade and improves Foreign’s. Chapter Five: Economies of Scale,Imperfect Competition,and International Trade 1. Economies of scale and international trade: -- an overview Economies of scale, also referred to as increasing returns, exists in many industries. Therefore, production is more efficient in the larger scale. Classification of economies of scale: -- External economies of scale -- Internal economies of scale 2. The theory of imperfect competition Perfect vs. imperfect competition -- perfect competition: there are many buyers and sellers, none of whom represents a large of part of the market, so firms are price takers. -- imperfect competition: only a few major producers in an industry, firms will view themselves as price setters. Two characteristics of imperfect competition -- in an industry, there are only a few major producers, and -- each producer’s product is seen by consumers as strongly differentiated from those of rival firms. Monopolistic Pricing and Production Decision 一个具有垄断地位的厂商 Cost, C 会选择这样一个产量: 在该 and 产量上, 边际收益等于边际 Price, P 成本。这个利润最大化的 产量就在图中的点QM, 与QM对应的价格为PM。 PM 由于边际收益总是低于 AC 价格,因此边际收益曲线 MR位于需求曲线D的下方。 垄断利润等于阴影的长 方形面积,即等于价格与 平均成本之差乘以产量QM。 Monopoly profit AC D MC MR QM Quantity,Q Monopolistic Competition Model • Two key assumptions: Each firm is assumed to be able to differentiate its product from that of its rivals. Each firm is assumed to take the prices charged by its rivals as given – that is, it ignores the impact of its own price on the prices of other firms. -- assumption of the model _ Q = S х[1/n – b х(p – p)] Equilibrium in a monopolistically competition Cost C, and 垄断竞争市场里的厂商数以 Price, P 及各厂商的定价由两个关系 所决定: 一方面,市场中的厂 商数越多,则它们的竞争越激 AC3 烈,相应地定价也较低.这一关 P1 系由曲线PP反映.另一方面,厂 P2,AC2 商数越多,各厂商的销售量也 AC1 越少,因而平均成本较高.这一 关系由曲线CC表示.如果价格 P3 高于平均成本,该行业就会赢 利,更多的厂商进入该行业,反 之,亦然. 当平均成本与价格相 n1 n2 等时(E)点,形成均衡的价格与 厂商数. CC . PP n3 Number Of firms,n Limitations of the Monopolistic Competition Model • There are two kinds of behavior arises in the general oligopoly setting that are excluded by assumption from the monopolistic model: First is the collusive behavior – through explicit agreements between firms, or through tacit coordination strategies, such as price leader. Second is the strategic behavior – through some of the behavior that may affect the competitors. 3.Monopolistic Competition and Trade • Since, • AC = F/Q + c = n хF/S + c • International trade will increase in total sales S, reducing the average costs for any given number of firms n. Therefore, the CC curve in the larger market will be below that in the smaller market. • P = c + 1/(b хn) • The size of the market does not enter into the equation, so an increase in S does not shift the PP curve. Effects of a larger market Cost, C and Price P 在其他条件不变的 情况下,随着市场 规模的扩张,各厂商 能生产更多的产品, 平均成本也随之下降, P1 结果是厂商数目的 P2 增加,可获取的商品 种类也因之而丰富, 各种商品的价格下跌. CC1 CC2 1 2 PP n1 n2 Number of Firms,n Economies of scale and Comparative advantage The difference between this model and the factor proportional model is that manufacturers is not a perfectly competitive industry in which a number of firms all produce differentiated products. Because of economies of scale, neither country is able to produce the full range of manufactured products by itself; thus, although both countries may produce some manufactures, they will be producing different things. If we assume the manufacture is a monopolistic competitive sector, Home will be a net exporter of manufacture and an importer of food. Home (capital abundant) Manufactures Food Trade in a World Without Increasing Foreign Returns (labor abundant) Trade with Increasing Returns and Monopolistic Competition Home (capital abundant) Foreign (labor abundant) Manufactures Food Interindustry trade Intraindustry trade Four points about this pattern of trade Interindustry trade(manufactures and food) – due to comparative advantage. Intraindustry trade(manufactures for manufactures) – due to economies of scale The pattern of intraindustry trade itself is unpredictable. The relative importance of intraindustry and interindustry trade depends on how similar countries are. The importance of intraindusty trade equals to exports – imports I=1exports + imports 4. Dumping and Reciprocal Dumping Cost, C and Price,P PDOM PFOR MC 3 1 2 DFOR=MRFOR DDOM MRDOM QDOM Domestic Sales QMONOPOLY Exports Total Output Quantities produced and demanded, Q 5. The Theory of External Economies Economies of scale apply at the level of the industry rather than at the level of the individual firms. Three main reasons why a cluster of firms may be more efficient than an individual firm in isolation: -- Specialized Suppliers -- Labor Market Pooling -- Knowledge Spillovers External Economies and International Trade As this model Price, Cost (per watch) shows, external economies potentially give a C0 strong role to historical accident in determine who 1 produce what, and P1 may allow established 2 patterns of specialization to persist even they run counter to Q1 comparative advantage. ACSWISS ACTHAI D Quantity of Watches Produced and demand Trade and Welfare with External Economies Clearly in this situation trade leaves Thailand