* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Economics in History

Survey

Document related concepts

Transcript

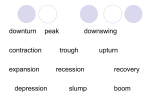

Economics in History The Business Cycle The Business Cycle: Short-run changes in the economy between expansion/growth and contraction/recession Boom and Bust! Business Cycle Terms Boom: period of growth beyond what is normally produced in a year Expansion/Recovery: economic upturn with increasing employment and output Panic: period of fear where economic output falls by a large amount Depression: severe and prolonged economic downturn Recession: economic downturn where production of goods and employment are falling Business Cycle Terms GDP- Market value of all of all final goods and services completed Unemployment Rate- Percentage of people that don’t have jobs that are able to work in the labor force Inflation- Continuing of the increases price of goods over time. Supply and Demand Law of Supply: businesses are more willing to produce and sell goods when prices are higher Law of Demand: people are more willing to buy goods when prices are lower Impact of Changes in Supply or Demand When supply or demand change (shift), equilibrium will also change. When Supply decreases prices go up. When Demand increases prices go up. When Supply increases prices go down. When Demand decreases prices go down. Stock Market Stock: a share or portion of a company that may be bought and sold in a marketplace Selling stock is a way companies access funds to expand their business Buying stock is a way people can earn profits on the part of the company they own As more people want to buy a certain stock, its value will increase As the company does well they will turn profits into dividends ($) that shareholders receive Buying on Margin Buying on Margin was common in the 1920s Put down 10-20% of the value of the stock you wanted to purchase and borrow the rest of the money Pay back the loan after the value of the stock increases If the stock does not increase the lender might issue a margin call and force the borrower to pay back the loan immediately Today this is often done by “shorting” a stock (Borrow it, sell it high, and then buy it for real hoping for lower price) NYSE and Dow Jones Average