* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Economies of Scale, Imperfect Competition, and International Trade.

Survey

Document related concepts

Transcript

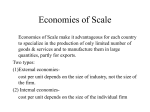

Lecture 3 ECONOMIES OF SCALE, IMPERFECT COMPETITION AND INTERNATIONAL TRADE By Carlos Llano, References: • Krugman P. Obsfeld : Economía Internacional. Prentice Hall, 2007. Capítulo 6. • Pol Antras, course materials for 14.581 International Economics I, Spring 2007. MIT OpenCourseWare (http://ocw.mit.edu/), Massachusetts Institute of Technology. Downloaded on [DD Month YYYY]. • Caves, R.E., Frankel, J.A. y Jones, R.W. (1999); chapter 2, page 22, chapter 3, pages36-37, chapter 8, pages119-134. • Teresa Domingo (Universidad de Valencia). Index 1. Introduction. 2. Internal and external economies of scale. 3. Imperfect competition and trade 1. The monopolistic competition model. 2. The intraindustry trade : definition and importance. 3. Measurement of intraindustry trade . 4. External economies and international trade. 5. Extensions and applications. 6. Conclusion Tema 5 -SE • 1. Introduction Some uncomfortable facts about the classical models of trade: – It only predicts trade between different countries. However, about 70-80% of trade (Grubel-Lloyd) is between similar countries. – It is difficult to predict bilateral trade (gravity model) and justify the two-waytrade. – Difficulty to explain the role of companies (intra-firm trade; multi-national trade). • In this lecture we will discuss economies of scale models, imperfect competition and product differentiation. – We will introduce these items slowly. • These models are complementary (not substitutive) of the classic ones. Tema 5 -SE 1. Introduction In the classic models: • • They explain trade between countries based on comparative advantage. Countries gain from trade if they are different. Ricardian Model: – – Key: Differences in productivity (availability of technology) Home (H) exports good 1, which is produced with higher relative productivity; it imports good 2, since Foreign (F) produces it more efficiently. Heckscher-Ohlin Model (H-O Model): – – Key: Differences in factor endowments. H exports good 1, whose production is intensive in the relatively abundant factor (K or L); it imports good 2, since F is specialized in producing the good that is more intensive in the factor that is relatively more abundant in F. There will be trade between 2 countries with equal productivity and the same factor endowment? Tema 5 -SE 2. Economies of scale Classic models assume: • “Constant returns to scale”: – Y=f(N); Si ↑2N → ↑2Y • Perfect competition: – – – – Small firms with similar cost structures; Non- differentiated products; “Price taker” and Economic profits =0. 2. Economies of scale Tema 5 -SE • Now, we assume “Increasing returns to scale”: – Y=f(N); If ↑2N → ↑3Y – Production is more efficient the more it is produced: • The average costs decrease as productivity increases. – Each country is specialized in a reduced number of products and imports the rest. • Now, we are interested in the trade that arises when there are economies of scale and the possibility of product differentiation • Thus, we will focus on the international trade arising between similar countries. 2. Economies of scale and international trade Tema 5 -SE An intuitive view: • Although both countries have equal productivity and factor endowments, international trade can exist. • Why? Because there are Economies of scale – We assume that consumers demand “variety”. – Each country is specialized in producing a variety of a good: by producing the entire quantity of that variety, costs are lower than if each country produced a portion of each variety. • Conclusion: – Each country produces the whole amount of a single variety, and imports the rest in which it is not specialized: therefore international trade in different products (varieties) arises. – The same number of varieties is produced but with lower cost (or more varieties with the same cost). Gains from trade arise in both countries. Tema 5 -SE 2. Economies of scale and international trade • The key is in the fixed costs: to produce each variety there are fixed costs. By increasing the scale of production of a single variety, one can reduce the average cost per unit of output. • However, to increase the production scale, new factors of production are needed (which, in autarky, they would be used in other industries). • A big