Externalities Chapter

... external cost. Sometimes it is possible to reduce the inefficiency arising from an externality by establishing a property right where one does not currently exist. The Coase theorem is the proposition that if property rights exist, only a small number of parties are involved, and transactions costs ...

... external cost. Sometimes it is possible to reduce the inefficiency arising from an externality by establishing a property right where one does not currently exist. The Coase theorem is the proposition that if property rights exist, only a small number of parties are involved, and transactions costs ...

View/Open

... supported by United States Department of Agriculture (ERS, FAS, OCE, and USITC), Agriculture and Agri-Food Canada and the participating institutions. The IATRC Working Paper series provides members an opportunity to circulate their work at the advanced draft stage through limited distribution within ...

... supported by United States Department of Agriculture (ERS, FAS, OCE, and USITC), Agriculture and Agri-Food Canada and the participating institutions. The IATRC Working Paper series provides members an opportunity to circulate their work at the advanced draft stage through limited distribution within ...

Implications for Cooperation among OIC Cotton Producing Countries

... introduced by the support payments of developed countries to their own cotton producers as well as the declining share of cotton in world textile consumption. The Action Plan for the OIC Cotton Producing Countries’ Cooperation Development Strategy (2007-2011) adopted in October 2006 aims to enhance ...

... introduced by the support payments of developed countries to their own cotton producers as well as the declining share of cotton in world textile consumption. The Action Plan for the OIC Cotton Producing Countries’ Cooperation Development Strategy (2007-2011) adopted in October 2006 aims to enhance ...

View/Open

... for these two countries. The model was simulated as follows. First, the effect of a $0.05/lb. subsidy on domestic price of poultry ($1.05/lb. in 1998) was simulated by setting m (= dS/Pd = $0.05/$1.05) in equation (9) equal to 0.0476, and setting dln(A) equal to zero. The percentage share of U.S. co ...

... for these two countries. The model was simulated as follows. First, the effect of a $0.05/lb. subsidy on domestic price of poultry ($1.05/lb. in 1998) was simulated by setting m (= dS/Pd = $0.05/$1.05) in equation (9) equal to 0.0476, and setting dln(A) equal to zero. The percentage share of U.S. co ...

Law of Supply PowerPoint

... to make a good increase, it will cost the business more to produce it. When it cost a business more to make a good, its profits decrease. This decrease in profits causes the business to make less of the good; it will decrease supply. Therefore, anytime the cost of production of a good increases, a b ...

... to make a good increase, it will cost the business more to produce it. When it cost a business more to make a good, its profits decrease. This decrease in profits causes the business to make less of the good; it will decrease supply. Therefore, anytime the cost of production of a good increases, a b ...

Chapter 10

... PRIVATE SOLUTIONS TO EXTERNALITIES • Government action is not always needed to solve the problem of externalities. • In some cases, the free market ends up maximizing total surplus even when there are externalities ...

... PRIVATE SOLUTIONS TO EXTERNALITIES • Government action is not always needed to solve the problem of externalities. • In some cases, the free market ends up maximizing total surplus even when there are externalities ...

Microeconomics_Part 2

... Similarly, when low-skilled people work for a wage that is below what most would regard as a “living wage,” the media and politicians talk of employers taking unfair advantage of their workers. How do we decide whether something is fair or unfair? You know when you think something is unfair, but how ...

... Similarly, when low-skilled people work for a wage that is below what most would regard as a “living wage,” the media and politicians talk of employers taking unfair advantage of their workers. How do we decide whether something is fair or unfair? You know when you think something is unfair, but how ...

Externalities

... • The intersection of the supply curve and the social-value curve determines the optimal output level. • The optimal output level is more than the equilibrium quantity. • The market produces a smaller quantity than is socially desirable. • The social value of the good exceeds the private value of th ...

... • The intersection of the supply curve and the social-value curve determines the optimal output level. • The optimal output level is more than the equilibrium quantity. • The market produces a smaller quantity than is socially desirable. • The social value of the good exceeds the private value of th ...

