* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Classical vs Keynesian

Nominal rigidity wikipedia , lookup

Fiscal multiplier wikipedia , lookup

Ragnar Nurkse's balanced growth theory wikipedia , lookup

Full employment wikipedia , lookup

Gross domestic product wikipedia , lookup

Transformation in economics wikipedia , lookup

Steady-state economy wikipedia , lookup

Business cycle wikipedia , lookup

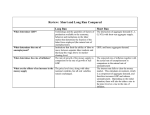

Classical vs Keynesian Which one do you prefer? CLASSICAL BELIEVES: Markets will behave according to S&D. In other words. S&D will respond accordingly to “Inflationary Gap, Recessionary Gap, and long run stability when all curves intersect. SAY’S LAW Economists agree Says law works in Barter economy and disagree about if it works in a money economy. Supply creates its own demand… baker bakes enough bread to trade for what he wants. That works. Classical economics believes it works in money economy and here is why. The Classical Model (cont'd) • Classical economists—Adam Smith, J.B. Say, David Ricardo, John Stuart Mill, Thomas Malthus, A.C. Pigou, and others—wrote from the 1770s to the 1930s. • They assumed wages and prices were flexible, and that competitive markets existed throughout the economy. The Classical Model (cont'd) • Assumptions of the classical model – Pure competition exists. – Wages and prices are flexible. – People are motivated by self-interest. – People cannot be fooled by money illusion. The Classical Model • Consequences of The Assumptions – If the role of government in the economy is minimal, – If pure competition prevails, and all prices and wages are flexible, – If people are self-interested, and do not experience money illusion, – Then problems in the macroeconomy will be temporary and the market will correct itself. Classical Theory Classical economists believed that prices, wages and interest rates are flexible. Say’s law says when economy produces a certain level of real GDP, it also generates the income needed to purchase that level of real GDP.) hence, always capable of achieving the natural level of GDP. Fallacy here: no guarantee that the income received will be used to purchase g & s.----some will be saved. But theory would be redeemed, if the savings goes into equal needed amounts of investment. Classical belief on wages and prices Believed all markets competitive- (S&D * Key) – adjust to surplus and shortage…. If oversupply of labor, wage rates drop and S&D of labor will be in sinc. What holds for wages also applies to prices. Prices adjust quickly to surplus or shortages Equilibrium established again. Three States of the Economy 1. Real GDP is less than Natural Real GDP (recessionary gap) 2. Real GDP is more than Natural Real GDP (inflationary gap) 3. Real GDP is equal to Natural Real GDP. What is Natural Real GDP? Real GDP that is produced at the natural unemployment rate. (which we agree around 5%) Key: Wage rates and prices will adjust quickly to surplus or shortage 1) In recession- unemployment rate higher than natural rate. 2) Surplus exists in labor market 3) Drives down wage rate ++++++++++++++ 4) In inflationary gap, unemployment lower than natural rate 5) Shortage exists in labor market 6) Drives up the wage rate BOTH THEORIES CLASSICAL AND KEYNESIAN DO AGREE…… TWO THINGS WE CAN DO WITH DISPOSABLE INCOMESPEND OR SAVE! We all know that consumption is 2/3 (or more) of GDP ***Classical theorists say, the funds from aggregate savings eventually borrowed and turned into investment expenditures which are a component of real GDP BUT…. What if no or low savings? Theory breaks down here – have to have equal amounts of investment for savings. (the idea here is that savings leads to investment) This is true… but it probably won’t do it by itself. Needs assistance through monetary or perhaps fiscal policy. The Classical View of the Credit Market In classical theory, the interest rate is flexible and adjusts so that saving equals investment. If saving increases and the saving curve shifts rightward the increase in saving eventually puts pressure on the interest rate and moves it downward. A new equilibrium is established where once again the amount households save equals the amount firms invest. Long-run Equilibrium The condition where the Real GDP the economy is producing is equal to the Natural Real GDP and the unemployment rate is equal to the natural unemployment rate. Recessionary (Contractionary) Gap The condition where the Real GDP the economy is producing is less than the Natural Real GDP and the unemployment rate is greater than the natural unemployment rate. Recessionary (Contractionary) Gap The economy is currently in short-run equilibrium at a Real GDP level of Q1. QN is Natural Real GDP or the potential output of the economy. Notice that Q1< QN. When this condition (Q1< QN) exists, the economy is said to be in a recessionary gap. Inflationary (Expansionary) Gap The condition where the Real GDP the economy is producing is greater than the Natural Real GDP and the unemployment rate is less than the natural unemployment rate. Inflationary (Expansionary) Gap The economy is currently in short-run equilibrium at a Real GDP level of Q1. QN is Natural Real GDP or the potential output of the economy. Notice that Q1>QN. When this condition (Q1>QN) exists, the economy is said to be in an inflationary gap. Economy and Labor Market Self Regulating Economy Closing the Inflationary (Expansionary) Gap The economy is at P1 and Real GDP of $11 trillion. Because Real GDP is greater than Natural Real GDP ($10 trillion), the economy is in an inflationary gap and the unemployment rate is lower than the natural unemployment rate. Self Regulating Economy Closing the Inflationary (Expansionary) Gap The economy is at P1 and Real GDP of $11 trillion. Because Real GDP is greater than Natural Real GDP ($10 trillion), the economy is in an inflationary gap and the unemployment rate is lower than