* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Market Structures – Perfect Competition

Marginalism wikipedia , lookup

Economic calculation problem wikipedia , lookup

Production for use wikipedia , lookup

Icarus paradox wikipedia , lookup

Brander–Spencer model wikipedia , lookup

Supply and demand wikipedia , lookup

Theory of the firm wikipedia , lookup

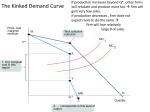

Market Structures – Perfect Competition Seher Sarin & Uma Kalkar Competitive Market: A market in which there are many buyers and many sellers so that each has a negligible impact on the market price Perfect Competition: Highest form of competition; must have three main characteristics to exist Goods sold by various sellers are quite similar Many buyers and sellers in the market (so no single buyer or seller has any influence over the market price) Firms can freely enter and exit the market Outcome of Perfect Competition Since buyers and sellers in perfectly competitive markets must accept the price the market determines, they are said to be price takers. At market price, buyers can buy all they want, and sellers can sell all they want. Example: In the wheat market, there are thousands of farmers who sell wheat and millions of consumers who use wheat. Because no single buyer or seller can influence the price of wheat, each takes the price as given. Revenue in Perfect Competition 1. Total Revenue: Selling price multiplied by quantity sold (TR = P*Q) 2. Average Revenue: Total Revenue divided by the quantity sold (AR = TR/Q) 3. Marginal Revenue: Change in total revenue from an additional unit sold (MR=ΔTR/ΔQ) For a competitive firm, marginal revenue & average revenue = price of good Profit Maximization Produce quantity where total revenue minus total cost is greatest Compare marginal revenue with marginal cost If MR > MC – increase production If MR < MC – decrease production Maximize profit where MR = MC Short-run Market supply with a fixed number of firms Short-run decision not to produce anything During a specific period of time Because of current market conditions Firm still has to pay fixed costs Shut down if TR<VariableCost (P<AverageVariableCost) Exit Long-run decision to leave the market Firm doesn’t have to pay any costs Sunk costs: costs that cannot be recovered when deciding to exit, but are ignored when considering shut down Short-Run Supply Curve: Part of the marginal-cost curve that lies above average variable cost Increase in demand raises price and quantity in the short run Each firm supplies a quantity of output so that its marginal cost = price Firms earn profits because price now exceeds average total cost. Long-Run Firms can enter and exit the market If P > ATC – make positive profit (new firms enter market) If P < ATC – make negative profit (firms exit market) ATC = Average Total Cost Process of entry and exit ends when: Firms in market make zero economic profit (P = ATC) Because MC = ATC: Efficient scale Long run supply curve – perfectly elastic o Horizontal at minimum ATC Long-Run Supply Curve: Part of the marginal-cost curve that lies above average total cost Measuring profit If P > ATC o Positive Profit=TR–TC=(P–ATC) x Q If P < ATC • Loss=TC-TR=(ATC–P) x Q o Negative profit Why do competitive firms stay in business if they make zero profit? Profit = total revenue – total cost Total cost includes all opportunity costs Zero-profit equilibrium Economic profit is zero Accounting profit is positive Zero Profit Equilibrium Firm’s revenue compensates the owners for the time and money they expend to keep business going The price of the good = firm’s average and marginal revenue. Maximize profit: firm finds a quantity of output such that marginal revenue = marginal cost Quantity at which price = marginal cost → firm’s marginal cost curve becomes its supply curve. Short run: firm cannot recover fixed costs, will shut down if price of the good < average variable cost Long run: firm can recover fixed and variable costs, but will exit if the price < average total cost In a market with free entry and exit, in the long run profits are driven to zero and all firms produce efficiently