Econ 281 Chapter10

... and producer surplus was transferred to the government -this transfer is still efficient -WHO gets the surplus is irrelevant After the tax, production decreases, and a small triangle of producer and consumer surplus is ...

... and producer surplus was transferred to the government -this transfer is still efficient -WHO gets the surplus is irrelevant After the tax, production decreases, and a small triangle of producer and consumer surplus is ...

Temptation and Taxation - Department of Economics

... consumption sets; the other describes temptation utility (v), which plays a key role in determining how actual consumption choices depart from what commitment utility would dictate. In this framework, the consumer’s welfare of a given set B, where B, for example, could be a normal budget set, is giv ...

... consumption sets; the other describes temptation utility (v), which plays a key role in determining how actual consumption choices depart from what commitment utility would dictate. In this framework, the consumer’s welfare of a given set B, where B, for example, could be a normal budget set, is giv ...

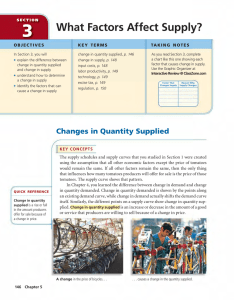

What Factors Affect Supply? - supportforstudentsuccess.org

... are often placed on items such as alcohol and tobacco— things whose consumption the government is interested in discouraging. The taxes increase producers’ costs and, therefore, decrease the supply of these items. Taxes tend to decrease supply; subsidies have the opposite effect. You learned in Chap ...

... are often placed on items such as alcohol and tobacco— things whose consumption the government is interested in discouraging. The taxes increase producers’ costs and, therefore, decrease the supply of these items. Taxes tend to decrease supply; subsidies have the opposite effect. You learned in Chap ...

Supply - Demarest School District

... • For each of the following problems, state which curve would shift: the supply curve or the demand curve. • Then state whether the curve would shift to the right (an increase in supply or demand), or shift to the left (a decrease in supply or demand). ...

... • For each of the following problems, state which curve would shift: the supply curve or the demand curve. • Then state whether the curve would shift to the right (an increase in supply or demand), or shift to the left (a decrease in supply or demand). ...

Supply - Cobb Learning

... (or service) is directly related to the quantity supplied, ceteris paribus. Quantity Supplied - the amount of a good (or service) produced by firms at a particular price. While demand typically refers to consumers, supply typically refers to firms. ...

... (or service) is directly related to the quantity supplied, ceteris paribus. Quantity Supplied - the amount of a good (or service) produced by firms at a particular price. While demand typically refers to consumers, supply typically refers to firms. ...

Market Failure-Part 2 File

... because there is an extra costs to society caused by the pollution that is created. This could be respiratory problems for people in the neighbourhood of the polluting firm. The firm will only be concerned with its private costs and will produce at Q1. It is not producing at Q* where the marginal so ...

... because there is an extra costs to society caused by the pollution that is created. This could be respiratory problems for people in the neighbourhood of the polluting firm. The firm will only be concerned with its private costs and will produce at Q1. It is not producing at Q* where the marginal so ...

market equilibrium

... Green dollar exchanges use a system of credits for goods produced or work done. For instance, baby-sitting clubs have been set up where parents can earn a "credit" whenever they baby-sit at a member's home. This credit can be "debited" (or spent) whenever the parents need babysitting services. No mo ...

... Green dollar exchanges use a system of credits for goods produced or work done. For instance, baby-sitting clubs have been set up where parents can earn a "credit" whenever they baby-sit at a member's home. This credit can be "debited" (or spent) whenever the parents need babysitting services. No mo ...

Negative externalities and the private provision of public goods: a

... be extended to other models of the voluntary provision of public goods to understand why certain schemes result in an increase in the voluntary provision of public goods. Simply put, schemes which introduce negative externalities stemming from voluntary contributions will increase the provision of ...

