* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Study Guide With Answers

Business cycle wikipedia , lookup

Economic growth wikipedia , lookup

Economic planning wikipedia , lookup

Steady-state economy wikipedia , lookup

Participatory economics wikipedia , lookup

Criticisms of socialism wikipedia , lookup

Rostow's stages of growth wikipedia , lookup

Non-monetary economy wikipedia , lookup

Economics of fascism wikipedia , lookup

Transformation in economics wikipedia , lookup

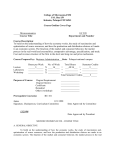

Unit 1 Study Guide 1. Explain specialization and division of labor. Specialization is becoming very productive in one area. Specialization is dividing up labor to become more productive overall. 2. What are the benefits of specialization? Increased productivity, efficiency, and higher standard of living. 3. Explain the term “Economic System”. An economic system is a system of production, resource allocation, and distribution of goods and services within a society or a given geographic area. 4. List at least three characteristics of each type of economic system. Traditional: Traditions and customs govern economic decision; Economic activities are usually centered toward the family, tribe, or ethnic group; Resources are allocated based on inheritance. Command: The government or other central authority makes all economic decisions; Individuals have little, if any, influence over economic function; Resources are owned by the government. Market: Economic decisions are made by individuals and businesses competing to earn profits based on supply and demand; Profit, not quotas, is motive for increasing work; Individual freedom is considered very important; individuals have freedom to make economic decisions. Mixed Market: Combines elements of pure market and command economies; Government and individuals share the economic decision making process; government guides and regulates production of goods and services. Resources are owned by individuals, businesses, and the government, government serves to protect both producers and consumers from unfair policies and practices. 5. List at least one advantage and one disadvantage of each economic system. Traditional: Adv – Individual roles are clearly defined. Disadv– Does not allow for growth and development. Command: Adv – Distributes wealth among all of society. Disadv – Lack of incentives for innovation and infringes on personal freedoms. Market: Adv – Prices determine by market forces (supply and demand) and competition brings down prices. Disadv– There are occasional market failures and high unemployment. Mixed Market: Adv – Can focus on social welfare and political freedom, as well as individual liberties. Disadv – May not lead to optimal use of resources dur to government intervention hindering progress. 6. Explain the difference between a trade-off and opportunity cost. Trade-off – The decision making process where you understand that you will gain something, but you also have to give up something when making decisions. Opportunity Costs – What you give up when a decision is made. Also described as the next best alternative that you did not choose. 7. Give one example of a trade-off and one example of opportunity cost. Give your own examples based on definition described in #6 above. 8. Explain the difference between microeconomics and macroeconomics. Give one example of each. Microeconomics: Focusing on one area of the economy. An individual household, business, or sector of the economy. Macroeconomics – The big picture – Looking at the nation as a whole. Gross Domestic Product (GDP) in a nation; national unemployment; National inflation rate. 9. What is the basic problem that all nations face? Scarcity – Unlimited wants and limited resources. 10. List the four factors of production and give one example of each. Land – soil and all minerals, etc in the soil; Labor – physical efforts of an individual to accomplish a job; Capital – all the manmade tools, machinery, and technology used in the production of a good or providing a service. Entrepreneurship – The person who takes a risk and goes in business for themselves with the goal of earning a profit. 11. What are transfer payments? When the government gives someone something without expecting anything in return. 12. Define human capital and physical capital. Human capital: the skills, knowledge, and experience possessed by an individual. Physical capital: the man-made tools, machinery, technology, equipment used to provide a service or produce a good. Examples: factories, computers, equipment, etc. 13. What is meant by a public good? A good that is paid for with tax dollars. Public highways, public libraries, etc. 14. Who pays for public goods? The government pays for public goods with tax dollars that individuals and businesses pay. 15. What is capital investment? A business purchasing capital goods/services. 16. What is a regulation? When the government tells a business or sector of the economy that they have to do something, but the government does not compensate the business/sector of the economy with funds to follow rules of government – regulation is usually an added expense to a business. 17. What is meant by standard of living? The quality of life in a country. 18. Explain the concept of a rational economic decision. A rational economic decision is when one’s benefits exceed their costs in decision making. Also referred to as marginal benefits exceeding marginal costs. 19. What is meant by marginal in economics? Marginal means extra or additional in economics. 20. Draw a production possibilities curve and label point that represent the nation in a recession, the nation operating efficiently, and an unattainable point, meaning, the nation does not have resources to produce at that point. 21. How might a nation gain economic growth? Through advances in technology/ increasing the nation’s resources. 22. Which would lead to faster economic growth: Capital Goods or Consumer Goods. Explain. Capital goods that help production enable a country to reach economic growth faster – example: technology. 23. What is meant by a Free Rider? One who uses a public good but does not pay or contribute to the production or upkeep of the good. 24. What is the purpose of anti-trust laws? Anti-trust laws prevent monopolies and enable competition to occur in a nation. 25. What is meant by the redistribution of wealth in a mixed-market economy? When one pays taxes to the government and the government uses those taxes to provide social programs/safety nets for less fortunate individuals.