* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download ECON6912_Assignment

Survey

Document related concepts

Transcript

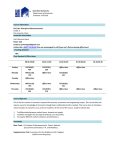

NAME:_______________________ ECON 6912 Fall 2014 Assignment 4: Due Monday, 12/01. 105 points It’s your last assignment so enjoy it! 1. a. b. c. Suppose the market demand for Nalgene bottles is Q=50,000 p -1.076, and the market supply is Q = 0.01p7.208. (3) What is the equilibrium price and quantity? (3) What is the producer surplus in the market? (3) What are the total variable costs of all firms in this market? 2. (12) Suppose the long run total cost function for the typical mushroom producer is given by: C ( q, w) wq2 10q 100 Where q is the output of the typical firm and w represents the hourly wage rate of mushroom pickers. Suppose also that the demand for mushrooms is given by: Q = -1,000P + 40,000 Where Q is the total quantity demanded and P is the market price of mushrooms a. If the wage rate for mushroom pickers is $1, what will be the long-run equilibrium output for the typical mushroom producer? b. Assuming that the mushroom industry exhibits constant costs and that all firms are identical, what will be the long-run equilibrium price of mushrooms, and how many mushroom firms will there be? c. Suppose the government tries to help mushroom farmers by paying each farmer a subsidy equal to 10% of the market price for each unit produced (so the typical farmer has a cost function given by C ( q, w) wq2 10q 100 - 0.1P*q. What is the new long-run equilibrium price of mushrooms, and how many mushroom producers will there be? d. Suppose instead of the subsidy, the government imposed a tax of $3 for each mushroom picker hired (raising total wage costs, w, to $4). Assuming that the typical firm continues to have costs given by C ( q, w) wq2 10q 100 How will your answers to parts (a) and (b) change with this new, higher wage? 3. (16) Suppose John McNally (the mayor of Youngstown) wants to help renters in the city. He is considering two policies that will lower the price renters pay for housing by the same amount. One policy is rent control, or placing a price ceiling (of p0) on rents. The other is a government subsidy that lowers the amount renters pay (to p0). a. Explain who would likely benefit and who would likely lose from each policy. b. Using a graph, compare the two policies’ effects on the quantity of apartments consumed, consumer surplus, producer surplus, government expenditures, and deadweight loss. c. Explain how the amount of deadweight loss from each policy depend on the elasticities of supply and demand. d. Given how you have drawn your graph, which policy would you recommend to Mayor McNally and why (you have to choose one of the two policies)? 4. (10) a. Suppose the federal government were to eliminate all agricultural price supports. Given our discussion of perfectly competitive markets (and the article titled, “Capitalization of Government Support in Agricultural Land Prices”), briefly explain what would happen in both the short-run and in the long-run to the following: the prices of agricultural products, prices of inputs used in farming, and economic profits of farmers. b. Which group(s) would be adversely impacted by the elimination of price supports? What group(s) would likely benefit from the elimination of price supports? Briefly explain. 5. (12) Suppose that the inverse demand function for a firm is given by P = 9 – Q/20. Its cost function is given by TC = 10 + 10Q – 4Q2 + (2/3)Q3 . a. Draw this firms demand, marginal revenue and marginal cost curves. b. Calculate the profit maximizing level of output, price, and profit level. c. Calculate the price elasticity of demand at the profit maximizing level of output. Show that the condition that (P – MC)/P = - (1/elasticity) is true the profit maximizing point. 6. (8) In the long run, a per-unit tax applied in a perfectly competitive, decreasing-cost industry will increase the market price by more than the amount of the tax. Using an appropriate diagram (including a long run supply curve), show and explain the basis for this result. 7. (12) In one market the price elasticity of demand equals -2 and the price elasticity of supply equals +3. The current equilibrium price equals $4 per unit and quantity sold equals 6,000. In another market the price elasticity of demand equals -1.5 and the price elasticity of supply equals +1. The current equilibrium price equals $10 per unit and quantity sold equals 8,000. Suppose a $2 per unit tax is applied in both markets. Calculate the following in each market: a.) b.) c.) d.) The new equilibrium price and quantity sold. The burden of this tax to consumer and producers. The revenue to the government from this tax. The deadweight loss associated with this tax. 8. (15) Use the article “Tax incidence with strategic firms in the soft drink market” to answer the following questions. a. The authors find that firms pass on to consumers between 60% and 90% of the ad valorem tax increase. They also find that the own price elasticity of demand is approximately -3.75. Calculate the range of the elasticity of supply. b. If the objective is to maximize tax revenue, which tax should be applied and why? c. If the objective is to minimize sugar consumption, which tax should be applied and why? d. The paper estimates that an excise tax based on sugar consumption results in the greatest deadweight loss. Briefly explain why this is the case (what is true about this tax that causes a greater deadweight loss compared to the other taxes). e. Why are the deadweight loss estimates not true estimates of welfare loss to society (what else has to be taken into account besides the loss in market surplus)? 9. (16) Suppose the domestic demand for basketballs is given by: Qd=5,000 – 100P and the domestic supply is given by Qs=150P. Basketballs can be imported at a flat price of $10. a.) What is the equilibrium price and quantity if no imports are allowed, and the price and quantity if imports are allowed? How many basketballs are imported? b.) If domestic producers lobby and convince policymakers to implement a $5 tariff, how does this change the equilibrium? How much is collected in tariff revenue? c.) How does consumer and producer surplus change as a result of the tariff? What is the deadweight loss associated with this tariff? d.) How would your results from part c. be changed if the government reached an agreement with foreign suppliers to limit the basketballs they export to 1,250 per year? Explain how this differs from the case of a tariff.