the natural unemployment rate. Self Regulating Economy Closing the Inflationary (Expansionary) Gap Wage rates rise, and the shortrun aggregate supply curve shifts from SRAS1 to SRAS2. As the price level rises, the real balance, interest rate, and international trade effects decrease the quantity demanded of Real GDP. Ultimately, the economy moves into long-run equilibrium at point 2. Policy Implication Laissez-faire • Classical, new classical, and monetarist economists believe that the economy is self-regulating. For these economists, full employment is the norm: The economy always moves back to Natural Real GDP. Laissez-faire A public policy of not interfering with market activities in the economy. How would it automatically adjust? Classical Slump in output yields…. Lower prices This increases consumer spending. Lower wages - eventually will occur… with lower prices Lower interest rate Increases investment spending Increases employment Excesses of supply of goods and workers would be eliminated and return to a balanced full-employment status. *Production of output automatically provides the income needed to buy the output. This theory was prevalent until Depression of 30’s hit. Then what happened? 25% unemployment Banks closed Production ceased Drought hit Stocks worthless No money for purchases No jobs Bleak! AS 1 AD 1 AD P R I C E L E V E L GDP AS Bottom Line Classical viewpointnot possible to overproduce goods because the production of those goods would always generate a demand that was sufficient to purchase the goods. (what would they say about the recent inventories of our auto industry?) • Keynesian Ideas The classical approach fell into disrepute during the economic decline of the 30’s. Real GDP fell by more than 30% 1930-33 In 1939- per capital income was still 10% less than in 1929. *U.S. began to embrace John Maynard Keynes’s theory of stimulating the economy through aggregate demand (Lord Keynes) had studied classical economics and wrote his famous General Theory of Employment, Interest and Money. (which was a complete rebuttal of the classical theory) Keynesian in a Nutshell John Maynard Keynes Nutshell explained • The General Theory of Employment, Interest and Money (1936) • Direct response to Depression. • His response to Say – merely producing goods would not spark demand for them • Government had an obligation to step in when economy was in trauma. Keynes’s View of Say’s Law in a Money Economy According to Keynes, a decrease in consumption and subsequent increase in saving may not be matched by an equal increase in investment. Thus, a decrease in total expenditures may occur. To learn more about John Maynard Keynes, click his photo above. Keynes’ Prescription • For an economy “stuck” at a high unemployment equilibrium, – Self-regulation was not working. – A “jumpstart” was needed: – An injection of new spending to get the economy moving again. • The only spender who could do this was Government. Keynesian Economics • Works only on the AD curve • Assumes AS is stationary • Critics of Keynes: – …But this will cause deficits! – …But the government can’t spend that much! The Economy Gets “Stuck” in a Recessionary Gap If the economy is in a recessionary gap at point 1, Keynes held that wage rates may not fall. The economy may be stuck in the recessionary gap. Keynesian Economics and the Keynesian Short-Run Aggregate Supply Curve (cont'd) • Real GDP and the price level, 1934–1940 – Keynes argued that in a depressed economy, increased aggregate spending can increase output without raising prices. – Data showing the U.S. recovery from the Great Depression seem to bear this out. – In such circumstances, real GDP is demand driven. Keynesian Economics was the answer to Classical economic theories and the suggested way to “jumpstart” the economy again… pull out of the depression. Idea: Government enters the economy. Stimulates the economy through Aggregate Demand. Fiscal policy would move the production engine by stimulating “spending.” increased employment, jobs would be filled, production would begin people would purchase with money they earned from jobs. Classical vs. Keynes I A Question of How Long It Takes for Wage Rates and Prices to Fall Suppose the economy is in a recessionary gap at point 1. Wage rates are $10 per hour, and the price level is P1. The issue may not be whether wage rates and the price level fall, but how long they take to reach long-run levels • The speed at which wage rate falls is a key To whether Keynesian or Classical theory Is more valid. Answers never for sure. Keynes rejected the classical notion of selfadjustment, (????) and he predicted things would get worse once a spending shortfall emerged. Example: • Business expectations of future sales worsens. • Business investment is cut back. • Unsold capital goods begins to pile up (includes office equip. machinery, airplanes, etc.) • *this is an “undesired” change… • Worsened sales expectations causes decline in investment spending that shifts the AD curve to the left leading to pileups of unwanted inventory. Example: Are the U.S. and European SRAS Curves Horizontal? • New Keynesians contend that the SRAS is essentially flat. • Based on research, they contend SRAS is horizontal because firms adjust their prices about once a year. • If the SRAS schedule were really horizontal, how could the price level ever increase? Keynesian Theory P R I C E AD 1 AD 2 AD 3 *Price Goes up L E V E L AS Real GDP Output Keynesian Theory AD unstable, prices and wages are inflexible AD no effect on prices until LRAS Figure 11-9 Real GDP Determination with Fixed versus Flexible Prices Shifts in SRAS Only Table 11-2 Determinants of Aggregate Supply Consequences of Changes in Aggregate Demand • Aggregate Demand Shock – Any event that causes the aggregate demand curve to shift inward or outward • Aggregate Supply Shock – Any event that causes the aggregate supply curve to shift inward or outward