worse off than it would be in the absence of trade Price,Cost (per watch) Co P1 P2 1 ACSWISS 2 ACTHAI DWORLD DTHAI Quantity of watches Produced and demanded Dynamic increasing returns External economies arising from the accumulation of knowledge differ something form the external economies considered above Dynamic increasing returns -- learning curve is determined by the cumulative output of the industry to date. While for ordinary external economies, the cost of the industry is determined by the prevailing production quantity. Chapter Six: International Factor Movements • 1. International Labor Mobility • A One- good Model without factor mobility Output, Q Marginal Product Of labor, MPL Q (T,L) Rents Real wage Wages Labor, L MPL Labor, L Causes and Effects of International Labor Mobility MPL MPL* Marginal product of labor B A MPL* Q Home employment C L2 L1 Migration of labor From Home to Foreign Total world labor force MPL Foreign Q* Employment 2. International Borrowing and Lending When we speak of capital flow in this part, we refer to it as a financial transaction – that is one country make loan to another. International borrowing and lending can be interpreted as a kind of trade – intertemporal trade Any economy will produce and consume its output either at present or in the future, therefore, it involves a trade-off between present and future production of the consumption good. We can summarize by drawing an intertemporal production possibility frontier. The Intertemporal Production Possibility Frontier A country can trade current consump-tion for future consumption in the same way that it can produce more of one good by producing less of another. Future consumption Present consumption The shape of intertemporal PPF will differ among countries Let suppose Home’s PPFs are biased toward current consumption, while Foreign toward future Without international borrowing and lending, Home will have a higher relative price of future product consumption than in Foreign Therefore, Home will export present consumption and import future consumption The relative price of future consumption is determined by interest rate --- 1/(1+r) Let’s assume that Home’s intertemporal PPF is biased toward present production – therefore Home has a comparative advantage in present production – a low relative price of present consumption. A country has a comparative advantage in future production of consumption goods is one that in the absence of borrowing and lending would have a low relative price of future consumption – a high real interest rate.A high interest rate means a high return to diverting resources from current production to future So countries that borrow in the international market will be those where highly productive investment opportunities are available relative to current productive capacity. (lenders are actually export their current consumption ). 3. Direct Foreign Investment and Multinational Firms Another important form of capital movement is direct foreign investment (FDI) A distinctive feature of FDI is that it involves not only a transfer of resources but also the acquisition of control The point is that while multinational firms sometimes act as a vehicle for international capital flows is to allow the formation of multinational organizations – the extension of control is the essential purpose. The theory of Multinational Firms Location – why should a firm to produce the same product in different countries -- differences of resources / transportation costs / government restrictions Internalization – why is production in different location done by the same firm in stead of a different country? -- it turns out to be more effective and profitable to carry out transactions within a firm rather than between firms, because: a) technology transfer – difficult to determine the price b) vertical integration – upstream and downstream often get into conflicts, these problems can be reduced or avoided through a single vertically integrated firm. Chapter Seven The Instrument of Trade Policy • 1. Basic tariffs analysis Supply, demand, and trade in a single industry -- without tariffs, the world Price, P XS price is determined by Home import demand P (MD) and Foreign export MD supply (XS) W QW Quantity,Q Effects of a Tariff Home Market Price,P S World Market Foreign Market Price,P Price,P 2 PT XS S* 1 t PW PT* 3 D Quantity,Q MD QT QW Quantity,Q D* Quantity,Q A tariff raises the price in Home while lowering the price in Foreign. The volume traded declines. Note, the increase in the price in Home is less than the amount of the tariff, because part of the tariff is reflected in a decline in Foreign’s export price Therefore, Home has the effect of the improvement of trade terms If Home is a “small country”, where it cannot affect foreign export price. As a result of the tariff, imports fall in the country imposing the tariff, while price raises equal to the tariff imposed. (see next diagram) A tariff in a small country When a country is small, a tariff it imposes cannot lower the foreign price of the good it imports. As a result, the price of the import rises and the quantity of imports