* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download document 7824428

Modern Monetary Theory wikipedia , lookup

Business cycle wikipedia , lookup

Full employment wikipedia , lookup

Ragnar Nurkse's balanced growth theory wikipedia , lookup

Gross domestic product wikipedia , lookup

Transformation in economics wikipedia , lookup

Early 1980s recession wikipedia , lookup

Pensions crisis wikipedia , lookup

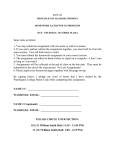

,5q

eueens Couege, ECo

101,

2nd

Mid-Term Exam Spring 2014

Last Name @rint)

Phone Number

Language spoken at home

,

First

Year_ Major

Prof. Dohan

Student ID #

College e-mail

Country of birth

Note: for a statement to be true, the entire statement must be true, not just part of it.

I. Matching basic vocabulary with concepts

Select the best answer for the word or term in Column

Put letter

here

2

3

Cause of Multiplier effect

4

Causes demarrd-pull infl ation

5

Induced investment (rnpi x Ya)

Aggregate demand <Yn

6

7

8

9

Real GDP

Marginal propensity to save

Current definition of investment

bv businesses

l0

B.

(Abbreviations/symbols were used frequently in class & are on "hint sheet".)

Column A

The reason why income taxes

reduce the multiplier

Y3 : Ypotelrral outprLt

I

(2pteach)

A fiom the answers given in Column

Cost of unexpectedly high

inflation rates

1l Federal government sutplus

t2 Rule of doubling time

Column B.

A Ir{ominal GDP coruected for price changes by the GDP deflator

B taxes on cigarettes, alcohol, per.fume, tires, phone service

C Taxes such as property tax that don't va.ty with income or sales

D Taxes-(gov't spending + gov't transfer payments >0

E Intports, income toxes, unenxployment payntent :) {value of ruultiplier

F 4ll vvorkers receiving unemployment benefits.

G 4ll non-institutionalized people above age 16 whorn actively seek work

H Adiustment to multiplier because taxes are paid partlyfrom sa:tings.

I Caused by the spending and respending oJ a prirnary shift in Yd from the

hioher incomes earned bv the workers - consunlers

J Noninal interest rates minus inflation rate

K

L

The prirne rate minus the federal funds rate

Sales - cost ofgoods and services boughtilom otherJirms.

M When Y,t > Yr,

N Building of new plant and equipntent,, building of new residences, and

the chdtrse in inventorie.s

1/(1-mpc + mpc*tx)

o

Equal increases in government spending and taxes raise Yn*

llt

of

investment

ng

Crowd

P I{oninal GDP adjusted by GDP price deflator.

CroVd ng out of investment

measured

in

use

as

Unernployment

a 70 divided by growth rate per period

R Hurts creditors and helps debtors if inJlation is higher than expected.

Excise taxes, examples of

S Inve,strnent caused by increased needfor capaci! as output rises

real interest rate

T Firrns dentanding higher prices for their excess inventory

Potential GDP or Yi.

U A saving resultingfroru an A in disposable hrcome

Equilibriurn only if I": Ia:Sa

V An increase in the deJicil increases interesl rates which leads to a

Interest-sensitive parl of

reduction in private investment

investment

\[ Yd:c:d +Id+Gd+xd- Md

The paradox of thrift

x Businesses order/produce more, same or less depending on Io 1, -, or >

Balanced budget multiplier

Ia. Io always : Sd in the short run

Y Taxes based on income reduces the multiplier ffict by reducing

Value-add by a firm

lisposable income earned at every level of outptrt '

Z Rapid increases in prices distorts peoples' and prodtrcers' purchase

The definition of aggregate

lecisions towards gold, hou,sing, etc.

dernand

aa .lggregale demandfor all inputs in the economy

Lump sum taxes

bb Tctxe,s > government spending and transfer paymenls

ct Derntmdfor investment goods increoses cts real interest ratesfall

dd Level of GDP (called

Yr) whichfully enploys the laborforce

ee An increase in produclion leads to an increase in investment as capacity

Automatic stabilizers

t4 Tax multiplier:

13

15

t6

l7

1E

le

20

2t

'r)

23

24

25

26

27

is reached

ff The economy

l4lhen

will experience unemployment

everybody tries to scne more they will probably saye the same or

less becquse of the fallacy of conryosition

II. Inflation (o pt')

price

We have identified three causes of inflation as measured by an increase in the consumer

price

(imporl

index. They are demand pul| (DP), cost puSh (cP), and increased prices of imports

that could be associated

shock : IpS;, no effect NE. There are several scenarios described below

with inflation.

l.

ven below

the

abbreviation for the

which shifted the

a. Price of crude oil rose sharply in 1973 and 1980 causing an oil price shock

aggregate suPPlY curve inward.

firriort lot"" ,p wages, then companies raise prices to cover higher costs, so unions force

up prices again etc.

ftre f'eO gr-atly increases the money supply to fight a deep recession & high

Write i

--b

_c.

unemploYment.

and the

e. Low interest rates in the US weakens the dollar relative to all other cumencies

prices of foreign goods rise and the demand for US goods rises.

goods a

_f ih" d"rnurrd fo-r g-oods a services exceeds the capacity of the economy to produce

services.

rising faster than labor productivity.

Wages

---g.

Eve| thougf,*. ur. at full employment the FED greatly increases the money supply to

--[ finance a major deficit incurred to finance a major upgrading of the infrastructure.

I[[. Investment and Saving(2

_-1*.

*irg.

_2*.

pts per question unless noted otherwise)

level of

In the long run the desired level of investment in the economy determines the equilibrium

(Careful)

But in the short run what determines the actual rate of investment in the economy?

a. The profitability of new investment.

b. The need to replace sold inventories and depreciated capital.

l

c. The interest rate.

d. The desired rate of savings, which also equals the actual rate of saving.

e. The desired rate of investment

one or

Which of the following affect the desired or planned rate of investment in the economy? circle

more answers. (6 pts) (Careful)

a. The desired rate of saving.

b. The profitability of new investment compared to the interest rate.

c. The depreciation of existing capital.

d. The need for new capacity as the economy expands'

by using new technology'

e. The opportunity to lower costs by automating the production process

is

Choose the complete definition of disposable income from the choices below

payments + imports+

transfer

all

a. GDp depreciation "addition to retained earnings" - all taxes

3x.

-

b. GDP c. GDp d. NDP e. GDP 4+

-

depreciation - all taxes r all transfer payments'

depreciation - "addition to retained earnings" - all taxes

all taxes + all transfer payment'

taxes f transfer payment.

t

all transfer payments'

What determines the desired leve1 of savings in an economy?

(X-M)

,. S;;;: Personal Saving * Co.po*t" Su"ing plus Government Saving plus net imports

b. Actual Saving: Actual Investment

Saving minus net imports (X-M)

c. Saving: personal Saving * Corporate Saving plus Government

d. S:Yai-C : Personal saving

e. saving : Personal Saving + corporate Saving plus Government Saving

.

5. 1: ptslt pt each) (For this problem it may

be helpful to consult your "cheat sheet" to look for the formula for the multiplier and

The multiplier is caused by the secondary expansion of demand that results when the

autonomous variables (C, Tx, Tr,I, G, x, M) as seen in the marginal propensity to consumption from

disposable income (yu,) and crowding in of new investment as output rises. The size of the multiplier

shift in

however, is also affected by something called "automatic stabilizers" which reduce the impact of a

impact each of the

aggregate demand. Using up t or down J arrows or zero for no change. Show what

following events has on the size of the multiplier.

to .9 its normal level.

