* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download The Stockman Report

Survey

Document related concepts

Transcript

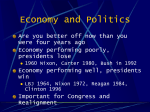

Former Ronald Reagan Advisor David Stockman Warns About the Health of the US Economy LEAR CAPITAL L ear Capital works hard to bring you expert analysis and insight every day so that you can protect your portfolio from forces quietly at work behind the scenes. There has been a lot happening in the world of finance and banking that will eventually take a bite out of your portfolio if you are unaware and unprepared. Respected financial experts and prognosticators sit down with us from time to time to tell us how to best educate and prepare our clients for what is coming. We discuss debt, the value of the dollar, the incentives of those in power at the Federal Reserve, how Wall Street really works - and most importantly, what investors should know in order to avoid the worst of what is to come. David Stockman was the Director of the Office of Management and Budget under Ronald Reagan. He is the author of “The Great Deformation,” a more accurate history of the economic forces at work here in the US in the last century or so. We peppered him with questions and he gave us tremendous insight and advice to pass along to you. First of all, where are we in the latest boom and bust cycle? Mainstream economists and government statistics say we’re doing fine and things are getting better. Is it true? How much longer can this “recovery” last? “Be aware of the same old saga coming from Wall Street and Washington. They told you that in 2007. At the time they said we have a “Goldilocks” economy, good growth, good jobs, inflation low, everything’s great, we’re onward and upward. If you look at the projections at the time, the hockey stick went straight up, the stock market they alleged was sweet because they were projecting for 2008, just to use an example, $117 per share of S&P earnings. The economy was rotten underneath, the housing calamity was beginning to unfold, the credit expansion had created a false prosperity. Wall Street was rotten to the core, and only a few months later everything came crashing down…. “Now, I’m mentioning this because I think we’re at the same inflection point. These bubble cycles that the Fed has created, going back to the dotcom bust, seem to last about five years. They seem to get the stock market up to a peak where the last sucker comes in. They’re calling the sheep in today for the shearing and so far most retail investors have learned their lesson. They were burned in housing, they were burned in 2008, they were burned in dotcom. They’re not going to fall for it again. We’re in the last gasp of the third bubble, and let me just give you one evidence of it. The Russell 2000, which is the main street index, also the favorite football of the punters and the gamblers is now trading at 85 times earnings. “Now that’s crazy. The market is never worth that kind of multiple, it’s very similar to where the Nasdaq was for different reasons in 2000, and we know what happened after that, or the equivalent of where housing was in 2007 and we know what happened there. I think we’re in the final days of this third bubble, and this time the crash is going to be even more traumatic, thundering let’s say. I doubt whether the monetary politburo is going to have the tools to do anything about it, because they already have interest rates at zero and they’ve already loaded their balance sheet to incredible levels.” 2 David Stockman on the Villains of the Federal Reserve Since the last crisis, the stock bubble has been blown up by low interest rates, multiple stimulus programs and more recently by corporate buybacks. Let’s be honest. In the olden days rising stocks were the product of rising industrial output, rising employment and rising wages. Today, we have none of that. Full-time jobs have been replaced by part time jobs, wages have fallen accordingly and cost cutting has become a primary source of corporate profit. So who’s to blame for all this? Who are the main villains here? Of course, Ben Bernanke was front and center: “[Ben Bernanke was an] absolute villain. The greatest disaster to afflict American society and our economy as far back as I can see or remember. He will be reviled in history as much as Herbert Hoover was for decades after the collapse of the market and the Great Depression in the early 1930s. He has been wrong on everything he has said about the economy. He didn’t see sub-prime coming, it came, he thought it was contained, it wasn’t. He said that housing prices generally can’t go down, they went down 35 percent. He said that housing was not going to feed into the economy, we had the worst recession since the end of WWII. He said that by this massive QE and money printing and zero interest rates the economy would rebound strongly and be growing at 3 – 4 % per year by 2011, 2012. It didn’t happen even remotely. “It’s amazing today in our economy that we have so many people who run this society on Wall Street and in Washington, on Capitol Hill. Among all of the brokers and their economic spokesmen who come out every day, celebrating what is a complete catastrophe. None of this worked, the only thing it did was reflate the third bubble of this century. We now have the stock market soaring, we have real estate prices in many of the busted markets