* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Economic Indicators

Survey

Document related concepts

Transcript

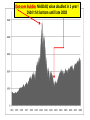

Economic Systems in the United States SOL GOVT.14 The student will demonstrate knowledge of economic systems SOL GOVT.15 The student will demonstrate knowledge of the United States market economy. SOL GOVT. 16 The student will demonstrate knowledge of the role of government in Virginia and United States economies Formulation of Economic Policies How do government officials make decisions about Fiscal and Monetary policy? Requires an understanding of accurate measures of the economy’s performance, known as “Economic Indicators” Economic Indicators: Economic statistics which indicate how well the economy is doing, and how well the economy is likely to do in the future Economists try to read the trends to know what the economy will look like in the future “Leading economic indicators” are indicators which change before the economy changes, (like the stock market) and indicate the economic future Economic Indicators: 1. Gross Domestic Product (GDP): the total dollar value of all final goods and services produced in the United States in a year World Rank in 2016 1. United States $18.5 trillion 2. European Union $17.1 3. China $11.4 4. Japan $4.71 5. Germany $3.49 6. U.K. $2.65 7. France $2.49 8. India $2.25 9. Italy $1.85 10.Brazil $1.17 2. Per Capita GDP A measure of the total output of a country that takes the gross domestic product (GDP) and divides it by the number of people in the country. Per capita GDP shows the wealth of one country’s citizens in comparison to other countries. Per Capita GDP 2016 source: The World Bank 1. Qatar $132,870 2. Luxembourg $99,506 3. Singapore $85,382 4. Brunei $79,508 5. Kuwait $70,634 6. Norway $68,887 7. UAE $67,217 8. Ireland $65,629 9. SanMarino $62,938 11. United State $56,084 152. Burundi 148. Liberia 139. Afghanistan 124. Pakistan 120. India 91. Ukraine 77. China 60. Mexico 48. Russia 15. Canada $267 $454 $678 $1,299 $1,499 $3,900 $6,670 $10,307 $14,612 $43,914 3. Consumer Price Index (CPI) The End measures the monthly price changes of the “market basket”: food, apparel, utilities, and education The annual percentage change in the CPI is used as a measure of INFLATION 1.6% 4. Inflation Rate Inflation is a rise in the general level of prices of goods and services in an economy over a period of time *Reflects the erosion in the purchasing power of money Deflation occurs when the inflation rate falls below 0% and causes a fall in the general price of goods 5. Unemployment Rate Measures Joblessness: number of people who are without work and are actively seeking work *Reached by dividing the number of unemployed people by all people currently in the labor force Unemployment reached 25% in U.S. during the Great Depression of 1930 to 1940 Current Unemployment in U.S. Both the national rate (4.6%) and the number of unemployed persons is down from 7.2% in Oct 2013 Subgroup rates: Bedford County 4.5% Teenagers (23.1%) Lynchburg 5.4% Blacks (15.8%) Virginia 4.7% Hispanics (11.0%) +280,000 jobs per month over Adult women (7.9%) last 3 months-Fed may raise Whites (7.5%) interest rates to slow econ… New York Stock Exchange *located on Wall Street in NYC *Responsible for setting policy, supervising members, and listing “securities” (stocks, bonds) The oldest and largest stock exchange in the U.S. founded in 1792 Stock Market Averages 6. Dow Jones Industrials shows how 30 large publiclyowned American companies have traded during a standard trading session in the stock market *Closed at 19,216 12/5/16 -17,847 on 12/4/15 -13,712 on 1/22/14 Some companies: AT & T Boeing Coca-Cola Dupont Exxon-Mobil Home Depot Intel IBM McDonalds Microsoft Verizon Walmart Walt Disney 7. NASDAQ Composite Averages stock prices of over 3,000 companies. An indicator of the performance of stocks of technology companies *Dot-com Bubble (1997-2000): NASDAQ closed over 5000 in March 2000 but the market collapsed from there… Amazon.com stock went from $107 to $7 per share, but a decade later exceeded $200-MANY other companies went out of business. Closed at 5308.89 on 12/5/16 (up over 20% since end of 2009 recession) Dot-com Bubble: NASDAQ value doubled in 1 year! Didn’t hit bottom until late 2002 8. S & P 500 Wether Stock market index based on the market cap of 500 leading companies publicly traded in the U.S. stock market, as determined by Standard & Poor's. Closed at 2204.71 Dec 5, 2016 Bell Many consider it the best representation of the market as well as a bellwether for the U.S. economy 9. Barrel of Crude Oil A barrel consists of 42 gallons, which can be processed into 19.5 gallons of gasoline, 9.2 gallons of heating oil, 15.7 gallons of kerosene, motor oil, liquid propane, lubricants, and asphalt Current price $51.36 a barrel $39 a barrel Dec 2015 $96 January 2014 10. Gold Gold standards have been the most common basis for monetary policies throughout human history The gold certificate was used from 1863 to 1933 in the U.S. as a form of paper currency. Each certificate gave its holder title to its corresponding amount of gold coin Current price $1179 “per troy ounce” $1080 in 2015, $1686 in 2013 11. Housing Market Housing Starts: the number of privately-owned new houses on which construction has been started in a month > Leading indicator *Up 23.8% in 2016, highest increase since 2007 • Mortgage Rates: the interest rate on a loan to buy a single-family home • A mortgage is the standard method by which a person can purchase real estate without the need to pay the full value immediately on their own (historically paid off in a 30 year loan) 12. Retail Sales Report • Total measure of the sales of retail goods in a month • Consumer spending responsible for nearly 70 percent of U.S. economic activity; driven by Consumer Confidence • The retail sales report captures store sales, catalogue sales and internet sales, by categories. • A “Leading Indicator” because it provides data that is only a few weeks old. Retail sales growing at 3.4 % in 2016 13. Foreign Exchange Rate Rate at which one currency may be converted into another *Used when someone wants to convert currency for travel to another country *Also, for speculating on currency in the foreign exchange market $1 US = .93 Euro (.743 Jan ‘14) 1 US $ = 7.47 Chinese Yuan $1 US = 1.33 Canadian dollar 14. Balance of Trade (BOT) In Macroeconomics, BOT is the difference between a country's imports and its exports A country has a trade deficit if it imports more than it exports; the opposite scenario is a trade surplus. The United States has been running consistent trade deficits since 1980 due to high imports of oil from the Middle East (Saudi Arabia) and consumer products from China, Japan and “Asian Tigers” and “Tiger Cub” nations Comparative Advantage Economic concept that says that a country should specialize in producing and exporting only those goods and services which it can produce more efficiently (cheaper) than other countries can. • Results from different endowments of the factors of production (capital, land, labor), resources, entrepreneurial skill, and technology. • Beneficial to all countries (and world economy) because each can gain thru voluntary trade by specializing according to its comparative advantage over other nations. Voluntary Trade Both parties experience gains from voluntary trade and avoid isolationism Bottom line: Countries that trade with the entire world are wealthier and their citizens have a higher level of satisfaction because of the gains they realize from trade Trade Agreements between nations NAFTA: North American Free Trade Agreement eliminated tariffs between U.S., Mexico, Canada in 1994 *Will Trump impose 35% tariff?? WTO: World Trade Organization represents 97% of world’s economic activity