_jJ tt . -rtginal propensity to consume falls from: .99

.|

b. the tax rate "lx" is lower on all income e.g. Tx Tx /rYa'

the marginal propensity to invest, e.g. the mpi ises from 0.01Yuto 0.05Yu'

-". d. the marlinal properrsity to import (*pm) goods fall because American made goods are becoming

exogenous components.)

less expensive.

The government decides to build a smaft electric grid'

(GDPX Put an "X if counted in the Expenditure

(yes), DI if only

approach, E if in Earnings approach, B if appear in both expenditures and earnings approach

*:>Careful (1 pt each : l8 pts)

in disposable income, Not if not included at all.

-e.

6. How are these items counted in gross domestic product

_a.

b. Purchase ofpaint by professional house painters.

c. Purchase ofa new house at a cheap price.

d. Purchase

ofa foreclosed house at a cheap price.

he

-e.

hiring of Transportation Safety Officers by the

government for airPorts

me hiring of a security force by the residents of a

ity.

-f commun

The payment by the govemment to private firms to

-g. build a new smart electricity grid.

Prrchase of a new computer by a homeowner to do

taxes.

-h*.ilurchase

at QC financed by the

governmenl.

--lt state

k. Wases oaid to private university professors

l. Social Securitv Davments paid to professors.

m. The total income from garnbling casinos at Atlant c City.

n. Capiial gains on the sale ofstock and other securities'

W"gd paid to a university professor

Purchase of paint by the rnan around the house

of paper and printer supplies by a student'

1""*s l}om the sale of gold purchased at $ 1,700 that

was ourchased at $2,700.

-"{"p,t"t

College students for which

_ lr--Sclt"t"rships received by Queens

no service is sunendered in exchange.

D"p...t"tton on private sector equipment and machinery

-.t

Interest paid by the government

-r*. government bonds.

IV. Growth

to households on

(z pts)

years?

Which policies would lead to a hisher per capita GDP growth rate over the next 20

Label as TRUE or FALSE.

:

Hint: Output per capita : Q/L : f,(K/L, N/L, HC/L)' {t pt each:7 pts)

A. The rate of population growth has fallen below the growth rate of GDP.

B. Increased investment by the government and private industry in research

and developmel.rt of new

technologies.

rates to stimulate

In our depressed economy with widespread unemployment, the FED lowers interest

investment in new plant and equipment.

D. Granting a dollar for dollar investment tax credit against corporate taxes making in essence the cost of

C.

investment zero.

it to no more than

China,s policy at first of restricting the birth rate to one child per family and now holding

2 children per familY.

and the government

F. In a fult employment economy, the Fed lowers interest rates to encourage investtnent

produce

ilrvestment

to

resources

real

increases taxes on households to discourage consumption to free up

E.

goods.

behavior (crowing in) the

[n an economy with unemployment but has a strong induced investment

government finally lowers household income taxes petmanently.

G.

4

-- A.

V. TRUE = T, FALSE = F. (1 Pt each, 19)

Even though these questions may look familiar, do not be fooled!

a significant impact

Cutting taxes on the poor (incomes under $20,000/yearlhousehold) will probably have

on

consuription because their marginal propensity to consumer is probably around 0.93.

function upward

lncreasing taxes on the rich and cutting taxes on the poor will probably shift the consumpiion

because of the differences in the marginal propensity to consume.

of unemployment to our society is the benefits lost by not having the lost output such as new

_B

_C.

The primary cost

infrastructure,

but some still have an MPS< 0'

_ D. Households which consume more than tlieir disposable income are dissaving,

to stimulate the

E. At a time of high unemployment and stable prices the sale of bonds by the federal governmentsmaller

capital

*itt..o*alut private investment and leave future generations worse off because of the

-;o"orny

stock and the larger national debt.

deficit each

F. We are still in a recession with high unemployment, stable prices and running a large national

; l;;;";;".ease in spending by the Federal government (G) to build infrastructure would actuallybestimulate

-y"u..

actually

ieal private investment ("ciowding in" or induced investment) so that future generations could

economically be better off because of the larger private capital stock.