back in bubble territory again, we learned nothing, we healed nothing, we fixed nothing. We simply go back to the same old bubble economic schemes. I would pin the tail right on Bernanke as one of the number one villains in this whole saga.” Next up, Janet Yellen: “Well, Janet Yellen is going to be worse. I think the next couple of years we’re going to call the Calamity Janet era. Unfortunately she’s a totally unreconstructed Keynesian, has been an apparatchik on the Fed staff and board for most of her career, believes unfortunately that a small elite of 12 people running the Open Market Committee in the Fed can micromanage through the crude instrument of interest rates and managing the yield curve, this $16 trillion economy caught up in a highly volatile, changing, competitive world. All of that is wrong. She fails to see, she’s not only bubble blind as both Greenspan and Bernanke were, but I think she’s bubble mute. When she testified before the Congressional hearing for her confirmation she refused to say the word “bubble”, 3 she kept referring to asset/price misalignments. “Now look here, we have bubbles everywhere in this economy, Bernanke’s created the third one this century, she is going to have to deal with it and I think we’re going to be totally unprepared.” And of course, don’t forget Henry Paulson, who helped create the myth of contagion that sold the necessity of the bailouts to a terrified American people – or at least to their Congressional Representatives: “[The great question of our time is:] Were we confronted, realistically, with the prospect of a Great Depression 2.0? [Was] the economy sinking into a black hole of dislocation and massive unemployment and economic breakdown in September 2008 when Lehman failed and the market plunged? “My answer is absolutely not. That is an urban legend concocted, manufactured by a small cadre of people in Washington. Secretary Paulson at the Treasury running around with his hair on fire because the stock price of Goldman Sachs was collapsing and Wall Street was undergoing the cleansing and the market discipline that it deserved for the massive and reckless leverage that had been built up during that period. “If you look at the facts, and I try to lay them out very clearly and cleanly in my book, The Great Deformation. There was no contagion effect outside of the canyons of Wall Street. The last two investment banks standing probably would have gone down, Morgan Stanley and Goldman Sachs. The world would be fine without them. They would have gone into Chapter 11 and they would have reorganized. The people who came out of it may have started some firms that would be run in a much more prudent, in a much more disciplined way today because they would have lost their equity and they would have realized that gambling can be rewarding in the short run, but it can be traumatic when nature finally takes its course.” Speaking of gambling… Wall Street is merely a casino. David Stockman says there are no investors on Wall Street anymore, only gamblers. “These aren’t markets, they’re casinos. There are no investors left in the world, just day traders and gamblers. “America’s become addicted to debt. It’s been happening for the last 30 years and now we’ve reached the day of reckoning. The stock market is not a market, it’s a casino that has been destroyed 4 by the Fed and the massive flooding of liquidity. Interest rates are no longer honest measures of the fixed income market, there is no real price discovery, the traders in the market today are day traders who trade the word clouds and liquidity provided by the Fed. It isn’t real financial capitalism. My point is no one owns the bond today, they’re simply running it day by day, trusting that the Fed can keep the whole game going. The minute that they lose confidence in the Fed, all of the speculators, all of the day traders will unwind their carry trades, they’ll unwind their repo, they’ll sell the bond and then the great unwind will start. “The Fed has become a serial bubble machine. We are now in the fourth great bubble of this century. Dotcom was a calamity, five trillion dollars of mainstreet American assets were destroyed. They reflated, foolishly, a housing bubble, seven trillion of housing value was destroyed and we’re still trying to limp out from under that catastrophe. Then in 2008 we have the great Wall Street bubble and another huge catastrophe that resulted. We learned nothing from this, they’ve simply doubled down, they’re doing even more of the same bubble inflating. We’ve now reached the third bubble and I think when it does burst the consequences will be even more traumatic.” Where is the inflation? Everyone has been asking the question – a legitimate one – that if there is $3-4 trillion in excess reserves on the Federal Reserve’s balance sheet after years of quantitative easing, where is the inflation? For years, the Federal Reserve created $85 billion a month in artificial demand for paper assets. Everyone knows this was a horrible idea. Let me illustrate. The $85 billion per month, printed by the Fed to buy Treasuries and Mortgage backed securities, was an amount equal to 6% of our entire GDP. But did we ever see 6% GDP growth? Never!! In 2013 we barely saw 3%. In 2014 we saw an average of 2.4%. In Q4 of 2014 we saw just 2.2%, less than half the two quarters prior. By Q1 of 2015, GDP growth all but disappeared coming