* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Example 12.1 Minimizing Costs for a Cobb

Brander–Spencer model wikipedia , lookup

Heckscher–Ohlin model wikipedia , lookup

Rebound effect (conservation) wikipedia , lookup

Icarus paradox wikipedia , lookup

Economic calculation problem wikipedia , lookup

Economics of digitization wikipedia , lookup

Marginalism wikipedia , lookup

Theory of the firm wikipedia , lookup

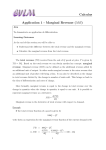

Econ 604 Advanced Microeconomics Davis Spring 2004, April 20 Lecture 13 Reading. Chapter 12 pp 298-327 Next time: Chapter 13 11.5, 11.6, 11.7 Problems: REVIEW X. Chapter 11. Production Functions A. Production Functions, and Marginal Productivity. B. Isoquant Maps and the Rate of Technical Substitution RTS (L for K) = -dK/dL| q=qo RTS and Marginal Productivities Reasons for a Diminishing RTS. C. Returns to Scale Constant Returns to Scale and the RTS q = f(X1, X2, .. , Xn) Consider mkq = f(mX1, mX2, .. , mXn) k=1 we have constant returns to scale D. The Elasticity of Substitution = %(K/L)/ %(RTS) = d(K/L) RTS = dRTS (K/L) ln(K/L) ln(RTS) E. Some Common Production Functions F. Technical Progress Measuring Technical Progress (Problem: Distinguishing increased capital accumulation from Technical progress Starting with we can develop Gq = GA q = + q,K GK A(t)f(K,L) + q,L GL Where Gx = dx/dt/x PREVIEW XI. Costs A. Some Cost Definitions B. Cost-Minimizing Input Choices C. Cost Functions D. Shifts in Cost Curves E. Short Run, Long Run Distinction 1 Lecture______________________________________________________ XI. Costs A. Definitions of Costs. Costs for economists differ from those for accountants. Accountants stress out-of-pocket expenses, historical costs and depreciation. Economists, on the other hand, focus on opportunity costs, or the replacement value of an item. The differences in these two perspectives affect various kinds of costs differently. 1. Labor Costs: These are explicit expenses for human inputs. Accounting costs and economic costs are similar. We will call this a wage 2. Capital Costs: For accountants capital costs are the historical price of a machine, adjusted for depreciation. Here the economists cost notion is quite different. For economists the cost of machine is the implicit value of the machine – that is, economic cost is assessed in terms of alternative uses of the machine. We refer to this as a rental rate (v) 3. Costs of Entrepreneurial Services: Accountants view profits as the residual that’s left over after labor and capital expenses have been paid. Economists tend to view entrepreneurial return as something over and above what they might have earned for their services in an alternative employment. 4. Economic Costs. We summarize these observations in the following definition Economic Costs: The economic cost of any input is the payment required to keep that input in its present employment. Equivalently, the economic cost of an input is the remuneration the input would receive in tits best alternative employment. 5. Two Simplifying Assumptions: Here we will analyze costs in a very simple world. Two assumptions are particularly important. - First, there exist just two inputs, Labor (L) and Capital (K). Inputs are measured in terms of hours of use. - Second, all inputs are acquired in perfectly competitive markets, at rates w and v for labor and capital, respectively. The return to the entrepreneur is presumed to be captured as part of the return to capital (e.g., the entrepreneur owns the machines) 6. Economic Profits and Cost Minimization: Thus we can write the cost function for the firm as total costs = TC wL + vK The objective for the firm is to maximize profits, or the difference between revenues and costs. = total revenue – total cost = Pq wL rK 2 B. Cost-Minimizing Input Choices. First, we will finesse for a minute the issue of optimal output, and consider the minimum costs associated with producing a given output level qo. 1. Mathematical Analysis. Parallel to the problem for the consumer, we can express the problem for the firm as a problem of constrained optimization. = wL + rK + [qo – f(K,L)] Taking first order conditions yields /L = w - (f/L) = 0 /K = v - (f/K) = 0 / = qo – f(K,L)] = 0 Solving yields the standard result w/v Notice also that [f/L]/w = [f/L] / [f/K] = RTS (L for K) = [f/K]/v = 1/ Thus represents the marginal cost of an extra unit of output. 2. Graphical Analysis. Graphically, the cost minimization problem is very similar to the (dual of the) consumer problem. K TC 1 TC 2 TC 3 K* q0 L* L The firm picks the minimum cost level (in the graph TC1) that allows production of output qo 3. Dual Problem: Output Maximization. We might, of course, also evaluate the dual problem of maximizing output, subject to a const constraint. 3 K TC 1 K* q1 q0 q00 L* L For most of our analysis, we focus on the primary problem. But occasionally, the dual to cost minimization lends useful insights. 