and the multiplier becomes

_G. If, the MpC falls from .99 to .90 the slope of the consumption function is flatter

smaller.

investment equals desired

Economists still believe that the economy will be in equilibrium when desired

savings (la:Sa) which both depend on the interest rate'

disposable income rather than on

I*. Keynes hypothesized that since consumption and saving depended mostly on We

now believe that the

the interest rate, so that the equilibriurn levei of income was reached when Ia:Sa

of income. Indeed, it is likely

equilibrium level of income willNor automatically go to the ful1employment level

tobe above or below Yn without some government intervention'

l

started to save more'

they

in200l,

prices

of

housing

collapse

the

(net

with

assets)

fell

wealth

J. As people,s

K*. Since interest rates on bonds right now are relatively low compared to historically normal rates, peoplea who

money to earn higher

are a good investment for retirement will have to save enough additional

_ H*.

_

_

-u"ri"r"'irr"tillror

income to compensate

_

_

for the lower return on their initial investment.

L*. Rapid growth in technology and investment, which increases labor productivit-v, makes it more difficult to

reduce unemployment in a slow growth economy'

generations and will depress

M. Republicans state that the size of the federal debt creates a burden for future

people

answer "no"'

most

debt

federal

the

by

consumption. Most people when asked if they are burdened

interest rates to increase

N. The economy is at full employment with price stability. Tlie Federal Reserve lowers

inu"r*ent in reaiplant and equipment. If this ls the only policy followed, this will cause inflation'

_ O.

government finances more spending on

The economy is at less than full employment with price stability. The

holds interest rates steady by

infiastructure such as roads, a smart gria, ana research by issuing bonds. The Fed

leave future generations better off and able

expanding the money supply so that no 'lcrowding out" occurs. This will

bonds.

additiorral

to pay the*slightly higher interest costs for servicing the

induced to

is raised by increased government spending, desired investment is

_ p. Ceteris pari6ers, when GDP (Y")

and

for more productiort capacity

rise by the marginal propensity to invest (mpi* LY ^) because of the need

investment.

inventories. we call this crowding in of private

however, rightly say that as interest rates retum to their normal higher level

_a The Republicans and Democrats,

have to raise tax rates or cut government spending on

as we reach full employment, they are concerned that we will

now larger public debt. Independents

essential services i, o.i". to pay ihe borrd holders the higher interest on the

spending will be more than

deficit

this

by

generated

say that the increased productivity and higher incomes

adequate to pay the slight increase in interest payments'

from 200 to 220 (10%) and the nominal GDP rises from $17 trillion to Sl8

_ R. If the GDp price deflator rises

trillion, then the real GDP has gone down as measured in constant prices'

of domestic producers, we measure the output of every good

_S. To get an accurate measurement of the output

us nominal GDP'

(grain, iour, bread) and service as evaluated aimarket prices which gives

5

T.

Nominal GDP measures the output of all legalfinal goods & serrrices bouglit by households, the government,

sold as expofis, or bought as an investment good by producers that are evaluated at the current market prices.

U. When we are at full employment on the PPF, then a large increase in the Federal deficit, (Tx - G - Tr > 0),

ceteris paribus, is likely to cause inflation and shortages.

_V. An increase in disposable income Yoi resulting from a small long-term reduction in weekly payroll taxes

withheld will probably have a higher irnpact on the consumption function than if we had the same total amount

sent out to us in one lump sum per year.

_W. The primary purpose of savings by households is to redistribute consumption over time and maybe to give to

their children rather than to earn interest and profit at their current levels.

PART

VI. MACRO ECONOMIC POLICY ltlttte algebra is required)

I'lo credit v,ill be givenfor just a number!

