* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Loanable funds - FMT-HANU

Survey

Document related concepts

Transcript

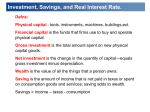

Macroeconomics Lecture 5 Saving, Investment & the Financial System Chapter 26 Lecture Objectives Learn about financial institutions. Consider how the financial system is related to key macroeconomic variables. Develop a model of the supply and demand for loanable funds. Use the loanable funds model to analyze various government policies. Consider how budget deficits and surpluses affect the economy. The Financial System Consist of institutions that help to match one person’s saving with another person’s investment. Move the economy’s scarce resources from savers to borrowers. Financial Institutions Financial institutions: Categories Financial Institutions Financial Markets Financial markets: Categories Financial Institutions Financial Intermediaries Financial intermediaries Categories Financial Markets Bond Market A bond: a certificate of indebtedness that specifies obligations of the borrower to the holder of the bond. Debt financing: sale of bond to raise money IOU Financial Markets Bond Market Characteristics of a Bond: Term Credit Risk Tax Treatment Financial Markets Stock Market Stock represent ownership in a firm a claim to the profits that the firm makes. offer both higher risk and potentially higher returns in comparison with bonds Equity financing sale of stock to raise money. Financial Intermediaries Banks Take deposits from people who want to save Make loans from deposits to people who want to borrow. pay depositors interest on their deposits charge borrowers slightly higher interest on their loans. Financial Intermediaries Banks Create a medium of exchange by allowing people to write checks against their deposits. A medium of exchanges: an item that people can easily use to engage in transactions, facilitates the purchases of goods and services. Financial Intermediaries Mutual Funds A mutual fund (USA)/ managed fund (Australia): an institution that sells shares to the public and uses the proceeds to buy a selection, or portfolio, of various types of stocks, bonds, or both. allow people with small amounts of money to easily diversify. Financial Intermediaries Others Credit unions Pension funds Insurance companies Loan sharks Financial Instruments in the US US household wealth (2014) Saving and Investment in the National Income Accounts GDP = total income = total expenditure Y = C + I + G + NX Some Important Identities A closed economy without international trade: Y=C+I+G Some Important Identities Subtract C and G from both sides of the equation: Y – C – G =I National saving, or just saving (S): total income in the economy after paying for consumption and government purchases and is called Some Important Identities Substituting S for Y-C-G S=I National saving, or saving: S=I S=Y–C–G S = (Y – T – C) + (T – G) where “T” = taxes - transfers Private Saving & Public Saving Private saving: the amount of income that households have left after paying their taxes and paying for their consumption. Public saving: the amount of tax revenue that the government has left after paying for its spending. Surplus and Deficit T>G: budget surplus G>T: budget deficit Saving and Investment For the economy as a whole, saving must be equal to investment. S=I Saving and Investment in the National Income Accounts National Saving or Saving: Y - C - G = I = S or S = (Y - T - C) + (T - G) where “T” = taxes - transfers Two components of national saving: Private Saving Public Saving Open economy NX= NCO = NCI Y=C+I+G+NX I=(Y-T-C)+ (T-G)-NCO The Market for Loanable Funds Market for loanable funds: coordinate the economy’s saving and investment. Loanable funds: all income that people have chosen to save and lend out, rather than use for their own consumption. Supply and Demand for Loanable Funds The supply of loanable funds The demand for loanable funds Supply and Demand for Loanable Funds Interest rate: price of the loan. the amount that borrowers pay for loans the amount that lenders receive on their saving. Interest rate in the market for loanable funds: real interest rate. Market for Loanable Funds Real Interest Rate Supply E 5% The equilibrium of the supply and demand for loanable funds determines the real interest rate. Demand 0 $1,200 Loanable Funds (in billions of dollars) Government Policies That Affect Saving and Investment Taxes and saving Taxes and investment Government budget deficits Taxes and Saving Taxes on interest income substantially reduce the future payoff from current saving and reduce the incentive to save. A tax decrease increases the incentive for households to save at any given interest rate. An Increase in the Supply of Loanable Funds Interest Rate Supply, S1 S2 1. Tax incentives for saving increase the supply of loanable funds... 5% 4% Demand 2. ...which reduces the equilibrium interest rate... 0 $1,200 Loanable Funds $1,600 (in billions of dollars) 3. ...and raises the equilibrium quantity of loanable funds. Taxes and Saving Change in tax law encouraging saving lower interest rates & greater investment Supply of loanable funds curve Equilibrium interest rate Quantity demanded for loanable funds Taxes and Investment An investment tax credit (tax reduction to encourage investment) increase the incentive to borrow. the demand for loanable funds the demand curve interest rate quantity saved An Increase in the Demand for Loanable Funds Interest Rate 6% 5% 2. ...which raises the equilibrium interest rate... 0 Supply 1. An investment tax credit increases the demand for loanable funds... D2 Demand, D1 $1,400 $1,200 Loanable Funds (in billions of dollars) 3. ...and raises the equilibrium quantity of loanable funds. Government Budget Deficits Budget deficit Government debt Government Budget Deficits Government borrowing to finance its budget deficit reduce the supply of loanable funds available to finance investment by households and firms Crowding out Crowding out: fall in private investment due to deficit borrowing The Effect of a Government Budget Deficit Interest Rate S2 6% 5% 2. ...which raises the equilibrium interest rate... $800 $1,200 0 3. ...and reduces the equilibrium quantity of loanable funds. Supply, S1 1. A budget deficit decreases the supply of loanable funds... Demand Loanable Funds (in billions of dollars) Government Budget Deficits budget deficit decrease the supply of loanable funds: A Supply curve Equilibrium interest rate Equilibrium quantity of loanable funds Government Budget Deficits and Surpluses Deficit Surplus 120% U.S. government debt (% of GDP 1970-2007) 100% 80% 60% 40% 20% 0% 1790 1810 1830 1850 1870 1890 1910 1930 1950 1970 1990 2010 Global loanable fund market Global intergration Capital mobility Real Interest rate differences Global loanable fund market Lecture Review Financial Markets and Intermediaries Saving and Investment Market for Loanable Funds Government policies that affect the economy’s savings and investment Government Budget deficits and surplus