in at a measly .2%. Proof positive, you can’t print money to this extent without eventually making it worthless. So why is it not worthless yet? David Stockman on Inflation: Hiding in plain sight David Stockman had some very sobering thoughts and observations on the matter. He said that the Fed, as an enabler of Congress and Wall Street simply resorted to printing money through quantitative easing and continued because they saw no reason to stop. “If you listen to the story today or any other day, [the Fed] says look, we see no inflation. We’ll just keep printing until we do.” 5 It is true that through a combination of statistical trickery and the currency race to the bottom, the value of the dollar has been holding, relative to where many expected it to be after all this abuse. CPI sits below the Fed’s target 2%. However, Stockman’s next observation was startling: “The problem is the inflation is in financial assets – they’re soaring. Russell 2000 is up 240% since the bottom in 2009. The main street economy that it represents has not had a bounding robust recovery by any means. The inflation is in financial assets. The central banks keep justifying this massive expansion of their balance sheet by the lack of labor and consumer price inflation, and we therefore have a kind of vicious cycle going that isn’t going to end well.” What does he mean that the inflation is in financial assets? He clarified: “The Russell 2000, which is the main street index, is now trading at 85 times earnings. Now that’s crazy. The market is never worth that kind of multiple. It’s very similar to where the NASDAQ was for different reasons in 2000, and we know what happened after that. Or the equivalent of where housing was in 2007 and we know what happened there.” He brought up Twitter as another example. Twitter is valued at a staggering $33 billion. While it may be a great company, this represents 64 times its reported sales, which is ridiculous. This is exactly the kind of thing that was going on in 2000. It is incredible that this is happening again in the market, but the reality is that massive piles of money have been pushed into the market and it is all looking for a place to go. The result is that all of this liquidity is inflating the prices of paper assets into the stratosphere. The economy is very sick, essentially on life support. What can be done to fix it? The economy needs a hospital. What is David Stockman’s Rx? Even though the chances of any of this happening are somewhere between slim and none, Stockman gave a quick but extensive rundown of what would need to happen to get the economy back on track. “Now what can we do about it? Well, first the Fed has to stop monetizing all of the debt. The Fed today is the great enabler. When it goes into the market, it buys $85 billion of trade free securities and government, GSE securities, mortgage back securities a month, which is over 70 percent of everything being issued. It is fundamentally distorting the pricing and the cost of government debt. It’s telling a lie to the politicians on Capitol Hill that debt is cheap, that the interest rate on the two year note even today is only 30 basis points, which is ridiculous when inflation is two percent or probably higher. Therefore, the signal given to Congress is you can wait until tomorrow, ‘you can kick the can, there is no cost to this fiscal policy’. 6 “If the Fed got out of the way, went back to its original mission and let interest rates rise to their natural level, let the market clear, let the supply and demand of savings between savers and borrowers find the natural rate, it would be dramatically higher than any of the treasury rates today. Whether it’s 30 basis points on the two year or 2.9 percent today on the ten year. “I was a Congressman in the 1970s. I remember well the early 80s when we came into the White House in the Reagan administration. We were terrified by high and rising interest rates. That does get politician’s attention. Until we get interest rates that reflect the true cost of capital over time and the risks and the inflation that’s built into our system, I don’t think Congress is going to act. “What should they do after the Fed gets out of the way? Well there’s three things. We need to fundamentally reform Social Security and Medicare. We can’t afford a universal entitlement to everybody, it needs to be dramatically means tested and the better off should either have their benefits cut, or eliminated entirely. An average duffer living an affluent retirement in Florida gets $50,000 a year between Medicare and Social Security. They shouldn’t be getting that. They didn’t earn it and we can’t afford it. That’s the first thing. “Second, our defense budget is utterly out of control. The cold war ended 25 years ago, we don’t need a war machine that’s bigger than the defense budget of the next ten countries in the world. There should be dramatic cuts in defense, not a little pinprick. I mean multi-hundred billion dollar reductions, a demobilization of much of our war machine. Why? Because we have no industrial state enemies left in the world. Russia’s a kleptocracy. They like to steal from each other but I don’t see that they’re going to harm their neighbors. China is totally dependent on our markets, so they’re going to bomb our 3000 Walmarts in America? As I say- I don’t think so! We’ve been fired as the world’s policemen. We