* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Nonexistence of Competitive Equilibrium

Survey

Document related concepts

Transcript

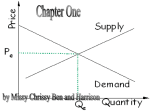

Nonexistence of Competitive Equilibrium A requirement of a competitive equilibrium is that no buyers or sellers have an incentive to leave the market and strike their own deal. Indeed, it can be shown that the competitive equilibrium is the only price-quantity pair such that no coalition of buyers and sellers can benefit by avoiding the market and striking a separate deal. The study of the incentives to form coalitions is referred to as the theory of the core (Telser 1978). Figure Long-Run Supply Consider Figure where all firms have the U-shaped average cost curve, there is free entry, and the long-run market supply curve is bumpy. Suppose, as shown, that the demand curve cuts the supply curve where price equals $12 and output equals 25. Because a firm can only produce at the minimum average cost of $10 if it produces 10 units, it is not possible to produce profitably the demanded output for $10. Is the price of $12 and quantity of 25 really a competitive equilibrium? Suppose that some buyers form a group that collectively buys 10 units and that the group negotiates a separate deal with one of many potential supplying firms. The group is able to obtain their 10 units at the minimum average cost of $10 apiece. They have an incentive to contract separately with a potential supplier, because they can do better than if they rely on the market, and their incentive is greater for bumpier supply curves (which occur when fixed costs are larger). If this incentive induces buyers to split off and negotiate separately with a supplier, the competitive equilibrium does not exist. To demonstrate this point, we first suppose that the intersection in Figure represents a competitive equilibrium. In this equilibrium, long-run profits are positive. But we cannot have a competitive equilibrium in which long-run profits are positive if entry is free. Firms will want to enter the market, so the proposed equilibrium is not an equilibrium. The example below discusses how the ocean shipping market coped with the nonexistence of a competitive equilibrium. When there is only room for a few firms (with sunk costs) in a market, the price-taking assumption of perfect competition is likely to fail, and other models of market behavior (those we study in later chapters) are appropriate. The nonexistence of competitive equilibrium cannot occur if the market supply curve is perfectly flat at finite output levels rather than only in the limit. If each average cost curve has a flat bottom for some range of output, then the long-run supply curve is perfectly flat at some finite output level. For example, if an individual firm's average cost curve in Figure is flat and equal to $10 for outputs between 9 and 11 units, then the long-run supply curve for the market is perfectly flat for outputs equal to or greater than 45 units. If there are five firms in the market, they can produce outputs of 45 through 55 at the minimum average cost. Six firms can produce outputs between 54 and 66 at minimum average cost. As long as the demand curve intersects the market supply curve in the perfectly flat portion, equilibrium exists. EXAMPLE What Happens When Equilibrium Does Not Exist? In some markets, a competitive equilibrium is impossible. That is, there is no coalition of buyers and sellers who can reach agreement with each other. For any given price, buyers and sellers leave the market and strike side deals. Chaos results. Some economists (Clark 1923) have described such situations as destructive competition. A market that is prone to such instability is likely to foster rules, laws, institutions, or associations that are designed to create stability. Pirrong (1987, 1992) shows that ocean shipping for small cargo (less than a boat-load) is characterized by destructive competition, whereas ocean shipping for boat-sized cargo is not. The supply curve for small cargo is bumpy and that for large loads is smooth. Pirrong identifies several instances of destructive competition for small cargo. As a result, numerous international regulations and cartels (a group of shipping firms) have been formed to control ocean shipping for small cargo. The cartels have often controlled price and allocated demand among suppliers. Buyers often sign loyalty agreements under which they agree to use only one cartel's ships. In contrast, the shipping of large, boat-sized cargo has behaved as a typically competitive industry. SOURCES: Clark, James M. 1923. Studies in the Economics of Overhead Costs. Chicago: University of Chicago Press. Pirrong, Stephen C. 1987. "An Application of Core Theory to the Study of Ocean Shipping Markets." Ph.D. diss., University of Chicago. Telser, Lester G. 1978. Economic Theory and the Core. Chicago: University of Chicago Press.