country can scale up production without giving up varieties. But a small one has to choose between giving up some varieties or to produce them with lower costs (decreasing the scale). • International trade (integration) makes it possible for a small country to take advantage of producing on scale without giving up variety. – Each country specializes in producing a lot (all of it) of few varieties. – It will exports the whole excess of production not consumed domestically. – The rest of varieties will be imported. Tema 5 -SE Constant returns P C TP C TC L MC=AC Q Q Increasing returns P C C TC TP MC AC L Q Q Decreasing returns P C TP C MC AC TC L Q Q Tema 5 -SE Production 150 140 130 120 110 100 90 80 70 60 50 40 30 20 10 0 Production Per worker The Production function and average and marginal returns 1 2 3 4 Nº of workers 5 30 25 Technical optimum 20 15 Average product 10 Marginal Product 5 0 Nº of workers Increasing returns gap Decreasing returns gap 2. Economies of scale: internal and external Types of Economies of scale • External ES External ES: They appear when unit costs decrease with the size of the industry (not necessarily with the size of each company). – – – • Internal ES Ex: clusters: The production cost of a pub in Bleecker street is less than in any other area where there is no agglomeration of pubs. Lower costs of: supplies, publicity, customers, workers… Idem: souvenirs shops around Times Square. Firms tend to be small, they offer the same product at a similar price. The market tends to work under “perfect competition”. Internal ES: They are produced when the unit cost decrease with the size of the company (not necessarily with the size of the industry). – – – – Ex: Production cost of transport services is lower for a big airport than for several small ones. The emergence of internal economies is related with the high fixed costs. Firms tend to be big, they offer a differentiated product on a different price. The market tends to behave with imperfect competition (oligopoly, monopolistic competition). L Q AC Internal ES External ES AC1 AC2 AC2 Zone 2 A AC1 Q1 B AC2 Q1 AC1 Zone 1 Q1 Q2 Q1 2. Economies of scale and market structure. • Internal ES: – • In imperfect competition, firms can affect the price. – – – • Problem: it forces us to move to a imperfect competition model: Industries with few producers Industries with product differentiation for consumers In order to sell more, the price must be decreased (strategic behaviors) Possible cases: – Monopoly; oligopoly; Monopolistic competition 3. Imperfect competition and trade MONOPOLY • The firm faces a downward-sloping demand curve: The firm can sell more units of output only if • The firm maximizes profits when: MR = MC 3. Monopolistic competition y trade. Tema 5 -SE Graphic 1. Demand and income of a monopoly Cost, C Price, P A Pm MR AR = D MR 0 q Q 15 3. Imperfect competition and trade Tema 5 -SE MONOPOLY: marginal revenue and price Which is the relationship between MR and price? Two factors: 1. It depends on the quantity that the firm is already selling. – Ex: if the company is not selling much, then the effect of lowering the price on all units is small. 2. It depends on the slope of the demand curve: – – Ex: if the curve is flat, the monopolist won’t have to reduce much the price in order to sell an additional unit. Therefore the difference between price and MR will be small. The marginal revenue (MR) is the income induced by the last unit sold. – – For a monopolist, the MR is smaller than the price: in order to sell an additional unit (Q) it has to P, but not just the price of the last unit sold, but of all the units. For a monopolist, the MR is always below the demand. 3. Monopolistic competition and trade. MONOPOLY: marginal revenue and price Demand: Q = A - B x P Q = units sold. P= price per unit A & B= two constants. B is therefore the slope of the demand MR = P - Q / B The MR < Price when Q MR B MR P MR depends on the units sold (Q) and on the sensitivity of the demand to an increase in the sales (B) • The higher Q is, the smaller the MR. • The higher B is, the smaller the difference between MR y P. Tema 5 -SE 3. Imperfect competition and trade MONOPOLY: average and marginal costs • The Average cost (AC=TC/Production) is a downward-lope curve: – – There are economies of scale: the higher the output, the lower the AC. Therefore, the MC is less than the AC COST OF THE FIRM = FIXED COST + VARIABLE COST TC = FC + Q x c where c = MC AC = TC / Q = FC / Q + c If the quantity increases (Q) the AC declines 3. Imperfect competition and trade Average and Marginal Cost AC MC TC = FC + Q x c AC = TC / Q = FC / Q + c AC = FC / Q + c c MC Q • The AC tends to infinite when Q=0; and tends to the MC when Q is large. • The production that maximizes the profit of a monopoly is the one for which MR=MC. • Therefore, it will maximize profit by producing q with price p (where p>AC) 3. Imperfect competition and trade Graph 1. Equilibrium of a firm in a monopoly Cost, C Price, P Monopoly Profits A Pm AC AC MR=MC MC D MR 0 Qm • Therefore, it max profit producing Qm with price Pm (where Pm>AC) Q 3. Imperfect competition and trade Monopolistic competition: assumptions • In reality, monopolies do not easily survive: • The profits of the monopoly attract competitors. • Therefore, usually arise: Oligopoly and monopolistic competition. • Oligopoly: several firms + different prices but interdependent. • Monopolistic competition: • Few firms with different products (varieties): • Product differences ensure a monopoly in its variety even thought there are some slight price differences with other substitutive goods. • Different and independent prices. • Each company accepts other firms’ prices as given. Tema 5 -SE 3. Imperfect competition and trade Monopolistic competition: example • Ex: Automobile market. • Few producers specialized in different models, that compete with each other (they are substitutes, thought not perfectly) but they have some scope on setting prices given a certain monopoly capacity due to the differences introduced by each maker. • Each company is a monopoly (just one produces each variety), although the demand of the good depends on the number of available similar products and on the prices of other firms in the industry. 3. Monopolistic competition y trade. MONOPOLISTIC COMPETITION: the basic model Demand faced by the firm under M. Competition: Q = S( 1 / n - b ( p - P’) ) • • • • • Q= Firm’s sales S = Total sales in the industry n= number of firms p= price in the company P’ = average price charged by competitors • Each company sells more the higher the total demand in the industry, and the higher the prices of the competitors. • If p = P’ all the firms will sell S / n (= share for each one). • The larger the difference of p over P’ the smaller the company market share. • The total sales S don’t depend on the price (pieces of a given “cake”) 3. Imperfect competition and trade MONOPOLISTIC COMPETITION: Market equilibrium: • Assumption: All firms are symmetric in costs and demand, even thought their products are differentiated. • The long run equilibrium depends on: “the average price” of the varieties (P’) and the “number of firms” (n). We will obtain them in 3 steps ___________________________________________________________________________________________________________________________ 1. Number of firms and average cost: since the firms are symmetric, in equilibrium, everyone produce with the same price (P=P’). Then Q=S/n. On the other hand, we know that the AC depends inversely on Q: AC = TC / Q = FC / Q + c • = FC / S / n + c = (n FC) / S + c Interpretation: The more firms in the industry, (and/or) the smaller the share that each one produces → the higher the average cost (that is, the more difficult to take advantage of the increasing returns). Tema 5 -SE 3. Imperfect competition and trade MONOPOLISTIC COMPETITION Market equilibrium 2. Number of firms and the price: the price that a firm charges also depends on the number of firms in the industry. • When n increases, there is more competition, and prices will be reduced. • On the other hand, each company accepts the price of the other firms (average price in the industry , P’) as given. • Then the Demand can be written as: Q = S (1 / n - b ( p - P’) ) = Q = S / n + S b P’ - S b p Q= Firm's sales; S = Total sales in the industry; n= number of firms p= company price ; P’ = average price charged by competitors b= parameter that measures the sensitivity of Q to the price 3. Imperfect competition and trade n competition price Q = S ( 1 / n - b ( p - p’)) = Q = S / n + S b P’ - S b p = S / n + S b P´ = A Sb=B Q=A-Bp Demand in a monopoly Q= the firm's sales will equal the equilibrium share if P=P’, plus an additional gain/loss from the share according to the difference in prices (p) from the rest of the industry (P´) 3. Imperfect competition and trade Substituting Q in MR we get: MR = p - Q / B = p - Q / Sb • Since the company maximizes the profits when MR= MC MR = p - Q / Sb = c • It can be rearranged as: p = c+ Q / Sb If all the firms charge the same price, each one will sell an amount Q=S/n. Substituting this we have: p = c + (S/n / Sb) = c + 1 / (nb) The larger the # of firms, the lower the price: n price Firm’s mark-up over marginal cost: p - c = 1 / (nb) 3. Imperfect competition and trade AC p CC = average cost in the company E p2 = AC2 = n FC/ S + c PP = price of the industry = c + 1 / nb n N2 = n firms in equilibrium (with profit=0) 3. The equilibrium number of firms: • PP Curve: ▲ # of firms in the industry, ▲competition and ▼ price. • CC Curve: ▲ # of firms in the industry, ▲ average cost in each company. • E: long run equilibrium in the industry (n2 firms producing on AC2) 3. Imperfect competition and trade MONOPOLISTIC COMPETITION : limitations of the model • The model captures certain key elements where there is imperfect competition, but not all of them. • Ex: there are common behaviors in the oligopoly that are not captured by the model: Collusive Strategic Price Agreements (P> P*) Expel competitors Q > Q* 3. Imperfect competition and trade MONOPOLISTIC COMPETITION AND TRADE • In monopolistic competition without trade, the small countries are restricted by their size: they have to choose between + varieties or higher production costs. • Trade increases market size, and the increase of the market produces the rise of Q and decreases of AC: AC = n x FC / S + c if n = constant and ↑S AC • If two markets are compared S1 < S2 , the S1 costs will be > S2 costs . Its CC curve changes. • The PP Curve does not vary because p= c + 1/ bn 3. Imperfect competition and trade CLOSED COUNTRY P C (S1) = n FC / S1 + c AC p1 LARGE MARKET WITH TRADE 1 2 p2 C (S2) = n FC / S2 + c P = c + 1 / bn n1 n2 N: firms / variety 3. Imperfect competition and trade Equilibrium in the automobile market Price per auto Price per auto PP PP CC CC 10 8,7 6 (H): Q = 900.000 Home 8 n (F): Q = 1.600.000 Foreign n 3. Imperfect competition and trade Integrated world with trade=Home+Foreign AC P PP Equilibrium in the Global Market S = S1 + S2 n = 10 (car varieties), with lower AC(= p) AC 8 10 N CONCLUSION: in Monopolistic Competition, trade allows taking advantage of internal economies of scale without giving up the variety. 3. Imperfect competition and trade ECONOMIES OF SCALE AND COMPARATIVE ADVANTAGE In the monopolistic competition model: • We assume that the cost of production is the same in all companies, even if they produce different varieties. • We also assume that the cost of trade is =0 (no transport costs). • We know the size of the global production, but not who will be the producing countries. – We know how many company will be in the long run, but not how many or which ones will be in (H) or in (RM). • We have to mix this model with the one for comparative advantage in order to determine the pattern of trade. 3. Imperfect competition and trade Assumptions: • 2 countries (H, F), 2 factors: labor L and capital K, • 2 products: manufactures (Qm) and food (Qa). • H is relatively abundant in capital, and the manufactures are comparatively intensive in capital. • (K / L) > (K /L)* Home Foreign and (akm / a lm) > (aka /ala) Manufactures Agriculture • How trade would be according to H-O… and according to the imperfect competition model? 3. Imperfect competition and trade In the H-O model, with constant returns , trade would be: H Relat.Abundant K / L Manufactures X Food M F Relat.Abundant L/ K Trade Pattern is easy to be identified • Therefore H would export manufactures and import food, • In this model the manufactures have a perfect competition structure and the product is homogeneous. 3. Imperfect competition and trade If the manufactures sector is Monopolistic Competition with increasing returns and product differentiation Manufactures H Relat.Abundant K / L F Relat.Abundant L / K Mixed trade pattern Xmi Food Ma Interindustry trade Intraindustry trade Mmj Xm - Ma Xmi – Mmj 3. Imperfect competition and trade Our country (H) is now both “exporter” and “importer” of manufactures, But since it had Comparative advantages in Qm it will be a “net exporter” Xm – Mm > 0 3. Imperfect competition and trade • Conclusion: in a monopolistic competition model, trade is constituted by two parts: • Inter-industry: Qa Food vs Qm manufactures. • It is based on comparative advantage. • The volume and the direction of trade is predictable. • Intra-industry: Exchanges of different varieties of manufactures. • It is not based on comparative advantages. • The volume of trade is predictable, but the direction It is not. 3. Imperfect competition and trade Characteristics & differences between intra/inter trade • Inter-industry trade reflects the comparative advantage. • Intra-industry trade has its origin in the economies of scale. 