demanded falls Price,P S PW+t PW D S1 S2 D1 D2 Imports after tariff Imports before tariff Quantity,Q Measuring the amount of protection Nominal rate of protection – arithmetic average Actual rate of protection – weighted average Effective rate of protection d w Vj – Vj ERP = w Vj 2.Costs and Benefits of a tariff The costs and benefits to different groups can be represented as sums of the five areas a, b, c, d and e Price,P PT Pw PT* a S c b d e D S1 S2 D 1 D2 QT Quantity, Q Consumers surplus loss: a + b + c + d Domestic producers gain: a Government revenue gain through tariff: c + e e represents the terms of trade gain Production distortion loss: b Consumption distortion loss: d Efficiency loss: b + d The net cost of a tariff: = (a + b + c + d) – a – (c + e) =b+d–e Net welfare effects of a tariff Terms of Trade gain d Consumption distortion loss Production distortion loss e 3. Others instruments of trade policy Export subsidies Price,P PS Subsidy PW a S b e c f g PS* D Producer gain:a+b+c Consumer loss:a+b Government subsidy: b+c+d+e+f+g Consumption and production loss:b and d Additional terms of trade loss:e+f+g Quantity,Q Exports Import quota – U.S. Import Quota on Sugar Price, $/ton Supply Consumer loss: a+b+c+d Producer gain: a Quota rents: c a b c d Demand 5.14 6.32 8.45 9.26 Import quota 2.13 million tons Quantity of Sugar million tons Voluntary Export Restraints (VER) – or Orderly Market Agreements (OMA) Local Content Requirements -- no strict limit on imports, it allows firms to import as long as it by more domestically, so the effective price of inputs of the firms is an average of the price of imported and domestically produced inputs. This differences of prices pass on to consumers. Export credit subsidies National procurement Red-tap barriers – War of Poitiers Comparing a Tariff and a Quota Price,P A quota Pq leads To lower PW+t domestic output and a PW higher price than a tariff that yields the same level of imports. MC D MRq Qq Qt Dq Quantity,Q 4. The effects of trade policy: A summary Tariff Export subsidy Import quota VER Producers surplus Increases Increases Increases Increases Consumers surplus Falls Falls Falls Falls Government Revenue Increases Falls (gov. spending rises) Overall national welfare Ambiguous (fall for small country) Falls No change No change (rents to (rents to holders) foreigners) Ambitious Falls Chapter Eight The Political Economy of Trade Policy • 1. The case for Free Trade Free Trade and Efficiency -- a free trade would remove both production and consumption distortions and increases national welfare Additional Gains From Free Trade -- economies of scale -- providing entrepreneurs with an incentive to seek new ways to export or compete with imports, since free trade offers more opportunities for learning and innovation than are provided by a system of “managed” trade. Political Argument for Free Trade -- it reflects the fact that a political commitment to free trade may be a good idea in practice even though there may be better policies in principle. 1) The conventionally measured costs of deviating from free trade are large. 2) There are other benefits from free trade that add to the costs of protectionist policies. 3) Any attempt to pursue sophisticated deviations from free trade will be subverted by the political process. 2. National Welfare Arguments Against Free Trade The terms of trade argument for a tariff -- a sufficiently small Tariff the terms of trade 1 benefits must outweight the costs. Optimal Prohibitive Tariff Rate tariff,t0 Tariff, tp The Domestic Market Failure Argument Against Free Trade -- the basic theoretical case for free trade rested on cost-benefit analysis using the concepts of consumer and producer surplus. -- some economists argue that these concepts do not properly measure the benefits of producing a good. -- since labor in a sector may be unemployed or underemployed, the existence of defects in the capital and labor market may prevent the transfer, the possibility of technological spillovers from industries – domestic market failure Distortion from tariff a and b, however, the calculation overlooks an additional benefit that may make the tariff preferable to free trade. Since the increase in production yields a social benefit Price,P s PW+t PW b D Dollars S1 S2 c S1 S2 D2 D1 Quantity,Q Marginal Social benefit Quantity,Q The social benefit is derived from the experience of production that improve the technology of the economy as a while but that the firms in the sector cannot appropriate this benefit and therefore do not take it into account in deciding how much to produce. The marginal social benefit is the additional production that is not captured by the producer surplus measure. We can prove that as the economy impose a sufficient small tariff, the extra social benefit (c) would outweight the distortions (a) and (b). The domestic market failure argument against free trade in a particular case of a more general concept known in economies as the theory of the second best. 3. Income Distribution and Trade Policy -- the discussion so far is confined to the national warfare, when we look at the reality, there is always individual’s desire reflected in the objectives of the government. -- in the following model we will assume the governments are trying to maximize political success rather than the abstract measurement of national welfare. Electoral Competition -- the so-called median voter. 