* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Aggregate Supply

Survey

Document related concepts

Transcript

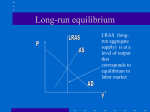

Aggregate Supply The AS is the part of our national economy model where the production side is studied. 1 An Analogy and a definition Which blade cuts the paper when you use a pair of scissors on the paper? The answer is that you need both to cut the paper. Up to now in our theory about the national economy we have talked about aggregate demand, AD. But, just like we need both blades in the scissors, we also have to build in aggregate supply into our theory. Aggregate Supply AS is about the relationship between the price level and the amount of real domestic output (RGDP) that firms in the economy produce. 2 Recall an earlier story Please recall our earlier work about a single firm and its production when prices were sticky and when they could freely adjust. With sticky prices we saw a horizontal supply and with flexible prices we saw a vertical supply. In the larger, full economy we recall this earlier story and build on it. In macro we will think about three scenarios: 1) Input prices and output prices are fixed, or are sticky, 2) Input prices are fixed but output prices can change, and 3) Both input prices and output prices can change. Let’s explore each of these scenarios next. 3 The Immediate Short Run Price level P1 ASISR Fact about our economy: 75% of a typical firm’s costs are wage and salary and these are fixed either by contract (like for me) or there is an implicit understanding that wages are negotiated only every so often (maybe yearly). A good deal of input prices are fixed in this time frame. RGDP 4 The Immediate Short Run Also in the immediate short run output prices are fixed. Firms print up menus and price lists and in the very short term they stick with these prices. So, the immediate short run is anywhere from a few days to a few months. The more important point is that it is that period of time when both input prices and output prices are fixed (sticky!). Hey, try not to be confused by input prices and output prices. Example: Say the output is pizza. The output price is the price of the cooked pizza. What are the inputs to making pizza? The dough, sauce and other ingredients are inputs that will have prices, as will the labor that is making the pizza (and the price of 5 labor is often called the wage!). The Immediate Short Run Price level AD Low AD Full P1 AD High ASISR Low Full Note that the level of output in this immediate short term will depend on aggregate demand and the RGDP level that corresponds to full employment will only occur if demand is AD Full. In other words the full employment level of output is not guaranteed in the economy. RGDP High 6 Short Run P AS P2 P1 RGDP1 RGDP2 The AS has an upward slope to it as we view it from left to right. This means the price level and the level of RGDP firms will offer for sale is positively, or directly, related. RGDP 7 Short Run Note that the short run is defined here as the time frame in which input prices are fixed but output prices can change. Higher (lower) output prices with fixed input prices means profits would be higher (lower) and this is the incentive (disincentive) firms need to increase (decrease) real output. On the last screen you can see that at low levels of RGDP the AS is somewhat flat and as the level of RGDP rises the curve is becomes steeper. Let’s look at this next. 8 Per Unit Production Cost In order to see the points about AS we need to think about the following ratio: Total input cost/units of output. This ratio is the per unit production cost (on average) of output. Ultimately the price per unit of output has to cover this or firms would not be able to produce because they wouldn’t be making any profit. The AS is a curve showing what price levels have to be to get the various levels of output produced. Now, if more units of output are made, additional inputs are needed (but remember the short run has the input prices fixed!). 9 Per unit production cost When output is already low, below the full employment level, this means many resources are underutilized. To add output resources that are idle get put back to work and the ratio of input cost to output does not change much. So the price level does not have to expand much to get more output. With the higher price level firms have an incentive to produce more. Now, when output is already at the full employment level of output or above, additional output is that much harder to come by. Adding inputs, when a great deal of output is already being made does not yield as much output as before and thus per unit costs rise. In order to get the additions, the price level would have to really jump to get the additional output. 10 Long run P ASLR P2 P1 Given a state of technology and resource endowments the ASLR is shown as one level of RGDP. This is the full employment level of output in the economy. Since it is a vertical line, we see that if the price level should change the quantity supplied in the long run will not change. RGDP RGDP1 11 Long Run The long run is defined as the time frame in which both input prices and output prices can change. Say that the economy is really producing a great deal of output. When the economy is operating at a high level workers are often putting in a lot of overtime because there are few excess workers and other resources. After a while workers and other resource owners conclude that input prices need to adjust because of this work pattern. Higher output prices resulting from high levels of output soon get matched with higher input prices. Output then stays at the potential level in the economy. 12 Summary up to Now The immediate short run aggregate supply is referred to as ASISR and is the result of both input and output prices being fixed. The short run aggregate supply is referred to as AS and is the result of input prices being fixed but output prices as being flexible. The long run aggregate supply is referred to as ASLR and is the result of both input and output prices being flexible. The authors note that a great deal of our time will focus on the short run and unless otherwise stated that will be the context of the discussion of aggregate supply for now. The reason for this is because business cycles are thought to have the same conditions as under13the short run – namely flexible output prices, inflexible input prices. There are 3 kinds of people in the world. There are those who can count and those who can’t ! Shifting AS The AS supply curve can shift if we have a change in 2) productivity, 3) business taxes and subsidies, and 4) government regulation. Let’s look at each idea here next. If productivity grows then firms can make available for sale a greater number of goods available for sale at each price level – The AS shifts to the right. When business taxes grow, or when subsidies fall, firms have to pay out a greater amount from the price level they receive and therefore they keep less. The fact that they keep less makes them more reluctant to supply and thus AS shifts to the left. Government regulation is usually costly for the firm to cover and so 14 more regulations reduce AS and this means the curve shifts to the left. Shifting AS The AS supply curve can shift if we have a change in 1) Input prices – WAIT A MINUTE – before we said input prices were fixed in the short run! What is up? The real story is that as the long run is approached input prices change and this will cause a shift in the short run AS. Plus there are shocks on the supply side that cause inputs prices to change. If input or resources prices rise, then per unit production costs rise and thus at the same price level firms in total would reduce output and AS would shift to the left. Note some inputs in US economy actually come from other countries. So, if the dollar becomes weaker foreign inputs get more expensive because we need more dollars to get a unit of foreign15 currency.