4. Derived Demand for Inputs. The preceding suggests that we might develop the (derived) demand for inputs just as we did consumer demand for a product. Unfortunately, such an analysis may not be done in terms of the simple figure, because as an input price changes, the optimal level of output may change, as well as the standard substitution and “income” (cost savings) effects. 5. The Firm’s Expansion Path. One thing we can consider from the above figure, however, are the optimal input combinations as the budget expands. This is shown in the following chart. K E TC 1 K* q1 q0 q00 O L* L The line OE in the above chart, which traces out optimal input combinations as the budget expands is termed the expansion path. Notice that the expansion path need not be linear. In fact it may even be backward bending. (For example, less labor may be expanded once the scale of operation becomes large enough to replace shovels with plows. 4 Example 12.1 Minimizing Costs for a Cobb-Douglas Production Function Consider the production function Q = 10K½ L½ The associated cost function is TC = vK + wL Suppose we consider the optimal input combination to produce q=04. To optimize, set up the lagrangian = wL + rK + [40 – 10K½ L½ Taking first order conditions yields /L = w - (5K½/L½) = 0 /K = v - (5L½/K½) = 0 / = 40 – 10K½ L½ = 0 w/v K/L = RTS (L for K) Solving yields = Thus, if w=$4 and v=$4, then equal amounts of L and K would be used (In this case 40 = 10(4) ½(4)½. So 4 of each would be used, for a total cost of $4(4) + $4(4) = $32. -Notice with K = L = 4, MPK = 5(4/4) ½ =5 = MPL -Notice that 1/ = MPK/v = 5/4 = $1.25. Or, alternatively MC = $0.80 -Notice that the production function is homogeneous of degree 1. Thus, it exhibits Constant Returns to Scale. The expansion path is linear. C. Cost Functions. Now let’s consider the cost function of a firm TC = TC(v,w,q). Typically, we should expect costs to increase as output expands., so TC/q >0 1. Average and Marginal Cost Functions. We often evaluate costs and revenues on a per unit basis. This requires development of the alternative cost expressions average cost AC = TC(v,w,q)/q 5 marginal cost MC = TC(v,w,q)/q Notice that these alternative definitions depend on both q, and input prices as well. 2. Graphical Analysis of Total Costs Costs make take on a number of relationships. One possibility is that costs are simply proportional to output. For example to produce 1 unit TC(q=1) = vK1 + wL1 Notice that this implies TC(q=m) = mvK1 + mwL1 =m[TC(q=1)] So this linear cost relationship exhibits constant returns to scale. TC K TC 1 L Q A more general cost relationship is illustrated below. This TC function takes on a “recliner” shape, first increase at decreasing rate (reflecting gains from specialization), then increasing at an increasing rate (reflecting the law of diminishing returns) 3. Graphical Analysis of Average and Marginal Costs. Now, with the linear cost relationship show in the first cost chart, Marginal costs equal average costs, which is a horizontal line. An extra shirt, for example, requires 10 minutes of sewing on a machine, by a human. However, for the more general case, marginal and average cost relations follow the pattern shown below. 6 TC MC AC Q This relationship is the inverse of the Marginal and Total Product Relationships were Developed in the last chapter. As before the Marginal “drives” the average. When the marginal is below the average, it pulls the average down. Conversely when the marginal is above the average. D. Shifts in Cost Curves. The cost curves shown above presume other things are constant. Let us consider now ways to quantify the shifts that arise from deviating from the ceteras paribus assumption. 1. Homogeneity. Suppose first that all input prices change. Notice first that the TC function is homogenous of degree 1 in input prices. Increasing all input prices by a factor of m inflates TC by m. Formally If TC1 = vK1 + wL1 Then mvK1 +mwL1 = m (vK1 + wL1) = mTC1 It immediately follows that AC and MC (which are based on TC) are also homogenous of degree 1, e.g., if TC’ = mTC Then AC’ = TC’/q = mTC/q = MC’ = TC’/q = m(TC’/q+ = mMC mAC And Thus, uniform changes in all input prices is a “pure inflationary” effect. 2. Change in the Price of One Input. Suppose now that just a single input price changes. Such a price change alters input ratios, so a new expansion path must be derived. We consider three effects (a) the qualitative direction of the effect on total, average and marginal costs, (b) the degree of substitution among inputs and (c) the quantitative effect on total, aveage and marginal costs. 7 a. Direction of Effect. An increase in an input price must exert a nondecreasing effect on TC. Thus AC (=TC/q) will also typically rise. MC is a bit more difficult, since we must allow for the (admittedly rare) possibility that the input is an inferior good. b. Input Substitution c. Partial Elasticity of Substitution d. Quantitative Size of Shifts in Cost Curves 3. Technical Progress E. Short Run, Long Run Distinction 1. Short Run Total Costs 2. Fixed and Variable Costs 3. Nonoptimality of Short-Run Costs 4. Short-Run Marginal and Average Costs 5. Short-Run Average Fixed and Variable Costs 6. Relationship Between Short-Run and Long-Run Cost Curves 7. Per-Unit Cost Curves 8