:

European economies, still recovering from the world financial crisis, have been suffering higher and liiglier rates

unemployment as they try to follow the policy urged by Germany's leader Merkel. Assume initially that these

economies are described by the following:

of

C:consumption, I:desiredorplannedinvestment,G-plannedgovernmentspending,X:expotls,M-imports,Tx:taxes'

:

:

transfer payments, Ya : actual GDP, Disposable Income Ydi Ya-Tx + Tr

"aggregateerpentliture"

dehnedasYd:C + I +G +X-Mf

(inlecture

orAEintexlandis

or

Yd:aggregate demand

output.

GDP

equals

actual

denrand

aggregate

Yd

where

Ya:

Ya* is where

/

C-C+.75Ydi, I - l, G - G, Tx-Tx, Tr:Tr, X:X, andM: M, C, l, G, X, M, Tx, andTrareassumedconstan{.

so Yd- C +.75Ya+ I + G + X-M.

Tr:

Initial Conditions of the Economv in billions of Euros.

The equilibrium level of GDP output is cur:rently:

Yu* =

11,000

Full employment level of G

Yfe = 15i000

You can draw straight lines on

the graph using your QC ID or

a credit card

Marginal propensity to consume

MPC

l

:

0.8

What is the one basic economic problem in this economy?

a. high rate of inflation b. grorving recession & unemployment c. slow growth.

German Chancellor Merkel believes that the large deficits such as in Greece,

Italy and Spain were the cause of their economic problems, so she has been 45o

urging them to cut government spending bv 400 Euros (austerity approach).

what impact do you predict such a cut will have on equilibrium the GDP (Y".) on

the European economv. Be sure to specili' sign of the change in Yo*'

2 pts

2ph

-2.

$Y,

3. Using post-Keynesian macro theory, what basic fiscal policy strategy would you

recommend to achieve ful1 employment?

a*. raise or lower Yd (aggregate demand) by the amount of the demand gap

b. crt][hg ieIpfl firSI and then see what else needs to be done'

c. lower the full employment level of income

d*. raise or lower Yd (aggregate dernand) by the amount of the income gap

e. simply change the equilibrium level of GDP

? f.S

Watch your signs & show equations and

I

rons

4. Calculate the simple multiplier (show equations)

?nh

*

I 5a. Calculate AYu lthe income or output gap)with the correct tign that gets Yt"

5b.Calculate

+ pts

Aya with the correct sign (aggregate demand gap AYa :

2 pt$

:> Yu* or Yu* :>

Yr"

the amount by which aggregate demand Ya has to be

shifted up or down to achieve economic goals of ,tY,-,

2

ncome Gap

AYo*

:

Yr. -Ya*

Aggregate Demand Gap So that AYa *

M : AY.- :

aY.* =

nu

mbers).

(Use a folded piece of paper as ruler)

on the appropriate place on the Yu axis and draw a verlical line up to 45o Y" line

line

Yu

45o

to

line

up

2..p,ts' 6b. Mark yi", on the ippropriate place on the Yo axis and draw a vertical

2

pts

6lIiT.t

:-2.ph;r.7a.

y",

Draw the "original" Yd curve so that it crosses the Ya line at Ya. from above'

6

Z,ps 7b. Draw the "new" Y6 curve sufficient to close the aggregate demand gap so that it crosses the

pb

2

Yu line flom above at Yfe

8. Now mark the income or output gap AYo- by drawing an arrow in the correct direction and label it "income gap" with the amount

2pis 9. Mark the "demand

gap"aYo by drawing an ar:row in the correct direction of desired change of Yd, and label it "demand gap" with

the amount.

The goal: Get Y"* to move from $11,000 to Yu*: $15,000: Yr".

B. Use Goal Oriented Thinking:

Start from where you want to end up (Yr. of 15,000) and rvork backwards. (same as 1ou calculated up above in 5b)

So Fiscal Policv is easy to figure out but you must show that your recommended change reaches the goal.