have failed as the world’s policemen. In Afghanistan or Iraq or Libya or Somalia or many other places you can mention, so we don’t need this war machine, it ought to be dramatically cut. Why isn’t it? Military-industrial complex. It’s because the politicians are essentially Military Keynesians, they see it as a jobs program. That’s an awful thing, to spend money on aircraft carriers to create jobs that can’t be sustained for aircraft carriers we don’t need. “The last thing is we’re going to need more revenue, but I think a kind that’s minimally harmful to the economy. We need a sales tax to this country and we’ve got to reduce the payroll tax. The payroll tax is killing jobs, especially entry level jobs at the minimum wage or slightly higher. That 15 percent between the employer and employee on a minimum wage job – which is $2,000 a year of excess cost – that, I believe, is a real job killer. 7 “We need to raise more revenue, dramatically slash defense, put a means test on the big entitlements and that’s how you could begin to bend the curve over a few years to balance. Is there any chance this will happen? I would say none. The chances are slim to none because the politicians today are entirely beholden to noisy constituencies, the political action committees, the special interest lobbies. There is no one speaking for the tax payer, for future generations who are going to bear this burden. Therefore, I call the budget – unfortunately – a doomsday machine. It’s heading towards a crash landing and no one is willing to stand up and do anything about it.” Lastly, what does all this mean for the average investor? What should you be doing to protect yourself from these forces at work behind the scenes? How can you preserve your assets from bubbles and crashes that threaten to sweep them all away? “I would say for right now, people should keep their powder dry, in the initial wave of dislocation and the bubble bursting and then the crash unfolding, which will happen very violently and very rapidly. As you know in the fall of 2008 it only took a few weeks for most of the air to come out of the bubble. It will be worse this time so keep your powder dry, because when the crash comes the margin calls will go out and everything will be subject to a margin call, even gold. There are a lot of speculators one way or another that are leveraged through options and so forth. When things hit bottom, this time I believe the central banks are out of ammo. They’re out of tricks, I don’t see what they can come up with, and as a result equities and other paper securities will not reflate this time. “As people begin to realize that the Russell 2000, the S&P 500 are not going to reflate, then something like gold, which you can have confidence in, which has been proven historically over decades and centuries, will become more and more attractive. Then the great rise in the value 8 of real money, which is gold, and then decay in the value of central bank stimulus will become more and more apparent. “I think there’s more danger ahead. What do you do? Stay liquid, stay out of the market. These aren’t markets, they’re casinos. “The lesson of that is that this system is pretty awful because it’s telling the prudent investor who is trying to protect his capital, that you’re going to earn nothing on it if you keep it liquid or in a treasury bill or in a bank account. But at this stage of the game preservation of capital is 100 percent of the game, it’s the name of the game, and the markets are far too dangerous to risk exposure. Now people say well, maybe there’s another ten percent in the market - Fine! If you’re smart enough to figure out when to get out, if you can hear the bell ringing when the last sucker has bought the last share of Netflix…” There you have it. In a nutshell, the world has become addicted to debt, but the bills are coming due and the bubbles will all begin to burst. The markets right now are merely casinos, and as you know, the house always wins. David Stockman’s best advice is to not risk too much of your wealth in the markets and instead preserve it in something proven, like gold, which he referred to as “real money.” Call us today to get started. The process is easy and fast. You’ll sleep better tonight knowing you have taken steps to protect your family and your earnings from the villains at the Fed and the gamblers on Wall Street. To speak to an experienced Lear Capital representative now and receive the latest research on Precious Metals investing: Call (800) 576-9355 CORPORATE ADDRESS Lear Capital, Inc 1990 S. Bundy Dr., Ste 600 Los Angeles, CA 90025 LEAR CAPITAL The Precious Metal Leaders Any written sources provided to customers or potential customers by Lear Capital, Inc. (“LCI”) are provided solely for informational purposes. LCI provides such resources with the understanding that each individual is responsible for doing his or her own independent research regarding any decisions he or she makes about purchasing precious metals through LCI or elsewhere. Moreover, information included in written resources may have already been changed by recent events and must be verified elsewhere before choosing to act on it. Precious metals may appreciate, depreciate, or stay the same depending on a variety of factors. LCI cannot guarantee, and makes no representation, that the precious metals will appreciate. C.P.D.Reg. No “T.S.11-05715” 9