... be extended to other models of the voluntary provision of public goods to understand why certain schemes result in an increase in the voluntary provision of public goods. Simply put, schemes which introduce negative externalities stemming from voluntary contributions will increase the provision of ...

Subsidy Reform in the Middle East and North Africa Recent

... greater social demands that have accompanied the wave of political transitions in the region. In many oil-importing countries, cheap subsidized prices have contributed to a widening of current and fiscal deficits, often against the backdrop of relatively large or rising public debt levels. In these co ...

... greater social demands that have accompanied the wave of political transitions in the region. In many oil-importing countries, cheap subsidized prices have contributed to a widening of current and fiscal deficits, often against the backdrop of relatively large or rising public debt levels. In these co ...

Energy Subsidies in Latin America and the Caribbean: Stocktaking

... the Caribbean (LAC) amounted to about 1.8 percent of GDP, on average, in 2011–13, with fuel subsidies representing about 1 percent of GDP, and those for electricity about 0.8 percent of GDP.1 This level of subsidies is somewhat larger than that reported for the region in IMF (2013a), a difference ma ...

... the Caribbean (LAC) amounted to about 1.8 percent of GDP, on average, in 2011–13, with fuel subsidies representing about 1 percent of GDP, and those for electricity about 0.8 percent of GDP.1 This level of subsidies is somewhat larger than that reported for the region in IMF (2013a), a difference ma ...

PDF

... common property resource, the question of who should compensate whom remains unanswered. This is particularly true of air pollution caused by open field burning of residue. Since the question of property rights per se is not within the scope of this study, we start with the premise that society in O ...

... common property resource, the question of who should compensate whom remains unanswered. This is particularly true of air pollution caused by open field burning of residue. Since the question of property rights per se is not within the scope of this study, we start with the premise that society in O ...

Price Quantity - Gore High School

... • Law of Demand __________________________________________ _______________________________________________________ • Law of Supply _______________________________________________________ _______________________________________________________ ...

... • Law of Demand __________________________________________ _______________________________________________________ • Law of Supply _______________________________________________________ _______________________________________________________ ...

Direct costs test (if satisfied, service is a definite recipient of

... Lower bound for stand-alone test—service’s fully distributed costs (if satisfied, service is a potential source of subsidy) The fully distributed cost of a service is defined as the sum of the service’s direct, attributable and unattributable costs, as per Australia Post’s cost allocation system. If ...

... Lower bound for stand-alone test—service’s fully distributed costs (if satisfied, service is a potential source of subsidy) The fully distributed cost of a service is defined as the sum of the service’s direct, attributable and unattributable costs, as per Australia Post’s cost allocation system. If ...

PDF

... The International Agricultural Trade Research Consortium is an informal association of University and Government economists interested in agricultural trade. Its purpose is to foster interaction, improve research capacity and to focus on relevant trade policy issues. It is financed by United States ...

... The International Agricultural Trade Research Consortium is an informal association of University and Government economists interested in agricultural trade. Its purpose is to foster interaction, improve research capacity and to focus on relevant trade policy issues. It is financed by United States ...

Lecture-3 - Arkansas Economist

... • The U.S. government subsidizes college education in the form of Pell grants and lower-cost government Stafford loans. How do these subsidies affect the price of college education? Which is relatively more elastic: supply or demand? Who benefits the most from these subsidies: suppliers (colleges) o ...

... • The U.S. government subsidizes college education in the form of Pell grants and lower-cost government Stafford loans. How do these subsidies affect the price of college education? Which is relatively more elastic: supply or demand? Who benefits the most from these subsidies: suppliers (colleges) o ...

supply

... • A subsidy is a government payment to an individual, business, or other group to encourage or protect a certain type of economic activity. • Subsidies lower the cost of production, encouraging current producers to remain in the market and new producers to enter. • When subsidies are repealed, c ...

... • A subsidy is a government payment to an individual, business, or other group to encourage or protect a certain type of economic activity. • Subsidies lower the cost of production, encouraging current producers to remain in the market and new producers to enter. • When subsidies are repealed, c ...