10. In this situation, how could the administration reach full ernployment using just government spending so that AG - AYa

I Change in Government Spending: AG (+ : increase in G, - : cut in G) show increase as f, decrease as j

\C:

:>

$AG--xMof

3 pt$

AYu*:$

+AY,.of$-:

-;' \z4x :

Tax and Transfer Poiicy (more difficult)

Let's assume that the administration is forced into rnaking (permanent) changes in taxes.

1 1. What two economic variables does changing taxes affect in order to shift Yd by the desired amount (AY6)

zffi

., 2 pts

ptfl

A I

-l

4

12.

ln taxes

So what amount of change in taxes or transfers do you wo[t, (1for

l3 How

.4

pts:: 14.

A

?

l'r bt'

does this Tax

increase and J for decrease)

to change AYa to make Yax

-

Yfe?

(Tr) policy work?

What change in transfer payments (Tr) would do the same thing?

(+l) AYaiby $_ which*MPC oL:>_ AC by $

:

AYu- of $

pts 15. What would this policy do at first to the deficit in the goverrrment budget?

a. Nothing

b. Lower it

c. Raise it.

d. Not enough information.

16. Changes in investment needed to achieve the same result.

The European central bank decides that it must act now using monetary policy to influerrce private irvestrnent that

responds to the interest rate because it could possibly leave a larger capital stock for the future. They change the

interest rate by changing the money supply (Ms).

The money supply (Ms) is currently 200

Here is how private investment I(i) responds to changes in the interest rate "i" usually.

Ms

100

200

300

400

500

600

800

i

14%

12

10

e

8

7

6

I(i)

500

800

1.000

lg00

2.200

2,800

3.000

2 Pts,:

? pr*

2,,p1$,.]

EI:-----l

2.pi$

Z,pi$'

2pE

2 pls

How much do we want investment to change and in wh/at direction?

o/

lncrease Ms

from

What do we want to do to the interest rate to achieve our goal of Yfe

How rnuch do we have to change the money supply to get the required rate of interest.

to

will go up by$

Yax

:

and Ya*

What

-

Yfb

will

happen to investment and Yd

if we change the interest rate that way?

After the multiplier effect, what will be the change in Ya*?

7

VII Consumption & Savings Functions, S:I equilibrium, Paradox of thrift

In a simple economy, with no I. G. or Tx or Tr.

? pts

_1.

_2.

M. consumption equals C= 500 + .75Y,

Which function is the numerical savings function that is the twin of the consumption function above?

A.

2 pts

or X &

S-Ya-C

B.

S:Ya-500

C.

S

:

-500

+.25Ya D. S-

-500

+

'75 Ya

What is the multiplier? It will help you answer the questions below.

What consumption graph below best plots this C-function.

2 pts

-3.

A

D

C

B

Ya

$

Ya

AE or Yd

Aggregate

Expenditure

500

Ya

4.

Ya

GDP

.75Y

2400

Output

Atwhat output level Ya- will the people be spending exactly as much

A.

5.Show

+.75Y

GDP

Output

R.

s00 c.2000 D.2400

as is being produced at

Y,

E. 2500

lour calculations to the right.

Saving-lnvestment Graphs (Not to scale)

la*+200'

Sa=0

.75Y

$t n

Sa=++6gl- u

Sa=+400

Sa

Sa=-500

l;=+200

Ya

Ya

Sr=-500

2000 1ioo

Sa=0

Sa=-500

Sa=-500

_6

function

Based on your choice above, or a calculation. which saving-investnent g:aph best representsthe savings

graph

corresponding to (or derived liom) the consumption poblem in the above problem \. Think about which

that

Ya.

Remember

C

equals

where

level

repre;efis thi acrual savings.function, such that Sd 0 at the outpfi

that

level

where the consumptionfuiction intersect,c the 15 degree Ya line, colwumption exactly equals output and

of ougtut is called the "hrealreven peiny". The slopes of these gnphs are reaesentational & not realistic-

:

So

:0

and Io =0. Calculate & enter on left. Show your calculation down below.

End ofExam

SCRAP PAPER