* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Price Ceilings

Survey

Document related concepts

Transcript

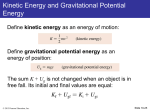

Chapter 5 Extensions of Demand, Supply, and Elasticity Copyright © 2005 Pearson Education Canada Inc. 5-1 Learning Objectives 5.1 Explain the role of markets, intermediaries, and prices in the price system. 5.2 Compare and contrast price ceiling and price floor policies. 5.3 Compare and contrast the offer-topurchase and the marketing board price support policies. Copyright © 2005 Pearson Education Canada Inc. 5-2 Learning Objectives 5.4 Describe the various types of quantity restrictions that governments can impose on markets. 5.5 Explain how price elasticity governs the effects that a per-unit excise tax has on tax incidence, resource allocation, and government tax revenue collected. Copyright © 2005 Pearson Education Canada Inc. 5-3 The Price System Price System (market system) An economic system that allocates resources based on relative prices determined by supply and demand. Prices signal what is relatively scarce and relatively abundant. Copyright © 2005 Pearson Education Canada Inc. 5-4 The Price System Transaction Costs The costs associated with exchange. Examples • • • • • Price shopping Determining quality Determining reliability Service availability Cost of contracting Copyright © 2005 Pearson Education Canada Inc. 5-5 The Price System The Rationing Function of Prices When surpluses and shortages exist price adjusts to clear the market. This adjustment is the rationing function of price. Copyright © 2005 Pearson Education Canada Inc. 5-6 The Price System When prices cannot adjust non-price rationing occurs Rationing by queues Rationing by lotteries Rationing by coupons Rationing by waiting Copyright © 2005 Pearson Education Canada Inc. 5-7 Price Ceilings and Price Floors Price Controls Government-mandated minimum or maximum prices. Price Ceiling A legal maximum price. Price Floor A legal minimum price. Copyright © 2005 Pearson Education Canada Inc. 5-8 Price Ceilings and Price Floors Price Ceilings: The Case of Rent Controls Price ceiling and black markets Price ceilings may prevent the equilibrium price from being achieved if it is above the ceiling price. Copyright © 2005 Pearson Education Canada Inc. 5-9 Price Ceilings and Price Floors Monthly Rent per Unit S Black market $1000 Price Ceilings: The Case of Rent Controls Pe=$800 Price Ceiling $650 Shortage D QS Qe QD 50,000 60,000 70,000 Quantity: Number of units per month Copyright © 2005 Pearson Education Canada Inc. 5-10 Price Ceilings and Price Floors Non-Price Rationing Devices All methods used to ration scarce goods that are price-controlled. Black Market A market in which price-controlled goods are sold at an illegally high price. Copyright © 2005 Pearson Education Canada Inc. 5-11 Price Ceilings and Price Floors The functions of equilibrium rental prices Promotes the efficient maintenance and construction of housing Allocates existing housing Rations the use of housing Copyright © 2005 Pearson Education Canada Inc. 5-12 Price Ceilings and Price Floors Discourages the construction of new housing Effects on the existing supply of housing Property owners cannot recover costs Rationing the current use of housing Reduces mobility Copyright © 2005 Pearson Education Canada Inc. 5-13 Price Ceilings and Price Floors Attempts at evading rent controls Forcing tenants to leave Tenants subletting apartments Housing courts Copyright © 2005 Pearson Education Canada Inc. 5-14 Price Ceilings and Price Floors Who gains and who loses from rent controls? Losers • Property owners • Low-income individuals Benefits • Upper-income professionals Copyright © 2005 Pearson Education Canada Inc. 5-15 Price Ceilings and Price Floors Wage Rate per Unit 800 Unemployed A B C S Wm We Reduction in quantity of labour demanded Excess quantity supplied at wage Wm E Increase in quantity of labour supplied D Qd Qe Qs 2000 2500 2800 Quantity of Labour per Time Period Copyright © 2005 Pearson Education Canada Inc. 5-16 Price Supports: Offer to Purchase and Marketing Boards Price Supports: The Case of Agriculture • Governments have implemented a variety of price support policies to combat lagging and variable farm income. Copyright © 2005 Pearson Education Canada Inc. 5-17 Price Supports: Offer to Purchase and Marketing Boards Offer to Purchase policy A price floor policy reinforced by the purchase of surplus output by the government. Consumers pay higher prices for the product, and taxpayers purchase excess surplus. Copyright © 2005 Pearson Education Canada Inc. 5-18 Price Supports: Offer to Purchase and Marketing Boards Price per tonne surplus S Price floor = $700 A surplus of 3000 tonnes per year will result in order to keep the price at $700 Pe= $500 D 14 15 17 Thousands of tonnes Copyright © 2005 Pearson Education Canada Inc. 5-19 Price Supports: Offer to Purchase and Marketing Boards Marketing Boards A policy which allows producers to band together to restrict total quantity supplied by using quotas. Copyright © 2005 Pearson Education Canada Inc. 5-20 Price Supports: Offer to Purchase and Marketing Boards Price per tonne S Market Board price = $700 Price will rise to $700 with imposition of a quota. Pe= $500 D 14 15 17 Thousands of tonnes Copyright © 2005 Pearson Education Canada Inc. 5-21 Price Supports: Offer to Purchase and Marketing Boards Who loses? Consumers pay more for the product. New producers must pay for purchasing the quotas. Foreign producers cannot export to Canada. Copyright © 2005 Pearson Education Canada Inc. 5-22 Quantity Restrictions Governments may also impose quantity restrictions on a product Outright ban of a product Government licensing requirements Import quotas Copyright © 2005 Pearson Education Canada Inc. 5-23 Elasticity and Excise Taxes Excise Tax A tax imposed on a particular commodity or service. • E.g. gasoline, alcohol, cigarettes, hotel rooms Tax Incidence The division of the burden of a tax between the buyer and seller. Copyright © 2005 Pearson Education Canada Inc. 5-24 Elasticity and Excise Taxes S 2 $70 S1 $65 $55 Supply will shift up by $15 with an excise tax of $15. Price per carton $50 D 14 15 17 Thousands of tonnes Copyright © 2005 Pearson Education Canada Inc. 5-25 Elasticity and Excise Taxes Elasticity and Tax Incidence When demand is elastic, sellers will bear a greater portion of the tax burden. When supply is inelastic, buyers will bear a greater portion of the tax burden. Copyright © 2005 Pearson Education Canada Inc. 5-26