选民被依照其偏好 的关税税率的高低 Preferred tariff rate 而排成一条直线。 如果一个党派提出 tA 高关税A, 那么另一 tB 个党派就可能提出 通过一个较低的关 税税率B而赢得大部 tM 分选票。政治竞争 迫使两个党派对提 出接近于M的关税 率, 其中M是中点 Median 选民所偏好的关税 Voter 税率。 Political support Voters however, this model doest not work well, in fact, it makes an almost precisely wrong prediction. According to this model, a policy should be chosen on the basis of how many voter it pleases. A policy that inflicts large losses on a few people but but benefits a large number of people should be a political winner. What is the reality? Collective Action - there is a problem of collective action: while it is in the interests of the group as a whole to press for favorable policies, it is not in any individual’s interests to do so. Modeling the Political Process - politicians may win the elections partly because they advocate popular policies – need money. So the relevant policies favoring the group that offering sufficient financial contribution will be put forward. Some people therefore envision the trade policy as a sort of auction – in which interest groups “buy” policies. 4. International Negotiations and Trade Policy The Advantages of Negotiation Helps mobilize support for free trade Helps governments avoid getting caught in destructive trade wars. Intentional Trade Agreements: A Brief History GATT – in 1947 WTO – 1995 Free Trading Agreements/Customs Union/Common Market/Economic Union Chapter Nine Trade Policy in Developing and Developed Countries 1. Trade Policy in Developing Countries Import-substitution Industrialization -- The Infant Industry Argument Pitfalls of the Infant Industry Arguments a. It is not always good to try to move today into the industries that will have a comparative advantage in the future b. Protecting manufacturing does no good unless the protection itself helps make industry competitive. c. The implementation of the policy is costly and time consuming to build up an industry. Justifications for Infant Industry Protection: -two reasons why infant industry should be protected: a. Imperfect capital market: infant industry in developing countries does not have a set of financial institutions, through protection, it allows more rapid growth – as a second best policy b. The problem of appropriability – the idea is that firms in new industry generate social benefits for which they are not compensated. -- Promoting Manufacturing Through Protection, in most developing countries, the basic strategy for industrialization has been to develop industries oriented toward the domestic market by using trade restrictions such as tariffs and quotas to encourage the replacement of imported manufactures by domestic products. As a strategy of promoting manufactures, the import-substituting industrialization has worked. The problem is :has the strategy promoted the growth of economic development. The Problems of the Dual Economy The division of a single economy into two sectors that appear to be at very different levels of development is referred to a economic dualism. The presence of economic dualism is often used to justify tariffs that protect the apparently efficient manufacturing sector. Some economists have argued that importsubstitution policies have actually helped to create the dual economy or at least aggravate some of its symptoms. Export-oriented industrialization Those countries adopting the policies have achieved spectacular economic growth. The so called HPAEs – high performance Asian economies. Some people argue that there is a correlation between rapid growth in exports and rapid overall economic growth, and the relatively low rates of protection in the HPAEs helped them to growth. The miracle can be contributed to : high trade ratio, high saving rate and rapid growth of education level 2. Strategic Trade Policies in Advanced Countries • Arguments for strategic trade policy Technology and Externalities – firms can appropriate some of the benefits of their own investment in knowledge, while other firms can benefit through “reverse engineer” Imperfect Competition and Strategic Trade Policy– since there exists the market failure that justifies the government intervention in the lack of perfect competition. The Brander-Spencer Analysis • Effects of a subsidy to Airbus Airbus Boeing Produce Don’t produce -5 0 -5 100 100 0 0 0 however, the problems of the strategic policies would face foreign retaliation. Since the policies are beggar-thy-neighbor policies that increase the welfare at the expense of other countries’ . We should note that strategic policy cannot be judged by asking whether the targeted industries grew. Although some of the industries finally grow and achieve substantial market share, but this does not mean that the policies accelerated economic growth, because an interventionist policy will not accelerated economic growth unless it corrects a market failure.