1. Intra-industry trade has an unpredictable pattern: we don’t know which country produces which goods, while interindustry trade has a determined pattern by the differences between countries (K/L). 2. The % between intra-industry / inter-industry trade in a given bilateral trade depends on the similarities between countries. Ex: (OCDE) H y F are = in technology and factors, then the intra % will be higher. 3. Imperfect competition and trade Index for measuring intra-industry trade (IIT) bj = 1 - X j – Mj (X +M) X j – M j = intraindustry trade (product j) X – M = total trade 0 bj 1 If (Xj = Mj) → X j – M j = 0 → bj = 1 All trade is intra-industry If Xj = 0 and Mj > 0 X j – M j = Mj ( X j + M j ) = Mj bj = 0 or If Mj = 0 X j > 0 X j – M j = Xj ( X j + M j ) = Xj bj = 0 “inter-industry trade” 3. Imperfect competition and trade Table. Indexes of Intraindustry trade for US industries1993 IIT Inorganic chemicals 0,97 Power-generating machinery 0,86 Scientific Equipment 0.84 Organic chemicals 0.79 Medical and pharmaceuticals 0.85 Office machinery 0.58 Telecommunications equipment 0.46 Road vehicles 0.70 Iron and steel 0.76 Clothing and accesories 0.11 Footwear 0.10 Data USA, 2009 Tema 5 -SE 3. Imperfect competition and trade Data about inter-industry vs intraindustry trade Intra-industry trade index for US and the EU with their main partners and types of products (1986 vs 1994) Gobalización, trade internacional y economía geográfica 43 Tema 5 -SE 3. Imperfect competition and trade Intra-industry trade index for US and the EU with their main partners and types of products (1986 vs 1994) Gobalización, trade internacional y economía geográfica 44 Besides the ES and product differentiation , there are other causes that can lead to Intraindustry trade 1.- Statistical aggregation problems 2.- Intra-firm trade 3 – Seasonality and stability of production and demand. 4.- Cross-border trade: Mexico –US 5.- Joint production –oil derivatives- the surplus has to be exported 6.- Distribution trade or re-exporting trade ( labeling, makilas...) 7.- Reciprocal Dumping 3. Imperfect competition and trade Why is intraindustry trade important? 1. Although there is no comparative advantage countries can gain from (intraindustry) trade: ( + variety – price). • Gains grows twice: - costs, + access to variety. 2. Intraindustry trade between similar countries ( ES and product differentiation) 3. Trade between countries that converge in income and technology can keep on increasing. 4. It doesn’t have to harm the income distribution between sectors or factors. 5. It produces a less problematic industry restructuration in the trading partners (H and F). 4. External economies and international trade. 4. EXTERNAL ECONOMIES AND INTERNATIONAL TRADE Tema 5 -SE 4. External economies and international trade. Nº firms Q AC • A cluster can be more efficient collectively than a single firm. – It does not favor the appearance of large firms – It is compatible with perfectly competitive markets . – It does not require the product differentiation. AC1 AC2 AC2 Zone 2 AC1 Q1 Q1 Zone 1 Q1 48 Tema 5 -SE 4. External economies and international trade. Why does External ES arise? 1. SPECIALIZED SUPPLIERS 2. SPECIALIZED LABOR MARKET • R+D+i ... 3. DIFUSSION OF KNOWLEDGE. • Knowledge Spillovers. 4. JOINT USE OF INFRAESTRUCTURES • Ports, logistic corridors,… 5. HIGHER INSTITUTIONAL SUPPORT: • Ex: Headquarters-capital (Proximity to regulators, lobbing…) 49 Tema 5 -SE 4. External economies and international trade. “When an industry has thus chosen a locality for itself, it is likely to stay there long: so great are the advantages which people following the same skilled trade get from near neighborhood to one another. The mysteries of the trade become no mysteries; but are as it were in the air,... Good work is rightly appreciated, inventions and improvements in machinery, in processes and the general organization of the business have their merits promptly discussed: if one man starts a new idea, it is taken up by others and combined with suggestions of their own; and thus it becomes the source of further new ideas. Marshall (Principles of Economics, London: MacMillan, 1920) Tema 5 -SE Tema 5 -SE 4. External economies and international trade. EXTERNAL E.S. CLASSIFICATION: (MARSHALL - ARROW – ROMMER-PORTER –JACOBS) 1. In the same sector • Technology-Silicon Valley; • Live Music Bars New York: Bleecker street; • Banking: Wall-Street; “The City” in London 2. Between different sectors: crossed E.S. – Jacobs • Refining-chemical; steel-mining. Tema 5 -SE 4. External economies and international trade. External Economies and international trade 1. In the presence of External ES, companies located nearby in a market where the industry is large, produce with lower AC. 2. Countries that, for different reasons have been major producers of something (historical accident), produce with lower costs given the external ES (agglomeration, suppliers, knowledge). 3. Even if another country could produce with lower unit costs (Ex: because of lower ULC), the lack of external ES prevents it from competing for that product. • Ex: watches (Switzerland- Thailand); Ships (Europe- Korea) Tema 5 -SE 4. External economies and international trade. Trade, welfare and external economies 1. There might be gains from the concentration. 2. Nothing ensures that the concentration of an industry in a country is the most efficient choice. 3. The specialization caused by a “historical accident” can harm a country. • Ex: Watches (Switzerland- Thailand); • Thailand could produce cheaper. • However, the accumulation of the industry in Switzerland forces Thailand to import with higher prices. 4. Argument for protectionism: potential industry. External economies and Specialization: swiss/thailand watches c Demand of watches (World) AC p B AC Sw AC Switzerland C q1 AC (potential) Thailand Q Tema 5 -SE External economies and Specialization: swiss / thailand watches c Demand for watches (Thailand) AC Demand of watches (World) p B AC Sw AC Th AC Thailand C q2 AC Switzerland q1 56 Tema 5 -SE 4. External economies and international trade. Dynamic economies of scale 1. Those derived from the knowledge and the accumulation of experience (Know-how): 1. The country that started an industry has an advantage towards the others (the cumulative process generates economies of scale) . 2. Its costs are lower and that gives him an advantage over possible competitors. 2. Other countries could have potentially lower unit costs but they will need time to “learn” • Argument for protection: argument of the “infant industry”. Tema 5 -SE Dynamic external economies and specialization Unit cost Demand for watches C*0 B C1 L=Swiss experience L*=Thai experience QL Accumulated production Tema 5 -SE 5. Extensions and applications Extensions: • • Economies of scale on “horizontal / vertical” integration. Trade modeling with n varieties, n countries… – • Dixit-Stiglitz Model(AER, 1977): base for most of the modern approaches of international trade with economies of scale. New Trade Theory Economic Geography – Core-Periphery Model: concentration / specialization. Applications: • International trade pattern / interregional in different countries: – – Inter o intraindustry trade. Ricardian / H-O-V / Dixit-Stiglitz / Ec Geography Evolution, link with productive structure, intrafirm trade… 5. Extensions and applications Tema 5 -SE Economies of scale on “horizontal / vertical” integration: • Vertical =difference in quality (price: value/volume). • Horizontal =other differences but quality. Tema 5 -SE • 5. Extensions and applications Economies of scale on “horizontal / vertical” integration. Tema 5 -SE Product space: (Hidalgo and Haussman) 5. Extensions and applications Tema 5 -SE 6. Conclusions 1. The internal and external economies of scale can act like as an engine of international trade additional to the existence of Comp. Advant. or differences in factor endowment. 2. The internal SE demand the develop of an imperfect competition model , it is the most used since the 70’ (Dixit-Stiglitz, 1977). 3. With the SE comes the distinction between interindustry and intraindustry trade. 1. The intraindustry trade has important consequences for the countries’ welfare. Its importance is growing between developed countries with similar factor endowments and technology levels. 4. The advantages of external economies are less clear, and they give place to several arguments usually used in favor of protectionism in international trade.